"Simply creating a 'better DEX experience' cannot change the current situation, so we decided to build our own ValueChain and SoDEX."

Written by: SoSoValue Team

To the companions of the SoSoValue ecosystem:

Thank you for your participation and attention; this is a ticket for early participants. It is called a ticket because we are not just launching a product, but gathering companions to embark on a journey to rediscover the original intentions of the industry together.

About the Ark of 2008 and the Misnavigation Seventeen Years Later

The story begins with the financial tsunami of 2008, when the trust in the traditional financial system collapsed overnight. Satoshi Nakamoto released the Bitcoin white paper, creating an ark for the world. The original design of that ark was simple: no need to trust any intermediary, everyone could control their own private keys and assets, using blockchain technology to reconstruct the way humanity establishes trust. In the initial conception, this technology was a gift for ordinary people, not a tool for Wall Street. In the eyes of believers in technology changing the world, AI and blockchain are shaping the world structure of the next 20 years from the two foundational dimensions of "productive forces" and "production relations."

However, seventeen years later, this ark named "Crypto" seems to be drifting away from its original course amidst fog and noise.

Bitcoin has become a giant, but the focus of the industry has quietly shifted. While AI is reshaping productivity at an exponential rate and continuously opening new value spaces, Crypto has gradually fallen into a purely liquidity speculation game, leading people to question the long-term value of blockchain technology for the world.

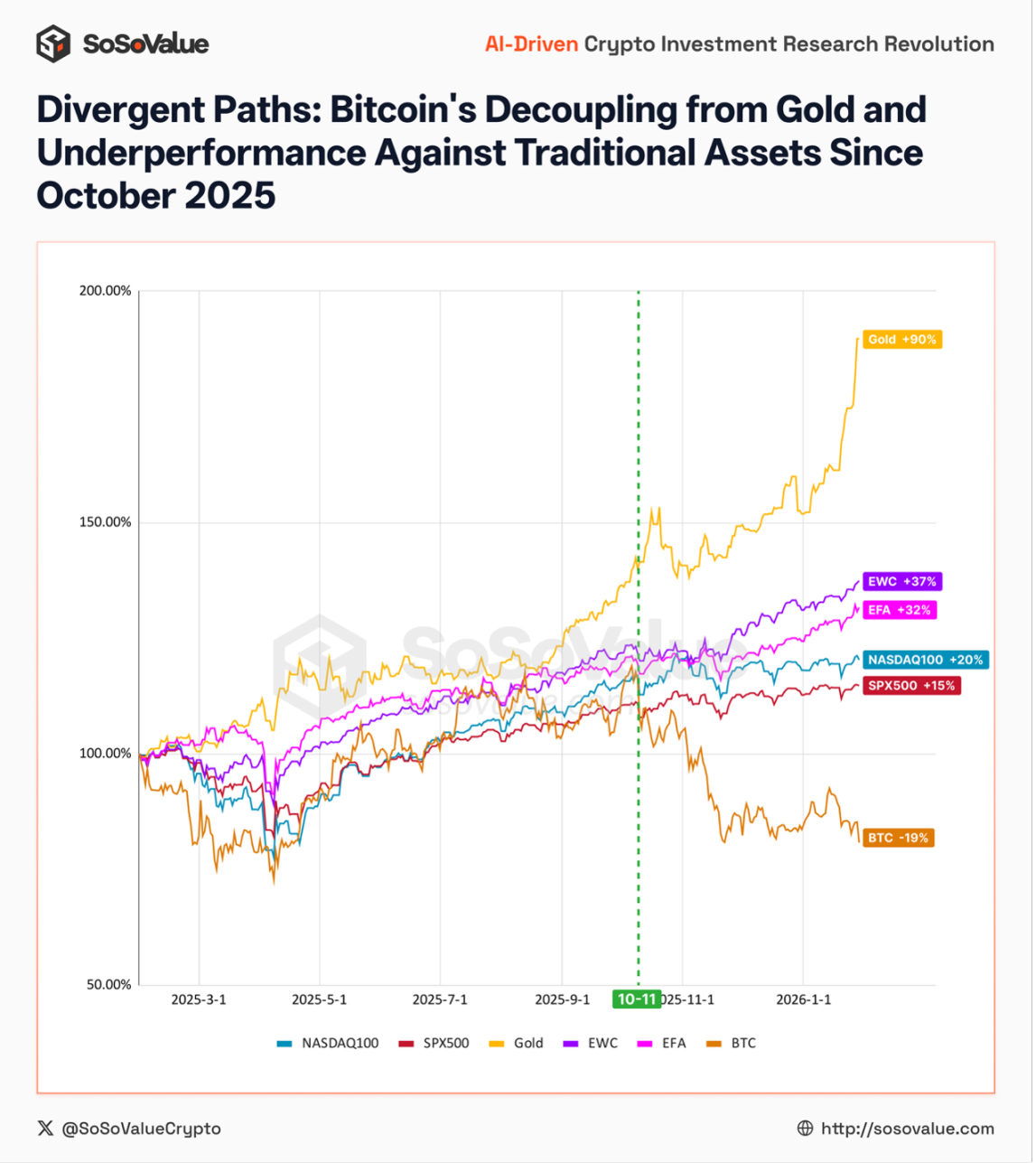

This rift became particularly clear in 2025: on one side, the tech-driven prosperity of the U.S. stock market; on the other, the internal liquidity dilemma of the crypto market, which is continuously spiraling but struggling to expand outward. In October 2025, the long-accumulated pure liquidity bubble began to burst in a chain reaction triggered by an incidental technical failure. Crypto assets entered their darkest hour over the past four months, diverging from the trends of all global risk assets. People began to doubt and worry: can blockchain technology still be one of the main lines of technology changing the world?

Figure 1: Since October 2025, Bitcoin has underperformed traditional assets and decoupled from gold trends, data source: SoSoValue

What Happened in 2025? The Collapse of the Mirage in the Fog

In the recently passed year of 2025, amidst anxiety over the lack of substantial innovation, the crypto industry as a whole slid into a more pure and naked liquidity game—exchanges began systematically promoting high-leverage products. The implicit goal of product design was no longer to enhance trading efficiency but to increase the probability of liquidation, with the attributes of a casino clearly overshadowing those of a trading platform.

At the same time, the main communication targets for project teams shifted from users to exchanges, market makers, and VCs. User value was almost completely absent during this phase. Issuing tokens was no longer an asset listing but rather the opening of a new gambling table. Asset quality was no longer the core standard for listing; the only requirement for this token issuance game was whether it could attract more people to place bets.

The original intention of crypto technology to reconstruct production relations and make the world more decentralized and equitable was exploited to the extreme by the most primitive desire business—casinos—as a fig leaf to evade regulation.

When "building" was mocked and "gaming" became mainstream, what we saw was not an increase in value through technology changing the world, but rather an acceleration of entropy in the world under the name of blockchain technology, causing the ark to drift. As the fog lifted and the mirage dissipated, people began to see the stark reality of the underlying issues in the industry while also removing much of the noise, clarifying the journey ahead.

For this reason, this may be both the worst of times and the best of times. In the morning when the fog dissipates, steadfast builders find it easier to connect with one another. Only through the unwavering efforts of like-minded individuals can this ark restore its intended course and move toward a brighter future. It is about truly using blockchain technology to reconstruct the way humanity establishes trust, and since the financial industry is composed of many modules that build trust, we believe that the first stop for blockchain technology to change the world is to reconstruct the financial industry, allowing more people globally, including various entities like AI agents, to have equal access to participate in financial life, making resource flow and allocation more efficient.

Looking Back at the Founding of SoSoValue: Serving the Crypto Mass Investor

SoSoValue was not initially a product developed specifically for consumers; it originated from our internal investment research needs. The original intention was very pure: as a team focused on investing in the tech industry, like many survivors of the financial cycle who lacked Crypto Native experience and were deeply educated by common sense, when we were called by the belief that blockchain technology could change the world and hoped to invest in crypto long-term, the chaotic and skeletal decision-making environment completely shattered the original paradigm of investment research work. The extremely fragmented and untraceable information dimensions, the inability to distinguish facts from opinions amidst social media noise, and the interpretations of the same concept from the perspectives of programmers, finance, marketing, and gambling made us realize that the industry was still in its very early stages, and we needed to build our own information filtering tools. The birth of ChatGPT allowed us to quickly create tools based on investment research needs.

This tool was initially shared only among friends, and based on the open spirit of blockchain, we made it available for free to the community. The name of the tool originated from a very chill discussion: "Jivvva, after filtering with your investment research tool, found that most cryptocurrencies have no value, just so-so." We felt that the name SoSoValue could remind us to persist in filtering out the vast majority of noise through research, as true value has always been in the minority in every era, requiring us to track, explore, and create.

In early 2024, the opportunity for mass adoption first smiled upon us. The team judged from an investment research perspective that a Bitcoin ETF was likely to be approved, which could not only reduce Bitcoin's volatility but also potentially become the main channel connecting the stock market and the crypto market, fundamentally changing the landscape of the entire crypto industry. Thus, we launched the world's first Bitcoin spot ETF Dashboard, also the first platform to systematically propose and track the core metric of "net inflow and outflow." The market gave us unexpected feedback; by helping users truly "see" the flow of funds, we gained our initial million-level high-quality real users.

Our vision and mission began to clarify: Enable crypto investment for the global masses! Everything is centered around the investor, using AI and blockchain technology to create a platform that prioritizes investor interests, providing noise reduction, efficiency, and convenient investment services.

Once our vision was firm and the path clear, more and more like-minded top experts in blockchain technology, DeFi products, trading systems, asset issuance, and investment banking joined the team, and the power of the community grew stronger. This became a challenging yet immensely enjoyable journey. The foundational knowledge from different fields, continuously discussed and collided based on first principles, allowed us to learn a great deal from our companions along the way. The lack of an urgent desire for results enabled us to focus on the continuous exploration of industry pain points and user needs, as well as the ongoing refinement of infrastructure and products.

Today, the full launch of SoDEX finally allows us to complete the foundational product landscape of SoSoValue.

Why Create SoDEX?

The birth of SoSoValue, SSI, and SoDEX did not stem from a sudden inspiration but from logical deductions based on industry pain points.

First, we wanted to solve the information asymmetry problem for investors. SoSoValue Terminal achieved its first PMF, which is the cornerstone for our users: whether in traditional finance or crypto, the core pain point has always been the "signal-to-noise ratio" being too low. SoSoValue's Terminal provides users with a free professional filter to reduce noise, incorporating the analytical framework of professional investors to filter and track information dimensions. This allows every ordinary crypto investor to enjoy Wall Street-level information services, achieving information equity. From the first launch of the ETF Dashboard to the accumulation of 10 million real users, it proved the market's thirst for "certain information."

Secondly, once investors understand, they need asset allocation, and SSI once again validated the PMF of passive investment. With the research terminal, users understand, and the next step is cognitive monetization—how to provide users with long-term safe asset allocation services. Our goal is to grow together with users for 20 years. According to financial common sense, most users do not have the ability to beat the market; they need Beta returns, not Alpha gambling. Therefore, based on data platform observations, we launched the SSI (SoSoValue Index) protocol, aiming to decentralize the power to "define assets," allowing excellent strategies to become tradable indices.

• For users: One-click allocation of asset portfolios constructed by top researchers, just like buying an ETF.

• For researchers: Use data and methods to publish their own indices, becoming "fund managers" in Web3. Provide users with richer, more convenient, and transparent return combinations, becoming the Vanguard on-chain. Allow more smart and honest individuals to become on-chain fund managers through the trust infrastructure we build.

In less than a year: SSI has garnered nearly 500,000 on-chain holders, with over 250,000 users holding Mag7.ssi. We confirmed one thing: users want not just data, but assets that can withstand cycles. Thus, we had our second goal: to assist users in configuring and managing assets on-chain and pursue long-term compounding.

Finally, we need to solve the bottleneck of scaling on-chain asset issuance, which led to the timely emergence of SoDEX. When SSI was only operating on a small scale, the L2 public chain + third-party AMM model was sufficient. However, once we wanted to expand categories, scale up, and truly deliver products to more ordinary users, the shortcomings of crypto infrastructure would be magnified. The convenience of user purchases and index synthesis, on-chain liquidity, and market maker capital utilization efficiency all became bottlenecks for scaling.

We needed a high-performance on-chain platform that supports order books and did not want to reinvent the wheel. However, after in-depth research, we found that no chain could simultaneously achieve three things: high-performance order books, friendliness to spot trading, and support for RWA (real-world asset) issuance. Ultimately, we concluded that to sail along our original intention, we must build our own Layer 1.

The Mission of SoDEX—Rebuilding an Ark

There is no road, so we will build one ourselves. However, during the research process for SoDEX, we saw a more troubling side of the industry. We discovered that the "difficulty" of the infrastructure is merely a surface issue; the deeper problem lies in the "misalignment" of the business model.

- Brutal Lifecycle — In this market, due to exchanges' pursuit of short-term traffic and profits, the average user lifecycle is less than 3 months. This "quick in and out" rhythm ensures that users can only be transient visitors.

- Hidden "Customer Loss" — We uncovered a widely existing unspoken rule in the industry: the main income of some platforms is no longer transaction fees but rather the capital losses of users. When platforms survive by making users lose money, the relationship with users is no longer one of service but a zero-sum game of adversaries.

- Bad Money Drives Out Good — Exaggerated calls from KOLs occupy the center stage, while serious researchers, unwilling to cooperate in "harvesting," face survival crises due to a lack of monetization pathways.

The "prosperity" under these rules is built on the consumption of the user base and the conscience of the industry.

At that moment, we realized that in the face of this unsustainable industry status quo, simply creating a "better DEX experience" would not change the situation. Thus, we decided to build our own ValueChain and SoDEX.

Satoshi Nakamoto created the first ark, allowing ordinary people to hold undiluted assets. We want to follow Satoshi's original intention and create an on-chain financial ark, enabling ordinary people to invest and trade assets safely and efficiently, lowering the barriers to participating in financial life through blockchain technology.

SoDEX, adhering to the two principles of on-chain transparency and security, has two major features in its technical architecture:

Leveraging the multi-subchain composite architecture of ValueChain L1, SoDEX connects the account systems of high-performance Spot (spot) and Perps (contract) trading subchains. This means users can trade crypto-native assets, stocks, indices, and RWA (real-world assets) in a one-stop manner without switching accounts, greatly enhancing capital efficiency and the convenience of asset allocation.

Reusing the Mirror Protocol infrastructure system of SoSoValue Indexes Protocol, it adopts a combination of third-party custody and Bridge solutions to improve the security of multi-asset cross-chain transactions.

In terms of product positioning, we focus on two things:

- Integration of Spot + Perps: We hope you can buy spot assets as smoothly as on centralized exchanges while also managing risk exposure with contracts. Moreover, relying on SoDEX's infrastructure, you can issue your own indices and participate in richer strategies.

- Continuous Optimization of Product Experience for the Public: We pay tribute to professionalism while making institutional-level performance and CEX-like smooth experiences accessible to every ordinary investor.

Today, SoDEX is launched. The blueprint in our hearts has finally come full circle.

- SoSoValue — Helping ordinary investors eliminate noise and see the truth.

- ValueChain — Building trust through performance with the transparency of L1.

- SoDEX, SSI, and more open tools — Creating a zero-threshold investment platform for users to access rich on-chain assets and enjoy a smooth trading experience.

The future that this new ark is sailing towards is a complete on-chain financial world; we are building this chain not just for current cryptocurrencies but for various assets to flow freely on the same transparent chain; SoDEX is the vessel prepared for that future.

Standing at a New "Renaissance" Moment

Finally, I want to talk about why we are so persistent. In many late nights, we pondered: why is the current market so fragmented? On one side is the rapid evolution of AI, while on the other is the liquidity exhaustion of Crypto; on one side is the exponential explosion of productivity, while on the other, production relations are still playing the most primitive game of "passing the parcel."

This sense of tearing reminds us of Europe 500 years ago. It was an era known as the "Renaissance." At that time, the birth of two technologies completely changed the course of humanity:

Gutenberg's Printing Press: It broke the church's monopoly on knowledge, allowing ordinary people to own books and igniting the liberation of cognition.

Double-Entry Bookkeeping: It established the foundation of trust in modern commerce, making cross-border capital cooperation possible and igniting financial prosperity.

History always rhymes. Today, we stand at the same crossroads:

- AI is the "printing press" of the new era: It makes intelligence and productivity extremely cheap and widespread, responsible for enlarging the cake.

- Crypto is the "double-entry bookkeeping" of the new era: It upgrades trust based on people to verification based on code, responsible for dividing the cake fairly.

This should be the singularity for ordinary people to change their destinies. This is also the underlying belief that drives us into this industry — we believe this is a ladder to a fairer world. We are not just building an exchange; we are maintaining a historical order of "technology for good."

One more thing.

SoDEX is a high-performance, highly trustworthy, zero-threshold, one-stop investment platform, not a casino that creates illusions. If you seek adrenaline-fueled short-term thrills, this may not be the best place. But if you recognize "long-termism" and are willing to let your wealth compound alongside the true value growth of the industry, then we are fellow travelers.

What Satoshi wanted to introduce to this world was not speculation but autonomy. Everything we do aims to continue this choice: to safely manage your wealth in a transparent and fair system.

On this new ark, we are not adversaries but fellow explorers.

This letter is your ticket.

We will distribute "ticket rights" to eligible early user accounts (specific rules will be subject to official announcements).

At the same time, we have also reserved an ecological incentive pool to support long-term participants and builders, rewarding genuine contributions and long-term companionship.

Stop Gambling. Start Compounding.

Love each other and benefit each other! — Mozi

Welcome aboard, let’s journey far together. Use technology to increase consensus, reduce disputes, and promote peace!

sodex.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。