The cryptocurrency market experienced a price drop after a period of sideways consolidation from last night to this morning. Bitcoin fluctuated downward in just a few hours, quickly falling below the $85,000 mark, retreating from around $89,000 on the 28th to about $82,000 on the 30th, with an overall decline of about 7-8%, reaching its lowest point since November of last year.

This sharp pullback, which caught investors off guard, is the result of a combination of collapsing tech stock sentiment, rising geopolitical risks, and internal liquidity exhaustion within the cryptocurrency market.

Microsoft's Earnings Report Raises Investor Concerns About AI Benefits

The starting point for this drop in the cryptocurrency market is largely related to the opening of the U.S. stock market. According to foreign media reports, after the U.S. stock market opened on Thursday, global markets immediately entered a downward channel. The core momentum came from tech giant Microsoft's earnings report released after the U.S. stock market closed the previous day.

Although the software giant's revenue grew by 17% in the fourth quarter, the slowdown in its cloud division and massive spending in the artificial intelligence sector raised concerns among investors about over-investment in AI within the tech industry. Microsoft's stock price plummeted by 12% after the earnings report was released, dragging the entire tech sector down.

After the U.S. stock market opened on Thursday morning, the Nasdaq Composite Index fell by about 2.3%, and the S&P 500 Index dropped by about 1.5%. The widespread collapse of tech stocks quickly spread to the cryptocurrency market. Bitcoin's price rapidly declined, hitting a low of $81,000. According to CoinGecko data, Bitcoin's recent trading price has dropped by 6% compared to a week ago.

Cryptocurrencies Among the First Risk Assets Sold Off by the Market

Timot Lamarre, the market research director at Unchained, pointed out that although many people view Bitcoin as the world's most resilient currency, the vast majority of market participants still see Bitcoin as a tech stock trading target. This perception makes it difficult for Bitcoin to stand out when traditional tech stocks suffer significant setbacks. Historical data also confirms this, showing a significant correlation between Bitcoin and the U.S. stock market, particularly tech stocks. When investors become doubtful about the tech industry's prospects, cryptocurrencies often become one of the first risk assets to be sold off.

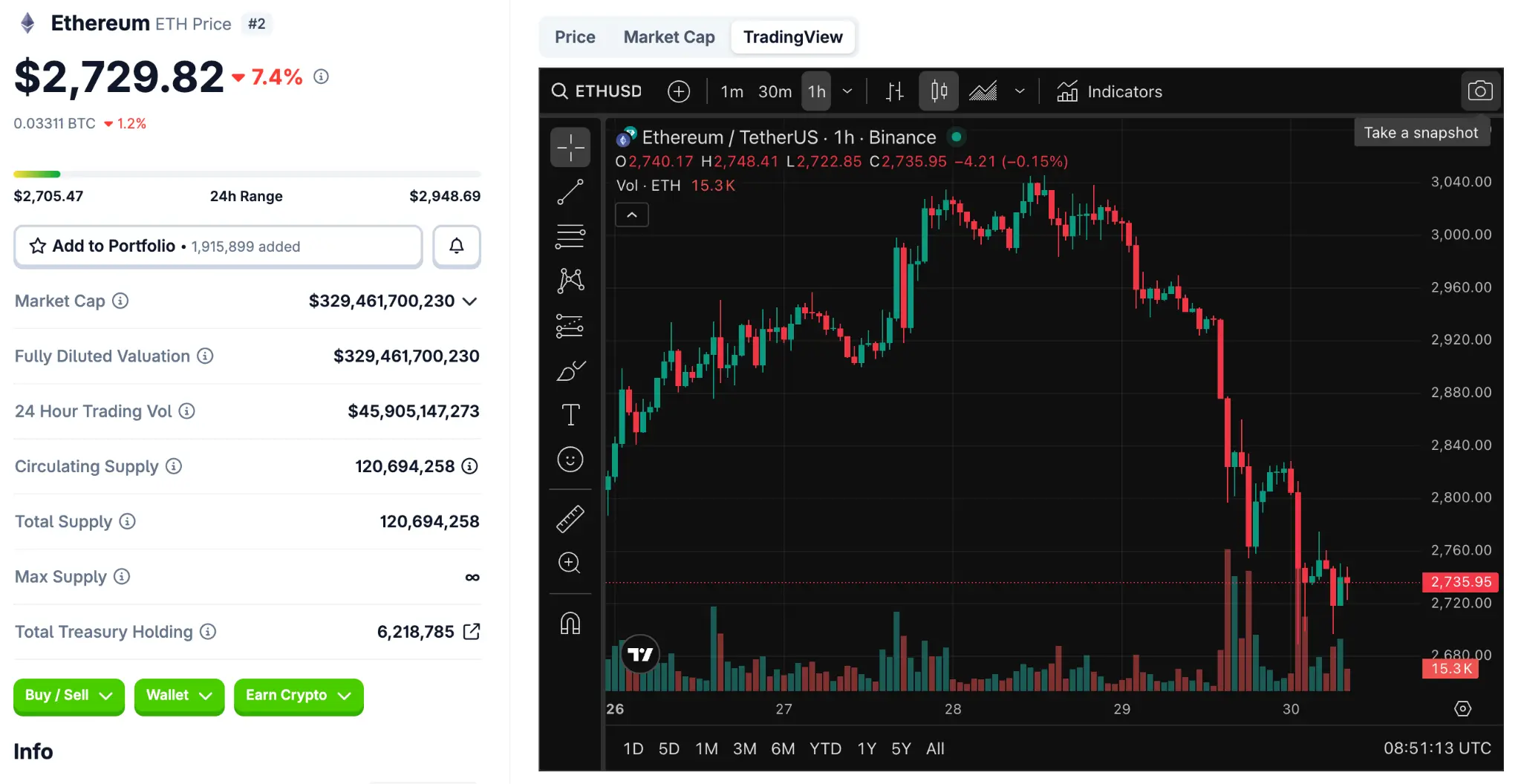

At the same time, Ethereum fell more than 7% in a single day, with trading prices dropping to around $2,729. Besides these two major cryptocurrencies, other top ten cryptocurrencies by market capitalization also generally experienced declines of 4% to 6%.

Among mainstream cryptocurrencies, popular tokens like XRP and Solana also experienced similar single-day declines. Overall, the total market capitalization of the cryptocurrency market dropped by about 5%, currently standing at $2.79 trillion.

Large-Scale Liquidation Events Create a Vicious Cycle

In addition, this sharp decline also led to large-scale leveraged liquidation events. According to CoinGlass data, over the past 24 hours, more than 200,000 traders' positions were forcibly liquidated, with a total liquidation amount exceeding $813 million. Among these, long positions accounted for the vast majority of the liquidation volume, reaching nearly $700 million, indicating that there were a large number of bullish bets in the market before the price drop.

DLNews data shows that positions betting on Bitcoin's price increase saw $313.7 million liquidated on that day, while another $327 million in Bitcoin-related positions were wiped out in the past 24 hours. Ethereum followed closely behind, with liquidation amounts reaching $134 million.

Such large-scale liquidation events often create a vicious cycle.

When prices begin to fall, the forced liquidation of leveraged positions further intensifies selling pressure, pushing prices down further and triggering more liquidations. This avalanche effect is particularly evident in a market environment with insufficient liquidity, leading to a decline in prices that far exceeds market expectations.

Unstable Situation in the Middle East, Multiple Macro Risk Factors Emerge

In addition to the drag from tech stocks, multiple macro risk factors are also simultaneously exerting pressure on the market. The tension between the U.S. and Iran has resurfaced. According to Reuters, U.S. Secretary of Defense Pete Hegseth stated today that regardless of what President Trump decides regarding Iran, U.S. forces will be ready to execute missions to ensure that Tehran does not develop nuclear capabilities, stating, "They should not seek nuclear capabilities. Regardless of what the President expects from the Department of Defense, we will be ready to accomplish the mission."

Some U.S. officials have also revealed that Trump is evaluating various options but has not yet decided whether to take military action against Iran. However, Trump has repeatedly warned that if Tehran resumes its nuclear program, the U.S. will take action.

At the same time, the risk of a government shutdown in the U.S. has also been factored into market pricing. Due to ongoing deadlock in negotiations before a critical deadline, if a last-minute agreement is not reached, several federal agencies may face operational disruptions, delayed payments, and reduced fiscal clarity in the near term. Historical data shows that during the last three government shutdowns, Bitcoin prices experienced significant declines, with the highest drop reaching 16%.

Weak Structure of the Cryptocurrency Market, Deeper Downturns and Difficult Rebounds

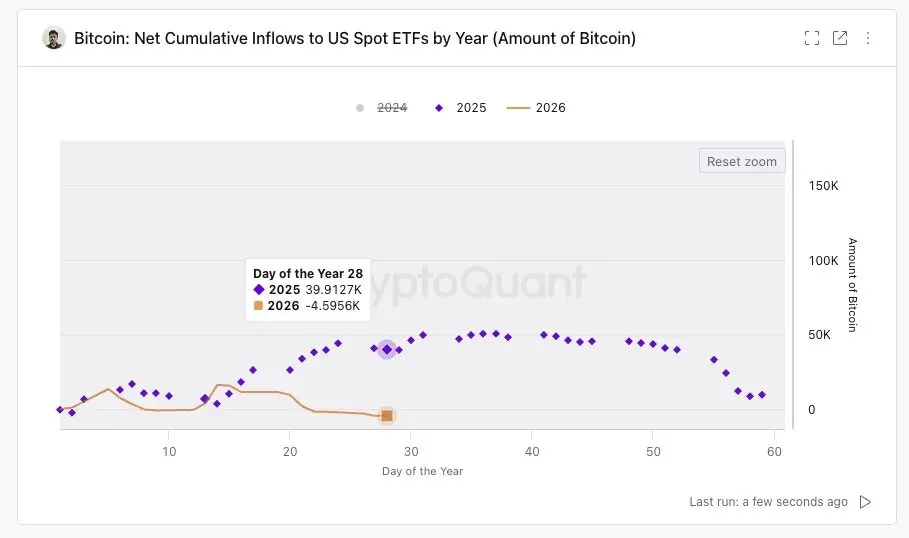

Finally, the inherent fragility of the cryptocurrency market structure should be considered the most important factor in the downward trend. The U.S. spot Bitcoin ETF has net sold about 4,600 Bitcoins so far this year, compared to a net inflow of nearly 40,000 Bitcoins during the same period last year. ETFs were supposed to be the most stable source of buying in this cycle, but now this support has disappeared, causing rebounds to lose momentum and declines to become more severe due to a lack of support.

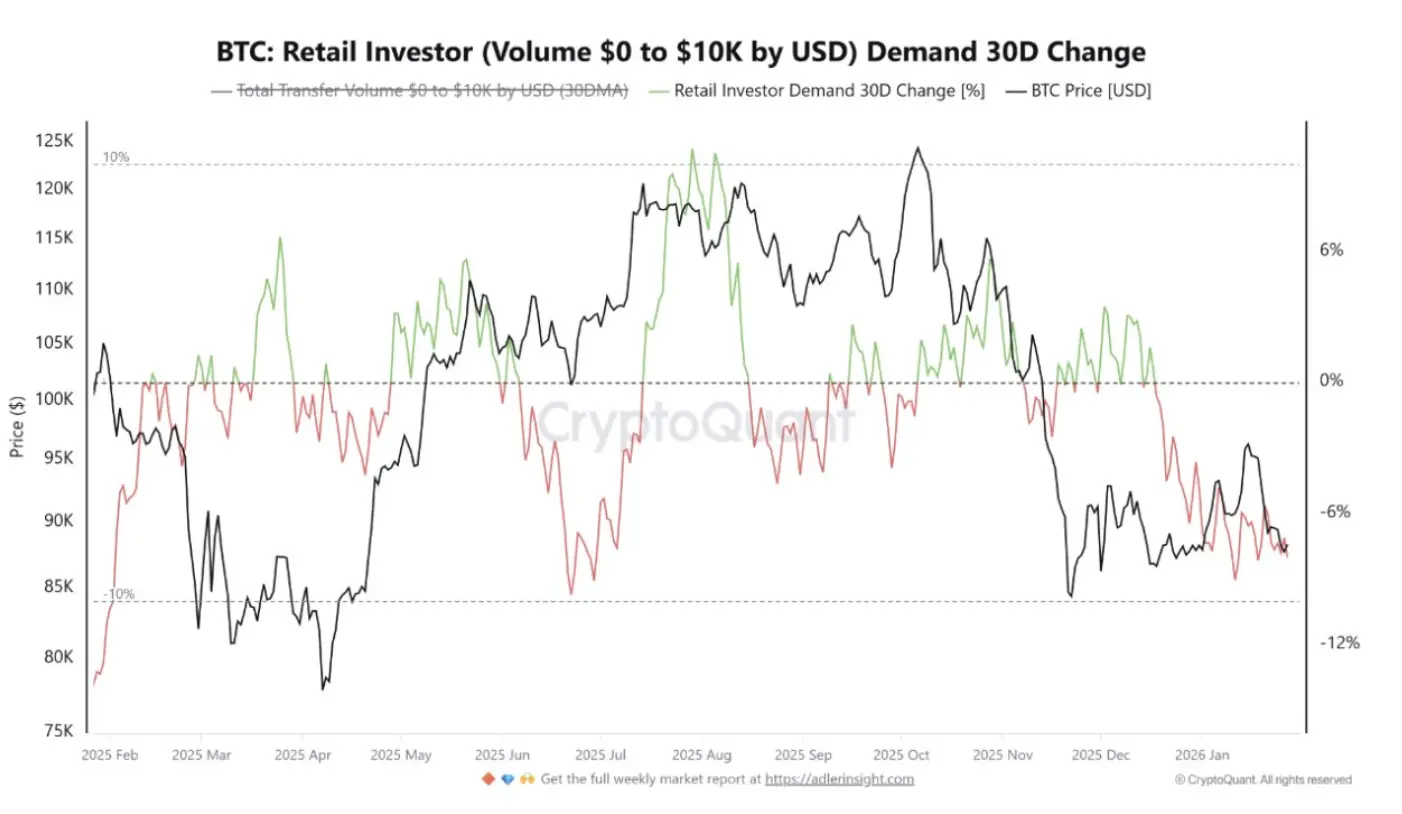

At the same time, retail investors are also withdrawing. On-chain data shows that small transactions of $0 to $10,000 have sharply declined over the past month, with not only buying slowing down but also a significant decrease in the number of participants. When ETF buying disappears and retail investors exit, the market is left with only short-term traders and leveraged speculators, inevitably amplifying volatility.

The Cryptocurrency Market is Maturing, but the Market Structure Remains Fragile

Additionally, according to Beincrypto, most holders are still in profit. The Bitcoin loss supply indicator is historically low, meaning that a large number of coins have not yet experienced real pain, which often indicates that Bitcoin may decline further rather than having reached a bottom. "Only when prices continue to decline and more holders turn to losses will panic selling truly begin."

However, according to Pantera Capital's outlook for this year's market, from a historical cycle perspective, the current duration of the decline in non-Bitcoin tokens has equaled that of the bear markets in 2018 and 2022 (about 12-14 months), and market sentiment has compressed to near capitulation levels, which may indicate that we are approaching a cyclical bottom.

Although the cryptocurrency market has been maturing, it still cannot withstand the accumulation of multiple negative factors. It can be said that the sell-off in U.S. stocks, the U.S.-Iran tensions, and the potential government shutdown have acted as catalysts for this sharp decline, but the liquidity exhaustion caused by ETF outflows and reduced retail demand points to an already fragile market structure.

If subsequent tech stock earnings reports fail to convey strong confidence, or if geopolitical tensions worsen further, Bitcoin and the cryptocurrency market may need to face deeper adjustments to regroup.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。