Author: @WazzCrypto, Legion

Compiled by: Frank, PANews

Observations on Prediction Markets in the Token World

Polymarket's token sale market has processed nearly $250 million in trading volume. The accuracy data touted by the platform is impressive: the subscription amount prediction accuracy reaches 100%, and the FDV (Fully Diluted Valuation) exceeds 90%. However, a deeper analysis reveals that these numbers are misleading. The real signal lies not in what the public predicts, but in how wildly they are wrong.

By analyzing 231 prediction markets across 29 token sale events and cross-referencing Polymarket's historical probability data with actual token performance on CoinGecko, we found that "prediction markets are not reliable forecasting tools. Instead, they are actually sentiment indicators and often represent a contrarian signal."

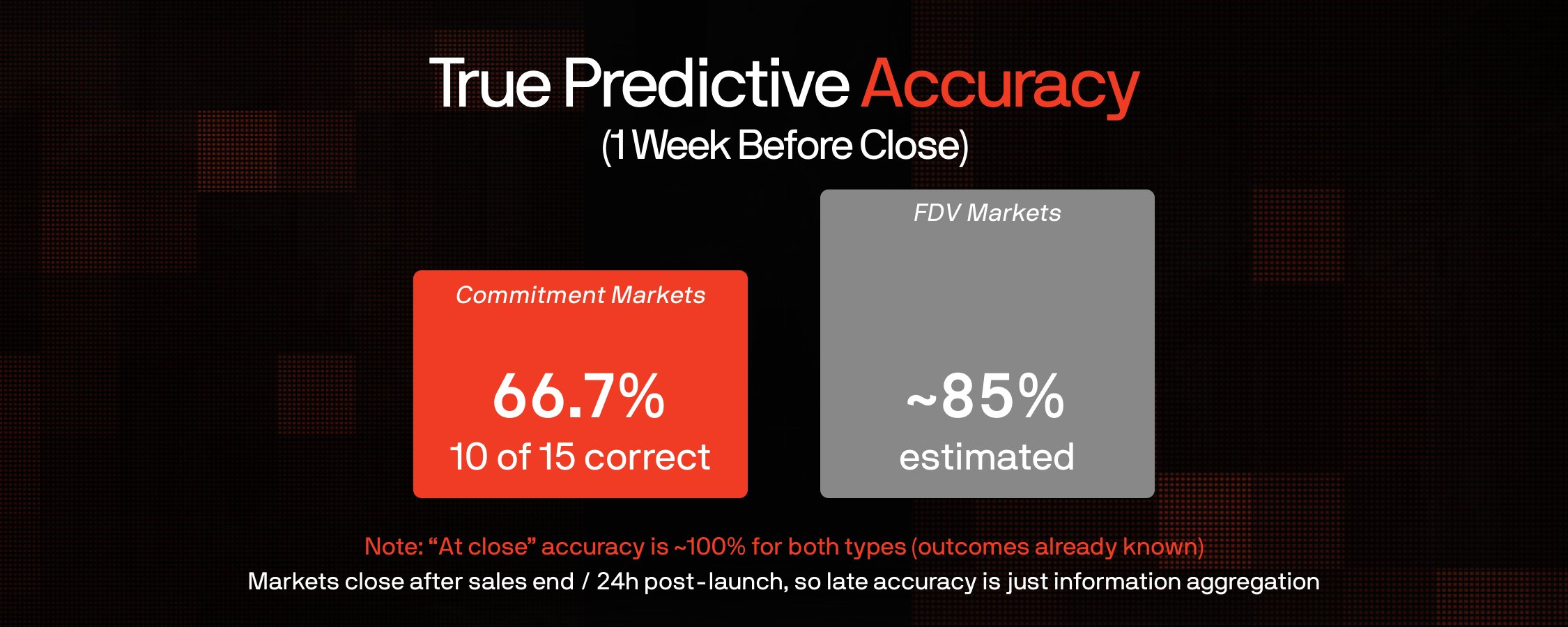

Key Finding: One week before the market closes, the actual prediction accuracy is only 66.7%. At critical moments, the public is wrong one-third of the time, and erroneous predictions often exhibit systematic over-optimism.

24-Hour Volatility Issue: Utilizing hourly data from CoinGecko, we found that Polymarket's market for "FDV higher than X one day after release" is actually betting on extreme volatility. The average 24-hour price fluctuation is ±23% (for example, best performer: Monad +54.8%; worst performer: Trove -38.7%). 75% of tokens experience sell-offs within 24 hours of opening. In this scenario, Polymarket's accuracy for 24-hour FDV predictions is only 62.5%.

The Fallacy of Accuracy: One-Third of the Time, the Market is Wrong

When we track market probabilities over time rather than just looking at static data at settlement, a very different picture emerges. The reason the subscription amount prediction market appears "100% accurate" is that as the sale progresses, the final numbers inevitably leak over time. Insiders and observers update prices accordingly, which is merely post-facto price discovery.

Key Insight: The reason subscription markets and FDV markets tend toward 100% accuracy at settlement is that they settle after the outcome is largely determined. Subscription markets close after the sale ends; FDV markets close 24 hours after release. The only meaningful predictive indicator is the accuracy one week before closing, which is when true uncertainty exists. A 66.7% accuracy rate for subscription predictions indicates that at critical moments, the market is wrong one-third of the time.

Public Predictions Go Wrong Due to Over-Optimism

We reviewed every prediction market where "public confidence exceeded 60% but ultimately failed to materialize." In each case, the erroneous direction was consistent: over-optimism. The public consistently believed that the funding amount would be higher than it actually was, and valuations would be more expensive than reality.

This systematic bias indicates that participants in these markets are optimistic speculators, and it is precisely this bullish sentiment that attracts them to token sales.

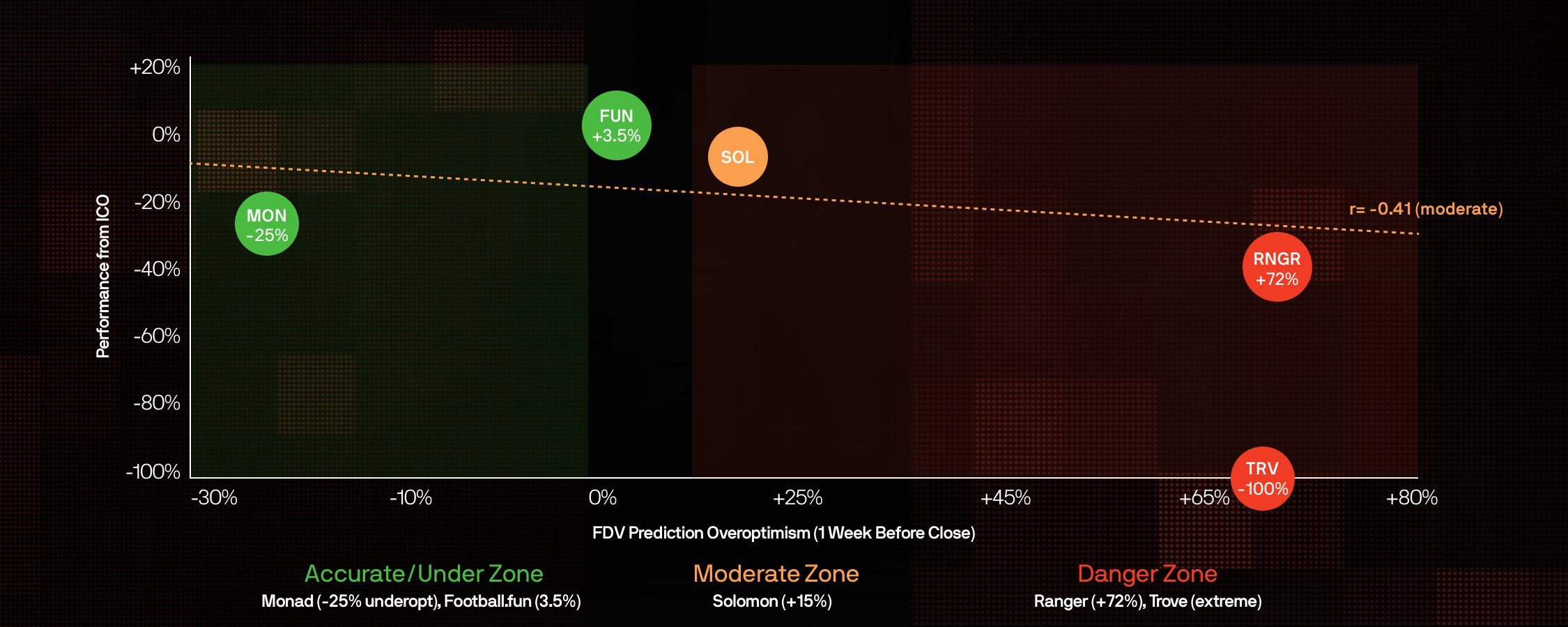

Over-Optimism vs. Token Performance (Based on ICO Data)

Methodology: This analysis only selected markets that have conducted public ICOs and issued tokens, using Polymarket odds from one week before market closure.

Over-optimism level = (Polymarket predicted FDV - actual 24h FDV) / actual 24h FDV.

The Y-axis shows price performance from ICO to the present.

The data shows a moderate negative correlation (r = -0.41) between the level of over-optimism and ICO return rates. Monad is "underestimated/pessimistic" by the market (-25%), but its price has still dropped 24% from the ICO. Ranger is the most "over-optimistic" (+72%), and its price has dropped 32% from the ICO. Only Football.fun remains above its ICO price (+1%).

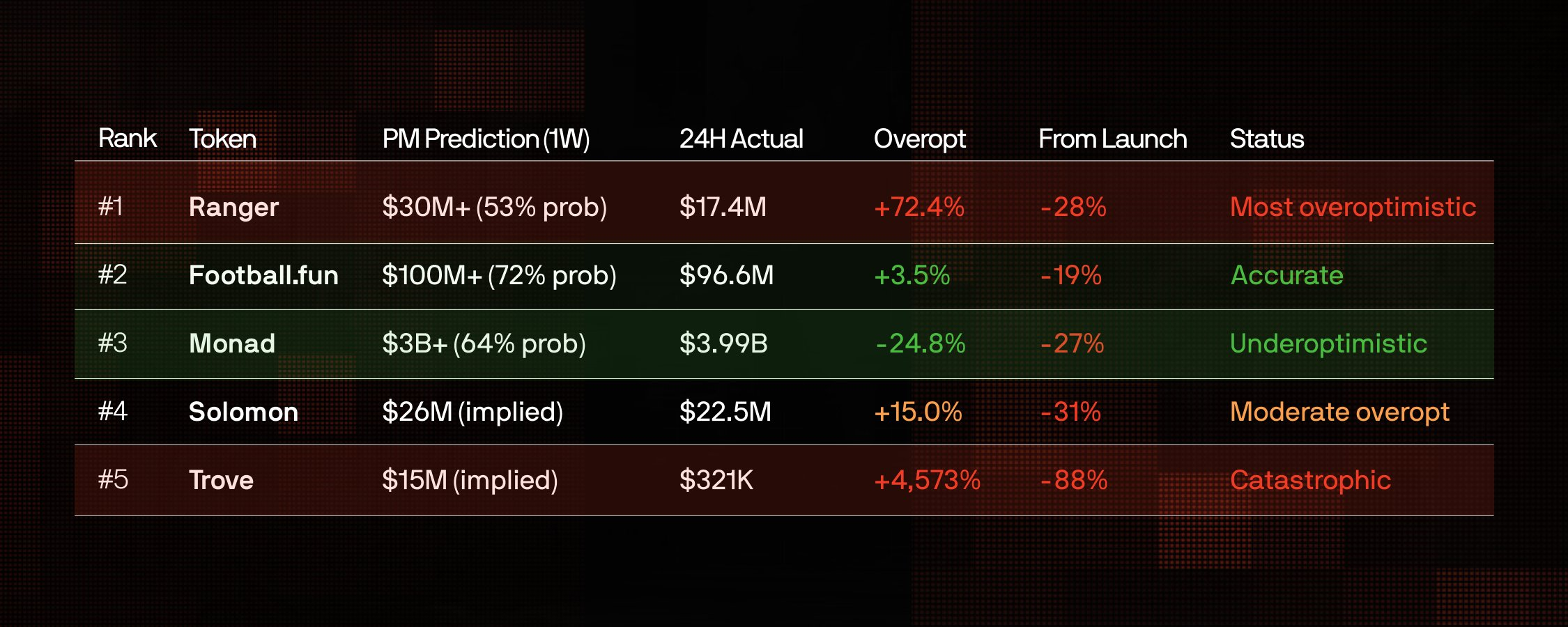

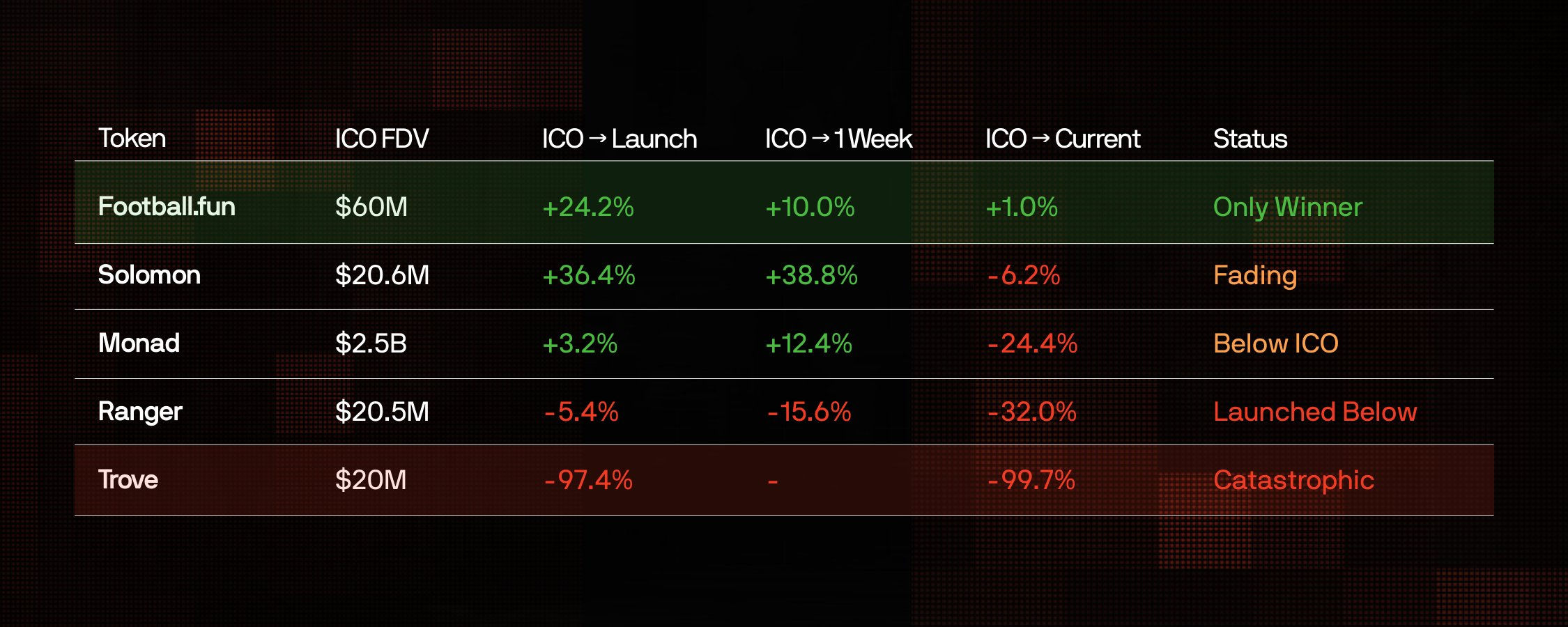

Token Performance Ranking: 40% of Launch Prices Below Valuation

The table below uses historical Polymarket odds from one week before closure to reveal the true prediction accuracy. The pattern is clear: extreme over-optimism predicts disaster, and high trading volume on Polymarket, even when predictions are accurate, often serves as a contrarian signal.

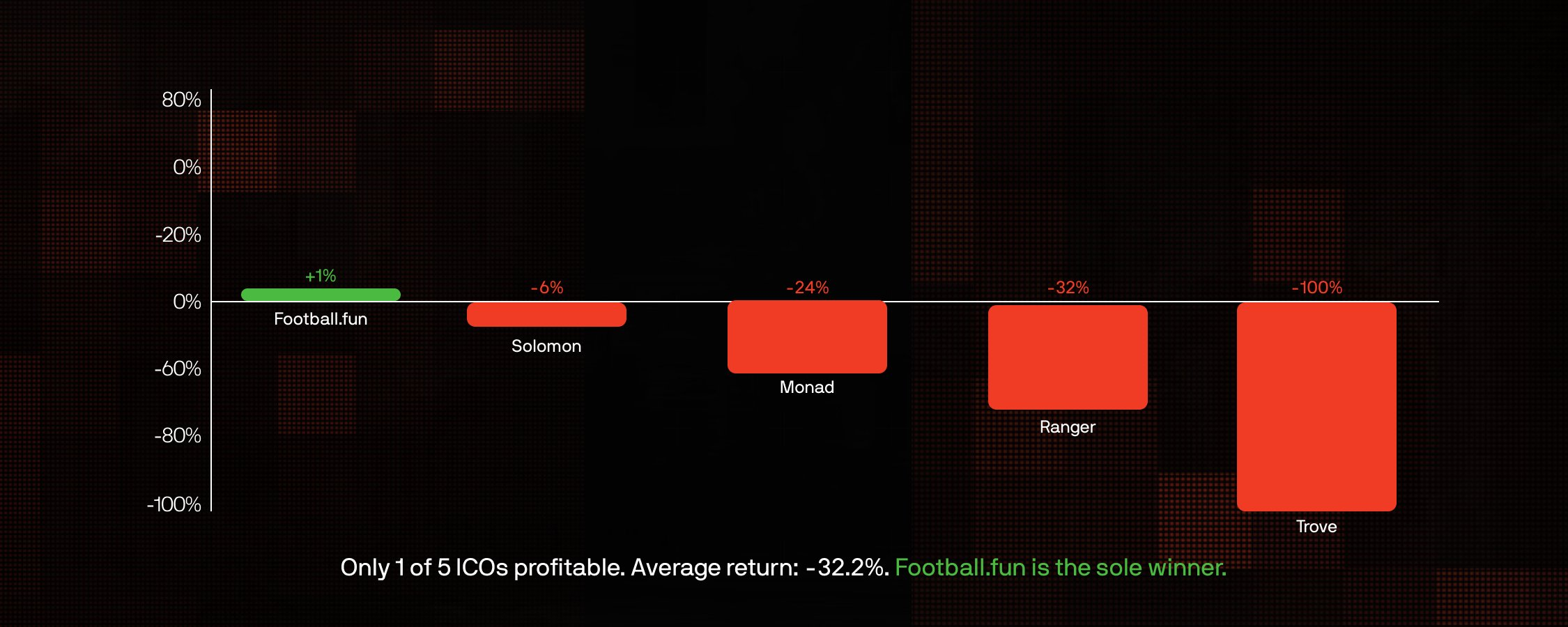

Key Finding: Among tokens with ICO data, 40% of tokens have launch prices below their ICO valuations. The average return rate from ICO to the present is -32.2%. Only Football.fun's trading price is above its ICO price.

This pattern is brutal: even tokens with launch prices above ICO valuations (like Monad and Solomon) ultimately fell below their issuance prices. Football.fun is the only winner among the five ICO tokens in this dataset, currently just 1% above its ICO price.

Core Conclusions:

After analyzing 231 markets, $241.5 million in trading volume, and 8 verified 24-hour FDV data tokens, several conclusions are clear:

"100% accuracy" is meaningless. Markets settle after the outcome is known (subscription markets after sales, FDV markets 24 hours later), so later accuracy inevitably approaches 100%. However, the actual prediction accuracy one week before closing is only 66.7%. At critical moments, the public has a one-third chance of guessing wrong.

Systematic over-optimism. Among the top 15 markets, five markets showed over 60% confidence in thresholds that were never reached. FDV is on average overestimated by +35%.

High trading volume in prediction markets is a contrarian signal. Monad ($89 million) and MegaETH ($67 million) exhibit the highest levels of over-optimism. The more money the public bets, the more confident they become, and the more wildly wrong the results tend to be.

Conservative predictions = better outcomes. Tokens with relatively accurate predictions (Monad, Football.fun) experienced smaller declines. Low hype and accurate predictions seem to be bullish signals.

Trading Signals:

Based on the analysis, we can distill actionable signals for evaluating future token sales. These are not absolute guarantees but represent patterns that consistently hold in the dataset.

Bearish Signals:

Polymarket trading volume > $50 million

FDV over-optimism level > 50%

All FDV prediction thresholds are likely to fail

Subscription amount over-optimism level > 30%

Bullish Signals (relatively speaking)

Polymarket trading volume $5 million

FDV prediction deviation within 20%

Multiple FDV prediction thresholds are met

Public expectations are relatively conservative

This asymmetry is important. Bearish signals are strong indicators of poor outcomes. Bullish signals are weaker, merely suggesting that the token's performance may not be "as bad" as those that are overhyped. In a market where all tokens are down from historical highs (ATH), "losing less" is already the best-case scenario.

Summary

Polymarket's token sale segment is essentially a hype barometer (HypeMeters). The signal lies not in the predictions themselves, but in how much they deviate from reality. When the public pours money into betting on higher valuations, it is wise to remain cautious. Historically, "extreme confidence" from the public often signifies "maximum pain" for investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。