At the beginning of 2026, the cryptocurrency industry is experiencing an unprecedented reshaping.

From the correction after Bitcoin broke its historical high to the substantial implementation of regulatory policies, the market is accelerating its transition from "barbaric growth" to "mainstream compliance." At this critical juncture, Huobi HTX Growth Academy has launched the "First Lesson of the New Year," gathering top experts in the fields of law, security, and investment research, aiming to clear the fog for investors and build a cognitive system that transcends cycles.

After the course went online, it quickly sparked widespread participation and discussion: the cumulative number of learners reached 66,591, with 14,566 completing post-class challenges, and a total of 3,830 scholarships awarded, with "top achievers" seizing 38.88 million $HTX tokens. The data not only reflects the high alignment between the "First Lesson of the New Year" and user needs but also indicates the practical value of systematic investment education during the industry cycle switch.

The "First Lesson of the New Year" is highly aligned with user needs and has received widespread recognition.

Review and Outlook: Navigating the Fog of Cycles and Locking Core Tracks

Regarding the cycle and trend issues most concerning the market, Yu Jianing, president of Hong Kong Uweb Business School and director of the Hong Kong Registered Digital Asset Analysts Association, HTX Research senior researcher Chloe Zheng, and Cloud, head of the Huobi HTX investment research team, conducted a systematic review and forward-looking judgment.

From a macro industry perspective, Yu Jianing assessed that the digital asset industry will accelerate toward "institutionalization" and "mainstreaming" in 2026. He pointed out that AI entities will be deeply embedded in finance and the real economy, driving the formation of programmable payments and automated asset management systems; simultaneously, physical assets such as gold, stocks, and even driverless vehicles will achieve on-chain confirmation of rights, transactions, and profit distribution through tokenization, while RWA, prediction markets, and US stock tokenization tracks will continue to expand.

He also emphasized that investors should shift from short-term speculative logic to long-term asset allocation thinking. Blockchain and digital assets are no longer marginal innovations but are becoming an important part of future financial infrastructure.

Cloud pointed out in "2025 Market Review and 2026 Investment Outlook" that the entire cryptocurrency industry experienced intense and dramatic narrative iterations throughout the year, with market fatigue and skepticism continually accumulating, most hotspots only existing at the level of short-term attention games, but there are a few narratives that have solidified into real application scenarios and sustainable market structures, becoming key forces in driving industry evolution. At the same time, the structure of market participants is changing; in addition to the trend centering on speculators, narratives more compatible with retail investor participation continue to expand, driving the user base's extensive growth.

He believes that in 2026, the focus can be on payment and stablecoin systems, RWA, privacy, scalable prediction markets, zkVMs, verifiable computing, and tokenized private markets and on-chain wealth management, all of which have long-term value.

Chloe analyzed in "Surge! Early Deployments in the Hundredfold Track" that 2025 is a watershed year for the crypto market transitioning from "barbaric growth" to "mainstream compliance." Bitcoin broke 120,000 dollars, the U.S. established Bitcoin strategic reserves, the SEC withdrew industry lawsuits, and stablecoin legislation was established, with regulation turning from opposition to full friendliness; major Wall Street giants entered the market, and the trend of cryptocurrency businesses going public began. However, the four-year cycle curse still held true—Bitcoin retraced more than 50% from its 120,000 dollar high, Ethereum was halved after breaking through 4,900 dollars, and the liquidity of altcoins dried up.

Despite the continued existence of the four-year cycle pattern, Chloe believes that 2026 is expected to break out of an "atypical bear market." Macroeconomically, expectations for Fed rate cuts and global monetary expansion are supporting the market, with declines expected to be smaller than in 2022; microeconomically, enterprises' continued accumulation of Bitcoin is forming a new demand pillar.

Information Alchemy: Extracting Wealth Codes from Chaos

So how should investors make decisions in practice? Taran, head of the Huobi HTX Growth Academy, proposed the "information alchemy" methodology in the course "Identifying Profit Signals in Chaotic Information," helping investors extract high-value signals from a vast amount of noise.

This method includes three core processes: first, source grading and cross-validation, categorizing information sources into four types based on credibility (original data, smart money/institution traces, professional media/deep communities, social noise), and using the "triangular validation method" to ensure information authenticity; second, narrative structure and signal priority sorting, distinguishing grand narratives (such as AI, RWA), project narratives, and market noise, and utilizing the "signal quadrant" (with the X-axis as certainty and the Y-axis as influence) to lock in high-certainty, high-influence "golden signals"; third, on-chain behavior analysis and intention translation, emphasizing that "behavior is more honest than language, and code is more reliable than promises," by tracking smart money flows, token distribution, developer activity, and other on-chain data, penetrating the surface to reach the essence of projects, ultimately building a scientific, replicable investment decision-making system.

Safety, Compliance, and Rule of Law: Building a "Dual Shield" for Assets

If insight into trends is the offensive spear, then compliance and safety act as the defensive shield. While capturing market opportunities, how to avoid legal risks and technical loopholes is an ongoing concern for cryptocurrency investors.

Lawyer Xiao Sa, supervisor and senior partner at Beijing Dacheng Law Firm for the China region, analyzed the attitudes of various countries towards cryptocurrency assets and their regulatory systems and typical judicial cases in the course "Navigating the Dark Forest - Judicial Remedies and Dispute Resolution for Cryptocurrency Asset Disputes."

She pointed out that the Central Political and Legal Work Conference held in January 2026 proposed, "To actively study and propose legislative suggestions for new issues such as driverless vehicles, low-altitude economy, artificial intelligence, virtual currencies, and data rights." This significant deployment marks the formal entry of China's virtual currency governance into a new phase of legalization, standardization, and precision, accelerating the prevention of financial risks and protecting legitimate innovations.

Regarding issues of asset theft and freezing, Xiao Sa proposed a systematic remedy path based on practical experience: prioritize criminal reports for theft followed by promoting on-chain freezes, and for frozen assets, handle through non-litigation communication, law enforcement collaboration, and even international arbitration concurrently, while ensuring the authenticity and consistency of statements and evidence in cross-border law enforcement communication, or face permanent asset freezing and even criminal risks.

Zhou Yajin, co-founder of BlockSec, sounded the alarm for users in "Web3 User Security and Compliance," emphasizing the absolute confidentiality of private keys and mnemonic phrases.

He reminded users to properly safeguard their private keys and mnemonic phrases, never to input them on any website or disclose them to others, and suggested using an asset layering management strategy: store the majority of assets in a cold wallet (main wallet), use only a small amount of funds in an interaction wallet for DeFi or NFT activities, and have a separate risk wallet for testing new projects. He also specifically warned about the risks of token approval (approve), advising against unlimited authorizations and to regularly revoke expired permissions using tools.

Leading Responsibility: Becoming "Long-term Builders" in the Crypto World

Market conditions fluctuate, but education and construction cannot pause. The establishment of Huobi HTX's "First Lesson of the New Year" conveyed a clear signal: the more complicated and emotionally unstable the market is, the more leading exchanges should take on the role of a stabilizing force.

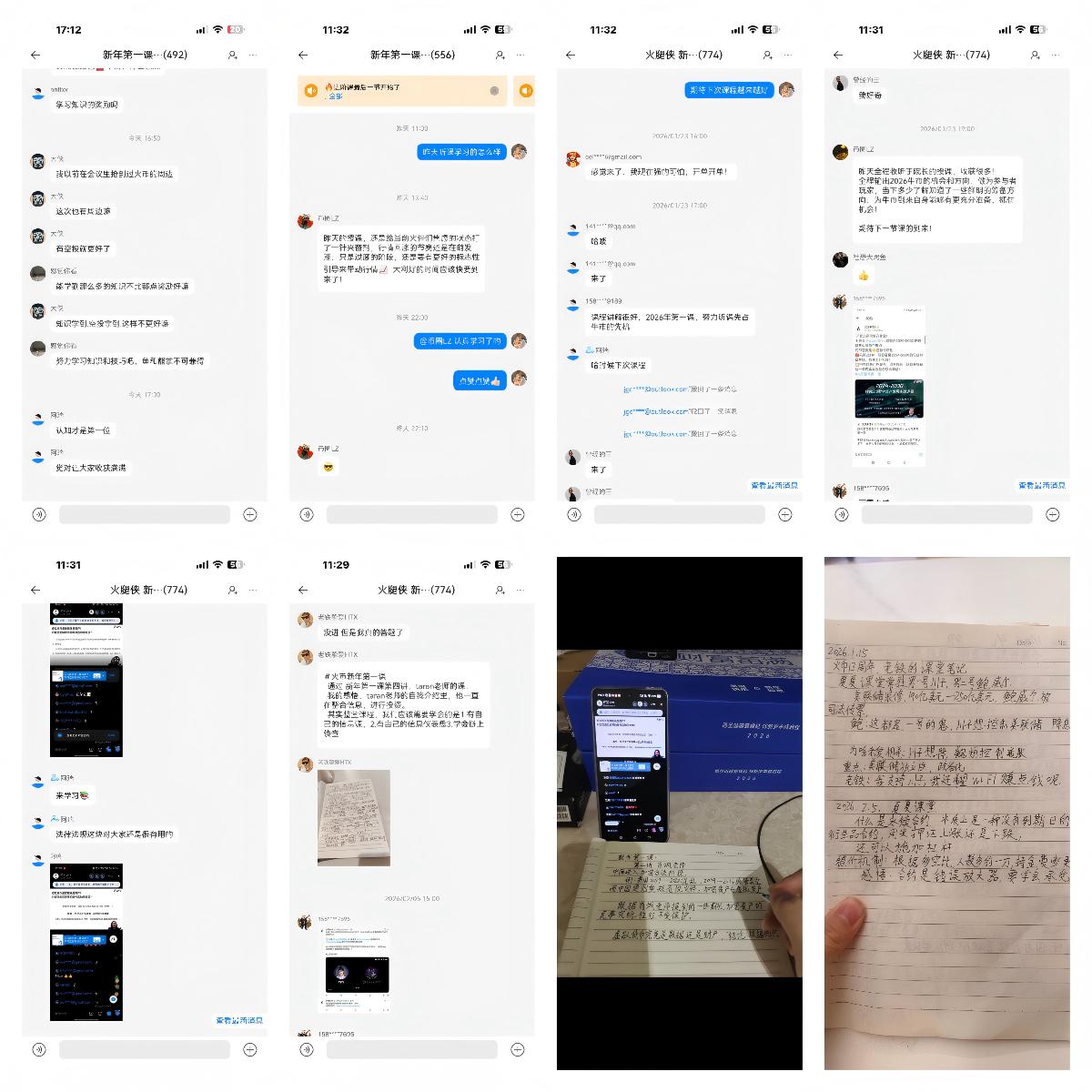

It is understood that the "First Lesson of the New Year" has received high recognition in terms of content depth and practical value.

During the course, several learners actively shared detailed notes and mind maps within the community, systematically organizing macro trend judgments, key track logic, and on-chain data analysis methods; after class, many users submitted structured summaries, transforming the course framework into personal investment decision checklists and risk control models.

Some users expressed that the course helped them connect the complete logical chain of "macro–track–project–execution," turning fragmented information into a clear structure; other participants reported that the triangular validation method significantly improved the efficiency of screening quality projects and avoiding noise. Overall, the course not only enhanced the quality of knowledge acquisition but also bolstered users' confidence in long-term asset allocation and compliance risk management.

Several learners shared their learning insights in the community.

Distinct from the noise of a bull market, Huobi HTX chooses to focus on providing high-quality, systematic courses to help users identify risks, understand compliance, and master safety skills. This long-termism of "teaching people to fish" is not only to protect investors' legal rights but also to promote the entire cryptocurrency industry towards a more mature and healthier direction.

The "First Lesson of the New Year" is just the beginning. In the future, Huobi HTX will continue to uphold its original intention, launching more customized and practical courses for users at different stages. Regardless of market fluctuations, Huobi HTX will accompany every user on their journey in exploring the crypto world with steadiness and perseverance.

About Huobi HTX

Huobi HTX was established in 2013 and, after 12 years of development, has transformed from a cryptocurrency exchange into a comprehensive blockchain business ecosystem encompassing digital asset trading, financial derivatives, research, investment, incubation, and other businesses.

As a leading global Web3 portal, Huobi HTX adheres to its development strategy of global expansion, ecological prosperity, wealth effect, and safety compliance, providing comprehensive, safe, and reliable value and services for cryptocurrency enthusiasts worldwide.

For more information about Huobi HTX, please visit https://www.htx.com/ or HTX Square, and follow X, Telegram, and Discord. For further inquiries, please contact glo-media@htx-inc.com.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。