原文标题:Blockchain Going Public: the Convergence of Public Markets and Digital Assets

原文作者:Paul Veradittakit,Pantera Capital 合伙人

原文编译:AididiaoJP,Foresight News

核心要点

· 加密企业 IPO 释放巨大价值,尽管市场定价面临挑战。

· 代币透明度框架旨在提升市场清晰度,吸引更多机构资金进入代币市场。

· 股票代币化正在重塑金融市场,提升效率并扩大全球资本准入。

被错误定价的加密 IPO

Coinbase 自上市以来的表现堪称典型案例,它揭示了公开市场对金融基础设施前沿创新的定价困境。我们目睹了 COIN 从开盘价暴涨 52% 、估值短暂突破 1000 亿美元的狂热高点,到随着市场情绪和加密周期波动而深度回调的全过程。每次市场转向似乎都在用新的估值框架重新定价 Coinbase,让长期价值投资者和建设者都感到困惑。

Circle IPO 是另一个近期案例:尽管市场对稳定币敞口需求旺盛,Circle 在上市首日却少赚了 17 亿美元,成为近几十年来定价最偏低的 IPO 之一。这不仅是加密行业的特例,更是新一代金融公司登陆公开市场时面临的结构性定价难题。

加密行业需要更具适应性的价格发现机制, 一种能在市场周期转换时,弥合机构需求与平台真实价值之间差距的机制。

新估值框架

加密市场仍缺乏类似 S-1 文件的标准化披露体系。加密 IPO 的错误定价证明,当承销商无法将代币经济学映射到 GAAP(美国通用会计准则)核对清单时,他们要么因炒作而高估,要么因恐惧而低估。为填补这一空白,Pantera Capital 的 Cosmo Jiang 与 Blockworks 合作推出《代币透明度报告》——包含 40 项指标,将协议不透明转化为 IPO 级别的清晰度。该框架要求创始人:

· 按实际主体各自计算收入

· 公布带标注的内部钱包归属

· 按季度提交代币持有者报告(涵盖资金库、现金流及 KPI)

· 披露做市商或 CEX 合作细节,让投资者在上市前评估流动性风险

这套体系为何能提升估值?

· 降低折现率:清晰的流通量和解锁数据让市场更接近内在价值定价

· 扩大买家基础:曾被「黑箱」协议阻挡的机构投资者可参与经认证的项目

· 监管相应:SEC 2025 年 4 月发布的加密发行指引与该框架高度契合,项目提交申请时已完成大部分文书工作,加速审批并缩小公私估值差距

以太坊最新升级完美诠释了区块链与传统企业的差异:每个新区块都会销毁部分 ETH(类似自动股票回购),同时为质押者提供 3-5% 的收益(类似稳定股息)。正确做法是将「发行量减去销毁量」视为自由现金流,折现后得到的估值才符合链上生态估值,而非仅反映资产负债表。但稀缺性只是第一步,链上活动才是完整故事:稳定币跨钱包流动、桥接活动、DeFi 抵押品流向等实时数据,才是代币价格的根本支撑。

全面的估值方法应以企业传统现金流为基础,链上收入(质押收益减去手续费销毁)作为核心要素校验。持续关注质押收益率、实时流量指标和情景分析,即可保持估值方法与时俱进,只有这样才能吸引传统资金进场。

股票代币化优化交易体验

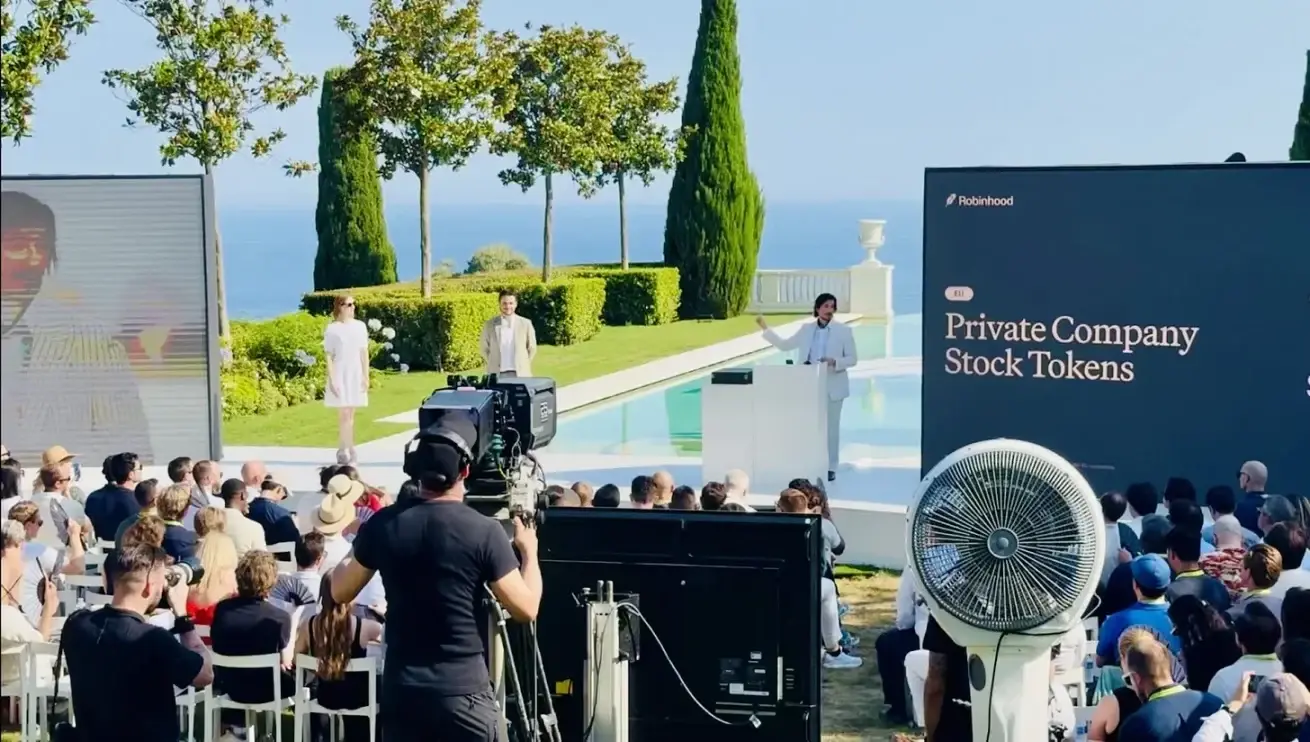

Pantera Capital 通过投资 Ondo Finance 支持 RWA(真实世界资产)代币化领域。近期,我们与 Ondo 联合推出 2.5 亿美元基金以推动 RWA 发展。随着 Robinhood 宣布将股票代币化,该领域正加速成熟。上周,Robinhood 在其平台推出代币化股票,凸显了这一新金融技术的核心矛盾:无许可金融 vs 许可金融,以及 DeFi 的未来角色。

无许可的代币化股票允许任何人在公链上随时交易,为全球投资者开放了美国资本市场,但也可能成为内幕交易和操纵的温床。而基于 KYC 的许可模式虽维护市场公正,却限制了代币化股票的全球准入核心优势。

我们相信代币化股票将重塑 DeFi。DeFi 的使命本是构建开放、可编程的金融原语,但此前主要服务于加密原生代币。代币化股票的引入解锁了全新用例。代币化股票的结构将决定下一波用户和流动性的归属:

· 许可模式中,Robinhood 等拥有用户关系的传统机构主导前端,DeFi 协议只能在后端竞争流动性

· 无许可模式下,DeFi 协议可同时掌控用户和流动性,打造真正开放的全球市场

Hyperliquid 的 HIP-3 升级完美诠释了这一愿景:通过质押协议代币配置预言机、杠杆和资金参数,任何人都能为代币化股票创建永续合约市场。Robinhood 和 Coinbase 已在欧盟推出股票永续合约,但其模式仍比 DeFi 更封闭、可组合性更低。若保持开放轨道,DeFi 将成为可编程无国界金融工程的默认场所。

比特币市值超越谷歌

2025 年比特币以 2.128 万亿美元市值跃居全球第五大资产,超越谷歌。在机构采用、现货比特币 ETF 获批和明确监管的推动下,比特币突破 10.6 万美元。这一里程碑事件证明:可编程货币已找到明确的产品市场契合点。

展望未来

正如 Dan Morehead 所言,加密货币投资提供了传统市场无法比拟的回报。这正是传统公开市场与加密领域在财务和结构上加速融合的原因:

· 数字资产国库和加密 IPO 为公开市场提供加密财务敞口

· 稳定币和代币化利用加密技术优化传统市场结构

十年后,加密将不再是技术爱好者讨论的利基市场,而将成为支撑日常生活的核心科技。

推荐阅读:

OpenAI “打假” Robinhood:揭秘股票代币化背后的四大争议

深扒 xStocks 开发商 Backed:“归零”团队二次创业,音乐生管项目增长

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。