Author: Nikka / WolfDAO (X: @10xWolfdao)

In January 2026, gold, silver, and BTC plummeted simultaneously, breaking the traditional classification of safe-haven and speculative assets. The pricing power of precious metals has long shifted to financialized markets, driven by macro factors such as U.S. dollar liquidity and real interest rates, and traded by the same institutional funds. Silver, due to its high leverage, acts as a volatility amplifier, and all three triggered leveraged liquidations at liquidity inflection points. The paper market for precious metals and the physical market show a split, while the decentralized narrative of BTC has been diluted by institutionalization, putting pressure on the crypto ecosystem.

Unusual Synchronization

On January 30, 2026, gold plummeted over 12% from its historical high of $5,600 per ounce, marking the largest single-day drop in nearly 40 years. Silver was even more severe, dropping 27% in a single day, followed by another 6.7% the next day. Bitcoin fell below $75,000, hitting the $70,000 range at the weekend low, and as of this week, it has dropped below the $60,000 mark, with market panic intensifying.

In traditional understanding, this should not happen. Gold and silver are safe-haven assets—low volatility, risk-averse, protecting wealth in times of crisis. Bitcoin is a speculative asset—high volatility, high risk, loved and hated. They should fluctuate at different times, in different ways, for different reasons.

But the reality of the market is proving in the most direct way: this classification system has failed. At least at the level of pricing logic, precious metals and Bitcoin are being treated as the same class of assets.

The issue is not that gold and silver have "become unsafe," but that the forces determining their prices have fundamentally changed.

Overlooked Shift

Let’s start with a key fact: the prices of gold and silver are no longer primarily determined by "safe-haven demand."

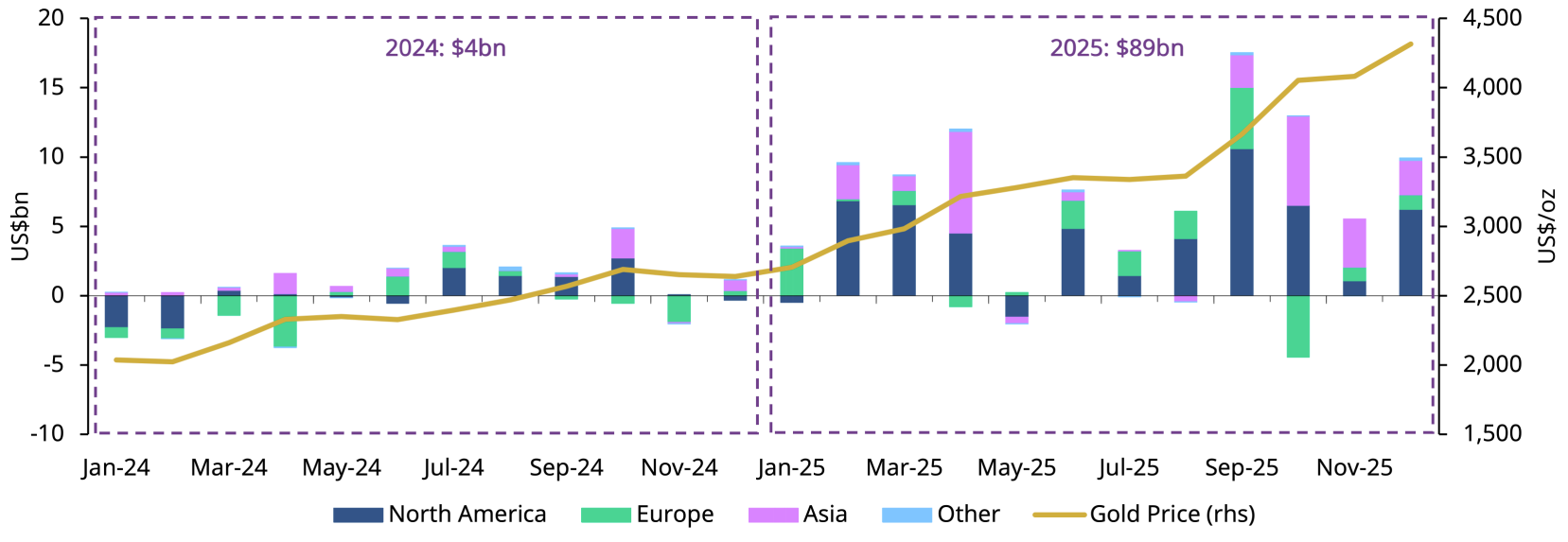

source: gold.org

In 2025, global gold ETF inflows reached a historic record of $89 billion, doubling the assets under management to $559 billion. The share of gold in global financial assets has risen from a low of 1.5% in 2010 to 2.8% in the third quarter of 2025.

This 2.8% marks a profound structural shift: the pricing power of precious metals has shifted from physical demand to financialized markets.

Today, the vast majority of marginal price fluctuations in gold and silver come from the same pool of global macro funds: hedge funds, CTA strategies, systematic trend funds, and cross-market allocation institutional accounts. These funds do not care whether "gold is a safe haven"; they only care about three variables:

- U.S. dollar liquidity

- Real interest rates

- The speed of changes in risk appetite

Research from JP Morgan shows that changes in U.S. Treasury yields can explain about 70% of quarterly gold price fluctuations. This means that gold pricing has become highly macro-driven and systematic. When you see gold prices fluctuate, it is no longer driven by India's wedding season or the buying enthusiasm of Chinese "aunties," but by Wall Street's quantitative models and algorithmic trading systems.

The Same Button

This explains why gold, silver, and Bitcoin have recently experienced significant fluctuations at the same time.

They are all exposed to the same macro factor: the violent reversals in global liquidity expectations.

When the market bets on interest rate cuts, a weaker dollar, and the dilution of purchasing power, these three asset classes are bought simultaneously—not because they are "safe havens," but because in quantitative models, they are all "non-sovereign scarce assets."

When inflation becomes sticky, interest rate expectations rebound, the dollar strengthens, or risk models trigger deleveraging, they are sold off simultaneously—not because they are "high risk," but because they are in the same risk basket.

Price fluctuations are not due to "changes in asset attributes," but because the crowd participating in pricing and the trading methods have homogenized.

January 30 is the best proof. Trump nominated Kevin Warsh as the Federal Reserve Chairman, which the market interpreted as a hawkish signal. The dollar rebounded, and immediately:

- Gold fell from $5,600 to below $4,900

- Silver plummeted from $120 to $75

- Bitcoin slid from $88,000 to $81,000

Three assets, at the same moment, in the same direction, with the same violence. This is not a coincidence, but direct evidence that they are priced by the same trading system.

Silver: Amplifier Effect

Silver's performance is particularly representative.

Compared to gold, silver has both precious metal and industrial metal attributes, with higher leverage and weaker liquidity. By the end of 2025, silver's 30-day realized volatility soared to over 50%, while Bitcoin compressed to the 40% range—this is an important reversal.

The recent rapid rise and fall of silver is essentially due to macro long positions concentrating in and out, rather than any structural changes in fundamentals occurring in the short term. The Chicago Mercantile Exchange raised silver futures margin requirements from historical lows to 15-16.5% in January 2026, ending the low-cost "paper silver" speculation era.

When prices fall, high-leverage speculators cannot meet the new margin requirements and are forced to liquidate. This triggers cascading liquidations—prices fall further, and more positions are forcibly closed. This "margin trap" is reminiscent of the 1980s when the Hunt Brothers were crushed by raising margins on silver hoarding.

This trend is almost identical to Bitcoin's performance near liquidity inflection points.

The Paradox of Truth

This also explains a seemingly contradictory phenomenon: safe-haven assets plummet when "risk arrives."

The reason is not that they have lost their safe-haven attributes, but that when systemic risk rises to a certain level, the market prioritizes "cash" and "liquidity" over "long-term value preservation logic."

When volatility spikes, liquidity often evaporates. Market makers narrow bid-ask spreads, spreads widen, and price gaps appear. In this environment, all highly financialized, quickly liquidated assets with leveraged exposure will be sold off simultaneously—whether they are called gold, silver, or Bitcoin.

As Ole Hansen of Saxo Bank said, "Volatility can be self-reinforcing." When prices fluctuate violently, market structure takes over everything. In this cycle, the "intrinsic attributes" of assets are almost irrelevant.

The Story of Two Markets

But this is not the whole truth.

While the paper market collapsed, the physical market showed opposite signals. After the silver crash, physical silver premiums in Shanghai and Dubai soared to $20 above Western spot prices. Major silver miner Fresnillo has lowered its 2026 production guidance to 42-46 million ounces. Industrial demand (solar energy, electric vehicles, semiconductors) remains strong.

This split reveals a key contradiction:

- Paper Market: Highly financialized, extremely volatile, driven by macro funds

- Physical Market: Supply constrained, demand supported, relatively stable

The same split exists in the gold market. Central banks are expected to purchase 750-950 tons of gold in 2026, marking the third consecutive year of purchases exceeding 1,000 tons. These "traditional" buyers—mainly emerging market central banks—continue to buy gold for reasons of de-dollarization, reserve diversification, and long-term value storage. They do not engage in short-term trading, do not use leverage, and will not be forced to liquidate by margin requirements.

This forms a dual structure:

- Long-term Floor: Central banks provide continuous buying support, setting a price floor

- Short-term Volatility: Institutional investors and algorithms dominate marginal pricing, creating extreme volatility

The Bankruptcy of Narrative

A deeper issue is that: the narrative system that the crypto market has long relied on is collapsing.

The narrative of "decentralized safe haven" has been diluted in the process of institutionalization. When Bitcoin plummets significantly during weekends with thin liquidity, it is largely due to leveraged trading and futures market liquidations—products of centralized finance. True holders of private keys, adhering to "not your keys, not your coins," have long been marginalized in pricing power.

The impact of this change is not limited to Bitcoin but affects the entire crypto ecosystem.

Altcoins face greater pressure: If even Bitcoin has lost its unique value proposition and is categorized as a "macro liquidity trading tool," where will those altcoins with weaker narratives and fundamentals go? When institutions allocate crypto assets, will they choose the already "tamed" BTC, or will they risk investing in Ethereum, Solana, or other public chains?

Ethereum fell 4% to $2,660 during the same period, performing even worse than Bitcoin. This suggests a brutal possibility: under macro risk patterns, funds will concentrate on "the gold of the crypto market" (BTC) while abandoning those seen as "the silver or copper of the crypto market."

The Paradox of DeFi: Decentralized finance was once seen as the most revolutionary innovation in the crypto space, promising to provide lending, trading, and other services without relying on traditional financial intermediaries. But if the pricing of underlying assets (BTC, ETH) is completely dominated by traditional financial markets, how much meaning does the "decentralization" of DeFi protocols still hold?

You can trade with decentralized protocols, but if price discovery occurs on Wall Street trading desks, Chicago futures markets, and quantitative model servers, this decentralization is merely superficial.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。