Author: Orthogonal Labs

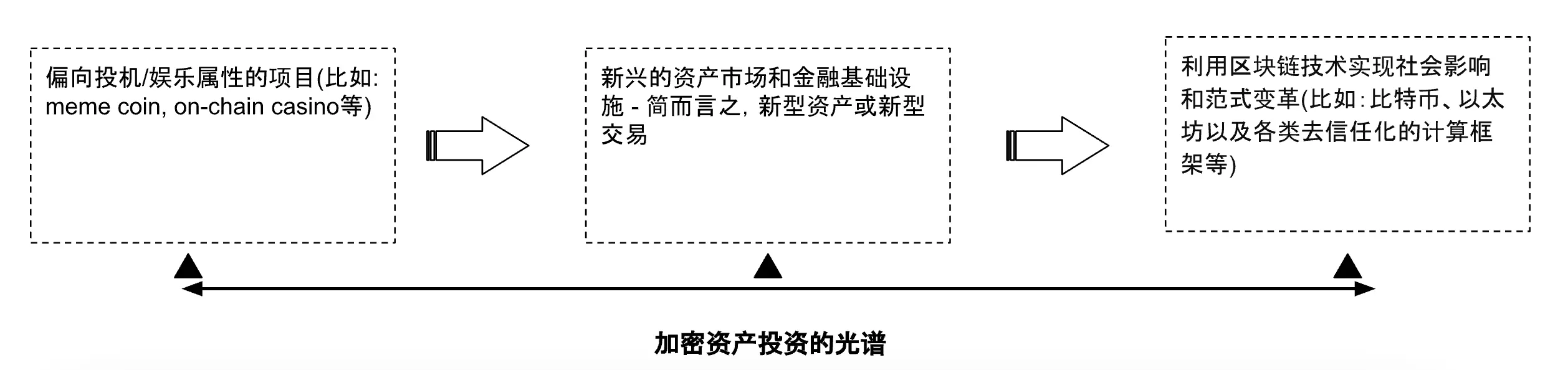

In discussions about investment projects, there is often a tendency to categorize projects as speculative (lacking fundamentals) or revolutionary innovation. At Orthogonal Labs, we believe that a simple binary perspective cannot fully encompass the complexity of projects. Instead, we believe that the value of investment projects is more like a "spectrum" range without clear boundaries but with gradients.

At one end of this "spectrum" are projects tailored for cryptocurrency users, providing relatively "entertaining" experiences through speculative trading, gaming, or Memo coins. We often question the value of these projects due to their lack of fundamentals. However, these projects actually have high user engagement (high activity).

Recent examples include the meme frenzy in the Solana ecosystem, including $WIF, $SLERF, $BOME, as well as the Telegram bot frenzy in 2023 (mainly for investing in meme coins), and similar traits seen in $RLB and $SHFL. Community/user participation is a crucial part of the cryptocurrency field. To some extent, the value of a project does not solely depend on investors' views but may depend more on community or user acceptance. In this sense, these projects have value - their "existence is reasonable." Of course, we should also acknowledge that these projects are limited in that they often struggle to attract a broader user base or drive widespread adoption of cryptocurrencies.

At the other end of this "spectrum" are projects that use technology to make significant impacts and changes, such as Bitcoin, Ethereum, stablecoins, or trustless computing frameworks. These projects represent a breakthrough innovation in existing implementation, like another orthogonal vector on the existing plane. Unlike the projects mentioned earlier, these projects are mainly driven by technological innovation and aim to solve underlying problems to achieve greater-scale applications of blockchain technology.

These projects are dedicated to addressing key issues such as scalability, censorship resistance, security, and usability, hoping to overcome the bottlenecks hindering widespread adoption. If these deep-seated challenges can be addressed, these projects have great potential to drive significant and sustainable growth in the entire cryptocurrency ecosystem.

However, these projects also have their own issues. Although they are important for laying the foundation for widespread applications, they often remain distant from users and practical applications. This disconnect from direct user needs can sometimes challenge the implementation and adoption of the technology (referred to as "dead infra"). In many cases, these projects may appear too abstract, with a vague user positioning, and are narrative-driven. They may gain market attention in the short term, but in the long run, this hinders their ability to gain broader support from users and developers, making them unsustainable.

From an investment perspective, although the efforts of these projects may seem distant from practical applications at times, their efforts to address underlying technical issues should be recognized, and the market valuation reflects this. Therefore, they continue to attract long-term investors seeking a position in the cryptocurrency market. Unlike projects focused on speculative trading or entertainment, these projects present a more explicit, stable, and long-term value proposition, potentially inspiring broader technological implementation and driving change in various fields. They are an important area in investment.

In the middle category of these two extremes, we can classify emerging capital markets or financial infrastructure, which serve as important links between the two extreme projects. These projects include initiatives such as tokenization of real assets, decentralized investment platforms based on blockchain technology, and various attempts at decentralized trading protocols (decentralized finance protocol). These projects introduce innovative assets and new trading experiences in the cryptocurrency field (summarized as "new assets" and "new trading"). Although they may not directly bring about revolutionary impacts, they signify significant evolution in financial infrastructure. By providing new investment opportunities and promoting the maturity of the cryptocurrency ecosystem, they are crucial in shaping the future of digital-era finance.

An interesting "experiment" in this field is Friend.tech, which capitalizes on the time/engagement of KOLs/Influencers using cryptocurrency (despite sustainability issues). Additionally, teams are exploring the integration of AI agents with cryptocurrencies, where decentralized AI agents are financialized, potentially creating a new category of micro-assets that can better unlock the value of these AI agents. These efforts demonstrate the potential for cross-innovation between blockchain, AI, and finance, adding depth to the landscape of continuous development in digital finance.

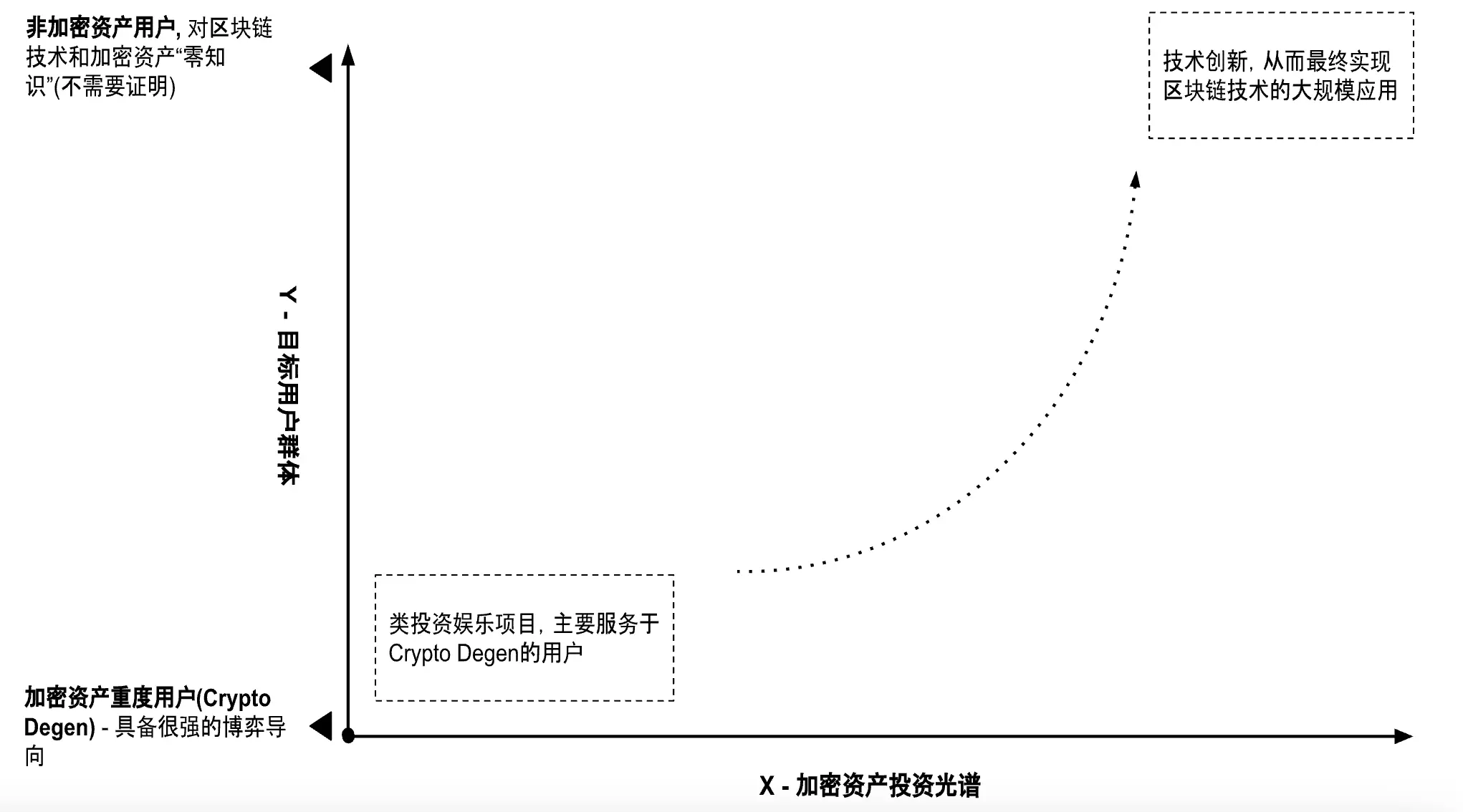

Expanding further, we can liken the above analysis to a coordinate system, where the X-axis represents the "spectrum" from "entertaining" projects to revolutionary projects, and the Y-axis represents user types, from non-cryptocurrency users to experienced cryptocurrency enthusiasts. At the top of the Y-axis are new users who have not yet entered the cryptocurrency world, while at the bottom are those deeply involved in the cryptocurrency community, often referred to as "Crypto Degen."

In the cryptocurrency field, people tend to analyze new developments from a technical perspective, focusing on technological innovation itself and lacking attention to the users being served. However, understanding the preferences, needs, and behaviors of the target audience is crucial for the success of projects. This highlights the importance of the Y-axis, representing the user base and community engagement of projects.

Typical examples that represent the importance of understanding user needs include: pre-markets, OTC markets, and Points Markets, which are segmented trading market products. Although these platforms primarily serve Crypto Degen, teams (such as Aevo and Whales Markets) are able to accurately capture and address user needs, demonstrating a deep understanding of the target audience.

On the contrary, an example may be attempting to simply lump all blockchain games (web2.5 games and full-chain games) together. In reality, web2.5 games and full-chain games serve different user groups. From the perspective of the entire cryptocurrency field, the missions of the two in achieving widespread cryptocurrency applications are completely different, and simplifying the two essentially overlooks the subtle preferences and behaviors of different users. We will further elaborate on this in another article.

The combination of the X-axis and Y-axis constructs a two-dimensional framework, where the value of a project increases as it moves from the bottom left corner to the top right corner (especially if we consider "massive adoption" as the ultimate goal of the entire cryptocurrency community).

What all investors may be looking for are projects in the top right corner: not only with the ability for technological innovation but also resonating with various user types, attracting them, and ultimately promoting wider adoption and sustained growth of the cryptocurrency ecosystem - this may be an ideal project that only has "abstract potential" :-)

Orthogonal Labs not only focuses on projects that can drive widespread adoption of cryptocurrencies, especially those at the intersection of blockchain technology and social transformation, but also recognizes and highly values the various projects within the "spectrum," which often act as catalysts for driving widespread adoption of cryptocurrencies. Whether these projects enhance the user experience of the cryptocurrency community or attract new users, each project plays a crucial role in shaping the future landscape of cryptocurrency adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。