"Positive Correlation Bitcoin" may be the truly important direction for the future, as Bitcoin may rise when interest rates increase.

整理 & 编译:深潮TechFlow

Guest: Jeff Park, Partner and CIO of ProCap Financial

Host: Anthony Pompliano

Podcast Source: Anthony Pompliano

Original Title: Why the Bitcoin Narrative Is Shifting Right Now

Broadcast Date: February 5, 2026

Key Points Summary

Jeff Park is a partner and chief investment officer at ProCap Financial. In this conversation, we discussed the recent price correction of Bitcoin, analyzed whether the market has entered a true bear market, and discussed the current interest rate environment and the role of the Federal Reserve in the economy. Additionally, we talked about the possibility of Kevin Warsh being nominated as the Federal Reserve Chairman, Jeff's outlook on the precious metals market, and his warning about a type of asset that investors should avoid in the future.

Highlights

- We are in a bear market. Even if policies become more accommodative, it may not push us into a bull market.

- If you have made good returns from silver investments, it may be time to shift funds into Bitcoin.

- "Positive Correlation Bitcoin" may be the truly important direction for the future, as Bitcoin may rise when interest rates increase.

- We initially chose Bitcoin because we believed that scarcity could solve the problem of artificially manipulated money supply.

- I remain very optimistic about the future of Bitcoin, but this is more because I believe the role of government will further centralize, and Bitcoin will again become the ultimate hedge against this system.

- The position of Federal Reserve Chairman should not be held by a socialist or nationalist; we need a technical expert, but this person must also be pragmatic, and Warsh and Bessant happen to possess these qualities.

- If interest rate cuts do occur in the future and liquidity increases further, I believe the price volatility in the precious metals market may become more intense.

- The market outlook for silver is not optimistic. Silver's performance in the precious metals market is very similar to that of altcoins in the cryptocurrency market.

- Kevin Warsh firmly believes that blockchain technology is not magic, but a tool that can solve many practical problems and improve efficiency, and Bitcoin is an important part of this technological culture.

Is the Bitcoin Sell-off Sustainable?

Anthony Pompliano:

Jeff, Bitcoin has been declining recently, and I personally feel that the market may continue to fluctuate or even decline; we may have entered a bear market. The 40% drop in Bitcoin has caught a lot of attention. What do you think? Do you believe we are in a bear market now? Do you think the decline in Bitcoin is sustainable?

Jeff Park:

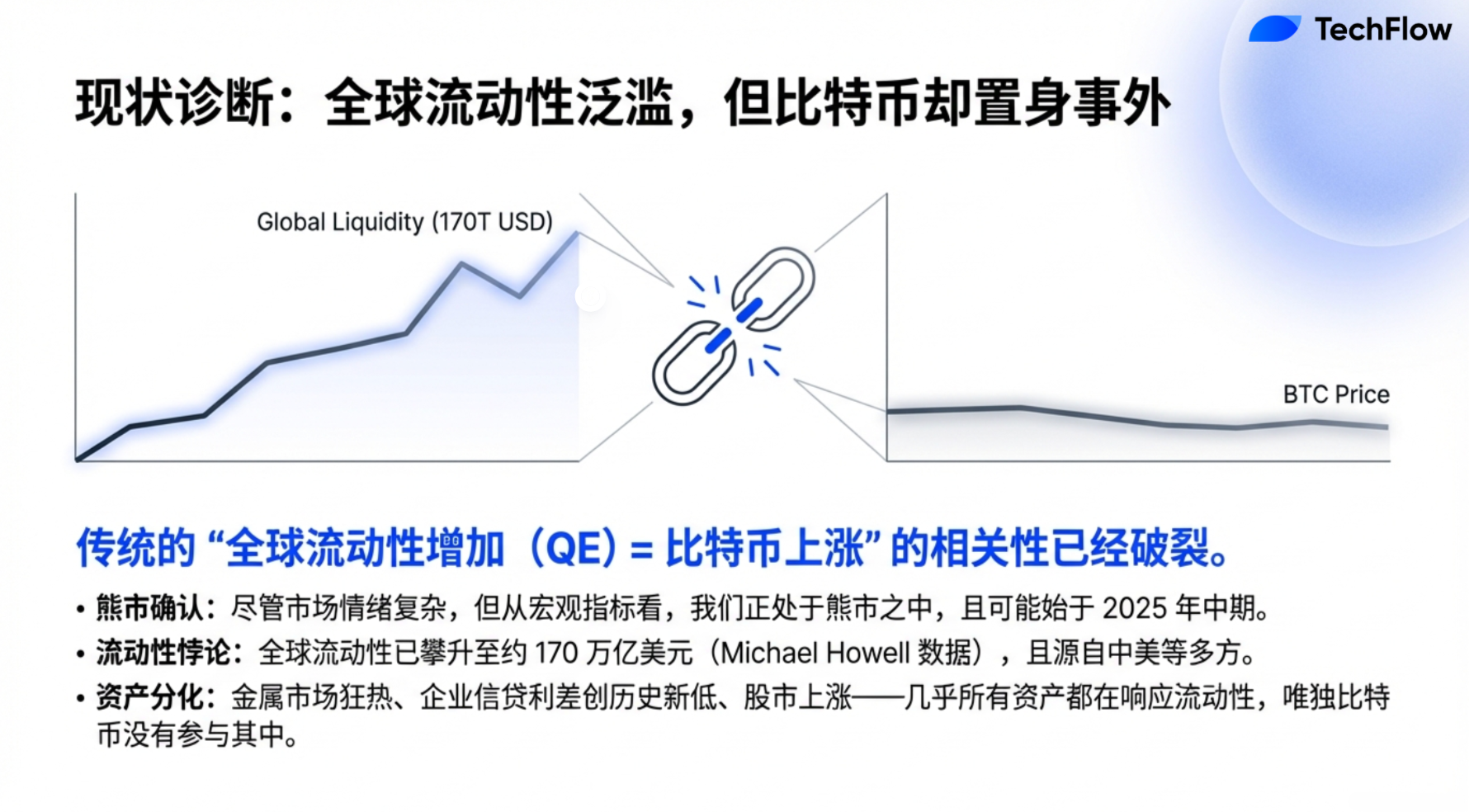

I believe we are indeed in a bear market, and it has been ongoing for some time. One thing to remember is that in the past, people liked to view Bitcoin as a hedge, believing it had a positive correlation with global liquidity—that is, an increase in global liquidity typically benefits Bitcoin. However, the fact is that this relationship has long been broken.

In the cryptocurrency space, we often tend to think that history will simply repeat itself. This idea is actually a compromise of behavioral biases, such as believing that altcoins always rise after Bitcoin or trusting in the so-called "four-year cycle," or assuming that quantitative easing (QE) and low interest rates will always benefit Bitcoin. But the world is constantly changing, and many situations are different from the past. Now, an important assumption we need to re-examine is whether quantitative easing, global liquidity expansion, and low interest rates truly benefit Bitcoin. While this was indeed the case in past cycles, the situation may have changed now.

Currently, global liquidity is actually increasing steadily. According to tracking data from Michael Howell, by 2025, global liquidity is expected to reach about $170 trillion, with sources including China and the United States, and it may accelerate further in the future. We can see this trend from the general rise in asset prices, such as the strong rebound in the metals market and corporate credit spreads reaching historical lows. This indicates that Bitcoin should have participated in this rise, but that is not the case, suggesting that some fundamental mechanisms may have changed. Therefore, I believe we are indeed in a bear market, and it may have started as early as mid-2025, when the Federal Reserve's balance sheet began to shrink, especially when the Treasury started to rebuild the General Account (TGA).

Looking ahead, we may need to accept a reality: even if policies become more accommodative, it may not push us into a bull market. However, this makes me somewhat optimistic about potential catalysts for Bitcoin's future rise.

I previously mentioned the concepts of "negative correlation Bitcoin" and "positive correlation Bitcoin." The familiar "negative correlation Bitcoin" refers to a situation where, in a low interest rate and accommodative policy environment, risk asset prices rise, and Bitcoin rises as well. But there is also the possibility of "positive correlation Bitcoin," which I believe is the ultimate goal, meaning when interest rates rise, Bitcoin may also rise. This situation is completely contrary to the theory of quantitative easing, and the logic behind it questions the reliability of the risk-free rate. In this case, we are actually saying that the risk-free rate is no longer risk-free, and the dollar hegemony is no longer absolute; we can no longer price the yield curve in the same way as before. This means we need a whole new model, such as a basket of currencies based on commodities, and Bitcoin may be that hedging tool.

Therefore, I believe this "positive correlation Bitcoin" may be the truly important direction for the future. The current money supply and financial system have encountered problems, and we are also aware that the cooperation between the Federal Reserve and the Treasury is not sufficient to drive the realization of the national security agenda. All of this makes me feel that in order for Bitcoin to emerge from its current slump, we may need to abandon old perceptions and return to the essential value of Bitcoin—we initially chose Bitcoin because we believed that scarcity could solve the problem of artificially manipulated money supply. Thus, even though global liquidity is increasing, it is not actually a friend to Bitcoin.

Federal Reserve vs. White House: Is Bitcoin Looking Forward or Backward?

Anthony Pompliano:

Jeff, I feel there are two different perspectives to analyze the current economic situation.

First, historically, we have always believed that monetary policy is the main force driving the economy and asset prices; however, now the current U.S. government seems to be trying to wrest control of the economy from the Federal Reserve. They are achieving this through deregulation, tax cuts, tariffs, and attempts to lower the dollar's exchange rate. At the same time, they are leveraging the momentum of AI development to drive economic growth. The Federal Reserve seems somewhat passive; whether voluntarily or involuntarily, they appear to be trying to figure out the various trends in the economy and how to respond.

Thus, the economy now seems to be in a dynamic power balance between the Federal Reserve and the White House, and we need to clarify whether it is the Federal Reserve or the White House that is leading the direction of economic policy.

Secondly, I am also pondering whether Bitcoin's market behavior is more forward-looking or more reflective of the current or past economic conditions. When you mentioned the psychology of Bitcoin holders, you described them as "looking in the rearview mirror while driving," believing that the past four-year cycle will always repeat, so there is no need to look to the future; just observing past patterns is sufficient. I feel your point is more like a reminder that we should "look through the windshield to see the future," which may be a better analytical approach.

So the question arises: Is Bitcoin's performance based on the current economic situation, or is it predicting future developments? For example, in 2020, many investors bought Bitcoin and gold because they anticipated inflation was coming, and the market is usually forward-looking. If Bitcoin is declining now, does that mean the risk of deflation is greater? Or is it warning us of other potential issues? What is your view on the power balance between the Federal Reserve and the White House? And is Bitcoin looking to the future or reflecting on the past? How should we interpret the current price trends in a larger context?

Jeff Park:

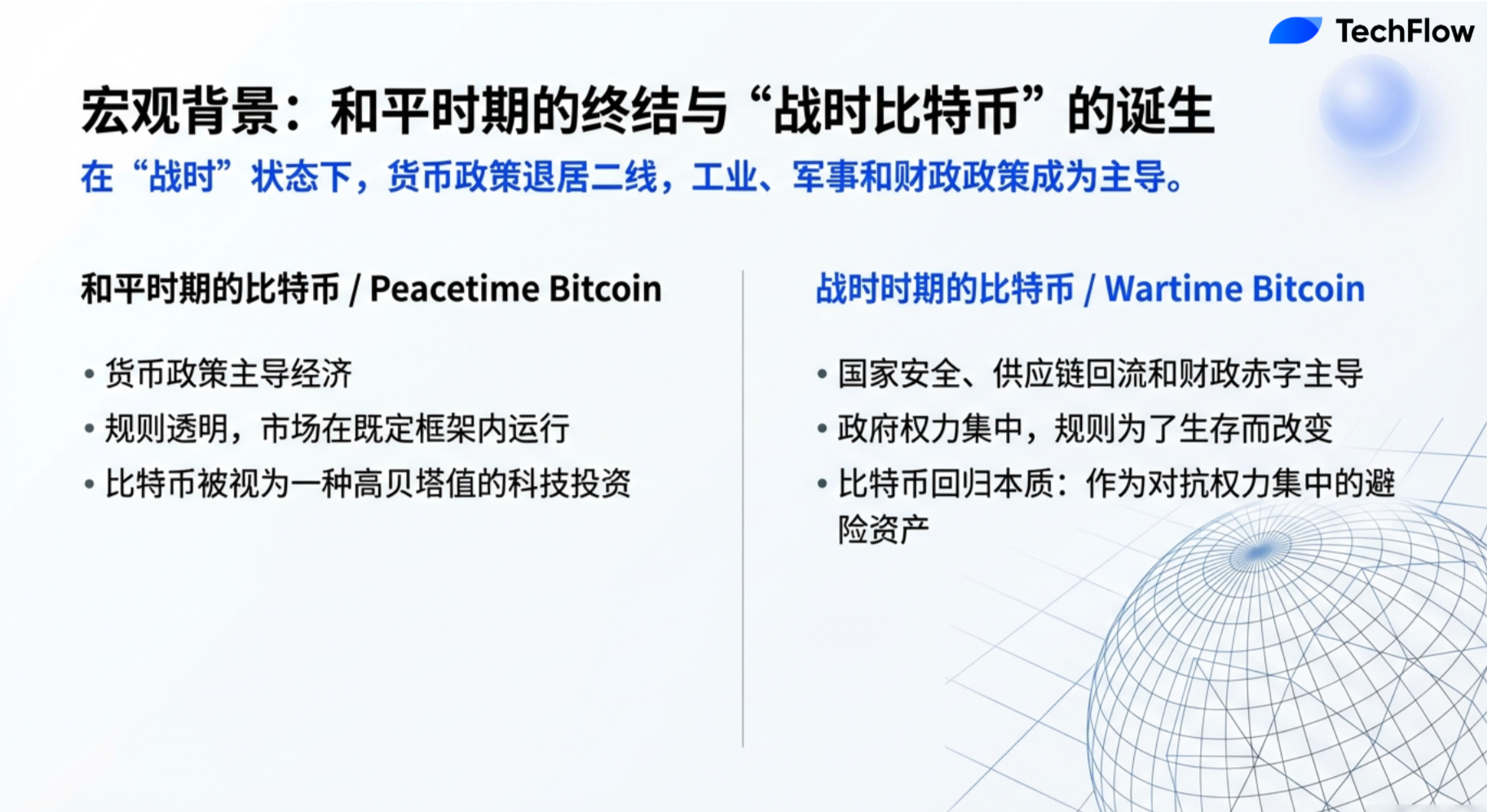

That's a great question. I have an interesting concept in my mind that I call "Peacetime Bitcoin" and "Wartime Bitcoin." In times of peace and prosperity, we expect the monetary system to function normally, and the investment framework to operate in traditional ways. This is "Peacetime Bitcoin," which is more linked to inflation and used as a hedge against inflation.

But "Wartime Bitcoin" is completely different. In "wartime," the main forces driving economic growth are no longer monetary policy, but rather a combination of industrial policy, military policy, and fiscal policy. This situation has also occurred in history—during crises between democratic nations and more authoritarian governments, the importance of monetary policy often yields to the priorities of power struggles.

Therefore, the future positioning of Bitcoin that you mentioned is correct. Part of the reason is that during the Trump administration, the world seemed to become more centralized. In the past, we were filled with aspirations for decentralization, believing that distributing resources and establishing checks and balances was a virtue, and Bitcoin and cryptocurrencies embodied this idea. However, a closer look at the recent U.S. cryptocurrency policy reveals that it is actually moving towards a more centralized model. For example, stablecoins are bringing banks into the centralization of yields; tokenization is increasingly being used as stocks rather than long-tail assets; coupled with the centralized characteristics of the Trump administration itself, all of this gives Bitcoin a kind of "centralized" energy.

The value of Bitcoin has always been in decentralization and censorship resistance; it represents a form of "free money." American investors have many other options, such as silver, metals, AI-themed investments, etc. But those who truly need Bitcoin are those living under oppression and facing capital controls. If you believe that the future world will become more fragmented, more chaotic, and even have more capital controls, then the importance of Bitcoin will become even more pronounced.

Therefore, I remain very optimistic about the future of Bitcoin, but this is more because I believe the role of government will further centralize, and Bitcoin will again become the ultimate hedge against this system.

Kevin Warsh and the Future of the Federal Reserve

Anthony Pompliano:

You mentioned Kevin Warsh, who is clearly the new nominee for Federal Reserve Chairman. He has expressed some very positive views on Bitcoin, believing that it does not compete with the dollar but has a unique role in investment portfolios. What do you think of his potential as Federal Reserve Chairman? How might he influence the development of Bitcoin in the future?

Jeff Park:

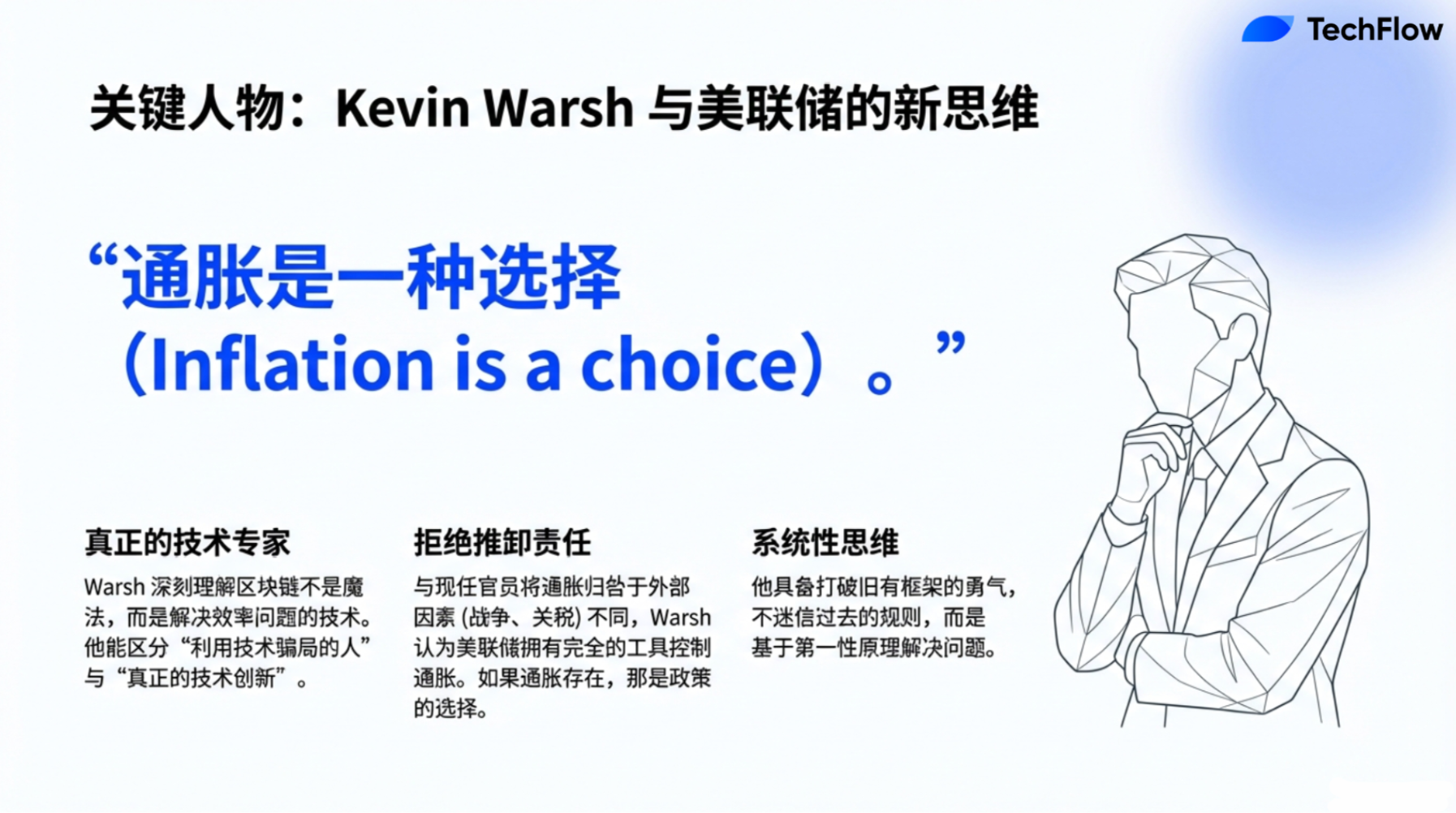

To be honest, I have a lot of admiration for Kevin because I think he is an expert with a profound understanding of how things work. He understands that sometimes you need to break existing patterns to take the next step, and he knows that only by truly understanding the root of the problem and diagnosing it correctly can you find a solution. You can't just change for the sake of change, and those who truly understand things are often reluctant to change the status quo; having this innovative mindset requires great courage, and Kevin possesses that quality.

Moreover, he is also an outstanding technical expert. In a conversation I had with him, I clearly remember his enthusiasm for cryptocurrencies. He mentioned that there are many "hypocrites" in the world who think technology is some kind of magic but do not truly understand the essence of technology; they are just blindly betting without the right reasons. In contrast, Kevin firmly believes that blockchain technology is not magic but a tool that can solve many practical problems and improve efficiency, and Bitcoin is an important part of this technological culture.

This is crucial because many technologists do not truly understand how technology operates in practice. For them, imagining the innovative space of technology is counterintuitive. For example, when we talk about productivity growth, the Federal Reserve may not perceive the deflationary effects brought about by artificial intelligence. This cognitive gap exists because many people cannot envision a future that may be radically different from the past, as Kevin Warsh can. Therefore, I believe he is primarily a technical expert, which is particularly important today. I think we need more leaders like him with technical foresight in the field of monetary policy.

Additionally, Kevin has extensive experience working at the Federal Reserve. By studying his past actions, it is clear that he truly believes in the value of the Federal Reserve as an institution. He is not the type to advocate for ending the independence of the Federal Reserve, but he understands why that independence is challenged and knows how to reshape the institution to regain public trust. He once said something that impressed me: "Inflation is a choice." In contrast, we see the current Federal Reserve Chairman Powell and others seemingly always looking for external excuses for inflation, such as "inflation is due to tariffs" or "inflation is due to the war in Ukraine." They are almost unwilling to admit that inflation is a choice of the Federal Reserve, whereas, in reality, inflation is a policy choice and one of the core missions of the Federal Reserve.

Regarding inflation, it is also important to clarify that inflation and nominal price changes are two different things. Many people confuse the two, thinking that a 5% increase in the price of a certain good is inflation, but that is merely a price change, which can be caused by various factors such as war or tariffs. True inflation is a dynamic concept, a long-term trend in the rate of price changes, not a one-time price fluctuation. The Federal Reserve's responsibility is not to focus on monthly price changes but to manage the trends of these price changes over the long term. This is often overlooked.

I strongly agree with Kevin Warsh's view that "inflation is a choice" because the Federal Reserve actually has all the tools to control inflation, as long as they are willing to take action.

Anthony Pompliano:

Interestingly, two seemingly contradictory situations can actually coexist. I feel that people always want to find a simple answer, such as whether it is inflation or deflation? High inflation or low inflation? But in reality, the economic system is very complex, and Bitcoin seems to simplify these complex economic relationships. You don't need to learn all these complicated economic principles; you just need to understand the relationship between supply and demand: if more people want something, its price will go up; if demand decreases, its price will go down. The idea of Bitcoin seems to be reimagining the monetary system. If that is the case, are they trying to make this system simpler? Do they hope to simplify this complex economic machine into a system that anyone can easily understand?

Jeff Park:

Yes, this system is inherently very complex, and I'm not sure it can really become simple. However, I think they should make it more transparent and honest. Americans have lost confidence in the current monetary system not only because it has become complex but also because it lacks transparency. I believe one of Kevin Warsh's tasks is to change the way the Federal Reserve uses its balance sheet while addressing the obvious transparency issues in the current system.

For example, at the Federal Reserve meeting in January this year, someone asked Powell a question about the relationship between the value of the dollar and the interest rate setting mechanism. In the context of a significantly strengthening dollar, this is clearly an important question because the core of interest rates is that the value of the benchmark currency directly affects long-term yields and rates. But Powell's response was, "We do not focus on the level of the dollar when making policy." To some extent, he may have been trying to simplify the issue, as it is not his area of expertise. However, this statement overlooks an important reality: the value of the dollar is indeed closely related to interest rate policy. But in fact, both can be considered.

This is why I am optimistic about the potential for a new agreement between the Federal Reserve and the Treasury. Bessant and Warsh have the opportunity to redefine this agreement. The core of the issue once again returns to the Triffin Dilemma: as the global reserve currency, the dollar must meet international reserve demands while ensuring domestic economic stability, and there is an inherent contradiction between the two.

Therefore, what we need is not the absolute independence of the Federal Reserve, but a functional interdependence between the Federal Reserve and the Treasury. I believe we need to move away from the notion that "the independence of the Federal Reserve is under threat" and instead accept that "the Federal Reserve must establish a functional collaborative relationship with the Treasury" to formulate more reasonable policies. Once we achieve this, the Federal Reserve will take an important step and regain public trust in its role.

Anthony Pompliano:

What do you think of the backgrounds of Warsh and Bessant? Both come from the same system and have learned under the same mentor, which can be said to have similar ways of thinking and working principles; perhaps they are among the greatest risk-takers in history.

Jeff Park:

This excites me a lot; I have publicly expressed my views online multiple times. Since last year, I have believed that Warsh must become the Federal Reserve Chairman. This is a historic moment because you can find two people who trust each other and know each other well, both of whom have worked under what may be the greatest market practitioners in history, and now they have the opportunity to bring about real change. In this regard, the importance of the trust relationship cannot be underestimated.

This reminds me of some previous situations, for example, Warsh was once a candidate, then Hasset appeared, he became a candidate, and then it was Rick Reer’s turn, but throughout the process, I kept thinking, "You are overlooking the bigger picture."

This seems to be a decision by Trump, but in reality, who ultimately influenced this decision? It was Bessant. Who would he choose to collaborate with? Who would he trust? Who can realize his vision and changes for the future of the country? The answer has always been the same: Warsh. When you realize this, you find that it is a very clear and powerful moment. Because of this trust relationship, we are now able to achieve some goals on the global stage that were previously unattainable. I am very excited about this.

Of course, I know many people have biases against billionaires, thinking they only care about their own interests and do not consider ordinary people, but I hold the opposite view. I believe we should expect these resource-rich individuals to do something meaningful. Because if it is not these resource-rich people driving change, it may be some ill-intentioned individuals taking control. Rather than that, it is better to let those who no longer need to make money for themselves drive improvements in the system. I believe that for Bessant and Warsh, what they care about the least is how to make more money for themselves; what they truly care about is how to fix the entire system.

For this reason, I have great optimism about them. They have a deep understanding of the market because they are practitioners of the capital market themselves. They know that while the Federal Reserve as an institution has its merits, there are still many issues. And they possess the wisdom, integrity, and clear communication skills to drive change; this combination is actually very ideal.

In my view, the position of Federal Reserve Chairman should not be held by a socialist or nationalist; we need a technical expert, but this person must also be pragmatic. Warsh and Bessant happen to possess these qualities, and I am very much looking forward to their future.

Anthony Pompliano:

What I find interesting is the collaboration between Warsh and Bessant. They not only have a deep understanding of the American financial system but also possess a global perspective. For example, some of the measures Bessant took in Argentina turned out to be very wise in hindsight. Although they caused quite a bit of controversy at the time, with some questioning why money was being spent in that area, looking back now, those decisions were indeed far-sighted.

America has always been a country full of adventurous spirit, always holding the mindset of "let's go build." But from the perspective of monetary policy, America is also trying to cut unnecessary spending and implement some reforms. In this mindset, you need those who truly understand probability and risk. I think this is also the key point you mentioned: these people have spent their lives studying these issues, right?

When Bessant was nominated, I am not sure how many people thought he would be outstanding. People might think he is smart, but there may not be an overwhelming consensus that he would be excellent. However, if we look back objectively now, he may be one of the best Treasury Secretaries I have ever seen in my life. And Warsh complements his shortcomings, creating a "1+1>3" effect. Warsh served as a Federal Reserve Governor during the global financial crisis and is well-versed in the internal workings of the Federal Reserve. After that, he applied that experience as a trader. Now he returns to this system, bringing a different perspective and experience, and the trust relationship between them bridges their differences.

Jeff Park:

Yes, I think a key point you mentioned is that leaders need to have the ability to think systemically. Because in economic policy, actions in one area can affect outcomes in another. To understand the probabilities of these interactions, it is essential to realize that monetary policy does not exist in isolation. It is actually closely related to fiscal policy and also tied to industrial policy. For example, Trump wanted to bring manufacturing back to the U.S. and increase investment in the semiconductor industry. These three areas are like a symphony orchestra that must coordinate to achieve the ultimate goal, and to do this, multidimensional thinking is required.

Unfortunately, most academics and those who have never worked in the for-profit sector often lack this systemic thinking. The operations in the nonprofit sector do not aim to assess the antifragility of multiple variables, let alone build complex systems. In fact, I even believe that a centralized, top-down government model often just mechanically executes orders and allocates resources but lacks accountability. It simply spends money without truly reflecting on whether these inputs have produced actual effects. This capacity for reflection and critical thinking typically needs to be cultivated through practice in the for-profit sector. Frankly, it also requires a great deal of self-awareness.

Repeating past practices will not solve future challenges; we need to carve out a completely new path. To achieve this, leaders must possess sufficient credibility, and this credibility comes from their authority as systemic thinkers. It cannot be cultivated in a closed, rigid-thinking institution. The combination of Warsh and Bessant gives me confidence in the future. They are not only technical expert leaders but also possess a pragmatic attitude and rich market experience. They understand how the market operates, know the strengths and weaknesses of the Federal Reserve as an institution, and have the ability to drive change through clear communication and integrity. This combination is very ideal. In my view, the position of Federal Reserve Chairman should not be held by someone with an overly extreme ideology. What you need is a leader who is both technically knowledgeable and pragmatic, and Warsh and Bessant fit this requirement perfectly.

Why Are Precious Metal Prices Soaring?

Anthony Pompliano:

Recently, the precious metals market has been very active, with significant price fluctuations in gold, silver, and even copper and platinum, sometimes soaring and then slightly retreating before continuing to rise. What is happening behind this?

Jeff Park:

This actually reflects a kind of frenzy in the current market, and I think this is one of the reasons we need to rethink the investment logic of Bitcoin. Although this wave of enthusiasm has not directly affected Bitcoin, it has been particularly evident across the entire precious metals market. As for the reasons, I believe the global liquidity environment is currently very loose. To be honest, if interest rate cuts do occur in the future, leading to further increases in liquidity, I think the price fluctuations in the precious metals market could become even more pronounced. Some funds may flow into Bitcoin, or they may not, but the key is that this market phenomenon is already happening.

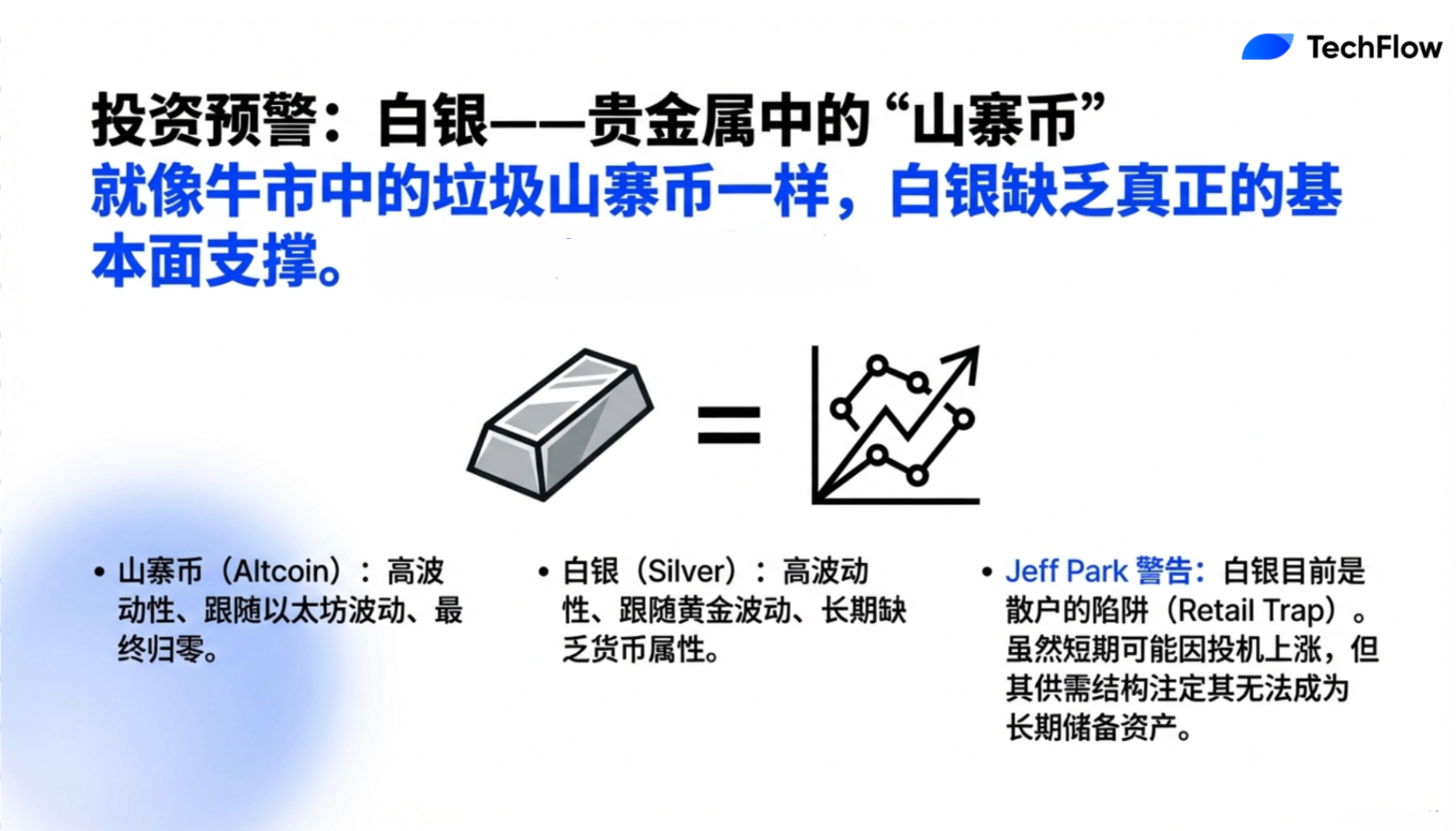

Especially silver, I feel it is currently a primary target for retail investors, which reminds me of the altcoin market. In fact, silver and altcoins have many similarities; silver's position in precious metals is akin to Ethereum's position in cryptocurrencies. While I do not intend to offend the Ethereum community, there is indeed a certain rationality to this analogy.

Analyzing the price fluctuations of most commodities can actually be boiled down to two fundamental factors: demand and supply. From the supply side, silver is actually a byproduct of mining other metals. Many people may not know that there are almost no mining companies that specifically mine silver; most silver is produced as a byproduct when mining zinc or copper, so it can be considered a "bonus." In the world of cryptocurrencies, this is like when you are yield mining, originally investing in Ethereum, but because you use Ethereum to participate in certain on-chain mining activities, you receive some random tokens as additional rewards. These tokens are like silver, representing an extra yield.

Therefore, miners do not specifically mine silver because of its price; it is merely a byproduct of mining other metals. From this perspective, the supply of silver is actually quite large. Unlike Bitcoin's scarcity, silver's supply is relatively abundant. Ultimately, the market will find a reasonable price for silver, and because silver is just a byproduct of other metals, its price may be suppressed due to ample supply.

On the demand side, while some have mentioned the industrial applications of silver in areas like artificial intelligence and solar panels, in reality, silver is a substitutable commodity. Silver is favored for its high conductivity, but copper's conductivity is only about 5% lower than that of silver. This means that while silver has excellent performance, its high price does not make it the only choice. In fact, due to the rising price of silver, many solar panels have started to use copper instead of silver.

Additionally, silver is not a reserve asset; no central bank buys silver. From the supply perspective, the production of silver is not entirely determined by its market price but is a byproduct of mining other metals. Therefore, overall, I believe the market outlook for silver is not optimistic.

This reminds me of the situation in the altcoin market. Silver's price volatility is high and is highly correlated with gold prices, a relationship similar to how the performance of altcoins often relies on the rise of Bitcoin. However, ultimately, the prices of most altcoins will return to the equilibrium point of supply and demand. For investors who have participated in the cryptocurrency market over the past few years, there is a lesson to be learned: the performance of silver in the precious metals market is very similar to that of altcoins in the cryptocurrency market.

Anthony Pompliano:

So you mean that silver prices could see a significant correction?

Jeff Park:

Yes, if you have already made good profits from silver investments, now might be the time to shift your funds into Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。