Author: Will Awang, Web3 Legal Expert

On February 6, 2026, the People's Bank of China and eight other ministries issued the "Notice on Further Preventing and Handling Risks Related to Virtual Currencies" (Yin Fa [2026] No. 42, hereinafter referred to as "Document No. 42"), which continues the strict regulatory stance of mainland China towards virtual currencies with a "one-size-fits-all" approach.

For stablecoins, Document No. 42 does not elaborate much, but based on the regulatory principle of "dynamic assessment," it leaves room for their permitted operations.

More importantly, Document No. 42 for the first time includes the tokenization of real-world assets (RWA) within the regulatory scope. At the same time, the China Securities Regulatory Commission also released "Guidelines on the Regulation of Asset-Backed Securities Tokens Issued Overseas for Domestic Assets" (hereinafter referred to as "Guidelines"), which, along with the regulatory requirements for real-world asset tokenization in Document No. 42, provides a framework for RWA operations that have long been in a gray area.

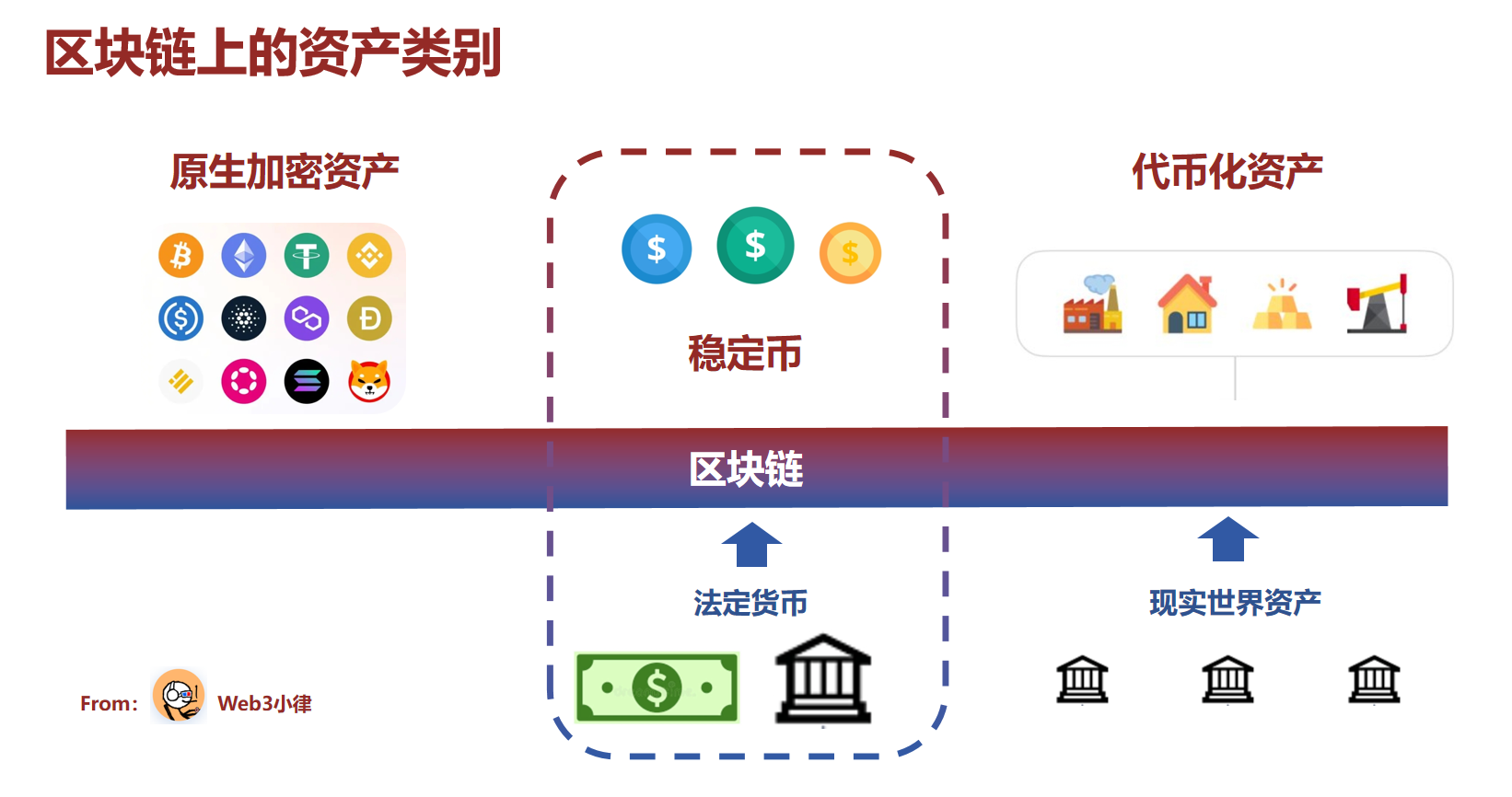

Document No. 42 brings all three types of virtual assets/digital assets—virtual currencies, stablecoins, and real-world asset tokens—under regulation, filling the previous regulatory gaps and serving as the most precise and complete legal normative document in the current field of virtual assets in mainland China.

Thus, the regulatory framework for virtual assets in China has initially taken shape.

I. Historical Evolution of Virtual Asset Regulation in Mainland China

The "Notice No. 94" (Announcement on Preventing Risks of Token Issuance Financing) issued on September 4, 2017, identified token issuance financing (ICO) as essentially unauthorized illegal public financing, involving various illegal activities, and comprehensively halted ICOs while requiring trading platforms to clean up and rectify related businesses within a specified period.

The "Notice No. 924" (Notice on Further Preventing and Handling Risks of Virtual Currency Trading Speculation) issued on September 24, 2021, clarified that virtual currencies are not legal tender, and related activities such as trading, exchange, intermediation, token issuance financing, and derivatives trading are all illegal financial activities. It prohibited overseas exchanges from providing services to domestic entities while establishing a multi-dimensional risk prevention and handling system.

Related reading: A Brief Overview of China's Regulatory Attitude Towards Virtual Currencies (January 25, 2023)

After this, there was a long period without comprehensive legal documents in this field. Until November 28, 2025, a coordination meeting of thirteen ministries reiterated that virtual currency-related businesses are illegal financial activities, for the first time clearly including stablecoins in the category of virtual currencies and listing them as a regulatory focus. It added that the Central Financial Office and other departments would strengthen central-local coordination and criminal justice intervention, focusing on monitoring and combating regulatory evasion in capital and information flows.

On December 5, 2025, a risk warning from seven associations clarified that virtual currencies are not legal tender, and no RWA tokenization activities have been approved in China. It strictly prohibited member institutions from participating in or providing related services, warning of illegal risks associated with stablecoins, air coins, and RWA tokens, and advising the public to stay away from speculation.

Thus, the regulatory approach in mainland China towards virtual assets has been non-comprehensive, patchwork, and one-size-fits-all, primarily aimed at preventing illegal financial activities, combating crimes, and maintaining social order.

Until February 6, 2026, Document No. 42 provided precise distinctions for various categories of virtual assets (virtual currencies, stablecoins, real-world asset tokens) and their corresponding regulatory forms.

II. Interpretation of Core Provisions of Document No. 42

The People's Bank of China, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration for Market Regulation, Financial Regulatory Bureau, China Securities Regulatory Commission, State Administration of Foreign Exchange on Further Preventing and Handling Risks Related to Virtual Currencies (Yin Fa [2026] No. 42)

Link:

https://www.pbc.gov.cn/tiaofasi/144941/3581332/2026020619591971323/index.html

Clarifies the essential attributes of virtual currencies, real-world asset tokenization, and related business activities.

2.1 "One-Size-Fits-All" Regulatory Principle for Virtual Currencies

(1) Virtual currencies do not have the same legal status as legal tender. Bitcoin, Ethereum, Tether, and other virtual currencies are characterized by being issued by non-monetary authorities, using cryptographic technology and distributed ledger or similar technologies, existing in digital form, and do not possess legal tender status; they should not and cannot circulate as currency in the market.

Virtual currency-related business activities are illegal financial activities. Engaging in exchanging legal tender for virtual currencies, exchanging between virtual currencies, buying and selling virtual currencies as a central counterparty, providing information intermediation and pricing services for virtual currency trading, token issuance financing, and trading of financial products related to virtual currencies is strictly prohibited and must be resolutely banned by law. Overseas entities and individuals are not allowed to illegally provide virtual currency-related services to domestic entities in any form.

Web3 Legal Expert Interpretation:

Firstly, the definition of virtual currencies is consistent with previous regulatory documents— they do not have the same legal status as legal tender. Additionally, it clearly defines the geographical scope of regulation— engaging in related virtual currency business activities within the territory is considered illegal financial activity. Finally, it adds that overseas entities and individuals are not allowed to illegally provide virtual currency-related services to domestic entities in any form.

This regulatory principle of "one-size-fits-all" for virtual assets/digital assets in mainland China—specifically for virtual currencies—clearly states that, apart from being defined as illegal financial activities, it further clarifies the geographical scope of regulation, strictly prohibiting any virtual currency-related activities within mainland China:

No related activities may be conducted within the territory.

No services may be provided to domestic entities from abroad.

Although virtual currencies in mainland China are recognized as a type of "virtual commodity" (partially acknowledging their property attributes in criminal and civil judicial practice); as a type of "financial asset" or "settlement tool," their existence has been completely eradicated in mainland China.

2.2 "Dynamic Assessment" Regulatory Principle for Stablecoins

_Stablecoins pegged to legal tender have, in circulation, indirectly fulfilled some functions of legal tender. _Without the approval of relevant departments in accordance with laws and regulations, no domestic or foreign entities or individuals may issue stablecoins pegged to the Renminbi overseas.

Web3 Legal Expert Interpretation:

This provision pertains to the regulatory principle of "dynamic assessment" for the second type of virtual assets/digital assets in mainland China—stablecoins.

Although the document from the thirteen ministries on November 28, 2025, clearly stated: stablecoins are a form of virtual currency, it also mentioned the need for "dynamic assessment of the development of overseas stablecoins."

Related reading: Stablecoins in 2025: You in the Red Mansion, I in Journey to the West

The "dynamic assessment" from the thirteen ministries also leaves room for stablecoins in Document No. 42: without the approval of relevant departments in accordance with laws and regulations… stablecoins pegged to the Renminbi may not be issued.

The pending questions to observe are:

- Under what circumstances will regulators agree to issue stablecoins pegged to the Renminbi?

- Does the circulation of the digital Renminbi CBDC, which has legal tender attributes, meet regulatory requirements?

- How will the Hong Kong stablecoin licensing system develop?

As for regulatory jurisdiction, Document No. 42 innovatively implements a multi-departmental collaborative mechanism, clearly dividing regulatory responsibilities into two lines:

- The central bank regulates virtual currencies (including stablecoins).

- The China Securities Regulatory Commission, National Development and Reform Commission, Ministry of Industry and Information Technology, State Administration of Foreign Exchange, etc., regulate based on the type of RWA.

2.3 "Permitted Operations" Regulatory Principle for RWA

_(2) Real-world asset tokenization refers to the activity of using cryptographic technology and distributed ledger or similar technologies to convert the _ownership, income rights, etc._ of assets into tokens (certificates) or other rights and bonds with token (certificate) characteristics, and to issue and trade them._

_Engaging in _real-world asset tokenization activities within the territory, as well as providing related intermediary, information technology services, etc., suspected of illegal issuance of token vouchers, unauthorized public issuance of securities, illegal operation of securities and futures businesses, illegal fundraising, and other illegal financial activities, should be prohibited; except for relevant business activities conducted with the approval of the competent business authority in accordance with laws and regulations, relying on specific financial infrastructure. Overseas entities and individuals are not allowed to illegally provide real-world asset tokenization-related services to domestic entities in any form._

_(13) Without the approval of relevant departments in accordance with laws and regulations, _domestic entities_ and their controlled overseas entities may not issue virtual currencies overseas._

_(14) Domestic entities directly or indirectly engaging in _real-world asset tokenization businesses in the form of foreign debt_ overseas, or conducting asset securitization-like real-world asset tokenization businesses based on domestic asset ownership, income rights, etc. (hereinafter collectively referred to as domestic rights), shall be strictly regulated in accordance with the principle of "same business, same risk, same rules" by the National Development and Reform Commission, China Securities Regulatory Commission, State Administration of Foreign Exchange, and other relevant departments according to their responsibilities. For other forms of real-world asset tokenization businesses conducted by domestic entities based on domestic rights overseas, they shall be regulated by the China Securities Regulatory Commission in conjunction with relevant departments according to their responsibilities. No unit or individual may engage in the above businesses without the approval, filing, etc., of relevant departments._

Web3 Legal Expert Interpretation:

These provisions pertain to the regulatory principle of "permitted operations" for the third type of virtual assets/digital assets in mainland China—RWA.

A. Clearly prohibits engaging in real-world asset tokenization activities within the territory

Firstly, Document No. 42 defines the nature of RWA for the first time, which is relatively broad overall. It also clarifies the geographical limitations of regulation, which is the same as for virtual currency-related businesses. It clearly prohibits engaging in real-world asset tokenization activities within the territory, as well as providing related custody, clearing and settlement, intermediation, information technology services, etc., all of which are considered illegal financial activities and should be strictly prohibited.

However, relevant business activities conducted with the approval of the competent business authority in accordance with laws and regulations are exceptions. But there is currently no clear definition of "specific financial infrastructure." If it involves RWA for fundraising purposes, it may be possible to land through domestic trading venues, but that is all; there is no programmability or composability on-chain.

B. Guidelines for Permitted Operations for RWA Issued Overseas Based on Domestic Assets

For real-world asset tokenization activities conducted overseas based on domestic assets, Document No. 42 and the Guidelines adopt a "strict regulation, compliant operations" principle for permitted operations. The specifics are as follows:

Based on the different nature of real-world asset tokenization businesses, regulatory oversight will be conducted by the corresponding regulatory departments in mainland China according to the principle of "same business, same risk, same rules." Domestic assets—overseas issuance—domestic approval and filing.

The types of RWA correspond to the same regulatory model as traditional cross-border financial businesses. RWA in the form of foreign debt falls under the supervision of the National Development and Reform Commission (NDRC) (enterprise foreign debt is reviewed and registered by the NDRC); RWA in the form of equity and asset securitization falls under the supervision of the China Securities Regulatory Commission (CSRC) (stock issuance is "reviewed by the exchange and registered by the CSRC," asset securitization is reviewed by the exchange).

Similar to traditional cross-border financial businesses, overseas RWA also involves issues related to the repatriation of funds raised overseas, which is regulated by the State Administration of Foreign Exchange (SAFE).

In addition, Article (13) of Document No. 42 leaves room for other types of RWA to meet the needs of different innovative businesses. The previous focus was more on financial assets as the underlying assets, while this article may provide a pathway for physical assets or other rights-based assets.

The guidelines from the CSRC further clarify the compliance requirements for "asset-backed securities tokens issued overseas for domestic assets" based on Document No. 42, and the CSRC is responsible for regulating and filing these tokens.

Definition: "Asset-backed securities tokens issued overseas for domestic assets" refer to activities that utilize cash flows generated from domestic assets or related asset rights as payment support, using cryptographic technology and distributed ledger or similar technologies to issue tokenized equity certificates overseas.

In addition to the CSRC's guidelines, further clarification from other regulatory departments is awaited, or it may be incorporated into the existing framework of traditional cross-border financial regulation.

For RWA, it is particularly important to clarify:

New blockchain and tokenization technologies cannot prevent any risks; the underlying assets have not changed, and the risks remain unchanged.

This type of RWA represents a new way of asset circulation based on blockchain, rather than a new way of asset creation.

At the asset end, the core issue is what types of assets are more suitable for tokenization.

III. China Has Initially Established a Regulatory Framework for Virtual Assets

China's regulatory attitude towards virtual currencies has remained unchanged, but this time, Document No. 42 not only reiterates the strict stance towards virtual currencies.

Document No. 42 distinguishes between three important forms of virtual assets/digital assets: from the "one-size-fits-all" approach to virtual currencies, to the "dynamic assessment" of stablecoins, and to the proactive shift towards "permitted operations" for real-world asset tokenization (RWA). This represents a layered regulatory approach and signifies that China will promote the development of virtual assets/digital assets from virtual to real.

The above image illustrates the categories of virtual assets/digital assets that I have consistently shared, and the regulatory distinctions in Document No. 42 serve as a confirmation.

Thus, China has initially established a regulatory framework for virtual assets/digital assets, with more detailed rules yet to be refined. However, the core red lines remain:

- Strictly prohibit operations within the territory and targeting domestic operations.

- Strictly prohibit the use of virtual currencies (stablecoins) to perform the functions of legal tender.

Reflecting on Dr. Xiao Feng's proposition from Hashkey, "Starting from the origin, looking at the first principles of blockchain," the underlying logic remains clear:

- Blockchain is becoming a new global unified ledger, the infrastructure of new finance;

- Tokenized money on this ledger will flatten the efficiency and cost of global value transfer;

- This constructs a global, round-the-clock, multi-asset class payment, lending, and capital financial market.

Therefore, the regulatory framework for virtual assets/digital assets that China has initially formed will fully leverage the advantages of blockchain and tokenization, injecting more innovative vitality into the real economy and traditional finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。