Author: Gu Yu, ChainCatcher

With the sharp decline in BTC and ETH prices over the past few days, the positions of Jack Yi, founder of Trend Research and Liquid Capital (formerly LD Capital), have drawn significant attention from many investors in the crypto space. His leveraged position of 650,000 ETH is now precarious in the current market, just a step away from liquidation.

For this staunch ETH bull, a rare on-chain trader, and a representative of the Asian crypto institutional sector, the current situation is indeed somewhat cruel and lamentable. After all, concepts like "transparency," "bullish sentiment," and "research-driven investment" align with the mainstream values of crypto, and Yi's current "battle" is, to some extent, a "battle for the legitimacy" of the crypto industry.

So, how did all this happen? Why did Yi go from successfully selling at the top to buying at the bottom and getting trapped? What insights and lessons can we draw from this?

From Bottom Fishing to Selling at the Top

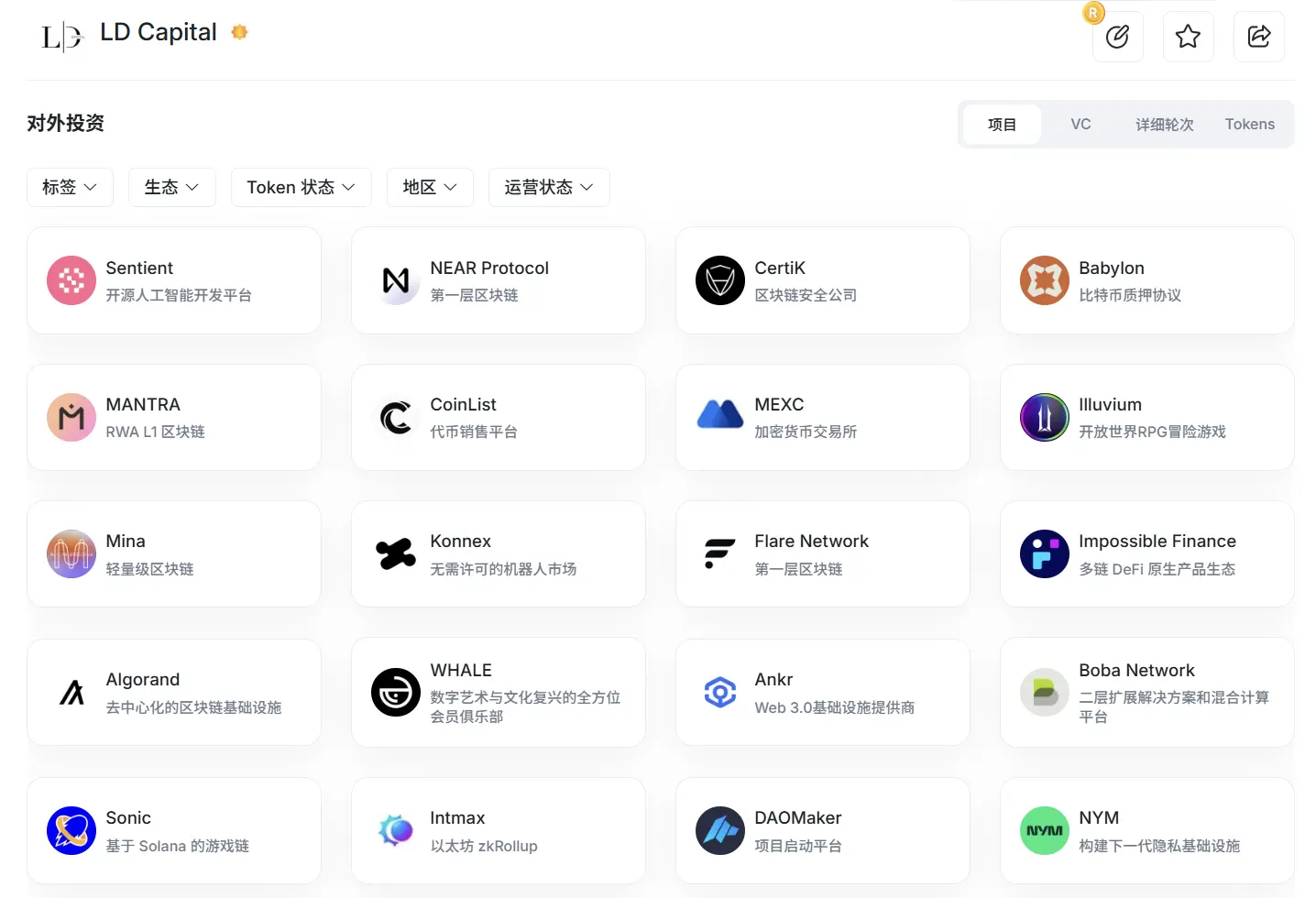

Jack Yi is an early OG in the Chinese crypto community, having invested in hundreds of blockchain projects since 2015. Early investment cases include EOS, Quantum Chain, VeChain, and in 2017, he invested in well-known projects like Near, CertiK, and MEXC through LD Capital.

LD Capital's investment cases Source: RootData

Since early 2025, Yi's focus has shifted from the primary crypto market to the secondary market. In April 2025, the price of ETH fell to a new low since 2022, dropping to as low as $1,385. Yi's bottom fishing quietly began at this time.

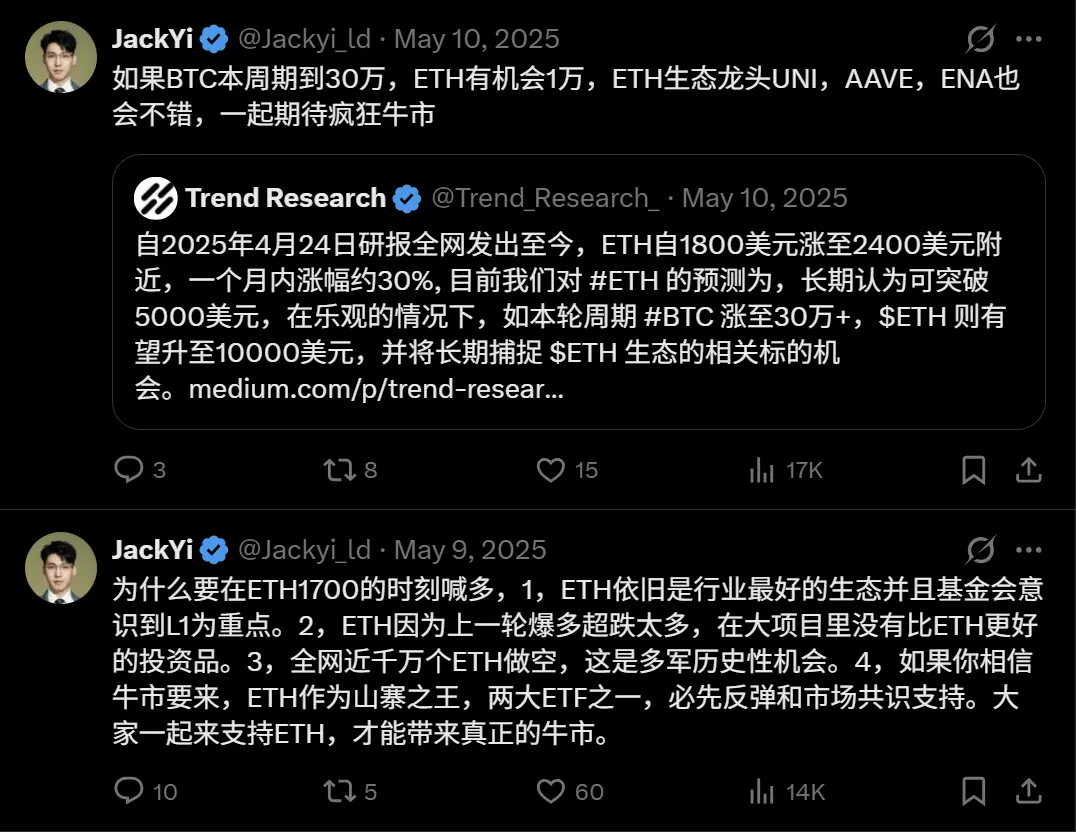

At the end of April, Trend Research publicly released a report bullish on ETH when the price rose to $1,800, stating, "Under the trend, more upward movement in the crypto market is imminent."

By the end of May 2025, Trend Research's frequent large-scale on-chain accumulation was discovered and disclosed by on-chain analyst Yu Jin, and Yi subsequently claimed this batch of addresses on X. At this point, ETH had risen to $2,600, and Trend Research's on-chain addresses held a total of 133,000 ETH, worth $360 million.

However, it should be noted that Trend Research's operations were not entirely cash accumulation; a significant portion of the funds used to purchase ETH was borrowed against early purchased ETH on Aave, effectively adding several times of leverage.

In June 2025, Trend Research published another article titled "On the Eve of a Surge, Why We Are Bullish on ETH," mentioning that the underlying logic for the institution's continued optimism about ETH is: the Trump administration's commitment to establishing a stablecoin system… and the most important infrastructure for stablecoins and on-chain finance is Ethereum. The influx of stablecoins and the ongoing development of RWA will bring further prosperity to DeFi, increasing Ethereum's consumption and GAS revenue, thereby boosting its market value.

At this time, the price of ETH was around $2,800. Yi publicly stated that he believed ETH's long-term price could break $5,000, and in an optimistic scenario, BTC's price could rise above $300,000, with ETH expected to reach $10,000. Meanwhile, Yi mentioned that he had purchased 100,000 ETH options.

In July 2025, Yi tweeted that the market had completely entered a long bull market, and there might no longer be traditional four-year cycle patterns. Stablecoins and blockchain represent the best opportunity for the globalization of the dollar for the United States, investing in cryptocurrencies with one hand and earning interest on stablecoins with the other, as the market would continuously attract new users and funds.

After that, Yi almost increased his positions every month until early October when he began to warn about market risks and quickly transferred most of his ETH holdings to Binance for sale, at that time around $4,700, just escaping the 1011 incident.

Through this precise bottom fishing (starting to build positions around $1,800 in the first half of the year) and cashing out at the peak, Yi achieved significant doubled profits and solidified his influence as a top trend investor in the Chinese-speaking community.

Second Position Building and Being Trapped

In the reshuffled market after the 1011 incident, Yi saw another opportunity to build positions. In early November, Yi tweeted again that ETH was starting to rebound and continued to be optimistic about the subsequent market and bottom-fishing strategy. He later stated that the $3,000-$3,300 range was the spot bottom-fishing area for ETH. As ETH continued to pull back, Yi indicated that he had fully loaded on ETH at a price of $2,700, and then continued to increase his positions through leveraged borrowing during the downturn, bringing his ETH holdings to over 650,000 by January this year, with an average cost reported to be $3,180.

"When ETH dropped to over $1,000, we saw through the main force's intention to clean out the ETH OG bulls and successfully bottom-fished. When ETH rose to over $4,500, we saw through the market's rise to a volatile peak and successfully liquidated. Trend Research has proven successful bottom-fishing and selling at the top in 2025; we will not change our investment strategy due to emotions," Yi was still encouraging the market in January.

But no one could have predicted that the market would hit this seasoned investor hard at this time, as ETH prices consecutively broke through key levels of $2,200, $2,000, and $1,800 in early February, approaching his liquidation price.

In just a few days, Yi continuously sold about 200,000 ETH to stop losses, lowering his liquidation price to around $1,600, narrowly escaping a disaster during the significant drop early this morning. According to on-chain analyst Yu Jin's analysis today, Trend Research has incurred a loss of $763 million on this long position, not only giving back all the previous profits but also losing $448 million in principal.

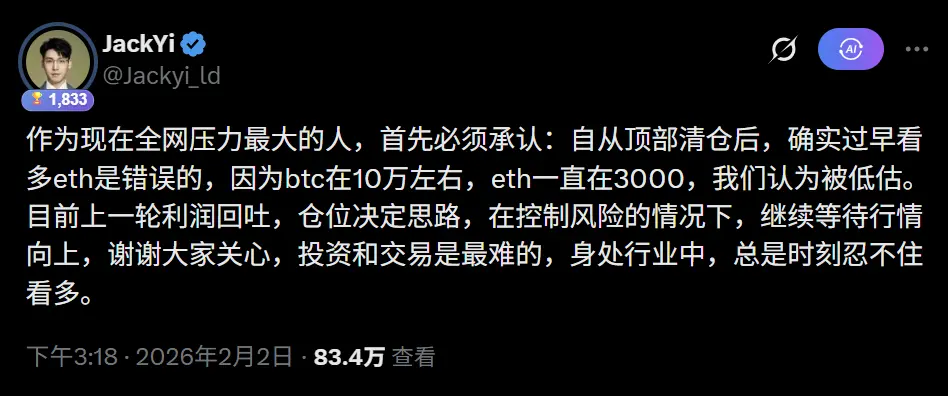

In recent days, Yi admitted his mistakes on Twitter, stating, "I must admit: since the top liquidation, it was indeed a mistake to be overly bullish on ETH too early, because BTC was around $100,000 while ETH remained at $3,000, which we believed was undervalued. Currently, the previous round of profits has been given back, and position size determines thinking. Under the premise of controlling risks, we will continue to wait for the market to move upward. Thank you all for your concern; investing and trading are the most challenging. Being in the industry, I always find it hard to resist being bullish."

"Why is it that being in the industry makes it hard to resist being bullish? It relates to my past entrepreneurial experience. Back then, I couldn't find a job and started my own business. After earning my first pot of gold, I didn't dare to spend lavishly and instead invested in tech projects. Entering the crypto space in 2015, I caught the golden era, which was a continuous journey of bullish gains. However, the subsequent bear market led to significant investment losses, and I couldn't withstand the bear market, liquidating BTC early, ultimately missing out on the big bull market after 312. We have experienced two rounds of bear markets followed by bull markets, so this time after selling at the top, I was relatively confident in bottom fishing too early, continuing to wait under the premise of controlling risks."

Zhusu, founder of Three Arrows Capital, posted on X discussing this matter, "In my experience, selling at a high often poses more danger than selling during a downturn. This is because the excitement from selling at a high can lead to premature additional buying and overconfidence. I suspect Jack Yi, after making a nine-figure profit on October 10, made a similar arrogant mistake."

However, after experiencing this setback, Yi still expressed his firm views on the future market, stating, "As a bull in this round, we remain optimistic about the performance of the new bull market: ETH reaching above $10,000 and BTC exceeding $200,000. We only made some adjustments to control risks. I know everyone is disappointed with the industry and the leaders, especially with the liquidity shortage and some platform manipulations brought about by the 1011 incident, but I believe the long-term trend of the crypto space remains unchanged. We are currently in the best buying period for spot assets. Volatility is the biggest characteristic of the crypto space; countless bulls have been thrown off by this volatility in history, but often the subsequent rebounds are doubled."

Currently, the price of ETH has rebounded to around $1,900, and the risk of Trend Research's positions has significantly decreased, but the impact and insights from this event will continue to resonate.

The Market Needs More Bullish Sentiment and Transparency

As one of the few representatives who choose "on-chain transparency" and openly share all thoughts and position dynamics, Yi's every statement and action has, in an intangible way, become a mirror for the industry: reflecting the belief in trend investing while amplifying the non-linear risks of leverage; showcasing the power of logic realization in a bull market while exposing the fragile balance between emotions and positions during a pullback phase.

However, in a market still dominated by anonymous manipulators, platform manipulation, and information asymmetry, Yi's public choice itself is a rare courage—he verifies his judgments through real on-chain operations rather than mere rhetoric. This approach, while bringing immense personal pressure and temporary floating losses, also provides countless retail investors and small to medium institutions with the most intuitive textbook: how to sell at the top in a bull market, how to bottom fish in a bear market, how to manage leverage, and how to restrain emotions.

In the highly volatile and uncertain arena of the crypto market, no matter how brilliant past successes or profound cyclical insights may be, they cannot completely exempt participants from the harsh lessons of the market—because every cycle will test participants anew with different forms, intensities, and variables. In this cycle, the crypto market has become closely intertwined with the macroeconomic environment (CPI, U.S. stocks, gold, etc.) and geopolitical events, where any significant change outside the industry could potentially reverse the cyclical trends within the industry.

This experience once again proves that what truly determines whether investors can navigate through cycles is not merely the correctness of a directional choice but whether they leave enough room for survival in the face of ongoing uncertainty, as well as their ability to stop losses and restart promptly when mistakes occur. Respecting the market is a principle that every investor must always adhere to.

Additionally, it is worth noting that Trend Research, as one of the top three ETH holding entities in the market, has become a barometer for institutional crypto investors in the Asia-Pacific region. Its successes and failures also relate to the voice and status of the Asian market in the crypto industry. There are also views in the market that the Asian market, as a significant liquidity support for the current crypto market, has a higher proportion of retail structure and more intense emotional transmission. Once the bullish sentiment is broken, the Asian market may very well become a passive recipient of North American narratives and liquidity.

Fortunately, Yi and his Trend Research are still at the table. The crypto industry needs more steadfast "bulls," more "transparency," and more "Jack Yis."

It is essential to know that the story of Trend Research will be seen by more mainstream institutions and deep-pocketed entities. The crypto industry needs more stories that emphasize research, adhere to investment discipline, and control risks to achieve returns, rather than more meme-like wealth transfers. The former can bring in incremental investors, while the latter can only exacerbate the casino-like nature of the crypto industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。