When a Perp DEX begins to evolve, the logic of valuation may change.

Author: David, Deep Tide TechFlow

In 2025, the predicted market trading volume is $44 billion for the entire year.

Polymarket did $33.4 billion, and Kalshi did $43.1 billion. One is an on-chain "truth engine," and the other is a CFTC-regulated "event exchange." The two have been competing all year, betting on everything from the U.S. elections to the Venezuelan coup, from the Super Bowl to the Federal Reserve's interest rate hikes. By the end of the year, even the parent company of the New York Stock Exchange, ICE, invested $2 billion in Polymarket.

The prediction market has become one of the fastest-growing crypto sectors in 2025.

On February 2, Hyperliquid announced the launch of the HIP-4 testnet. The official term is "outcome trading." Fully collateralized contracts settle within a fixed price range, suitable for prediction markets and option-like products.

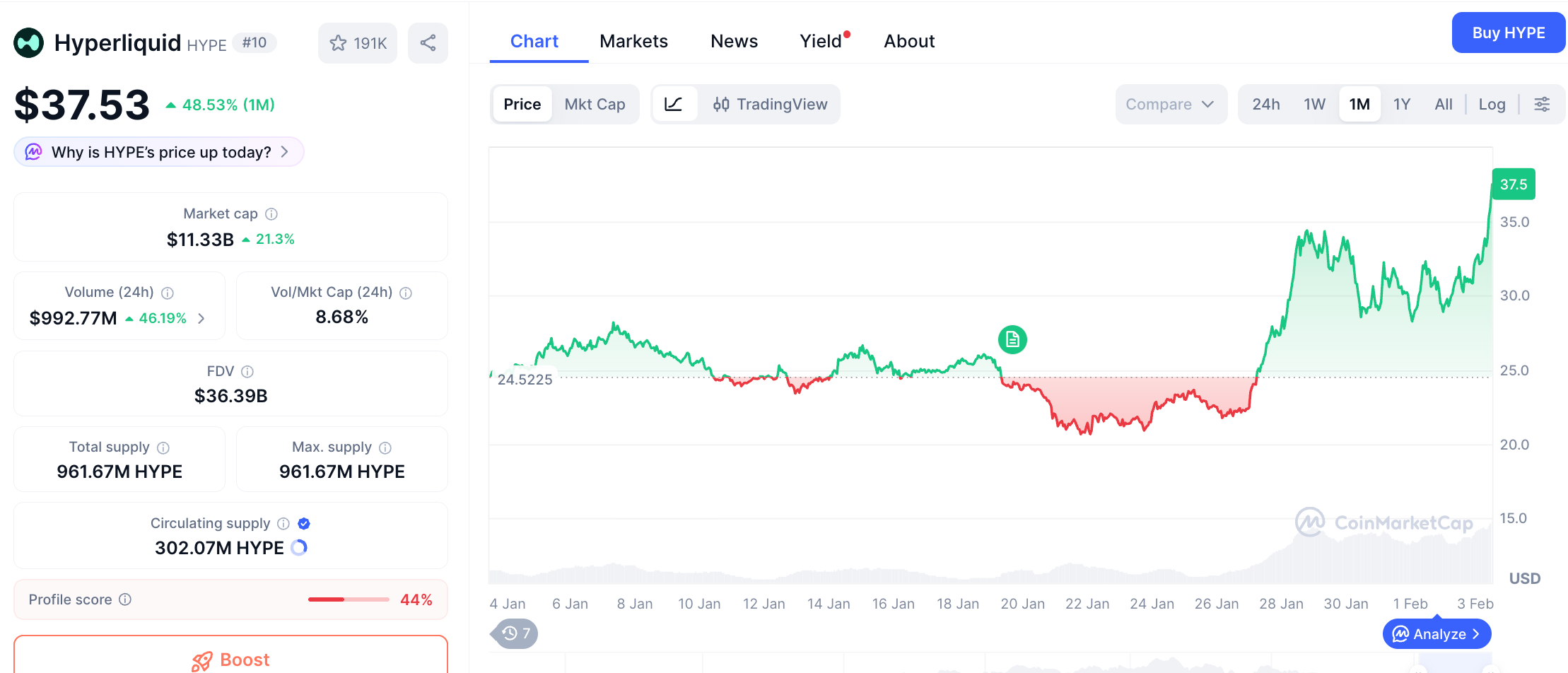

Upon the announcement, HYPE rose by 10%. Over the past week, it has accumulated a rise of over 40%; in comparison, BTC once dropped to $75,000 during the same period.

The market clearly views HIP-4 as a positive development. However, if you only understand HIP-4 as "Hyperliquid doing prediction markets," you may underestimate the intention behind this move and misjudge Hyperliquid's value in the current crypto ecosystem.

First, what is HIP-4?

Hyperliquid's previous core business was perpetual contracts (perps): no expiration date, leveraged, and subject to liquidation. This is the largest category of on-chain derivatives trading volume and the main source of revenue for Hyperliquid.

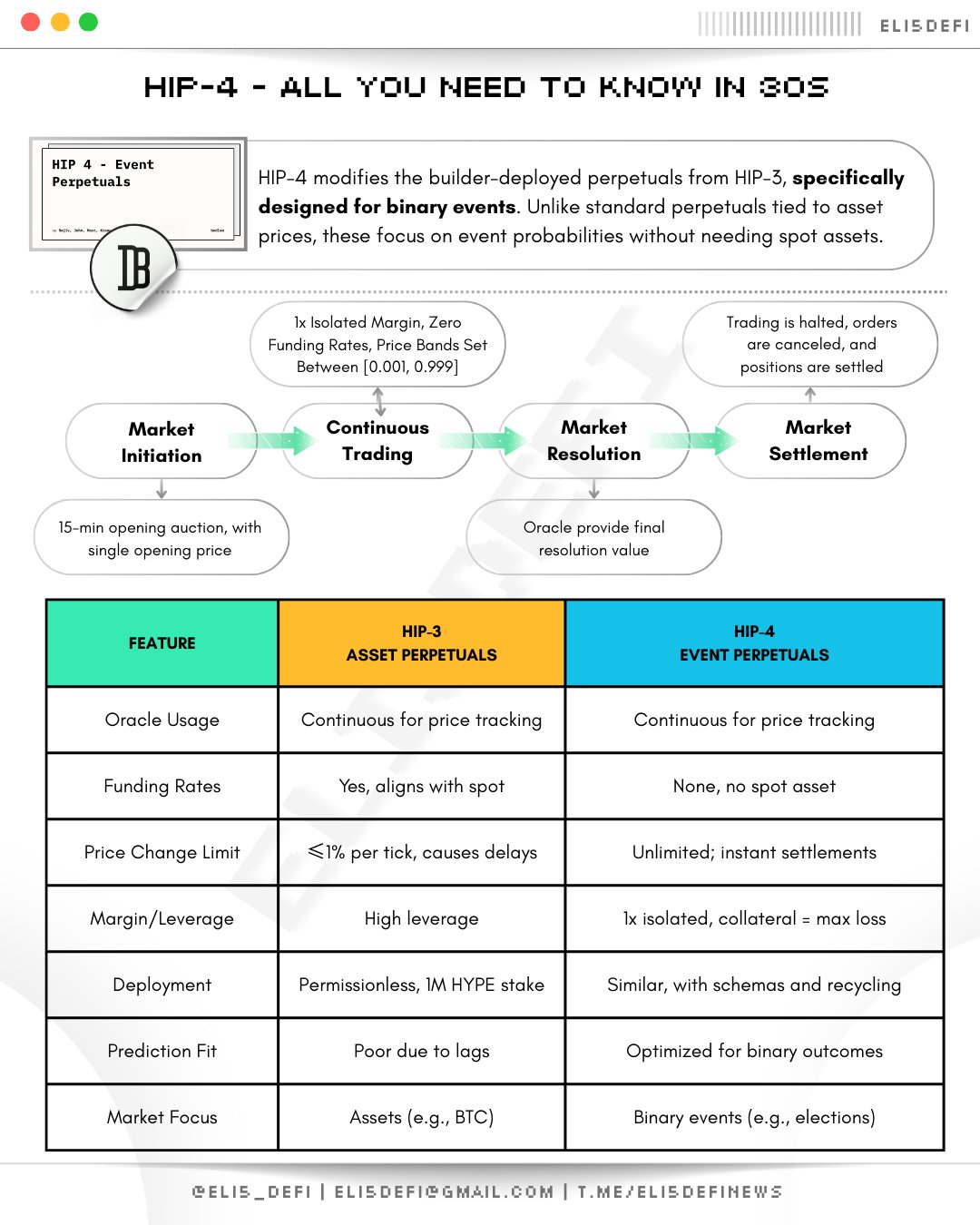

But the outcome contracts introduced by HIP-4 are almost the opposite.

They have an expiration date, are fully collateralized, not leveraged, and cannot be liquidated. Contracts settle within a fixed price range, where the buyer can only lose their principal and will not owe the platform any money.

For example.

If you believe BTC will rise above $100,000 before the end of March, you can buy a corresponding outcome contract. If BTC indeed breaks $100,000 by the expiration date, the contract settles at the upper limit, and you make a profit; if not, it settles at the lower limit, and you only lose the initial purchase cost. There are no margin calls, and you won't be liquidated in the middle of the night.

This structure naturally fits two types of scenarios: prediction markets (betting on event outcomes) and option-like products (expressing directional views within a fixed range).

Betting on "whether Trump will be re-elected" on Polymarket essentially follows this logic. Fully collateralized, binary settlement.

HIP-4 turns this logic into a universal primitive, not limited to yes or no, supporting continuous price ranges.

(Source: @Eli5defi)

Currently, HIP-4 is still in the testnet phase.

Once officially launched, the first batch of markets will be curated by the official team and priced in USDH (Hyperliquid's native stablecoin). Future plans include opening up permissionless deployment based on user feedback, allowing anyone to create outcome markets.

Doesn't this sound like "Hyperliquid's version of Polymarket"?

It's not that simple.

Composability, overused but most valuable

Polymarket is an independent prediction market platform.

The contracts you buy there have no relation to your positions on Aave, liquidity on Uniswap, or any other protocol. The same goes for Kalshi. Each contract is an island.

HIP-4 is different. Outcome contracts run directly on HyperCore, sharing the same trading engine and margin system as perpetual contracts.

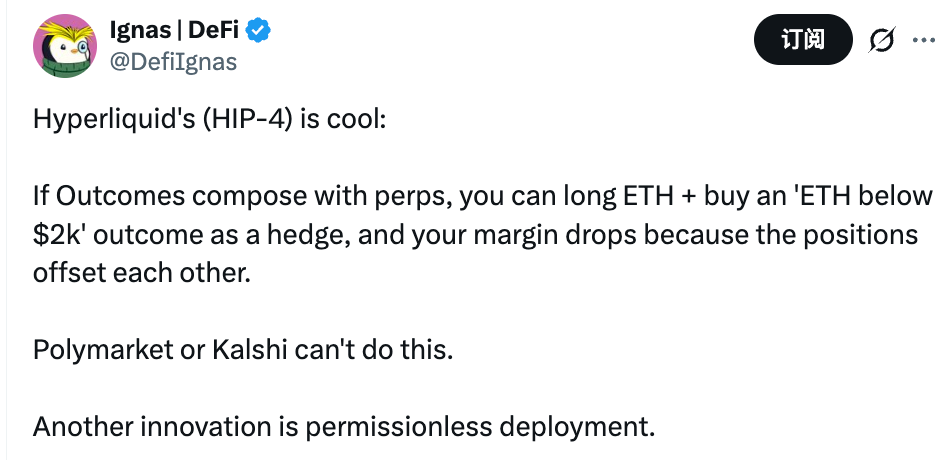

Renowned DeFi researcher Ignas pointed out a classic scenario after the announcement of HIP-4:

While you are long on ETH perpetual contracts, you can also buy an outcome contract that pays out if "ETH is below a certain price at expiration." The two positions are under the same margin account, hedging each other, and the system automatically recognizes the reduced risk exposure, releasing excess margin.

To translate:

You express a direction with one position and hedge with another, and the combination occupies less capital than opening positions separately.

This is called structured products in traditional finance.

Investment banks help institutional clients create such combinations and charge hefty fees. Now Hyperliquid aims to achieve this natively on-chain, without intermediaries, with contracts automatically recognizing hedging relationships.

Polymarket cannot do this, nor can Kalshi. They are independent event exchanges, not derivatives engines.

Thus, the outcome contracts of HIP-4 are less of a product and more of a primitive that enhances Hyperliquid itself; a building block that can be combined with other parts.

The prediction market is just the most intuitive use of this building block.

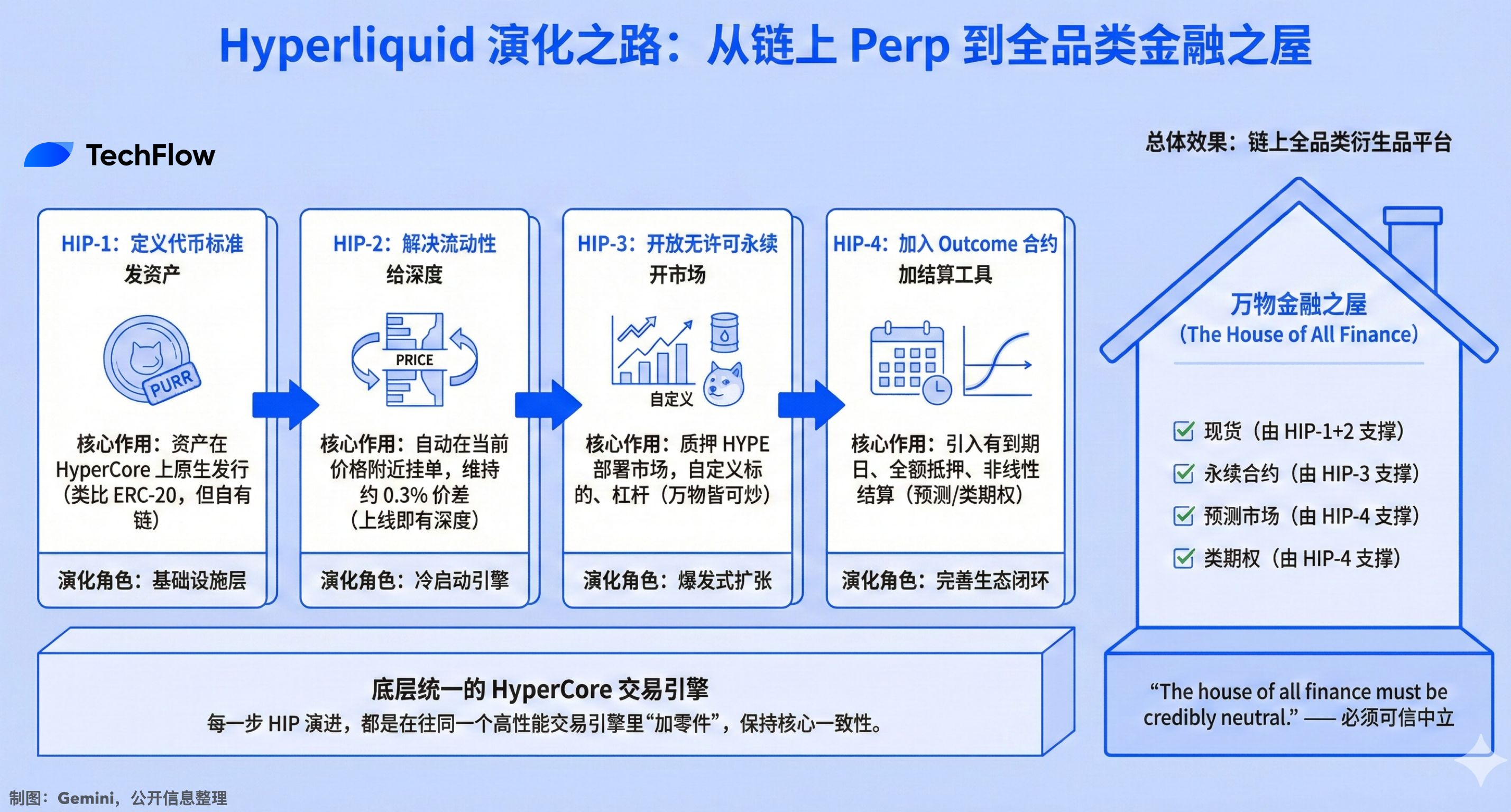

From HIP-1 to HIP-4, the four steps of on-chain Perp

Looking at HIP-4 within the product evolution of Hyperliquid, the logic becomes clearer.

HIP-1, defining the token standard.

Launched in 2024, it allows any asset to be natively issued on HyperCore, with the first token minted using this standard being PURR. It is equivalent to Ethereum's ERC-20 but runs on Hyperliquid's own chain.

HIP-2, solving liquidity.

Automatically placing buy and sell orders near the current price of the token, maintaining a price spread of about 0.3%. There is depth from the first second the token goes live, without waiting for market makers to enter.

HIP-3, opening permissionless perpetual contracts.

Anyone can stake 500,000 HYPE to deploy their own perpetual contract market, customizing the underlying asset, oracle, leverage, and collateral type. Since its launch, the cumulative trading volume has approached $42 billion, with open interest exceeding $1 billion. Stocks, commodities, meme coins—there's something for everyone.

HIP-4, adding outcome contracts.

With an expiration date, fully collateralized, and non-linear settlement.

When you look at these four steps together, it resembles the continuous iteration and growth of an internet product: issuing assets, providing liquidity, opening contract markets, and adding settlement tools.

Thus, Hyperliquid has transformed from a perpetual contract DEX into a comprehensive on-chain derivatives platform covering spot, perpetual, prediction markets, and option-like products.

Each step adds components to the same trading engine.

Hyperliquid's founder, Jeff Yan, once said:

"The house of all finance must be credibly neutral." — The house of all finance must be credibly neutral.

The four HIPs are more like the four walls of this house.

Pricing $HYPE

HYPE has risen over 40% in the past week. The market is bleeding, but HYPE is going against the trend.

This is certainly not solely due to the news of HIP-4.

In the past few weeks, several things have been brewing for Hyperliquid: the permissionless perpetual contract market of HIP-3 continues to expand, hot trading in precious metals has generated data, and HYPE's buyback mechanism has been continuously accumulating chips, with 97% of the platform's trading fees used for HYPE buybacks.

However, on the day of the HIP-4 announcement, HYPE surged by 10%, indicating that the market at least considers this information valuable.

I need to remind you of the role of USDH.

All outcome contracts of HIP-4 are settled in USDH. USDH is Hyperliquid's native stablecoin, issued by Felix Protocol, backed by short-term U.S. Treasury bonds, with the yield used for HYPE buybacks and incentivizing DeFi activities within the ecosystem.

This reinforces the previous flywheel:

More product types launched (HIP-3's perpetuals, HIP-4's outcomes) --> leading to more trading volume --> more trading volume generates more fees --> fees buy back HYPE --> more markets settle in USDH, increasing USDH demand --> the Treasury bond yield of USDH feeds back into HYPE buybacks --> HYPE price rises --> increases the actual value of the higher staking threshold for HIP-3 --> attracting more capable builders to deploy new markets.

The cycle continues, but the premise is that Hyperliquid's trading volume can continue to grow. The current crypto market environment and competitive landscape for predictions are quite severe.

The settlement of outcome contracts relies on external data sources. Who won the election, what price BTC is at expiration, whether a certain event occurred… this information must be accurately and immutably fed to the on-chain contracts.

Hyperliquid claims it will use "objective settlement data sources," but has not specified whose oracle will be used or how to prevent manipulation. In the history of prediction markets, oracle controversies are the most common triggers for crashes.

Regulation is also a variable.

In January 2026, a Massachusetts judge issued an injunction against Kalshi, regulated by the CFTC, ruling that its sports contracts constitute illegal gambling. Compliant exchanges cannot escape state-level lawsuits, and decentralized protocols will not always be out of regulatory reach.

There is also a more fundamental question: how large is the demand for predictions?

Breaking down the $44 billion, over 90% of Kalshi's volume is from sports betting, while Polymarket's volume is concentrated on major events like elections and geopolitical issues. The liquidity for everyday prediction demand remains thin. Whether HIP-4 can attract incremental users or just add another button for existing traders remains unanswered.

However, Hyperliquid clearly does not want to be the next Polymarket; it aims to make predictions a native capability of the existing trading engine, as fundamental and natural as perpetual contracts.

When a Perp DEX begins to evolve, the logic of valuation may change.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。