Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Can "renovation" really remove the Federal Reserve Chairman?

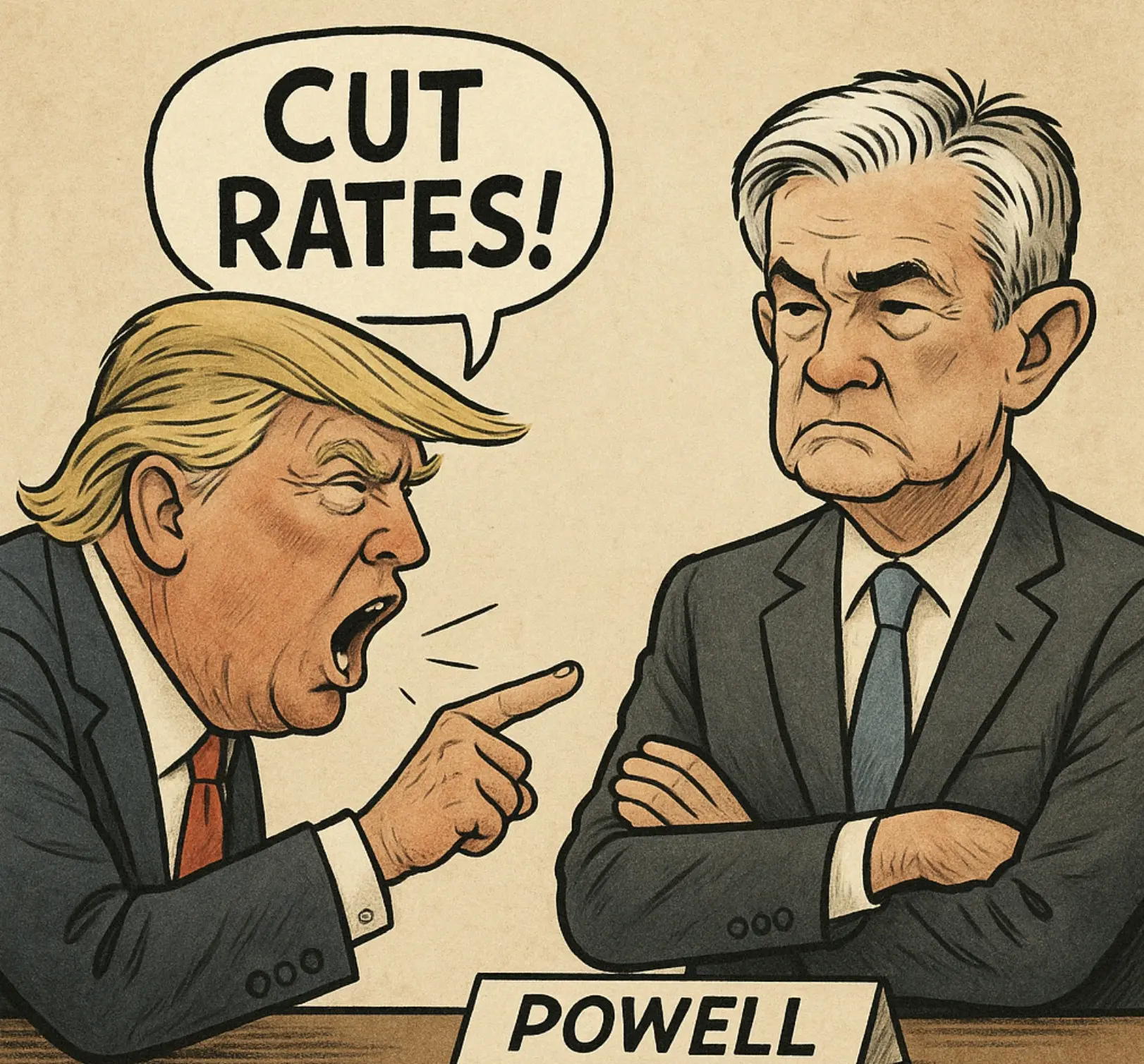

Trump has been "attacking" Powell since the election campaign, and now he is using the renovation controversy as a pretext to "force him out." This seemingly absurd political drama is pushing global market sentiment to a critical point.

What kind of pressure is Powell under now? If he is indeed forced to resign, what kind of storm will it trigger?

Trump and Powell: A Seven-Year Love-Hate Relationship

The conflict between Trump and Powell boils down to one sentence: one wants to cut interest rates, while the other stubbornly refuses to do so. This core disagreement has kept them at an impasse since 2018.

Interestingly, Powell's appointment actually came from Trump's nomination. In February 2018, Powell officially took office as the Chairman of the Federal Reserve, nominated by Trump. At that time, Trump expected Powell to implement loose monetary policies to support economic growth.

In October 2018, Trump publicly criticized Powell for the first time, claiming that the Fed's rapid interest rate hikes were the "biggest threat" and accusing Powell of "going crazy." The conflict between the two began to surface, and Trump continued to pressure Powell, leading to an ongoing war of words.

In 2022, Powell was nominated for a second term by Biden, extending his tenure until May 2026. As the 2024 election year approached, the situation escalated further. Whether during the campaign or after winning, Trump has consistently criticized Powell for being "too slow to act and ineffective in cutting rates." In recent months, Trump has repeatedly called for Powell's resignation.

However, it is not easy for Trump to replace Powell. According to U.S. law, the President cannot remove the Chairman of the Federal Reserve due to policy disagreements unless there is evidence of "illegal conduct or gross neglect of duty."

In July of this year, a real breakthrough occurred. The Trump team suddenly introduced a "new script": Trump demanded Congress investigate Powell on the grounds of "political bias" and "making false statements to Congress," accusing Powell of leading a major renovation project at the Fed's headquarters that allegedly involved significant violations.

During this period, rumors surfaced that Powell was "considering resigning," causing the situation to rapidly escalate. Seven years of power struggle reached a climax.

Policy Dilemma: Powell's "Monetary Hell"

Former Federal Reserve economist Robert Hetrick bluntly stated, "The Fed has been cornered."

Currently, Powell finds himself in a "monetary hell": on one side, Trump's tariff policies may bring upward pressure on prices, while on the other side, signs of cooling in the labor market are already evident. This dual threat poses a dilemma for Powell and the Fed's policy-making.

If the Fed cuts rates too early, it could lead to uncontrolled consumer inflation expectations; if it chooses to raise rates to stabilize inflation, it could trigger turmoil in the bond market, soaring interest rates, or even a "financial panic."

Beyond the economic predicament, he also faces intense political battles. However, in response to Trump's pressure, Powell has chosen to fight back. He requested the Inspector General to continue reviewing the headquarters renovation project and, in a rare move, spoke out through the Fed's official website, detailing the reasons for rising costs and refuting the "luxurious renovation" accusations.

Caught between economic and political pressures, Powell is in a challenging moment of his career.

What Would Happen If Powell Resigned?

If Powell cannot withstand the pressure and steps down, the "pricing anchor" of the entire global financial market may loosen.

Deutsche Bank's global head of foreign exchange strategy, Saravelos, analyzed that if Trump forcibly removes Powell, the trade-weighted dollar index could plummet by 3%-4% within 24 hours, and the fixed income market could see a sell-off of 30-40 basis points. The dollar and bonds would carry a "persistent" risk premium, and investors might worry about the politicization of the Fed's currency swap agreements with other central banks.

Saravelos further pointed out, "What is even more concerning is the current fragile external financing situation of the U.S. economy, which could lead to more severe and destructive price fluctuations than we predict."

Additionally, a report from the strategist team at ING, including Padhraic Garvey, stated that while the likelihood of Powell resigning early is "low," if it were to happen, it would lead to a steepening of the U.S. Treasury yield curve, as investors would expect rate cuts, accelerating inflation, and a weakening of the Fed's independence. They also noted that this would create a "deadly combination" for dollar depreciation.

Crypto KOL Phyrex provided a more risk-asset perspective in his analysis. He stated that even if Trump successfully replaces Powell, it does not guarantee that he can "control" the Fed. If inflation rises again, the new chairman would ultimately have to return to a tightening path. If the Fed begins to cut rates in September while the economy remains stable and unemployment is low, risk assets may receive a short-term boost, benefiting the crypto market as well. However, current rates are still at 4.5%, and there is still "plenty of room" for further easing.

A slight shift in Powell's position could cause market turbulence. This is not just a game of monetary policy; it is also a struggle for power and independence.

Recommended Reading:

Crashing U.S. stocks, Bitcoin plummeting: Did Musk and Trump "curse" us into a financial tsunami?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。