Author: WST

Powell's term will end in May 2026, and throughout 2025, speculation about who will succeed Powell has been rampant.

Finally, on January 30, Eastern Time, there was a definitive answer to this question: Kevin Warsh

Trump Officially Nominates New Fed Chair, Shaking the Financial World

On Friday morning, Eastern Time, President Trump officially nominated Kevin Warsh as the new chair of the Federal Reserve, succeeding Powell. This decision ended a five-month power struggle for the Fed's leadership and thrust this veteran, who has deep ties to both the Fed and Wall Street, into the spotlight.

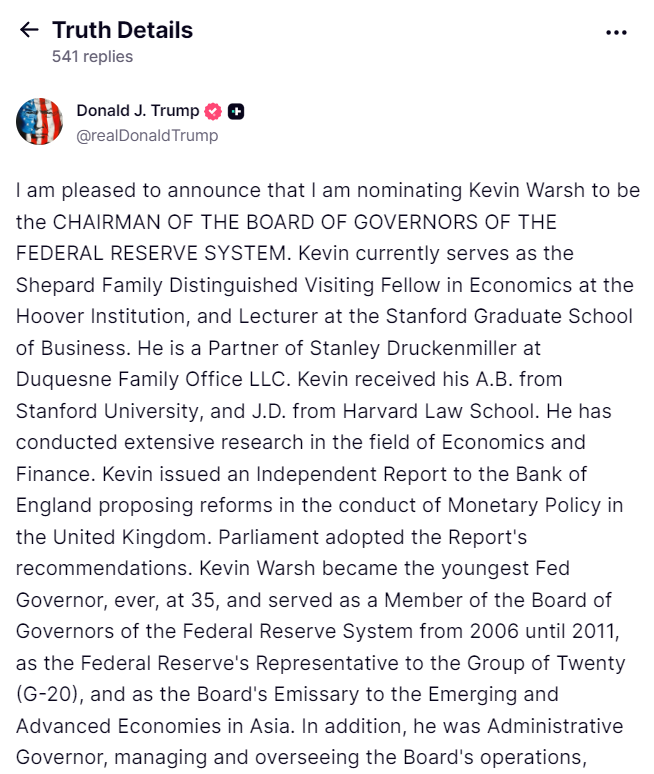

After the announcement, Trump took to Truth Social to express his support for Warsh: “I have known Kevin for a long time, and I have no doubt he will be one of the greatest Fed chairs in history, without exception.”

cr. truthsocial

At 56, Kevin Warsh was once considered by Trump in 2017 for the Fed chair position. However, he lost to Powell, and after Powell raised interest rates, Trump began to regret not choosing Warsh.

Looking back at the past of this new Fed leader, he earned a Bachelor’s degree in Public Policy from Stanford University, majoring in Economics and Political Science; he then attended Harvard Law School, graduating with a J.D. in 1995 with honors. He also studied Market Economics and Debt Capital Markets at MIT Sloan School of Management and Harvard Business School.

Warsh started his career at Morgan Stanley in mergers and acquisitions, rising to the position of Executive Director in the M&A department. He was nominated to the Fed by George W. Bush in 2006, becoming the youngest appointee in the Fed's history at just 35 years old.

During the 2008 financial crisis, he became a "key liaison" between the Fed and Wall Street due to his connections.

It’s worth noting that Warsh's rise in his career is partly due to his personal excellence and partly due to his marriage. Warsh and his wife are Stanford alumni; his wife, Jane Lauder, is the granddaughter of the founder of Estée Lauder, with a net worth of about $2.6 billion, and currently serves as the global brand president of Clinique. Warsh's father-in-law, Ronald Lauder, is a longtime friend and key supporter of Trump, and was the first to propose buying Greenland, providing Warsh with unique networking resources in both political and business circles.

His extensive policy experience and recognition on Wall Street have led to a relatively calm market reaction to this nomination. The market generally believes that Warsh will not completely follow Trump's orders; his understanding of both policy and the market is an advantage, allowing him to balance the demands of Wall Street and the White House. His policy decisions are expected to consider both market principles and political demands. However, his "Wall Street background" has raised concerns that policies may favor financial institutions over ordinary citizens.

The conflict between Trump and Powell has long been public. Since Powell took office as Fed chair in 2018, Trump has continuously criticized his policies, and even after the Fed cut rates three times in the second half of 2025, Trump’s dissatisfaction remained unquenched. Trump even sued Powell for mismanagement of the Fed, claiming he should be ousted immediately:

cr. CNBC

Warsh himself, in a July 2025 interview with CNBC, openly called for a "change of guard" at the Fed. This statement also suggests that if he takes office, he may break from the Fed's previous consensus-driven policy style and adopt a more aggressive reform stance.

It is noteworthy that this nomination comes at one of the most turbulent times for the Fed in decades:

Inflation has not yet fallen to the target level of 2%;

Government debt continues to rise;

The Fed's monetary policy faces unprecedented political pressure for intervention…

Previously, the Trump administration had repeatedly proposed strengthening the White House's control over the Fed, even requiring the Fed chair to consult with the president before setting interest rates. Discussions about the Fed's independence have shifted from theoretical debates in academia to real concerns in the market and among the public.

Warsh's path to taking office will not be smooth. Republican Senator Thom Tillis has explicitly stated that he will block all Fed nominee votes until the Department of Justice completes its investigation into the Fed.

In addition to political resistance, Warsh will also face severe economic challenges: high inflation, a labor market stuck in a "no layoffs and no hiring" stagnation, making policy formulation a dilemma.

How the market will specifically react remains to be seen.

That said, this "battle" for the Fed chair once attracted 11 candidates, including former Fed officials, renowned economists, and Wall Street moguls. After a screening led by Treasury Secretary Scott Bessent, the candidate list was gradually narrowed down to five, then four. Here are the most popular candidates:

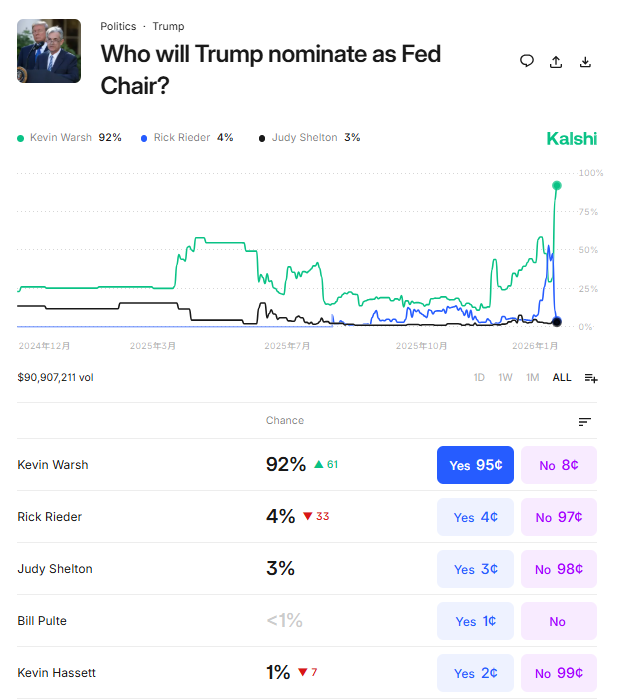

Kevin Hassett, from 80% support to 1%

By the end of 2025, Kevin Hassett was widely recognized as the top candidate for the next Fed chair; at that time, on prediction platforms, Hassett's share even exceeded 80%. However, as of January 29, 2026, his nomination probability plummeted to 1%, completely dropping out of the core competition.

For decades, Kevin Hassett has been a frequent presence in Washington and Wall Street.

Born in 1962 in Greenfield, Hassett earned a Bachelor’s degree in Economics from Swarthmore College and later obtained a Ph.D. in Economics from the University of Pennsylvania. He served as an assistant and associate professor at Columbia Business School.

In the 1990s, Hassett worked as an economist in the Fed's Research and Statistics Division, and later spent several years at the conservative think tank American Enterprise Institute (AEI), focusing on tax policy, fiscal issues, and stock market research. He co-authored "Dow 36,000," a book predicting that the U.S. stock market was undervalued.

Hassett served as the chair of the White House Council of Economic Advisers from 2017 to 2019 and returned to the White House in January this year as the director of the National Economic Council, becoming Trump's top economic policy advisor and a key figure in formulating tariff strategies, tax policies, and government inflation information.

cr. WSJ

Hassett has always been a staunch supporter of Trump, and one of the reasons Trump values him is that they are completely in sync on the issue of "interest rate cuts." He sharply criticized the Fed and Powell for being too slow in cutting rates and even publicly confirmed that the White House was exploring whether Trump could fire Powell for some reason.

Christopher Waller

Christopher Waller is considered an insider at the Fed, having been nominated by Trump in 2019 and currently serving as a Fed governor.

Waller holds a Bachelor’s degree in Economics from Bemidji State University and later earned a Master’s and Ph.D. from Washington State University. He joined the St. Louis Federal Reserve Bank in 2009 as the research director and also served as the bank's executive vice president.

Last July, he and Bowman opposed the Fed's decision to "not cut rates," marking the first instance of a dual opposition in over 30 years, highlighting his firm stance on rate cuts. However, compared to Hassett, Waller has a much lighter political color and leans more towards being a technocrat.

Rick Rieder

Rick Rieder is the "Wall Street heavyweight" among the candidates: the Global Chief Investment Officer of Fixed Income at asset management giant BlackRock. Rieder is responsible for approximately $2.4 trillion in assets at BlackRock, which is equivalent to holding half of the Fed's "money bag."

cr. BlackRock

Rieder holds a Bachelor’s degree in Finance from Emory University and later obtained an MBA from the Wharton School of the University of Pennsylvania. He previously worked at Lehman Brothers, leading the global proprietary trading platform's global proprietary strategy team. Before joining BlackRock in 2009, Rieder served as president and CEO of R3 Capital Partners.

Michelle Bowman

Michelle Bowman was appointed as a Fed governor by Trump in 2018 and this year was nominated by Trump to serve as the Fed's Vice Chair for Supervision, making her a formidable figure within the Fed.

Bowman's background is also interesting: her family owns one of the oldest banks in Kansas—Farmers & Drovers Bank. She also founded her own public affairs and consulting firm, the Bowman Group, in London. In politics, Bowman started as an intern for Senator Dole and later served as legal counsel for the U.S. House Committee on Transportation and Infrastructure and the Committee on Government Reform and Oversight.

Her core viewpoint is that the Fed has fallen behind the curve, and rate cuts must be decisive, even faster and more substantial. This strong stance on rate cuts aligns closely with Trump's demands.

Additionally, Trump has frequently expressed a desire for current Treasury Secretary Scott Bessent to take the chair position, but Bessent has repeatedly declined.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。