Kyle's departure is essentially a "value choice."

Written by: Dora B Dream, Deep Tide TechFlow

*This article expresses personal opinions

On February 5, a morning that began with a significant drop, I was scrolling through Twitter as usual when suddenly a statement from Kyle Samani, a partner at the well-known crypto VC Multicoin, popped up in my feed. My finger paused on the screen for a few seconds, and I felt a jolt in my heart—why him?

I know Kyle, or rather, I "know him unidirectionally."

In my junior year of college in 2020, I first read Multicoin's "thesis" paper, and it was refreshing; the term "Thesis-Driven" was etched in my mind.

It turns out that VCs can write like this, without the PPT-style "we are optimistic about the long-term value of XX sector," saying some ambiguous things, but instead thinking like traders, directly providing clear long and short logic, avoiding ambiguity, and expressing strong opinions.

Kyle's image on Twitter has always been very distinct: aggressive, mean, offending countless people.

He dared to publicly short Ethereum's scaling route when everyone was optimistic about it, he firmly bet on Solana when others were skeptical, and he was the first to openly and transparently disclose losses and review decisions after the FTX collapse, which caused significant losses for Multicoin.

Many in the Western crypto circle dislike him, thinking he is too arrogant, but I have always felt that this industry needs people like him.

Now he is gone. Turning to AI, longevity technology, and robotics. I suddenly feel a bit sad: if even Kyle doesn't want to play anymore, what is happening to this industry?

When Kyle Leaves

What makes me sad is not just another VC turning to AI; who isn't talking about AI these days?

What makes me sad is that it is precisely Kyle from Multicoin, someone I see as very resolute.

What is the investment logic of most Crypto VCs? Broadly casting nets, betting on sectors, saying pretty things but never making judgments, or only knowing how to follow investments.

If you open the investment reports of those well-known institutions, it is always "we believe in a decentralized future," "we are optimistic about innovations in XX field," but you will never see a firm statement like "we believe project A will outperform project B."

This is not caution; it is sophistication. Regardless of who wins, they can always say, "Look, we were already positioned."

Kyle, or rather Multicoin, is not like that; he dares to make "life-and-death judgments."

In 2017, he publicly stated that Ethereum's sharding route was a dead end, he once bet on EOS and failed, and in 2018 he placed his bets on Solana, believing in 2020 that Helium and DePIN were the only non-financial scenarios that could land in Crypto.

Yes, he missed many opportunities and made big mistakes; EOS and FTX are bloody lessons. But he never hides, disclosing losses as they are, admitting every mistake.

He is not the smartest VC, nor the most gentle evangelist, but he is one of the most "authentic." His departure symbolizes that a certain "honesty and sharpness" is disappearing from this industry.

The Tweet That Was Deleted in Seconds

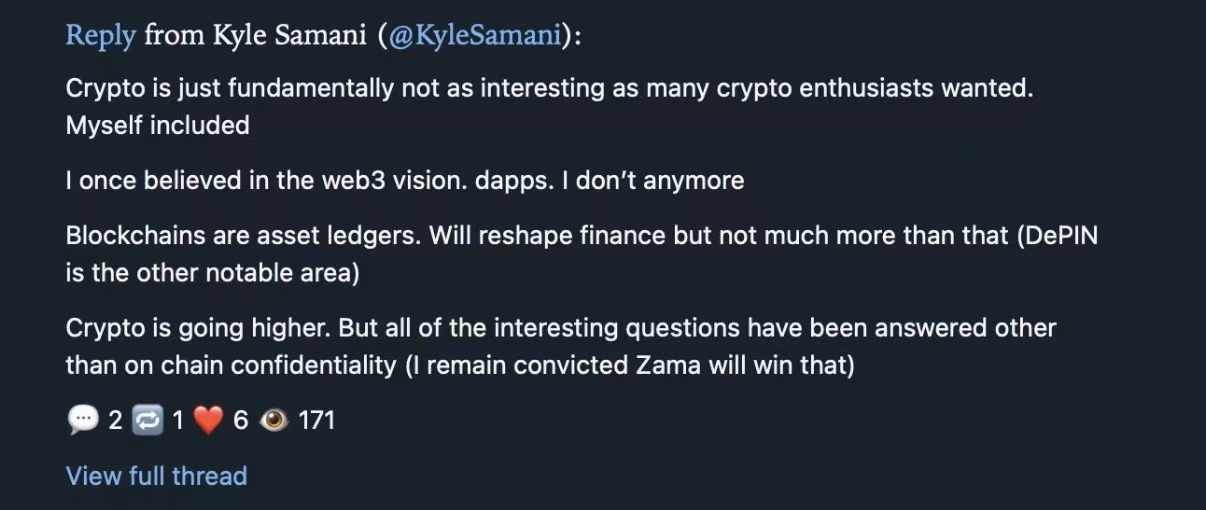

What concerns me more is the tweet he posted before leaving, which was deleted in seconds.

He said: "Cryptocurrency is not as interesting as many crypto enthusiasts expect. I once believed in the vision of Web3 and dApps. Now I don't. Blockchain is mainly an asset ledger; while it can reshape finance, its potential in other areas is limited."

Why delete it in seconds? Because saying it makes one an "heretic."

Why did he still post it? He is a person caught between faith and reality, spending 8 years and investing over a hundred million dollars, ultimately arriving at this conclusion.

I understand this feeling all too well because it mirrors my own journey this year.

What did we believe when we entered in 2021? That decentralized social media would disrupt Twitter, that on-chain identity (DID) would allow users to control their own data, and that GameFi would enable players to truly "own their assets." Back then, everyone's Twitter timeline was filled with discussions on "how Web3 would change the world," and every new project seemed like a gateway to the future.

What is the reality in 2025? Friend.tech is dead, Lens Protocol is unused. ENS has become a speculative tool; aside from wallet addresses, no one really uses DID. The collapse of Axie and StepN proves that "X to Earn" is just a guise for a Ponzi scheme.

But Kyle hasn't completely negated everything. He still believes in stablecoins, DeFi, RWA financial applications, and projects like Helium, and he continues to bet on Zama's fully homomorphic encryption technology.

The question is: do these things still require "faith"? Or do they only need rational calculation?

Kyle's departure has been described as a betrayal by some, but in my eyes, it is a "disenchantment," transforming from a Crypto Evangelist into a Crypto Realist. This shift may be a rite of passage that the entire industry must undergo.

Last Time We Lost Money, This Time We Lost Confidence

When FTX collapsed in 2022, the entire industry hit rock bottom. Luna went to zero, Three Arrows Capital went bankrupt, and the market was halved again and again. But at that time, everyone still held onto a belief: the market crashed, but we were not wrong. As long as we persist, the bull market will prove everything.

Back then, we still believed in Ethereum's "endgame narrative," from PoW to PoS, from single-chain to modular, thinking this was the necessary path to becoming a "world computer."

We still believed in Solana's "performance revolution," thinking that as long as we survived the bear market, high-performance chains would surely win.

We still believed in Web3's "paradigm shift," thinking that the next chapter of the internet would inevitably be decentralized.

What about now in 2025?

Objective data is actually much better than the last downturn; BTC once broke $100,000, ETFs were approved, and Crypto is more closely linked to Wall Street.

But the subjective feeling is completely opposite; prices are higher, but confidence is lower.

The "culprit" or "mirror" is AI.

When ChatGPT was released in 2023, everyone was discussing "how AI would change the world." Meanwhile, what was Crypto discussing? "Should L2 sequencers be decentralized?" One side is talking about a productivity revolution, while the other is arguing over technical details.

In the following two years, AI's progress has been dizzying: the competition among the three giants—Gemini, Claude, and ChatGPT—brings new things every day, and recently everyone has been obsessed with OpenClaw.

What about Crypto? There are more and more L2s and chains, but no one can clearly explain "why we need 100 L2s," and even Vitalik has reflected on past route errors. NFT, GameFi, and SocialFi have all made appearances, but they are just fleeting moments.

At this point, the biggest innovation of this cycle is actually Meme Coins and "reinventing gambling."

I often ask myself late at night: AI is redefining productivity with technology, while Crypto is redistributing wealth through financial games. The former is creation, the latter is transfer. What exactly are we building?

Kyle's departure is essentially a "value choice."

He chooses to pursue AI, longevity technology, and robotics—fields that truly "expand the frontiers of humanity." Meanwhile, Crypto, at least for now, feels more like a high-end casino.

But I Don't Want to Leave Yet

At this point, you might think I am about to announce my exit as well.

But no, I still want to "bet" one more time.

Kyle can leave because he is already financially free and can pursue grander dreams. But for someone like me, Crypto still represents: a relatively fair "class leap" channel, a "permissionless" testing ground that requires no degrees, backgrounds, or connections, only cognition and courage—a burgeoning industry that has not yet been completely monopolized by the elite.

More importantly, perhaps the grand narrative of Web3 has failed, but that does not mean Crypto is without value.

The revolution in financial infrastructure has already occurred; the daily settlement volume of stablecoins has surpassed Visa, and DeFi allows people around the world to access financial services and RWA 24/7.

The key point is: I still haven't figured out my answer.

Kyle spent 8 years arriving at the conclusion that "Crypto is just an asset ledger,"

but I am still a rookie; why should I make a judgment now?

Maybe in a few years, I will leave like him. But at least for now, I want to stay at the table and see if this industry still holds some possibilities we haven't seen.

Years later, Crypto may no longer be a "revolution that disrupts everything," but rather a value settlement layer in the AI era.

By then, I will order a cup of coffee and chat about the scenery I saw along the way.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。