All collapses begin with an excessive arrogance towards long-term certainty.

Written by: Frank, Maitong MSX

Tom Lee and Jack Yi probably haven't been able to sleep well these past few days.

After all, if we were to choose the most dramatic protagonist for the cryptocurrency market in early 2026, it would likely not be Bitcoin, nor a new narrative emerging, but rather these two ETH "whales" that are publicly being grilled over an open flame.

Onlookers have never been shy about making a big deal out of a funeral.

In recent days, global investors have been holding their breath, collectively watching how the largest and most transparent batch of bullish positions in Ethereum's history is struggling to survive amidst unrealized losses.

1. ETH "Whales" Have Accumulated Over $10 Billion in Unrealized Losses

Year after year, the situation remains similar, but the "whales" change.

In the context of Web3, the term "whale" typically refers to institutions or individuals with substantial capital that can influence market direction.

However, in recent years, the positive connotation of this term has been continuously diluted by reality, transforming it from merely a heavyweight presence into the most conspicuous and easily targeted target amidst market volatility.

The two ETH "whales" that have garnered the most market discussion in recent days are BitMine (BMNR.M), led by Tom Lee, and Trend Research, headed by Jack Yi. Although both are bullish on Ethereum (ETH), they represent two entirely different paths: the former is the company with the largest ETH holdings, while the latter is an investment institution that openly leverages and goes long on ETH on-chain.

First, let's look at BitMine.

As one of the most representative Ethereum reserve companies, BitMine once boldly proposed a long-term goal of acquiring about 5% of Ethereum's total supply, and as of the time of writing, the company has accumulated 4,285,125 ETH, with a market value close to $10 billion.

According to ultra sound money statistics, the current total supply of Ethereum is approximately 121.4 million ETH, which means BitMine has directly locked up about 3.52% of the circulating supply of ETH, making this vision quite aggressive.

It's worth noting that it officially launched its "Ethereum treasury" transformation only after completing a $250 million private placement in July 2025, meaning in less than six months, BitMine has transitioned from a Bitcoin mining company to the largest ETH holding entity globally.

Source: ultra sound money

What’s even more noteworthy is that even when ETH fell below $3,000 last week, and the market was rapidly collapsing, BitMine chose to increase its position against the trend, continuing to buy 41,787 ETH (about $108 million) at around $2,601, demonstrating strong conviction in its holdings.

But problems soon followed—costs. Belief comes at a price; BitMine's average holding cost for ETH is about $3,837, which means that when ETH fell back to around $2,350, its unrealized losses had expanded to about $6.4 billion.

This extremely aggressive "coin-based" transformation has also played out in a wildly speculative valuation game in the U.S. secondary market.

Looking back to July 2025, when BitMine first began disclosing its Ethereum purchasing strategy, its stock price (BMNR.M) was hovering around $4. Subsequently, the stock price completed a leap from the floor to the sky within six months, peaking at $161, becoming the most dazzling "Ethereum shadow stock" in the global capital market.

However, success and failure both hinge on Ethereum. As ETH prices sharply retreated, the premium bubble of BitMine's stock quickly burst, and it has now plummeted to $22.8.

If BitMine represents a long-term spot path that exchanges time for space, then Jack Yi's Trend Research has chosen a significantly riskier road.

Since November 2025, Trend Research has been openly bullish on ETH on-chain, with its core strategy being a typical "staking borrowing—buying—re-staking borrowing" cycle:

- Stake the ETH held into the on-chain lending protocol Aave;

- Borrow stablecoin USDT;

- Use USDT to buy more ETH;

- Continuously cycle to amplify long exposure;

The actual logic of this operation is not complex; at its core, it is about using existing ETH as collateral to borrow funds to continue buying ETH, betting on leveraged gains when prices rise.

This is undoubtedly a highly lethal strategy in a bullish market, but the risk also stems from this; once ETH prices fall, the value of the collateral shrinks, and the lending protocol will require additional margin, or else it will trigger forced liquidation, selling ETH at market price to repay debts.

So when ETH plummeted from around $3,000 to a low of about $2,150 in just five days, this mechanism was forced into "stress mode," and on-chain, a rather dramatic "small knife cutting flesh" scene unfolded:

To avoid forced liquidation, Trend Research continuously transferred ETH to exchanges, selling it for USDT, and then recharging USDT back to Aave to repay loans, barely managing to lower the liquidation line and buy some breathing room.

As of February 2, Trend Research has deposited a total of 73,588 ETH (worth about $169 million) into Binance in multiple transactions for sale and loan repayment, with total losses in the ETH lending position reaching $613 million, including realized losses of $47.42 million and unrealized losses of $565 million, currently still bearing a stablecoin leveraged loan of about $897 million.

Especially during the rapid drop of ETH in the $2,300-$2,150 range, the entire network was almost watching in real-time this "stop-loss survival" drama unfold—with every ETH sold by Trend Research, it was both fighting for its own survival space and inadvertently adding new selling pressure to the market, further tightening the noose around its own neck.

In other words, Trend Research almost killed itself.

Source: Arkham

2. The "Ice and Fire" Dichotomy On-chain and Off-chain

Ironically, if we temporarily step away from the tens of billions of dollars in unrealized losses of the whales and look at Ethereum from the on-chain structure rather than the price itself, we find a reality that is almost opposite to the sentiment in the secondary market—ETH on-chain is continuing to heat up.

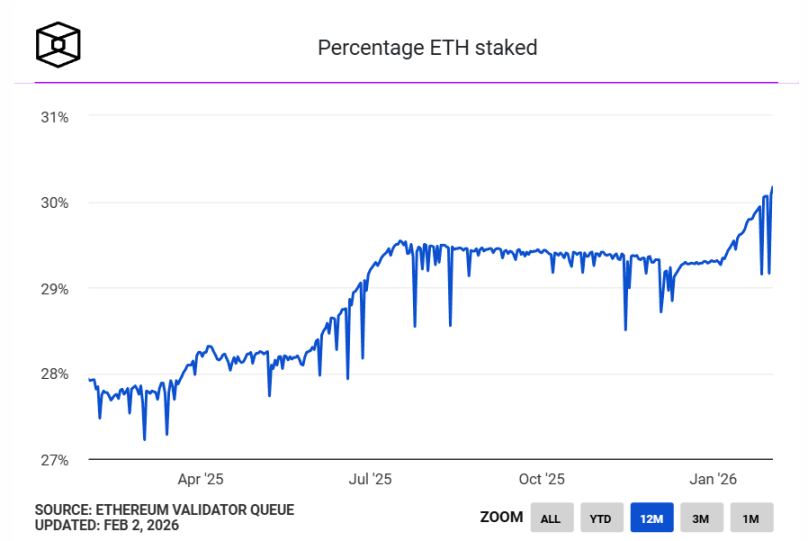

The Block's statistics show that approximately 36.6 million ETH are currently staked on the Ethereum Beacon Chain, exceeding 30% of the network's circulating supply, setting a new historical high.

It's worth noting that the previous record for staking rate was 29.54%, which occurred in July 2025, and this round marks the first time since Ethereum entered the PoS era that the staking rate has substantially crossed the 30% threshold.

Source: The Block

From the perspective of financial supply and demand structure, this change is highly significant.

A large amount of ETH being staked means that they are actively exiting the freely circulating market, transforming from a "speculative currency" used for high-frequency trading and speculative games into a "yield-bearing bond" with productive attributes. In other words, ETH is no longer just a medium for Gas, transactions, or speculation, but is increasingly playing the role of "means of production," participating in network operations through staking and continuously generating returns.

Of course, the heavyweight role cannot be separated from treasury players like BitMine—BitMine has staked nearly 70% of its ETH holdings (about 2,897,459 ETH) and continues to increase its stake.

Meanwhile, the validator queue has also shown subtle changes, with the staking exit queue nearly empty, while the entry queue for staking continues to lengthen, with over 4.08 million ETH waiting in line to "enter." In summary, "exiting is smooth, but entering requires a 7-day wait."

This queue size has set a new high since the launch of Ethereum's PoS staking mechanism, and from a time dimension perspective, the steep rise of this curve began precisely in December 2025.

This is also when Trend Research began its aggressive bullish stance on ETH.

Source: Ethereum Validator Queue

It is important to emphasize that, unlike trading behavior, staking is a low liquidity, long-term configuration method that emphasizes stable returns; after all, once funds enter the staking queue, it means giving up the possibility of flexible reallocation and short-term speculation for a considerable period.

Therefore, as more and more ETH choose to re-enter the staking system, it at least conveys a clear signal: at this stage, an increasing number of participants are willing to lock in for the long term, actively bearing opportunity costs in exchange for certain on-chain returns.

Thus, a highly tense structural picture emerges. On one side, nearly 1/3 of ETH is continuously being "cellared," with a steady stream of ETH waiting off-chain to be locked up; on the other side, liquidity in the secondary market is tightening, prices are under continuous pressure, and whales are forced to stop-loss, with positions frequently exposed.

This obvious divergence between on-chain and off-chain is creating the most distinct "ice and fire" scenario in the current Ethereum ecosystem.

3. The "Whales" with Open Positions Have Already Made It to the Menu?

In traditional financial games, the bottom cards are often not publicly transparent; positions, costs, leverage ratios, and so on can be hidden within information-asymmetric derivatives, over-the-counter agreements, and other tools.

However, on-chain, every transfer, every collateralization, and every liquidation line of the whales is exposed to the entire market 24/7. Once they choose to go long openly, they can easily fall into a physically exhausting battle of "self-fulfilling Murphy's Law."

From a game theory perspective, although Tom Lee and Jack Yi are both bullish and have made their positions clear, they stand at opposite ends of the risk curve.

Despite an unrealized loss of $6.4 billion, BitMine has chosen a "low leverage, high staking, zero debt" spot path. As long as they do not trigger structural risks, they can choose to lie flat within the time window, allowing staking returns to gradually offset volatility.

In fact, contrary to what most of the market imagines, BitMine's structure is not aggressive. As Tom Lee emphasized in a social media post on February 2: They have $586 million in cash reserves, and 67% of their ETH is staked, generating over $1 million in cash flow daily. For him, a price drop is merely a shrinkage of numbers on paper, not a survival crisis.

On the other hand, Jack Yi has leveraged through Aave's circular lending, thus falling into a negative cycle of "price drop - approaching liquidation line - transferring ETH to sell - adding margin - further decline," resembling a "performance art" observed by the entire network.

Short sellers do not necessarily need to blow you up; they only need to suppress the price → force a reduction in positions → create passive selling pressure → trigger follow-on selling, which is enough to complete a structural hunt.

This is also why every repayment and transfer by Trend Research is magnified and interpreted as a change in Jack Yi's confidence or whether he will surrender. As of the time of writing, Trend Research has sold 73,588 ETH (worth about $169 million) to stop losses, and the liquidation price of their lending position has dropped below $1,800.

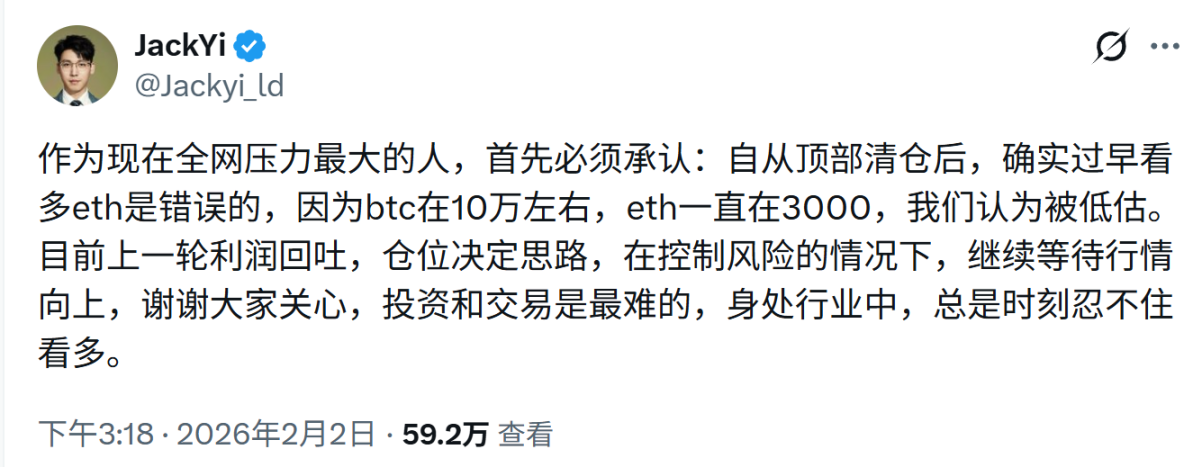

On the same day that Tom Lee posted, Jack Yi also publicly reflected: as the person under the most pressure in the network, he must first admit that being bullish on ETH too early was a mistake… Currently, after the last round of profit-taking, he is waiting for the market to move upward while controlling risks.

Ultimately, going long through on-chain circular lending is equivalent to laying one's bottom cards open for everyone to see. Whether or not there is truly an organized single-point assassination, when you make your positions, costs, leverage ratios, and liquidation lines public on-chain, you have already made it onto the hit list of all resonant forces in the market.

Of course, to some extent, this is also a path dependency. After all, in April 2025, Jack Yi publicly called for a bullish stance and continued to increase positions when ETH fell to $1,450, ultimately welcoming a rebound and profit, becoming a "spiritual banner" for bullish ETH.

However, this time, the direction of the story remains uncertain, and Tom Lee's chances of winning are clearly a bit greater.

In Conclusion

From Three Arrows Capital to FTX, and now to BitMine, which is being publicly observed, the script has never changed: all collapses begin with an excessive arrogance towards long-term certainty.

As Keynes famously said, "In the long run, we are all dead." Jack Yi's mistake was not in being bullish on Ethereum in the long term, but in underestimating the cruelty of the market during short-term irrational phases. From the moment he chose to go long openly with leverage, he had already sacrificed himself to this transparent algorithmic world.

But from another perspective, this may be a "great cleansing" that Ethereum must undergo; every cycle requires such a process of whale fall: whales are observed, leverage is squeezed out, path dependencies are shattered, and chips are redistributed.

Only when those who need to stop losses do so, and those who need to endure have endured, can they truly enter the fray unencumbered.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。