Written by: imToken

As we all know, throughout the history of financial development over the past thousand years, the role of gold in the global monetary system has been redefined multiple times.

The most recent role change undoubtedly occurred after the establishment of the credit-based modern fiat currency system, where gold gradually moved away from daily transactions and exists more as a "safe-haven asset," "central bank reserve," and "macro-hedging tool." Especially in the lives of ordinary people, apart from specific cultural contexts like "three golds" and "five metals," gold has almost completely withdrawn from payment scenarios.

However, if we shift our perspective away from developed economies and observe regions where inflation is out of control and monetary systems frequently fail, we will discover another line of thought for reconsidering a new transformation:

With the support of blockchain technology, gold is expected to regain its ability to be "valued, circulated, and paid," thus no longer just a safe-haven asset on paper, but returning to the forefront of the monetary system.

This article will also explore how, in the current economic and technological context, re-discussing the "gold standard" may not just be a retro fantasy, but a real discussion about the credibility of valuation units.

1. The Problem is Not Just Inflation, but the Failure of "Measurement"

Objectively speaking, in countries like Venezuela and Argentina, the inflation pain faced by the public cannot be summarized simply as "rising prices." The real fatal issue is that due to severe fluctuations in the local currency exchange rate, the function of currency as a "measure of value" is completely lost, while people's labor results rapidly shrink in the face of inflation.

Imagine that under hyperinflation, the price of a glass of iced lemonade could double within a week or even a few days. At this point, people may not even know "how much is considered valuable." This uncertainty not only leads to the silent harvesting of labor results but also means that the unit of measurement is no longer credible, resulting in a deeper systemic problem than just "declining purchasing power."

In such an environment, people will instinctively seek alternatives for self-rescue, which explains why dollar stablecoins like USDT and USDC have rapidly penetrated the grassroots in countries like Argentina, becoming de facto "parallel currencies."

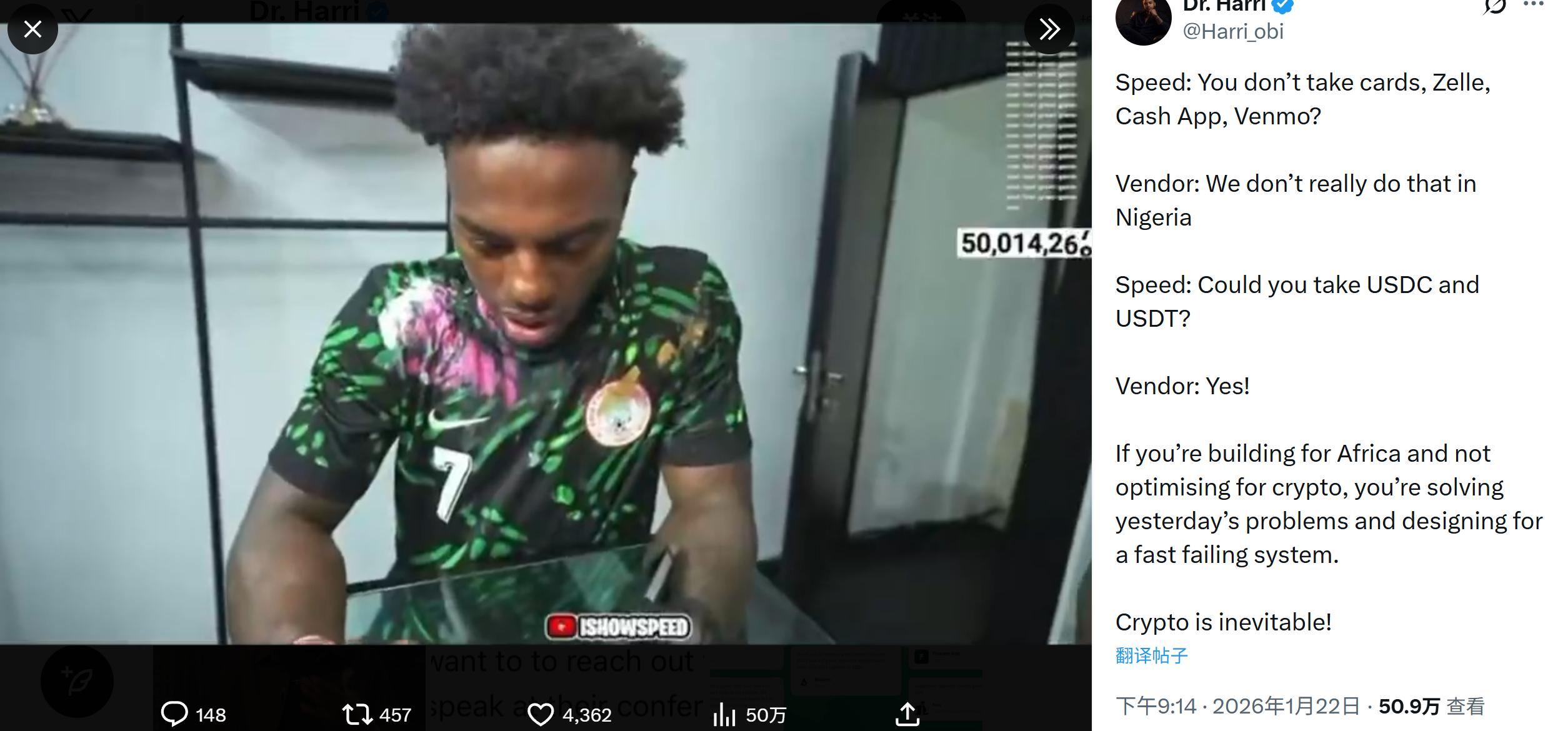

A recent typical case of breaking the mold: globally renowned internet celebrity "Hyperthyroid Brother" iShowSpeed faced frequent limitations with traditional financial payment methods (such as he mentioned bank cards, Cash App, etc.) while shopping in Nigeria, ultimately choosing to complete the payment with USDT/USDC, and merchants were willing to accept it directly.

As shown in the video, a transaction worth approximately 2.3 million naira (about 1,500 USD) was settled in just a few seconds.

Ultimately, the widespread adoption of dollar stablecoins is not because they are "more advanced," but because the dollar itself remains the most widely accepted unit of value globally, while stablecoins bypass the local banking system, avoiding cumbersome foreign exchange controls and settlement thresholds.

Consensus (dollar) + Technology (blockchain), both are indispensable.

This leads to a logical question: if people are pursuing a long-term credible unit of value, then the reason gold, with its thousand-year monetary history, has lost to credit fiat currency in grassroots payment competition is not because it is not valuable enough, but because it has fatal physical limitations as a medium of circulation—it cannot be circulated and used for payment; after all, from a physical form, it is difficult to split, transport, verify, has low settlement efficiency, and high transfer costs…

This is why, in the traditional financial system, gold is more often treated as a "stored asset" rather than a true "currency." In fact, even in historical "gold standard" currency systems like the British pound, the significance of gold was more as "reserves," serving as the ballast of the entire system rather than being directly used as a unit of value.

This has led to gold gradually retreating to the background, existing only in balance sheets and central bank vaults.

2. Transforming Gold from "Dead Asset" to "Living Currency"

Ultimately, what has truly prevented gold from returning to its monetary role has never been consensus, but rather technological conditions. If gold cannot participate in payments, it will forever remain a "held asset" and cannot become a "used currency."

This is where a fundamental change has occurred for the first time with the support of RWA and Crypto—based on blockchain technology, heavy gold bars can be broken down into countless tiny digital particles, allowing for free circulation globally 24/7.

Taking Tether's XAUt (Tether Gold) as an example, each XAUt corresponds to 1 ounce of physical gold stored in a London vault, and the physical gold is kept in a professional vault that is auditable and verifiable. At the same time, tokenized gold holders have a claim to the underlying gold.

When an on-chain transaction occurs, the system automatically reallocates the gold shares in the vault to ensure that the tokens held by users always correspond to specific physical assets, while the physical gold is stored in a highly secure vault in Switzerland. Although the custodian is an affiliated party, it operates independently, maintaining separate financial accounts and customer records. Users can also access the official "Look-up Website" to directly query the serial number, weight, and purity of the gold bars associated with their assets by entering their on-chain address.

It can be said that this design does not introduce complex financial engineering, nor does it attempt to amplify gold's attributes through algorithms or credit expansion. On the contrary, it deliberately respects the traditional logic of gold, and thanks to the transparency of blockchain, anyone can verify the full collateral of on-chain assets at any time, a level of transparency that traditional gold passbooks cannot match.

Ultimately, tokenized gold like XAUt and PAXG is not about "creating a new narrative for gold," nor is it as simple as "moving gold onto the chain" like real estate tokenization and other RWA projects. It enables gold to simultaneously possess the capabilities of being valued, circulated, and paid for the first time.

This is equivalent to repackaging the oldest asset form through blockchain, so in this sense, XAUt is more like a rebirth of a "digital real gold" (for further reading, see “Tether's 'Gold Standard' Ambition: Analyzing XAUt, How the Stablecoin Giant is Hoarding Gold?”):

- Infinite Splitting: You no longer need to cut gold bars; RWA allows you to pay for 0.00001 grams of gold;

- Instant Verification: No need for burning or chemical testing; on-chain signatures serve as the best proof of purity;

- Global Circulation: Gold is no longer limited by geographical location; it becomes a form of digital information that flows 24/7;

It is in this sense that Web3 + RWA is not about speculating on gold, but about bringing gold back to the core of monetary discussions.

Of course, the on-chain gold solution mainly addresses the asset form and settlement layer issues. To truly achieve the "monetization" of gold, we still cannot avoid the final real-world challenge:

How to be truly "spent" in the real world?

3. How to Form a Closed Payment Loop?

The theoretical payment closed loop must meet two conditions: it must be simple and seamless for users; and it must not require merchants to change their existing systems.

This requires an efficient terminal tool, which is precisely the purpose of many payment card products currently on the market. Taking the imToken Card as an example, if it can bridge the connection between on-chain gold and the real world, it truly has the potential to turn "gold standard payments" from a geek's idea into a daily occurrence at the supermarket checkout.

The core value of the imToken Card lies in its ability to streamline the backend settlement of complex assets. For example, if a user holds RWA gold assets (like XAUt) in their imToken wallet, at the moment of consumption, the system will automatically complete the following closed loop:

- Asset Retention: During non-consumption periods, your wealth exists in the form of "gold tokens," enjoying its anti-inflation properties;

- Instant Settlement: When you swipe your card at tens of millions of Mastercard-supported merchants worldwide, the backend will convert a portion of the gold tokens into fiat currency at real-time exchange rates;

- Seamless Payment: Merchants receive fiat currency for settlement, while you pay with your gold token balance;

The entire process is seamless for users, yet it completes a value transfer from "gold → payment" at the underlying level, and the assets remain stored in the user's on-chain wallet, rather than in the traditional sense of a "paper gold passbook" or bank account. This means you have absolute ownership and control over the gold tokens, rather than relying on a bank's promise of redemption.

If RWA addresses the question of "how gold goes on-chain," then payment cards solve the issue of "how on-chain gold can be spent."

Overall, when gold can be both a long-term value anchor and used like cash at any time, it has truly completed the leap from "stored asset" to "payment medium."

At this moment, we may be standing at a rather interesting turning point: an ancient form of currency with a history of thousands of years is being revitalized through cutting-edge technology that has only emerged in the past decade.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。