Organized by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

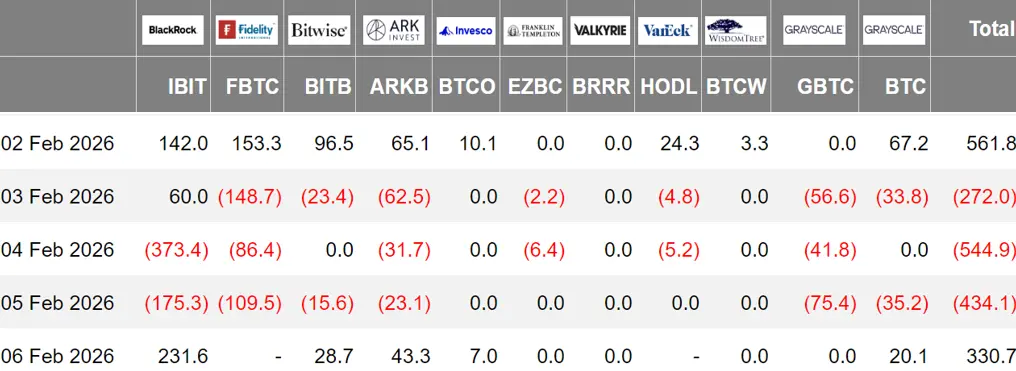

US Bitcoin Spot ETF Net Outflow of $358 Million

Last week, the US Bitcoin spot ETFs experienced a net outflow over four days, totaling $358 million, with a total net asset value of $80.76 billion.

Five ETFs were in a net outflow state last week, with outflows mainly from FBTC, GBTC, and IBIT, which saw outflows of $191 million, $173 million, and $115 million, respectively.

Data Source: Farside Investors

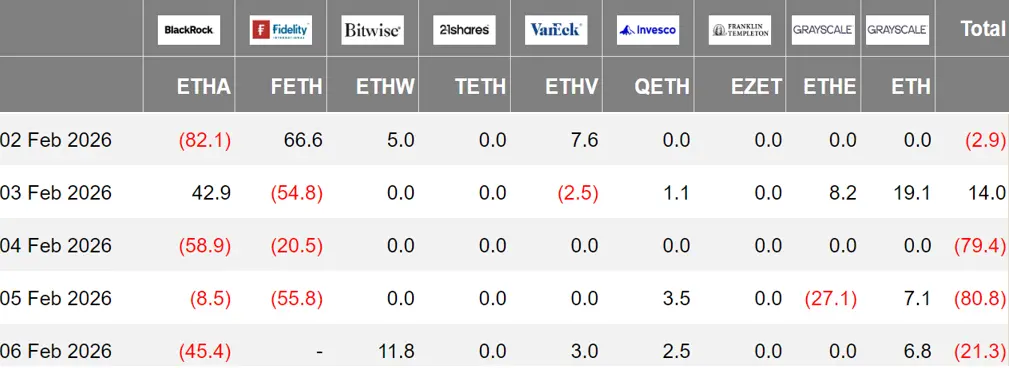

US Ethereum Spot ETF Net Outflow of $170 Million

Last week, the US Ethereum spot ETFs experienced a net outflow over three days, totaling $170 million, with a total net asset value of $10.9 billion.

The outflow last week mainly came from BlackRock's ETHA, with a net outflow of $152 million. Three Ethereum spot ETFs were in a net outflow state.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 28.6 Bitcoins

Last week, the Hong Kong Bitcoin spot ETFs saw a net inflow of 28.6 Bitcoins, with a net asset value of $24.9 million. The holdings of the issuer, Harvest Bitcoin, decreased to 290.66 Bitcoins, while Huaxia increased to 2,410 Bitcoins.

The Hong Kong Ethereum spot ETFs had a net inflow of 36.96 Ethers, with a net asset value of $7.201 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of February 5, the nominal total trading volume of US Bitcoin spot ETF options was $5.87 billion, with a nominal total long-short ratio of 0.78.

As of February 5, the nominal total open interest of US Bitcoin spot ETF options reached $22.32 billion, with a nominal total long-short ratio of 1.56.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bearish.

Additionally, the implied volatility is at 67.61%.

Data Source: SoSoValue

Overview of Crypto ETF Dynamics Last Week

Bitwise Submits S-1 Registration for Uniswap Spot ETF to US SEC

According to official documents, Bitwise has formally submitted an S-1 registration statement to the US Securities and Exchange Commission (SEC) to launch the Bitwise Uniswap ETF.

This product is managed by Bitwise Investment Advisers and custodied by Coinbase Custody. It currently does not participate in staking but may introduce it in the future through amendments to the registration documents.

ProShares Launches Crypto Exchange-Traded Fund CoinDesk 20 Crypto ETF

According to CoinDesk, asset management company ProShares announced the launch of the KRYP ETF, the first crypto asset ETF in the US tracking the CoinDesk 20 Index, providing investors with exposure to a basket of the 20 largest and most liquid cryptocurrencies.

The index is market-cap weighted with a cap on weights and is rebalanced quarterly to reduce concentration risk. The CoinDesk 20 is selected from the top 250 crypto assets by market cap, excluding stablecoins, meme coins, privacy coins, and various pegged/wrapped assets.

Pilgrim Partners Asia Reduces Holdings in BlackRock Ethereum ETF Worth Over $16 Million

Singapore asset management company Pilgrim Partners Asia disclosed in a filing to the US SEC that it sold 620,000 shares of BlackRock's iShares Ethereum Trust ETF last quarter, valued at $16.21 million.

As of now, the company still holds $25.49 million worth of BlackRock Bitcoin ETF and $10.64 million worth of Strategy shares.

Grayscale CoinDesk Crypto 5 ETF to Add BNB

According to official news, Grayscale announced that its CoinDesk Crypto 5 ETF will add BNB. This ETF has been listed on the NYSE Arca and covers Bitcoin, Ethereum, SOL, and XRP, with the trading code GDLC. The product was formerly known as the Grayscale Digital Large Cap Fund.

Views and Analysis on Crypto ETFs

Bloomberg's senior ETF analyst Eric Balchunas stated on the X platform that the previous judgment that the investor structure of Bitcoin ETFs would be stronger than market expectations still holds, but he had expected ETF funds to reduce market volatility, which has proven to be incorrect.

Eric Balchunas mentioned that he originally thought retail funds in ETFs would replace the highly speculative retail investors before the FTX incident, thereby enhancing market stability, but he did not fully consider the selling pressure from early holders (OGs) reducing their positions at high levels. He also pointed out that Bitcoin's approximately 450% increase over two years is a potential risk signal, as rapid price increases are often accompanied by high volatility, thus the high volatility and high-risk attributes of Bitcoin will continue in the foreseeable future.

As Bitcoin's sell-off intensified and fell below $70,000, its core selling point of "limited to 21 million" is facing market skepticism. Analysts point out that ETFs, cash-settled futures, options, and financing lending derivatives have diluted Bitcoin's scarcity, creating "synthetic supply," making prices more influenced by derivatives trading rather than supply and demand.

Senior analyst Bob Kendall stated, "Once synthetic supply can be created, assets are no longer scarce, and prices become a derivatives game, which is the current state of Bitcoin. Similar structural changes have also occurred in the gold, silver, oil, and stock markets."

Bloomberg Analyst: Bitcoin ETF Investors Hold Firm, Actual Outflow of Assets Only About 6%

Bloomberg's senior ETF analyst Eric Balchunas stated on the X platform that despite Bitcoin's price experiencing a 40% drop, leading to many investors showing paper losses, only about 6% of assets in Bitcoin ETFs have actually flowed out, with 94% still holding their positions.

In contrast, the behavior of long-time Bitcoin investors (OGs) may differ under similar market conditions, indicating that the new generation of ETF investors is more committed to long-term holding strategies.

Citi: Bitcoin Approaches Support Level Before US Elections, ETF Fund Inflows Have Clearly Slowed

According to CoinDesk, Citi's analysis indicates that Bitcoin is approaching a key price support level before the US elections.

The report states that after several weeks of decline, Bitcoin's price has fallen below the estimated average entry cost of about $81,600 for US spot Bitcoin ETFs and is nearing the critical level of about $70,000 before last year's elections.

The report notes that the main new demand source supporting the market—ETF fund inflows—has clearly slowed, while the futures market continues to see long positions being liquidated. Analysts state that the cryptocurrency market exhibits volatility similar to precious metals but has failed to follow the recent safe-haven rise in gold, highlighting that its price is still primarily influenced by liquidity conditions and risk sentiment rather than safe-haven demand.

The report believes that regulatory progress remains a key potential catalyst, but the advancement of the US Digital Asset Market Structure Act is slow and uneven, and related expectations have weakened. The report also mentions macro risks, including concerns about the Federal Reserve's balance sheet contraction, which historically puts pressure on cryptocurrencies by reducing liquidity in the banking system.

According to Bloomberg, the core issue of this round of "slow" Bitcoin sell-off is that the group of investors originally expected to become the most stable buyers in the new round has not continued to enter the market. Glassnode data shows that investors entering through US spot Bitcoin ETFs have an average buy-in cost of about $84,100. With Bitcoin currently hovering around $78,500, this group is facing a paper loss of about 8% to 9%.

This is not the first time ETF investors have faced paper losses. Back in November of last year, when Bitcoin briefly fell below $89,600 (which was the average cost range for ETF investors at the time), analysts pointed out that this would be a key test of the "strength of conviction" for new mainstream investors. Subsequently, as capital inflows at the beginning of 2024 remained profitable, the overall average cost of ETFs decreased, but the funds that entered later have all fallen into losses. From the peak, Bitcoin has dropped over 35% from its high in 2025 and briefly fell below $77,000 in a low liquidity trading environment over the weekend.

Analysts believe this is the result of multiple factors: exhaustion of capital inflows, declining market liquidity, and an overall weakening of macro attractiveness. Bitcoin's failure to respond to traditional bullish factors such as a weakening dollar or geopolitical risks, along with its "decoupling" from other assets, has made its price movement increasingly lack direction. The main difference between the sharp drop in October and the current downturn is market sentiment: there is no panic now, only "absence."

The rally that pushed Bitcoin above $125,000 in 2025 was driven by the market's heightened excitement over regulatory prospects, institutional entry, and a bullish retail base. However, since the October crash liquidated billions of dollars in leveraged positions, it is these buyers who once drove the rally that have chosen to remain inactive and temporarily step back to observe.

According to Glassnode analyst Chris Beamish, Bitcoin has now fallen below the average cost basis of US spot ETF holders (approximately $84,000), leading to unrealized net losses for ETF buyers. Chris Beamish stated that this is the first real stress test for US spot ETF holders.

After the US stock market opens, investors will choose to buy or panic sell, and tonight may bring a "stress test."

Matrixport: Bitcoin Lacks a New Narrative, Weak ETF Funds May Lead to Continued Consolidation

Matrixport released a recent analysis indicating that the core reason for Bitcoin's continued consolidation is the "lack of narrative." Data shows that Bitcoin spot ETFs have recorded net outflows for three consecutive months. Despite several US wealth management institutions gradually opening allocation channels, the new channels have not brought in corresponding incremental funds, resulting in an overall weak ETF funding situation.

Matrixport believes that the marginal demand from traditional finance (TradFi) may have reached a stage of saturation. In terms of timing, July was the last significant net inflow window, after which the momentum of funds has continued to weaken. The report suggests that Bitcoin may need a "narrative reboot" or a new core pricing theme to form substantial support in terms of funds and expectations and to attract TradFi capital back; the current trend is more likely a phase of correction rather than a long-term trend reversal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。