Author: Haotian

“The superior man hears of the Way and diligently practices it; the average man hears of the Way and is uncertain; the inferior man hears of the Way and laughs loudly at it.

-- Tao Te Ching

This is a phrase that suddenly came to my mind amidst the noise filled with "Anything But Crypto," "Meme Nihilism," and "Crypto Doomsday."

Especially after reading @VitalikButerin's interview about 2026, this feeling has become even stronger. (Related reading: Revisiting Vitalik: Rejecting the Doomsday Script, Seeking the Lost Soul of Crypto)

We see @VitalikButerin sitting relaxed on a swing in Chiang Mai, not ecstatic about the progress of Ethereum's technical roadmap, but rather seeing the huge disconnect between technology and application.

Why? Ethereum has made significant progress in scaling technology, with the Gas Limit doubling, zkEVM successfully implemented, and significant improvements in account abstraction. Technically, we are winning, but at the application level, we are losing terribly.

In other words, we have built a supercar capable of 300 km/h (L2/L3), but the roads are filled with "old man’s joy" (meme coins) and "bumper cars" (PVP mutual liquidation).

This strong sense of "dislocation" is something that most people cannot comprehend. Borrowing from Vitalik's thoughts, I want to strip away the grand narrative and discuss four harsh truths that only the "superior man" is paying attention to:

When "Infrastructure" Becomes an Addictive Dependency

We have fallen into a collective illusion: not only do we need to build roads, but we also need to build more roads, faster roads, even if there are no cars on them.

What we originally envisioned was a "decentralized Uber," a "Web3 Amazon," but what we got was endless financial churn. This is a typical structural mismatch of "infrastructure overcapacity" and "extreme scarcity of PMF (Product-Market Fit)."

Why is this happening? The answer is simply that "selling shovels" is easier to tell stories about than "mining gold."

In the past few years, VCs and developers have conspired to stage a carnival of "technological narcissism." As long as your TPS is high enough, and your ZK algorithm is obscure enough, you can get a high valuation. As for whether anyone uses it? That’s not important; that’s a problem for the next cycle.

In fact, true technology should be like air and water: essential for survival, yet imperceptible. The hype around infrastructure must shift to applications and services; if we do not solve the problem of "who will drive," no matter how many roads we build, we are merely erecting tombstones for the industry’s desolation.

The Essence of Social Interaction: Don’t Let Dopamine Kill Oxytocin

Vitalik stated a harsh truth: if financial incentives are too strong, they will directly destroy the essence of social interaction.

When we introduce tokenomics into social products, we think we are incentivizing users, but in reality, we are feeding greed. The early growth data—was that social interaction? No, that was the carnival of "on-chain gold mining studios." Once expected returns decline and the crowd disperses, it leaves behind a mess.

This is why Vitalik affirmed the strategic wisdom of @farcaster_xyz transitioning to a wallet.

In the era of AI agents and high-frequency interactions, wallets are the "universal connectors" that link everything. When Farcaster decided to embed social relationships at the wallet level rather than simply creating a "Web3 version of Twitter," it was not a retreat but a recognition of the lifeblood of crypto products.

The ultimate goal of social interaction is not to turn "likes" into transactions but to transform "content" into an "asset." Only by stripping away excessive financial noise and returning to a curation and filtering logic similar to Substack can Web3 social regain its lost soul.

The Redemption of AI: Giving Silicon-Based Life a "ID Card"

The grand narrative surrounding AI + Crypto has been hyped wave after wave, with the AI Agent MEME token issuance craze, x402 Agent payment expansion, and so on. But who can answer the core question Vitalik raised: What can Crypto really bring to AI?

The answer is not the next hundredfold meme coin, but as Vitalik said, "permissionless": whether human, company, or AI agent, all have equal access rights.

In the Web2 world, no matter how powerful an AI agent is, it is essentially an "undocumented entity." It has no bank account, no legal identity, and can be disconnected by OpenAI at any time, or its funds frozen due to risk control. It is merely a string of code on a server, private property of tech giants.

But Crypto gives AI an on-chain identity that cannot be frozen. In this regard, Vitalik also provided several directions:

AI's bank account: This is the EndGame of PayFi or the x402 protocol. Because the high-frequency, transparent, and trustworthy micropayments between AI agents can only be supported by blockchain.

Prediction markets: This is where AI's super cognition can be manifested. Prediction markets will be the best stage for AI to showcase "cognitive monetization."

Data rights: When AI-generated content floods the market, only blockchain can prove "who is the original, who is the counterfeit."

Perhaps this is the true intersection of Crypto and AI: we are not issuing tokens; we are building a legal and financial system that allows silicon-based life to breathe freely.

The End of Nihilism: Meme as a Rebound After "Destruction of Technical Narrative"

Vitalik worries that the industry will die from the nihilism of memes. I worry too.

But we need to understand the logic behind the prevalence of memes: this is the retail investors' "non-violent non-cooperation" against the greedy model of "VC orchestrating, high valuations with low liquidity, and unlimited unlocking."

When so-called "value coins" become tools for institutions to cash out at high positions, retail investors choosing memes is a retaliatory rebound, with the underlying message being that since all are scythes, I might as well gamble in a casino where the rules seem fair.

But this carnival is dangerous because it is overextending the industry's future. If Crypto ultimately becomes 100% gambling, it loses its legitimate foundation for existence and will eventually deplete due to a lack of blood production capacity.

Recently, the prejudice we have felt from outsiders and even the unfair treatment by algorithms are all costs of the alienation of Crypto culture.

Only when the technical narrative serves the real world, rather than serving a pure casino, can we break out of this "vicious cycle."

That’s all.

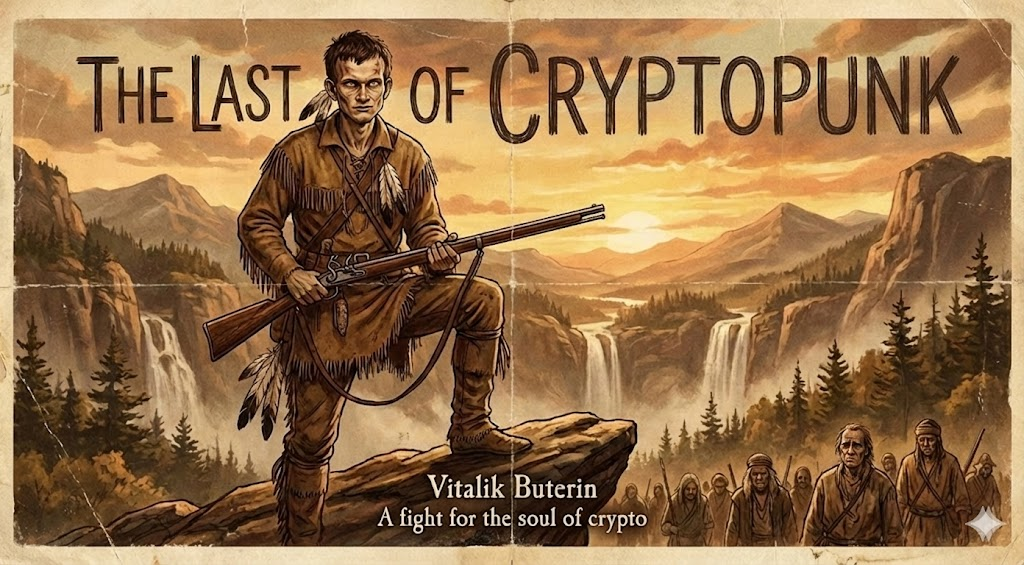

You may have noticed that I included a similar image of the last Mohican at the end of this article. In my eyes, if one day the doomsday script of crypto really unfolds, @VitalikButerin will be the last crypto punk watching over the depths of the jungle.

Returning to the beginning, regarding the phrase from the Tao Te Ching, I feel it is necessary to explain:

The "inferior man" (Gambler) laughs at the desolation of the crypto industry, seeing through it all, declaring crypto dead and indulging in the thrill of PVP mutual liquidation;

The "average man" (industry practitioners) is half-believing and half-doubting, enduring the industry's trials without idealism or speculative thrill; idealism has been worn away, and the thrill of speculation cannot be grasped, leaving only internal strife and confusion;

And the few like Vitalik, the "superior men," do not see the "end of crypto," but rather the eve of another "cocoon-breaking" for the crypto industry.

The superior man hears of the Way and diligently practices it; the average man hears of the Way and is uncertain; the inferior man hears of the Way and laughs loudly at it. Often, the more popular something is, the less it has the Way; the inferior man never seeks the Way, but rather seeks excitement.

The question arises, if one day the doomsday script of crypto unfortunately comes to pass:

Would you be willing to follow @VitalikButerin and join his army of crypto punks?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。