Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The partial "shutdown" of the U.S. government caused by immigration enforcement disputes has been temporarily resolved with Trump's signing of a funding bill, but the Department of Homeland Security's funding can only last until February 13, leaving suspense for subsequent negotiations. Meanwhile, Federal Reserve Governor Milan has resigned from the White House Economic Advisory Council. In terms of geopolitics, U.S.-Iran relations are tense, with the U.S. military shooting down an Iranian drone near the USS Lincoln, and reports of Iranian speedboats harassing U.S.-flagged tankers. Although Trump stated that negotiations are ongoing, White House Press Secretary Levitt emphasized that military options remain if diplomacy fails.

Duan Shaofu, Deputy Secretary-General of the China Nonferrous Metals Industry Association, revealed that China is studying the inclusion of copper concentrate in the national strategic reserves to cope with supply pressures and enhance the industry's bargaining power. Funds are flowing into safe-haven assets; although spot gold once corrected over 20%, dropping to a low of $4,402, the price has now rebounded and surpassed the $5,000 per ounce mark, with an intraday increase of up to 2.3%. Goldman Sachs still maintains its forecast of gold prices reaching $5,400 by December 2026, Deutsche Bank keeps a target price of $6,000, and JPMorgan remains bullish on gold, raising its end-of-2026 target price to $6,300. JPMorgan believes that despite recent market volatility due to the nomination of a new Federal Reserve chair, the long-term upward trend of gold remains unchanged. The core driving force behind the rise in gold prices comes from the continuous demand for gold purchases by central banks and investors' allocation for portfolio diversification. Compared to gold, the bank holds a more cautious view on the short-term outlook for silver. After a more than 40% crash, the silver market has rebounded over 20%, causing significant losses for retail investors. In January, retail investment in silver ETFs hit a record, but leveraged ETFs like AGQ plummeted 60%. In domestic silver investment, the Guotou Silver LOF has hit the daily limit down for three consecutive days, with the premium rate falling to 64.6%.

Impacted by AI technology, the S&P North American Software Index plummeted 15% in January, marking the largest single-month decline since 2008. The launch of AI tools by Anthropic further exacerbated market panic, leading to the most severe sell-off in software stocks since last April, with Thomson Reuters (TRI) and Legalzoom seeing declines of over 20%. Investors are concerned that the competitive moat of traditional software companies is being weakened. Jefferies analysts called the current situation the "SaaS apocalypse," while Morgan Stanley analyst Toni Kaplan pointed out that this marks intensified industry competition. Although Palantir surged 7% against the trend, private credit firms like Blue Owl with software exposure saw their stock prices suffer. UBS strategists even warned that if AI disrupts aggressively, the U.S. private credit default rate could soar to 13%.

As gold and silver rebound, Bitcoin continues to decline, with prices briefly dropping below $73,000, erasing gains since Trump's re-election. Coinbase's Global Investment Research Director David Duong bluntly stated that the circulating narrative that "gold's rise will drive Bitcoin's rise" is a mistaken view. Adam also pointed out through the Engle-Granger test that there is no cointegration relationship between Bitcoin and gold. Santiment data shows that while retail investors are panicking over Bitcoin below $60,000, this may provide an opportunity for a short-term relief rebound. Galaxy Digital Research Director Alex Thorn noted that 46% of Bitcoin supply is currently at a loss, with prices potentially dipping to around $58,000, where the 200-week moving average lies, or even testing the realized price of $56,000. However, he believes this is usually a good entry point for long-term investors. Compass Point analysts believe the bear market is entering its final stage, with a bottom likely between $60,000 and $68,000; Killa predicts the bottom will appear in Q3, planning to accumulate in batches between $69,000 and $45,000. Sykodelic sees this as a mid-term top and a significant bear market trap, optimistic about subsequent rebounds. Nevertheless, Bitwise Chief Investment Officer Matt Hougan believes the "crypto winter" is nearing its end, with the market closer to recovery than further decline.

The Ethereum market is also facing significant deleveraging pressure, with prices nearing a drop below $2,100, and funding rates turning negative, indicating extreme market panic. On-chain data shows that Trend Research has reduced its position by $352 million in ETH and repaid debts to lower leverage since February 1, with the liquidation price range of its remaining borrowing positions concentrated between $1,685 and $1,855, mainly around $1,800. If prices fall into this range, there will be liquidation risks. Ali Charts analysis indicates that Ethereum's historical bottom typically forms below the 0.80 MVRV level, around $1,959. Despite short-term indicators being pessimistic, Trend Research founder Yi Lihua remains optimistic about a future bull market, maintaining the expectation that ETH will exceed $10,000, believing that now is the best buying period for spot. Cointelegraph analysis points out that while negative futures funding rates are usually a buy signal, the effectiveness of this signal may be significantly discounted in the current context of a weak U.S. macro economy and a pullback in tech stocks.

In the altcoin market, Geoff Kendrick, head of cryptocurrency research at Standard Chartered Bank, has lowered the 2026 price forecast for SOL to $250 but remains optimistic about its long-term potential, expecting it to reach $2,000 by 2030. From a technical perspective, Ali Charts warns that if SOL falls below support, the next target could be $74.11 or even $50.18; however, some analysts point out that SOL may form a V-shaped reversal bottom near $100, and if it can recover the 20-day EMA at $106, it may rebound to the $120-$150 range, with a long-term bullish outlook to $260, and the Solana network's TVL and daily trading volume have recently reached new highs.

2. Key Data (as of February 4, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $76,532 (Year-to-date -12.69%), daily spot trading volume $75.98 billion

Ethereum: $2,278 (Year-to-date -23.3%), daily spot trading volume $48.54 billion

Fear and Greed Index: 14 (Extreme Fear)

Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

Market share: BTC 59.2%, ETH 11.8%

Upbit 24-hour trading volume ranking: BTC, ETH, XRP, BIRD, ZIL

24-hour BTC long-short ratio: 9.04% / 50.96%

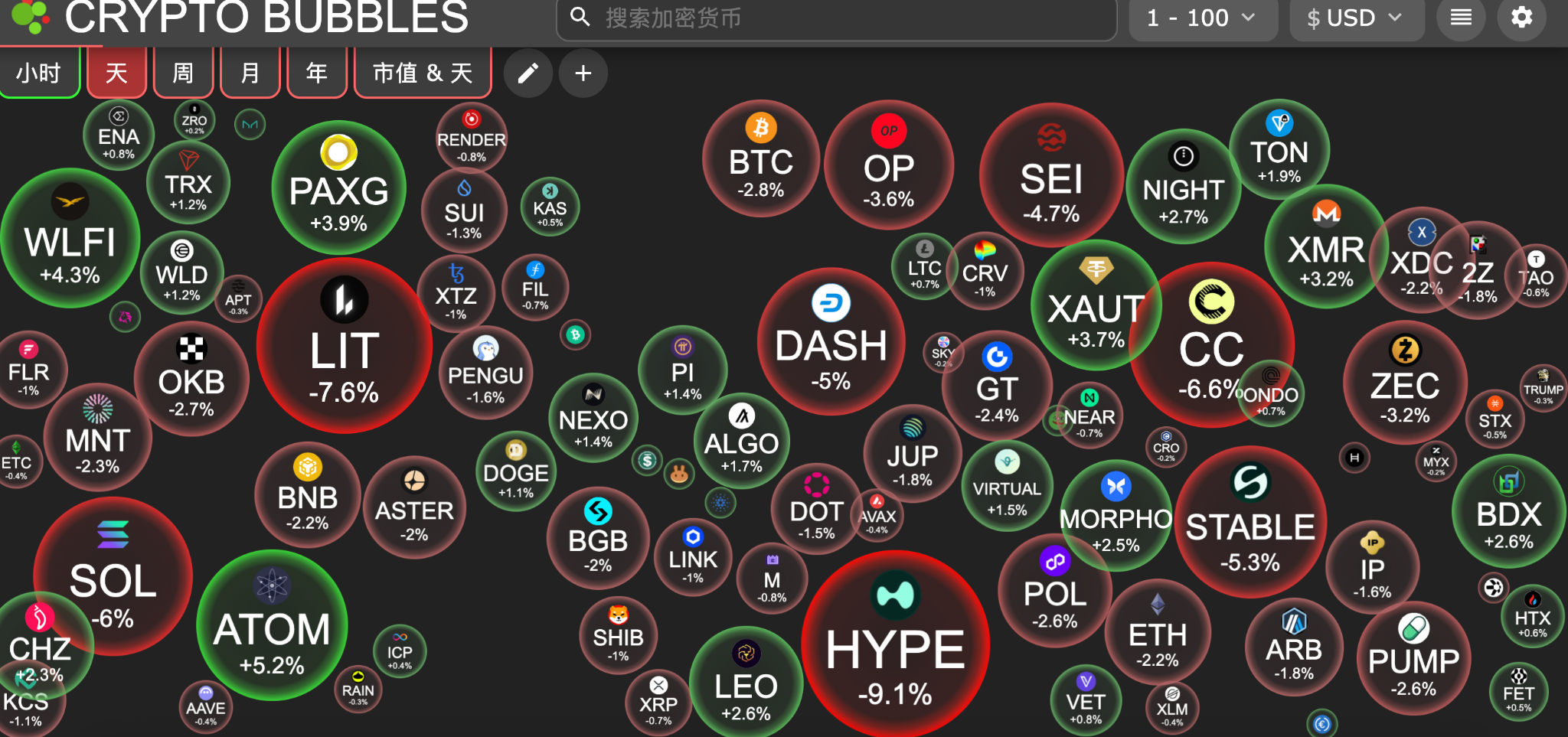

Sector performance: Most crypto sectors have retreated, with only DePIN, AI, and SocialFi sectors relatively strong

24-hour liquidation data: A total of 123,352 people were liquidated globally, with a total liquidation amount of $515 million, including $205 million in BTC, $178 million in ETH, and $20.87 million in SOL.

3. ETF Flows (as of February 3)

Bitcoin ETF: -$272 million

Ethereum ETF: +$14.0551 million, first net inflow after three days of net outflow

XRP ETF: +$19.46 million

SOL ETF: +$1.24 million

4. Today's Outlook

Binance Alpha will launch Warden Protocol (WARD) on February 4

Tether-supported Stable mainnet will upgrade to v1.2.0 on February 4

MagicBlock announces $BLOCK token economics, presale starts on February 5

XDC Network (XDC) will unlock approximately 841 million tokens at 8:00 AM Beijing time on February 5, with a circulation ratio of about 5.00%, valued at approximately $29.3 million;

Today's top gainers among the top 100 cryptocurrencies by market capitalization: Cosmos up 5.2%, World Liberty Financial up 4.3%, PAX Gold up 3.9%, Tether Gold up 3.7%, Monero up 3.2%.

5. Hot News

Anthropic plans to allow employees to sell shares at a valuation of $350 billion

A certain whale sold 5,076 BTC within 8 hours, incurring a loss of approximately $118 million

Ark Invest increases holdings in stocks of companies like Bitmine, Coinbase, and Circle

Trump signs funding bill, ending partial government "shutdown"

Chiliz will launch U.S. fan tokens, with 10% of the revenue used for buybacks and burning CHZ tokens

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。