Author: flowie, ChainCatcher

Editor: Marco, ChainCatcher

It took Doge 4 years to break through a market value of 1 billion US dollars, while BOME only took 3 days. It seems that more retail investors would rather participate in the "meme coin" market than the "value coin" market.

But as memes become more popular among retail investors, VCs seem somewhat unhappy.

Top VC a16z has successively criticized meme coins. First, a16z pointed the finger at the SEC on its official website, accusing the crypto policy of allowing memes to flourish but not protecting true blockchain innovation.

a16z Crypto CTO Lazarrin then complained on X platform, "Memecoin disrupts the long-term vision that keeps many people in the crypto field, and it is not attractive from a technological perspective; it is not attractive to builders."

Compound VC Managing Partner Michael Dempsey also accused "meme coins of causing a large loss of true builders."

VCs have shifted the blame for disrupting crypto innovation to meme coins, quickly causing dissatisfaction in the crypto community.

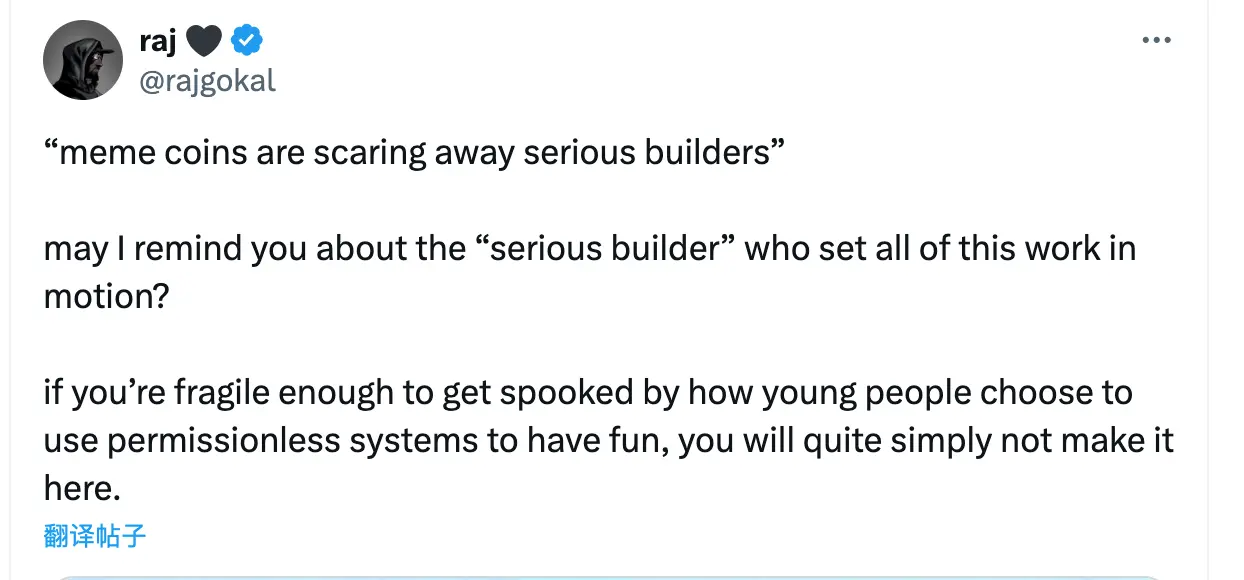

Solana co-founder raj stepped forward to defend meme coins, sarcastically remarking on the claim that "meme coins cause a large loss of true builders," stating that if these so-called true builders are afraid of even meme coins, then they cannot succeed at all.

Retail investors, in turn, questioned the value coins promoted by VCs. What started as a debate about the value of memes has turned into a roast of VC coins/value coins.

Community's Reverse Education on VCs

VCs, who like to educate users, are being educated by users.

First, meme coins are not to blame for disrupting crypto innovation. @MarinadeFinance mocked, "People often look for excuses, but in reality, no one or nothing can stop you from building something truly innovative."

And @XBEBEeth added, "No one hates these true builders, they just hate the 'builders' who deceive users with fancy narratives."

Rather than criticizing meme coins for having no value, it's better to reflect on whether the innovation promoted by VCs is genuine. @mfer7166 believes that pseudo-innovation should be more criticized. The problem is not with memes, but that in this cycle, the industry lacks any epic narratives.

It seems that retail investors can only dare to speculate on memes, expressing the helplessness of retail investors.

AI+Crypto, DEPIN, RWA, modularization, Bitcoin Layer2… VCs are becoming increasingly adept at creating some seemingly impressive narratives, hoping that projects will overlay these concepts and then sell them to secondary retail investors, hoping that they will buy into these long-term visions.

Even former retail investors are not falling for this. They hope that some new narratives will be widely applied, and they can follow projects endorsed by VCs even if they can't make a profit.

But times have changed. Retail investors are beginning to realize that the technological innovation promoted by VCs seems to be just hype, and there has been no actual progress in application. And in terms of speculation, following VCs not only fails to yield profits but may also result in significant losses.

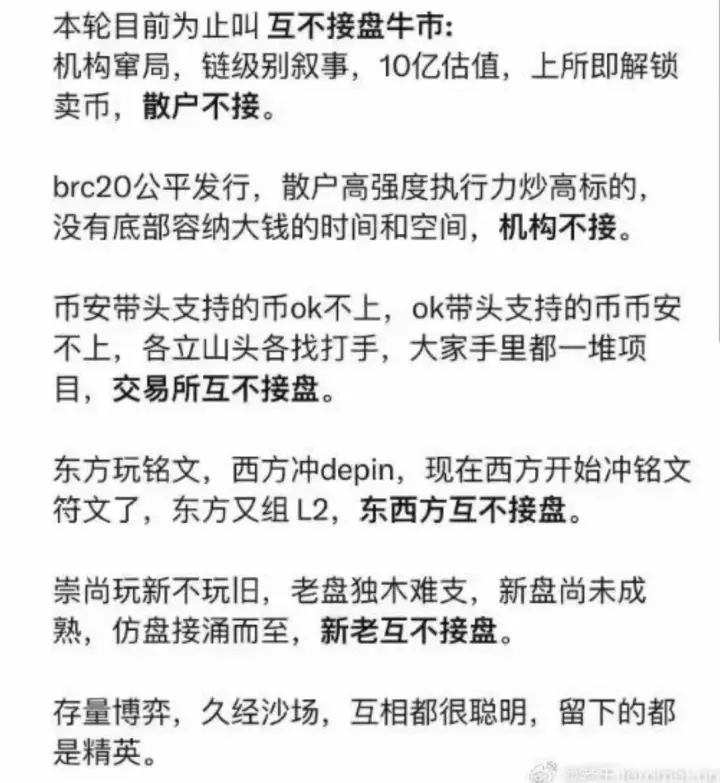

The "no cross-trading" bull market theory mentioned some time ago has resonated with many people. But @connectfarm1 bluntly stated, "There is no such thing as no cross-trading; not cross-trading means not being able to keep up."

Currently, so-called value coins have high market capitalization but generally do not see a rise in coin price, leaving retail investors frustrated with high market cap, high valuation, low circulation, and continuously unlocking value coins.

Many new value coins listed on exchanges have lost their ability to create wealth. WLD was valued at 30 billion US dollars before its launch, and on the day of its launch, its FDV reached as high as 28 billion US dollars, equivalent to the valuation of OpenAI at the time. How much room for growth in the secondary market is left with such a high market cap? New coins like Bitcoin Layer2 leader Merl also experienced a continuous decline after being listed.

Moreover, there are too many new concepts, and the sector is moving rapidly, making it impossible to understand. @EasonJiang experienced that holding a value coin, the coin price took a roller-coaster ride back to "where the dream began," with profits significantly retracting or even being trapped, as attention shifted to other tracks.

It seems that retail investors can no longer buy low and sell high. Ethereum Layer2 leader and representative of value coins, ARB, dropped from 2 US dollars to 1 US dollar. Retail investors wanted to buy low, but VCs unlocked a large amount of coins, and the coins in the hands of VCs doubled, potentially leading to being buried.

In the current situation where crypto has not yet been widely applied, 90% of the market is speculative. Although memes have no intrinsic value, compared to value coins, retail investors are closer to opportunities for hundredfold or thousandfold returns.

@BTCdayu voiced the thoughts of many retail investors, "Meme coins are very simple, and it's better to release them. Basically, everyone is directly gambling in a relatively fair environment, and its greatest value is actually 'buy me, I might rise 100x.'"

Although the fairness of memes needs to be put in quotes, compared to the transparent attempt of VC coins/value coins, retail investors have a higher tolerance for memes.

Memes are nothing more than a game between players, where life and death are determined in a few days. Most users bet a small amount of capital for a large return, even if the majority end up losing, they do so cleanly, without enduring years of uncertainty.

Of course, not all VCs are rejecting memes. Some VCs are recognizing the situation and joining in.

Mechanism Capital has already started to build positions in memes. Its co-founder Andrew Kang stated on his social platform that Mechanism Capital has completed its first batch of positions for 2024, with the target assets being Trump-themed meme tokens and NFTs.

DWF Ventures publicly stated that they are interested in investing in projects with large-scale community participation in the future.

DWF Ventures stated that meme coins will become a new go-to-market strategy for many ecosystems and projects, believing that meme coins will serve as an effective marketing strategy in the following verticals: infrastructure ecosystems, consumers and gaming, and new projects with a background in meme coins.

Variant co-founder Li Jin has started hosting meme marathons, writing, "Born too late to explore the Earth; born too early to explore the universe; born at the right time to host a meme hackathon."

Meme Temporarily Bears the Heavy Responsibility of Mass Adoption

Seemingly valueless memes may be bearing the heavy responsibility of mass adoption.

@mdudas refuted a16z CTO, stating, "Meme coins have attracted many users, even making chains like Base, Blast, and Solana active."

In fact, compared to some VCs' disdain for memes, meme coins have become a top priority for activating public chain ecosystems.

After Solana founder Anatoly personally promoted Silly Dragon last year, Solana continued to benefit from the meme craze. The explosive popularity of a BOME coin caused the number of active addresses on Solana to rank first. Within 3 days of BOME's launch, the number of active wallet addresses on Solana increased from 1.24 million to 2.42 million, a 95% surge.

In addition, network fees and income on the Solana chain also saw significant growth as a result.

A public chain that was questioned for not being used by anyone, at least now has people using it because of memes. Solana's huge success with memes has also attracted attention from other public chains and led to imitation.

Base creator claims that meme coins will be the key to attracting millions of users to the Base network. The Arbitrum community's new proposal aims to establish a Memecoin fund.

Some public chains are even launching meme coins.

On March 17th, Aptos launched the official Meme coin $LME.

On March 18th, Bitcoin Layer 2 public chain Ligo announced the launch of the Meme coin SOLIGO on Solana.

There are also public chains hosting meme innovation competitions to incentivize meme innovation on the chain.

BNB Chain recently announced the official launch of the "Meme Innovation Battle" activity, competing for a total prize pool of up to 1 million US dollars. TON also announced the launch of the Meme Coin and Community Token Culture Center, Memelandia, to reward the top meme coins and community tokens on TON.

The TON Foundation also airdropped over 200 perfect TON to active meme coin traders within the ecosystem.

Fantom has begun to develop meme framework standards. Recently, Fantom Foundation co-founder Andre Cronje tweeted that they are busy conducting due diligence on memecoins in order to create a framework to launch, support, and nurture community-safe meme coins on Fantom.

Ethereum co-founder Vitalik Buterin previously mentioned in relation to memes, "I hope to see higher-quality interesting projects that make positive contributions to the ecosystem and the world around us (not just 'attracting users)."

In fact, in addition to serving as a traffic driver for many public chains, some meme coins are also starting to take action.

Shib, known as the "Doge Killer," announced the launch of the Layer 2 solution Shibarium Beta version early last year, aiming to reduce the load on the blockchain network and improve the user experience of the metaverse and gaming applications.

Meme Rush: Will the Season of Imitation Coins Come Again?

Meme coins and value coins are not completely opposed. For most retail investors, they are both tracks to participate in.

In a typical bull market, Bitcoin rises; after Bitcoin rises, Ethereum rises, and it drives the simultaneous surge of hot altcoins. Finally, the crypto market enters a comprehensive upward trend, and meme coins start to rise.

But in this cycle, the order of sector rotation seems to have been rearranged, with meme coins rushing ahead to become the main theme of this cycle.

After the meme explosion, will the season of imitation coins dominated by so-called value coins still come? This is also the most concerning issue for retail investors.

In a recent interview, a crypto influencer stated that the season of imitation coins may not come. "Because the current players in the market are different from before, from the perspective of miners, after the Bitcoin spot ETF was approved on January 10th, risk hedging has been carried out months in advance to deal with the risk of Bitcoin halving."

The influencer mentioned that the characteristic of this cycle is that funds mainly flow into Bitcoin through ETFs and other channels. As for when these funds will flow into other cryptocurrencies, it still needs to be observed.

Crypto trader Thiccy also expressed pessimism about whether the season of imitation coins will come. Thiccy stated that due to the increasing number of projects launching tokens, the growth rate of fully diluted valuation (FDV) has exceeded the circulation, increasing by about 70% since the beginning of the year. "Now, 3-5 'high-quality' tokens are added to the market every week, and everyone seems very excited. But ask yourself, who will buy all these tokens? Unless institutions or retail investors flood in, this will just be an eternal PvP."

Crypto KOL @BTCdayu believes that the season of imitation coins has already passed. "Currently, altcoins, especially various L2 and new narratives, have a total scale that has reached the peak of the previous bull market."

However, some investors still believe that the season of imitation coins will not be absent. In the current market where value coins are generally not favored, crypto researcher @0xNing0x believes it is the best time to build positions. "At this stage, I quietly buy the top assets in modular public chains, RollAPP, AI Agent, ZK hardware acceleration, RWA, Bitcoin L2, and other sectors, actively providing market exit liquidity."

@0xNing0x's logic is that the golden rule of investment has always been "when people abandon, I take; when people take, I abandon." When meme coins account for an increasingly large proportion of everyone's investment portfolio, truly high-risk-reward ratio alpha opportunities are emerging in the value coin sector.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。