Ethereum has transitioned from being questioned to sweeping Wall Street, with ETFs and enterprise applications changing the game.

Written by: Brendan on Blockchain

Translated by: Baihua Blockchain

A few years ago, Ethereum was seen as Bitcoin's "little brother," known for decentralized finance (DeFi), pixelated NFTs, and highly creative smart contract experiments, far from being a choice for "serious" investors. However, by 2025, Ethereum has become the focus of Wall Street.

Goldman Sachs perfectly embodied the traditional institutional mindset in 2021 when they dismissed Ethereum as "too volatile and speculative," calling it a "solution in search of a problem." Their research team believed that smart contract technology was overhyped, with limited real-world applications, and that institutional clients had "no legitimate use case" for programmable currency. They were not alone; JPMorgan referred to it as a "pet rock," and traditional asset management firms avoided it altogether.

However, this view is as outdated as calling the internet a "flash in the pan." Today, Goldman Sachs is quietly building Ethereum-based trading infrastructure, JPMorgan is processing billions of dollars in transactions through its Ethereum-driven Onyx platform, and those asset management firms that once shunned it are now rapidly launching Ethereum-related products.

The real turning point occurred in 2024 when the U.S. Securities and Exchange Commission (SEC) finally approved the Ethereum spot ETF. This may not sound like an exciting dinner table topic, but its significance is profound. Unlike Bitcoin, which is simply categorized as "digital gold," Ethereum poses a challenge for regulators: how to regulate a programmable blockchain that supports everything from decentralized trading platforms to digital art markets? They ultimately solved this problem and gave the green light, indicating the direction of the industry's development.

The Floodgates for ETFs Open

For years, there has been skepticism about the regulatory clarity surrounding Ethereum, especially regarding the SEC's ambiguous stance on whether Ethereum qualifies as a security. However, the approval of the ETF marks an important signal: Ethereum has matured into an investable asset for pension funds, asset management companies, and even conservative family offices.

BlackRock was the first to launch the iShares Ethereum Trust, and honestly, watching this release felt like witnessing institutional investors' "fear of missing out" (FOMO) unfold in real-time. Fidelity quickly followed suit, and Grayscale converted its existing products into ETFs; suddenly, every major asset management company was launching Ethereum products. But more notably, these products are not limited to ordinary ETFs tracking ETH prices; some also incorporate staking rewards, meaning institutional investors can earn returns on their holdings just like DeFi participants.

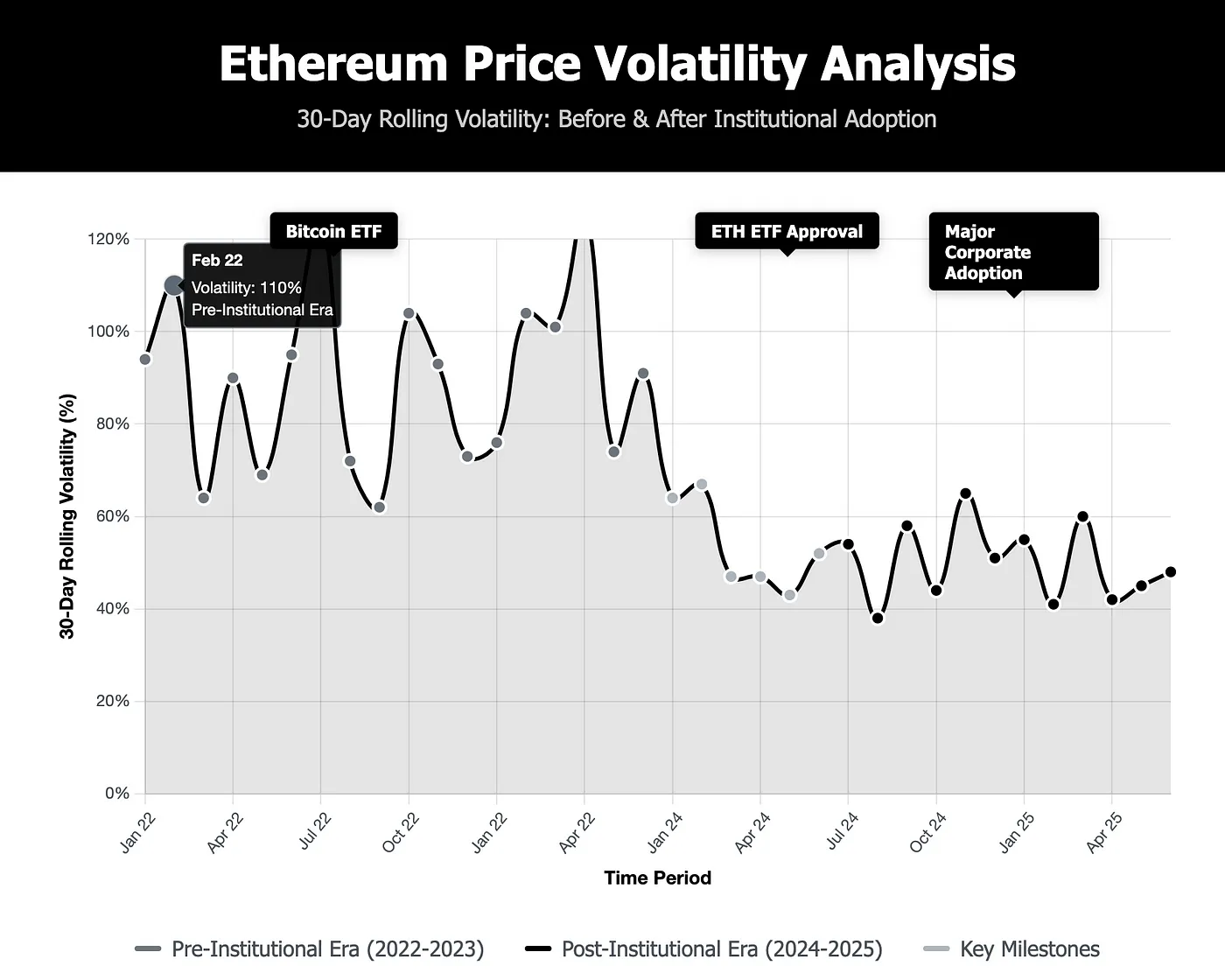

A visual representation of Ethereum's price fluctuations before and after institutional adoption.

A visual representation of Ethereum's price fluctuations before and after institutional adoption.

Enterprises Fully Embrace

What is truly captivating is how enterprises are integrating Ethereum into their actual business operations. This is not about speculative asset reserves like Bitcoin; rather, companies are building digital infrastructure on Ethereum because it solves real problems.

The true value of Ethereum for institutions lies in its infrastructure as a programmable blockchain capable of handling tokenized currencies, digital contracts, and complex financial workflows.

Institutions are rapidly joining this wave:

Franklin Templeton, a company managing $15 trillion in assets, has tokenized one of its mutual funds on Ethereum, allowing investors to hold digital shares on the blockchain and enjoy the benefits of transparency and 24/7 settlement.

JPMorgan, through its blockchain division Onyx, is testing tokenized deposits and asset swaps using Ethereum-compatible networks (such as Polygon and their enterprise version of Ethereum, Quorum).

Amazon AWS and Google Cloud now offer Ethereum node services, allowing enterprises to easily access the network without building their own infrastructure.

Microsoft is collaborating with ConsenSys to explore enterprise use cases ranging from supply chain tracking to compliance smart contracts.

These are no longer just the domains of crypto-native players. Traditional financial giants are awakening to the fast, secure, and automated intermediary-free financial services that Ethereum offers.

Conversations among CFOs of Fortune 500 companies have completely changed. They no longer question whether blockchain makes sense; instead, they are asking how to automate smart contract applications for vendor payments, supply chain financing, and internal processes as quickly as possible. The efficiency gains are evident.

The gaming and entertainment industries are particularly aggressive. Mainstream game studios are tokenizing in-game assets, music platforms are automating royalty distribution, and streaming services are experimenting with decentralized content monetization. The transparency and programmability of Ethereum have almost overnight resolved decades-old issues in these industries.

Why is Ethereum So Attractive to Institutions?

Ethereum allows assets (whether dollars, stocks, real estate, or carbon credits) to be digitized, tokenized, and programmed. Combined with stablecoins that primarily operate on Ethereum (such as USDC or USDT), you suddenly have the building blocks for constructing a whole new financial operating system.

- Need cross-border instant settlement?

- Need programmable payments based on contract milestones?

- Need transparency without losing control?

- Ethereum can do it all, and more.

With Layer 2 networks like Arbitrum and Optimism, these solutions expand Ethereum's capacity, reduce costs, and significantly increase speed. Many institutions choose to build on Layer 2 networks to enhance efficiency while still leveraging Ethereum's liquidity and security.

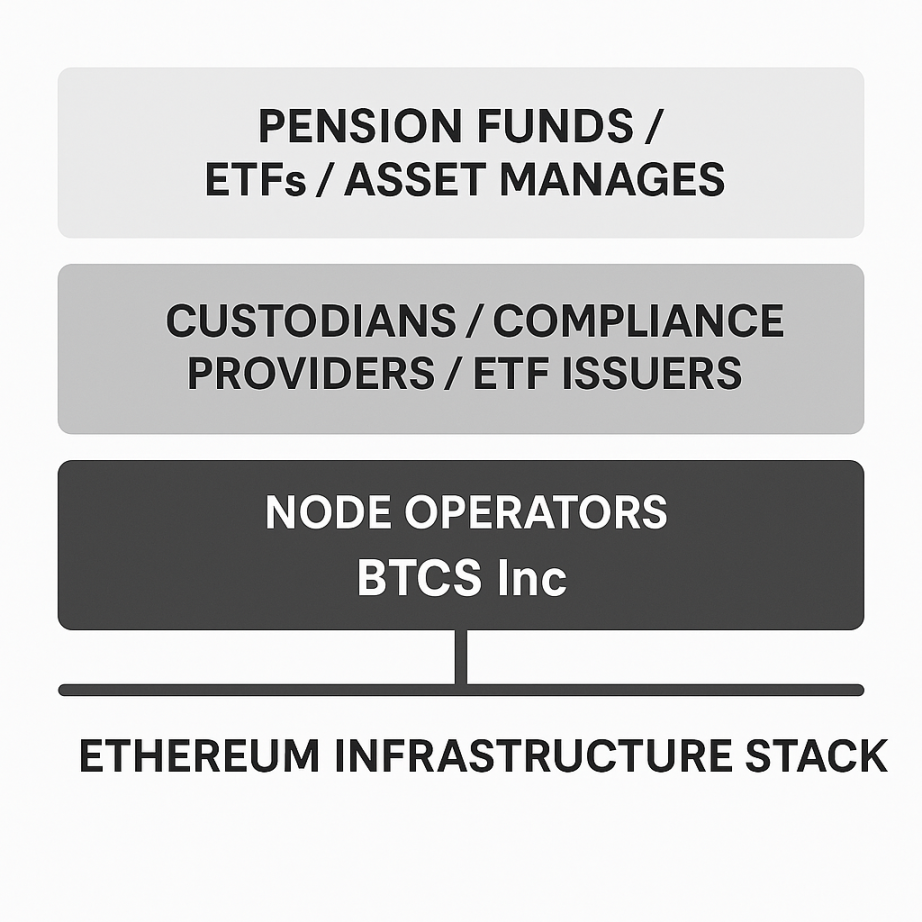

All of this institutional adoption relies on an infrastructure layer that most people overlook. Companies like BTCS Inc. are increasingly supporting the necessary infrastructure for traditional financial institutions to participate in Ethereum and products like ETH ETFs. BTCS focuses on operating secure enterprise-grade Ethereum validation nodes, maintaining network integrity, and allowing institutions to participate in staking without dealing with technical complexities. While they are neither custodians nor ETF issuers, their validation node operations support Ethereum's functionality and credibility, enhancing the network resilience and transparency that institutional investors require.

Looking Ahead

What does the future trend look like? I believe the direction is very clear. Ethereum is becoming the infrastructure layer for programmable finance. We are no longer just discussing cryptocurrency trading; we are talking about automated borrowing, programmable insurance, tokenized real estate, and 24/7 operational supply chain financing.

Integration with central bank digital currencies (CBDCs) is another huge opportunity. As countries formulate digital currency strategies, many are considering Ethereum-compatible solutions to enable seamless interaction between government-issued digital currencies and the broader DeFi ecosystem.

More importantly, this institutional embrace is driving the long-awaited regulatory clarity for the entire industry. As major financial institutions build products around Ethereum, regulators have a strong incentive to establish workable frameworks rather than impose blanket restrictions.

We are witnessing a technology that started as an experimental platform gradually becoming a critical financial infrastructure. The approval of ETFs is significant, but it is just the opening act. The real story lies in how Ethereum fundamentally changes the way financial services operate, how enterprises manage operations, and how value flows in the global economy.

Honestly, I believe we are still in the early stages of this transformation. The current institutional adoption is merely the beginning of the large-scale integration of programmable currency with traditional finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。