Author: Xu Chao, Wall Street Insights

"I lost an entire year's after-tax salary today."

This was the desperate cry of a Reddit user in the forum last Friday.

Just a few days earlier, silver was seen as the "GameStop of 2026," a totem for retail investors banding together to fight Wall Street. The Reddit forum was filled with "Diamond Hands" memes, vowing to send silver to the moon.

However, the celebration came to an abrupt halt in just three days.

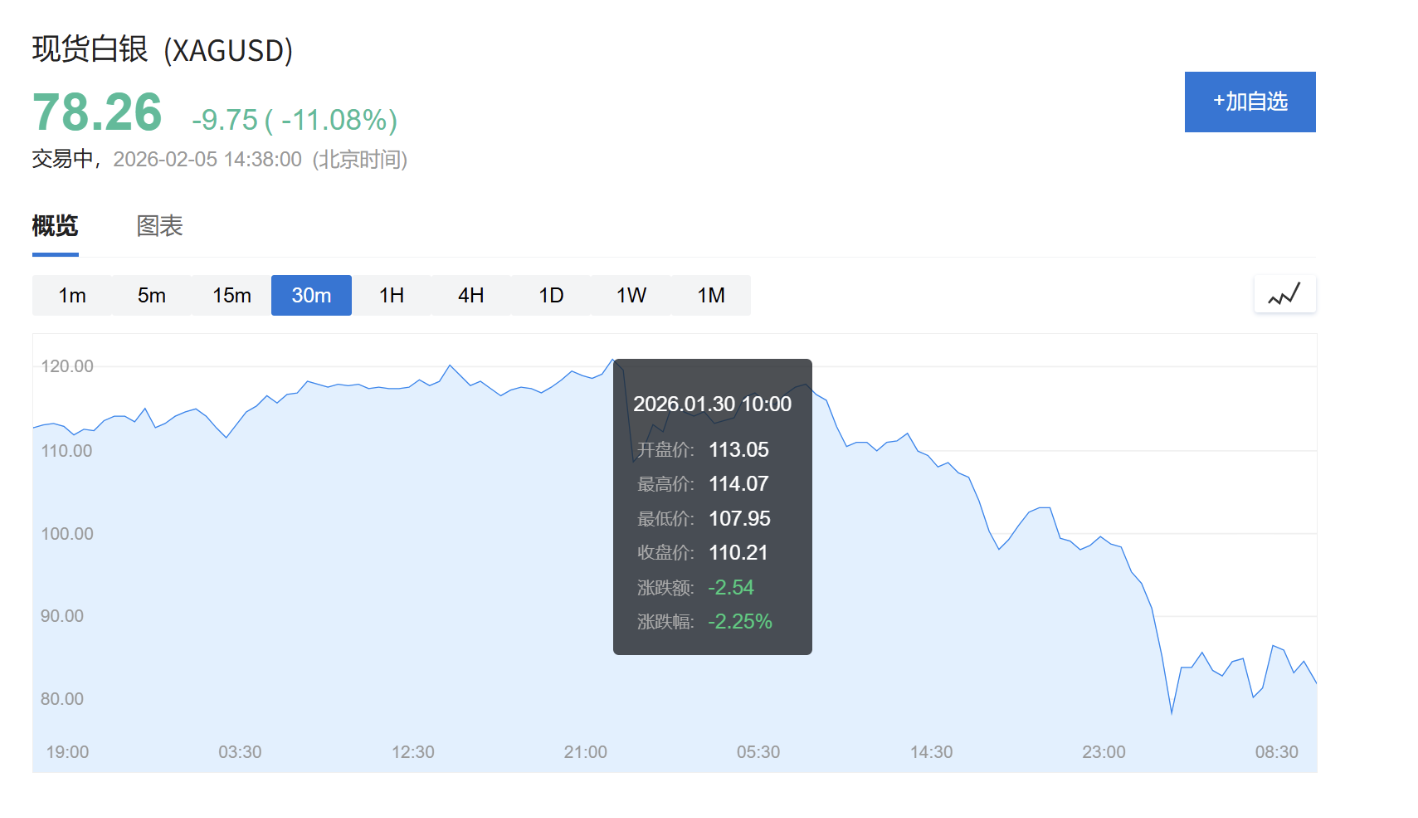

The price of silver plummeted from a high of over $120/ounce, free-falling 40% in three days, erasing recent gains and leaving a shocking cliff on the chart.

For those retail investors who bought in at the high, this was not a correction; it was a massacre. The silver market, once a vessel for dreams of wealth, has been turned into a "mass grave" by retail investors.

How did all this happen? While we were talking about "short squeezes," the big sharks on Wall Street had already opened their jaws wide.

The Crazy Casino: When Silver Became a "Meme Stock"

The silver market in January 2026 can no longer be described as rational.

According to VandaTrack data, retail investors injected a record $1 billion into silver ETFs just in January.

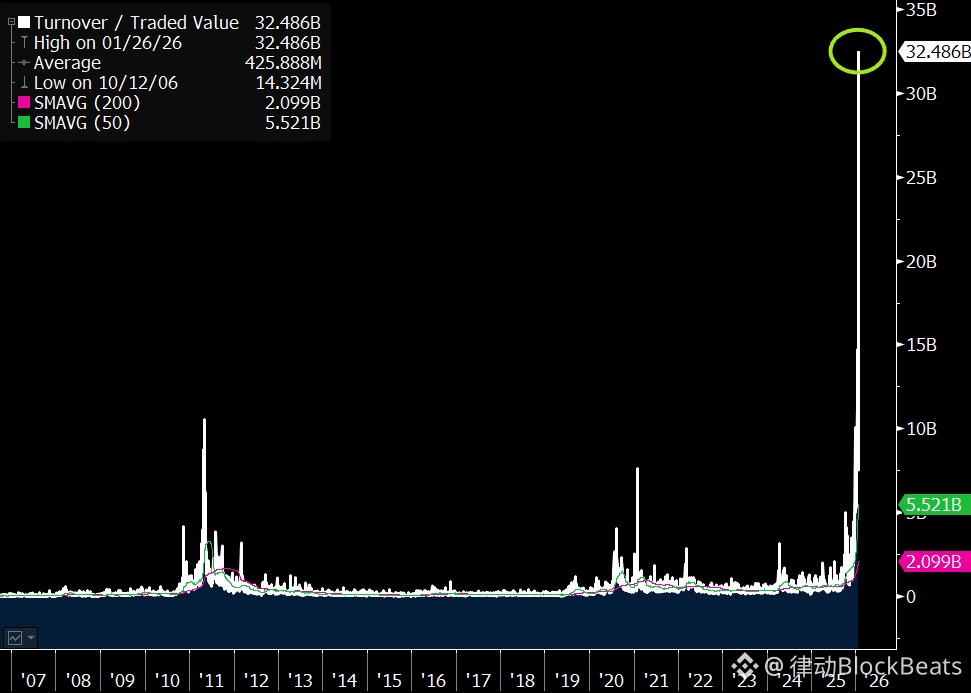

This frenzy peaked on January 26—on that day, the trading volume of the silver ETF (SLV) reached an astonishing $39.4 billion, nearly matching the $41.9 billion of the S&P 500 ETF (SPY).

It's worth noting that this is just a single metal ETF, and its popularity was almost on par with the overall U.S. stock market.

StoneX market analyst Rhona O’Connell bluntly stated, "Silver is severely overvalued and has fallen into a self-fulfilling madness. Its current performance is like Icarus, flying too close to the sun and destined to be burned."

Social media became the catalyst for this frenzy.

In the WallStreetBets and Silverbugs sections of Reddit, posts about silver surged to 20 times the five-year average. Retail investors flocked to this highly volatile market in droves, attempting to drown out the fundamentals with their financial clout, just like they did with GameStop in 2021.

Market strategist Michael Antonelli from Bull and Baird lamented in an interview with CNBC, "Silver has completely turned into the GameStop of 2026. The price doubled in three months, completely detached from the fundamentals of industrial demand, purely a vertical rise fueled by retail money."

But they forgot that silver has a nickname: "steroid gold." It rises wildly and falls just as mercilessly.

The Truth Behind the Crash: Who Pulled the Trigger?

On January 30, the tragedy struck. Silver faced an epic sell-off within hours.

Media and analysts quickly found a perfect scapegoat: Kevin Warsh was nominated as the Federal Reserve Chair.

The market logic seemed straightforward: Warsh is hawkish, meaning interest rates will remain high, which is bad for non-yielding precious metals.

But the truth often lies in the details.

Warsh's nomination was announced at 1:45 PM Eastern Time (1:45 AM Beijing Time on February 1). However, the crash in silver began as early as 10:30 AM on the 30th. More than three hours before the announcement, the price of silver had already plummeted by 27%.

Blaming the Federal Reserve nomination was merely a cover-up for the real "massacre tool"—margin requirements.

In reality, the true driving force behind this "mass grave" tragedy was the change in exchange rules. The Chicago Mercantile Exchange (CME) raised the margin requirements for silver futures twice in the week leading up to the crash, with a total increase of 50%.

What does this mean?

If you are a retail investor fully leveraged, your account originally needed only $22,000 to maintain your position, but suddenly the exchange required you to put up $32,500. Can't come up with the extra $10,500? Sorry, the system will automatically liquidate your position, regardless of price or cost.

This is why the crash was so rapid. The margin increase triggered the first round of liquidations, which led to price declines, and falling prices triggered more liquidations. It was a vicious cycle, and retail investors were at the bottom of this cycle.

An Asymmetrical Game

While retail investors wailed in the "mass grave," what were the institutions doing?

The answer may send chills down your spine: they were waiting for retail investors to sell off, ready to buy low and profit. And this is not illegal; it is a structural advantage built into the market's operation.

According to columnist analyst Luis Flavio Nunes, during this crash, institutions represented by JPMorgan exhibited textbook-level "profit-taking" tactics:

Step 1: Obtain emergency liquidity.

Just as the exchange raised the margin requirements for retail investors, banking institutions were enjoying the Federal Reserve's "blood transfusion."

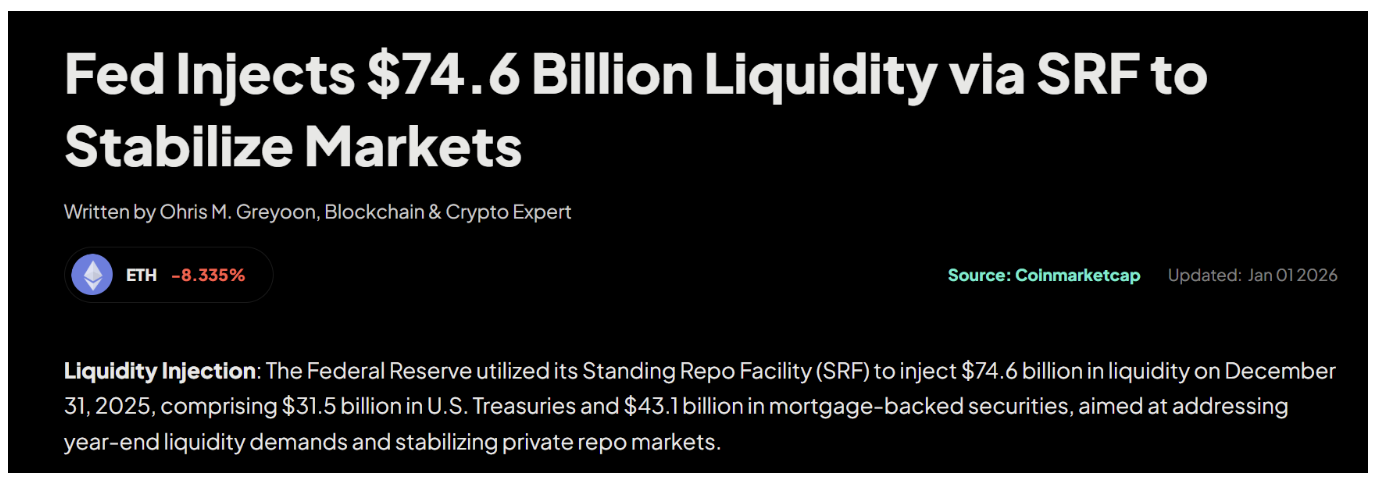

Data shows that on December 31, banks borrowed a record $74.6 billion from the Federal Reserve's emergency lending window (SRF). This mechanism exists to provide short-term liquidity to eligible financial institutions, originally designed to prevent financing crises. But the reality is that only specific institutions qualify to use this tool.

At the same time, the exchange raised the silver margin requirements by 50% within a week. The Federal Reserve's emergency funding tools provided cash to eligible institutions at favorable rates. Retail investors could not access the same channels for emergency central bank financing. This is not favoritism; it is determined by the design of the financial system: central banks lend to banks, not individuals.

Step 2: Wait for the market chaos caused by the margin increase.

The core mechanism of the silver crash lies in the disparity between retail and institutional responses to the increased margin requirements.

On December 26 and 30, just before the crash, the CME raised the margin requirements for silver trading by 50% in a short period. This meant that a trader holding a position needed to immediately provide 50% more cash.

For most retail investors, this sudden financial pressure directly triggered their brokers' automatic liquidation mechanisms, forcing them to sell at any cost during the market downturn.

Meanwhile, institutions that could use Federal Reserve tools had more options.

They could draw on credit lines, obtain emergency loans, or quickly transfer funds between accounts. While this did not prevent all liquidations, it provided them with more time and flexibility. Thus, retail positions were often sold at the worst prices during panic, while institutions could manage their positions more strategically.

Step 3: Fully exploit the privileges of authorized participants for arbitrage.

Take JPMorgan as an example; this bank plays a dual role in the silver market: they store all physical silver for the largest silver fund (SLV) and are also "authorized participants," meaning they can create or redeem shares of the fund in bulk.

During the panic sell-off on January 30, the SLV ETF's share price experienced an unusual discount, dropping to $64.50 per share, while the value of the physical silver it represented was $79.53, creating a price gap of $19.

This specific market mechanism provided significant arbitrage opportunities for institutions with "authorized participant" status. Authorized participants (a small group of large financial institutions) took full advantage of this price difference, buying ETF shares at a low price and redeeming them for higher-value physical silver.

Data shows that on that day, approximately 51 million shares of SLV were redeemed, which alone implied an arbitrage profit of about $765 million.

This operation helps maintain the linkage between ETF prices and net asset values, and it is a compliant market function, but it is a source of profit that ordinary investors cannot access. Retail investors may see the discount but cannot benefit from it due to their lack of authorized participant status.

Step 4: Strategic positioning in derivatives.

JPMorgan also held a large number of short positions in silver, meaning they were betting on a decline in silver prices or hedging other positions. As silver rose to $121 in late January, these positions were all in the red.

The most ironic scene occurred at the bottom of the price. On January 30, when retail investors were forced to liquidate at a low of $78.29 due to insufficient margin, JPMorgan stepped in. CME records show that JPMorgan took over 633 contracts at this price, acquiring 3.1 million ounces of physical silver.

The critical four steps almost happened on the same day. Did Wall Street orchestrate this series of events? This cannot be confirmed. But they were structurally positioned to benefit in multiple ways simultaneously: only institutions with their unique combination of roles and privileges could achieve this.

"Silver is Always a Death Trap"

In this wave of market activity, countless retail investors, like the Reddit user at the beginning of the article, lost years of savings.

StoneX analyst Rhona O’Connell was right: "Silver is always a death trap."

Financial markets have never been a fair playing field. When retail investors try to challenge a steel machine composed of algorithms, leverage, and rule-makers with "sentiment" and "memes," the outcome is often predetermined.

Silver is not GameStop; it is a battlefield far more brutal than stocks.

Retail investors thought they were charging at Wall Street, unaware that they were unwittingly digging a massive "mass grave" and then lining up to jump in.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。