Author: YettaS, Partner at Primitive Ventures

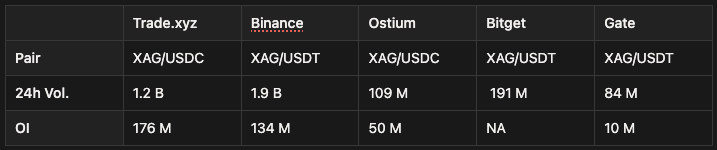

As gold and silver continue to reach new highs, with Trade.xyz daily trading volume approaching $2 billion, and Binance almost effortlessly launching TSLA perpetual contracts, the trend has become hard to ignore: traditional financial assets are becoming a new entry point for the crypto market to absorb global liquidity.

Just a year ago, most CEX operators probably could not accept the fact that an on-chain trading venue could leverage TradFi assets as a wedge to begin directly eroding and reshaping the core territory of centralized exchanges.

We all know that crypto funds inherently prefer volatility; from a product structure perspective, equity perpetual contracts happen to be at the intersection of several key upgrades, which is the fundamental reason for their emergence in this cycle:

With CBOE / CME gradually accepting crypto in-kind margin this year, the liquidity and availability of crypto assets as collateral will significantly increase.

Once DTCC establishes a direct on-chain connection, the settlement layer will begin to penetrate on-chain, providing stock assets with a native on-chain settlement channel from the source.

The truly interesting part follows: tokenized stocks as collateral → perpetual contract exchanges accepting them → institutions beginning to systematically engage in basis farming.

Onshore Issuance, Offshore Distribution

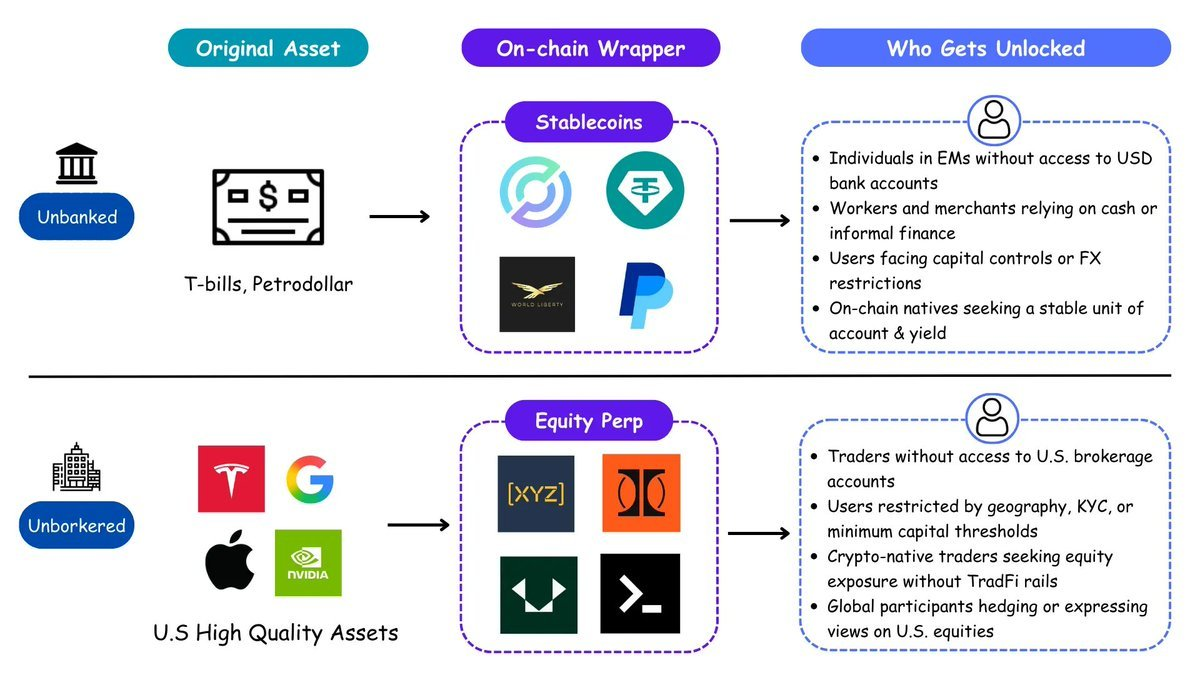

The U.S. exports finance not by exporting financial institutions themselves, but by exporting "access." The petrodollar system distributes dollars globally, transferring inflationary pressure; stablecoins replicate this logic by wholesale U.S. Treasury bonds, turning the entire world into new dollar holders without the need for banks or brokers. On-chain stocks are the next step in this logic. From unbanked to unbrokered, dollar assets will once again complete a global dumping.

CEX recognized the opportunity and potential threat early on, thus choosing to expand first. Ondo and xStocks focused on the issuance side—connecting with brokers, custodizing real stocks, and minting 1:1 tokenized stocks across multiple chains—but it has proven that issuance alone does not automatically create a market.

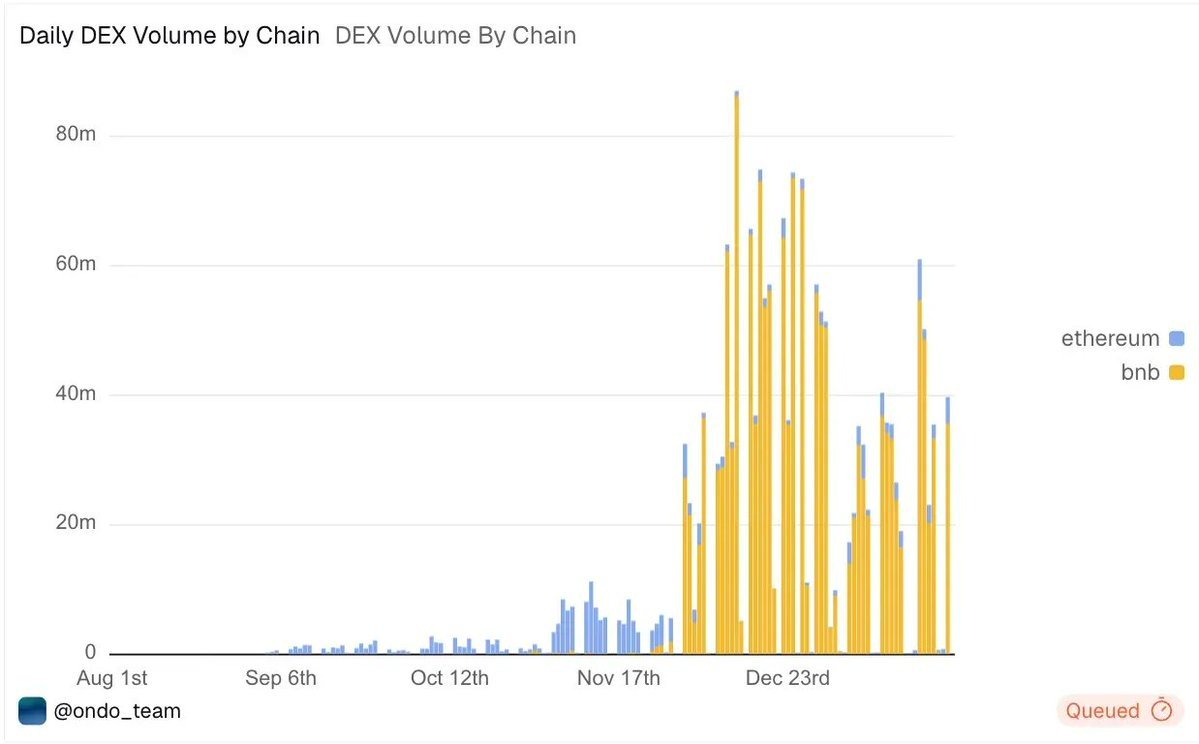

The first wave of real demand comes from traders who cannot access the U.S. broker system and crypto-native users who wish to gain exposure to U.S. stocks without relying on TradFi infrastructure. The issuers completed the heaviest compliance and custody work, but the funds flowed to the side that truly captured trading attention and distribution capability. Offshore platforms embedded products directly into trading interfaces, naturally accumulating trading volume. Ultimately, we see that the vast majority of tokenized stock trading volume is concentrated on BNB Chain, accounting for over 80%.

If offshore spot trading unlocked retail demand, on-chain equity perpetual contracts further attracted the flow of professional traders. These users are global trading participants who wish to trade or hedge U.S. stocks without being constrained by broker access, trading hours, or jurisdictional limitations.

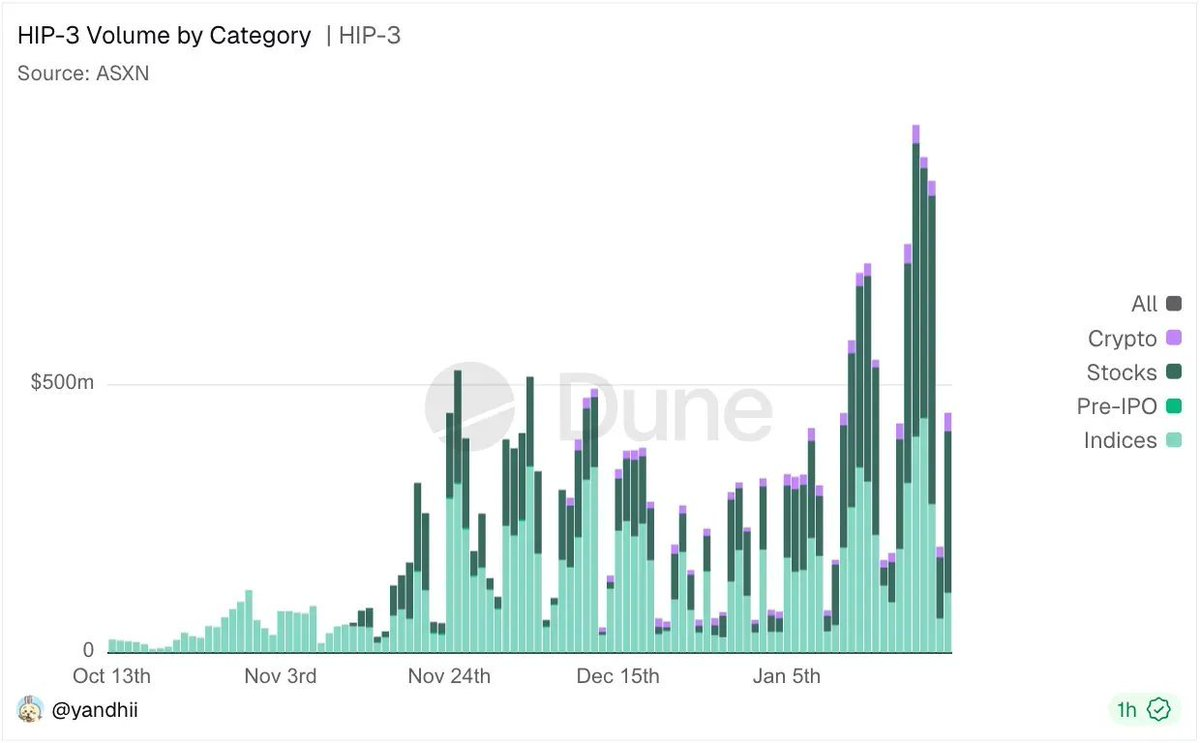

Taking HIP-3 as an example, it provides professional traders with a trading interface that can systematically engage in basis trading, capture cross-market discrepancies, while covering stocks, crypto assets, and indices. Under the potential overlay of airdrop incentives, trading volume continues to hit new highs.

The Golden Window for On-Chain Stock Perpetuals

Once a spot anchor exists, perpetual contracts almost always become the most efficient trading tool, and the reasons remain straightforward:

24/7 trading, unrestricted by market hours

Cross-margining with all assets, extremely high capital efficiency

High leverage allows for the release of true risk appetite

Can be integrated into DeFi strategies

Provides a clear margin path for RWA / tokenized assets

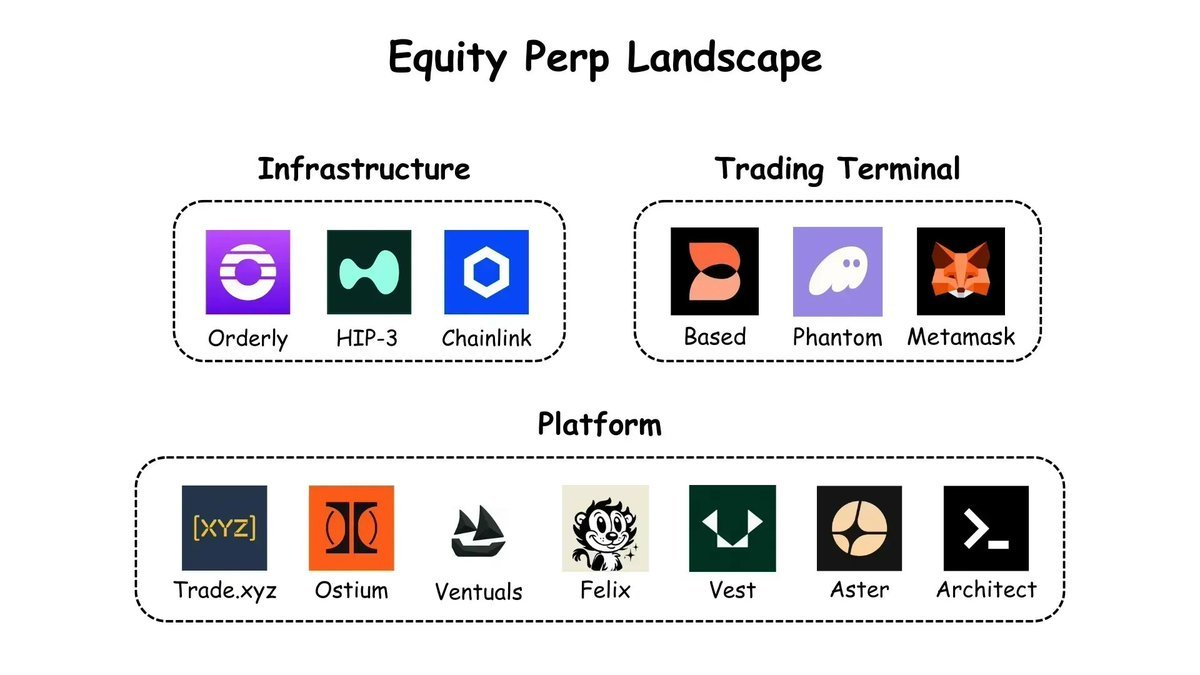

The entire tech stack is rapidly taking shape:

Infrastructure

HIP-3 / HyperCore: High-performance order book engine supporting any perpetual market

Orderly: Unified cross-chain order book, anyone can launch perpetuals without code

Chainlink: Stock price oracle (core data layer)

Platforms

Trade.xyz: Currently the largest equity perpetual DEX based on HIP-3

Ostium: FX / commodities / stocks, leaning towards CFD structure

Ventuals: Pre-IPO market (HIP-3)

Felix / Vest / Aster / Architect: Each focuses on settlement, coverage, and distribution

Terminals

Based: A multi-asset interface aggregating Hyperliquid, HIP-3, and prediction markets

Phantom / Metamask-like frontends: Converting wallet traffic into trading actions

Looking ahead, the focus is shifting from "tokenization" to "velocity of money," where true on-chain GDP will be generated. Ultimately, the winners will not just be those who can mint on-chain packaged assets, but those who can transform any asset into usable collateral at scale, providing the deepest liquidity and the cleanest matching/risk control engines in trading venues.

The future can be imagined as a globally unified "margin network": Bitcoin, U.S. stocks, gold, and U.S. Treasuries are no longer locked in their respective systems but can be used as collateral like building blocks at any time; perpetual contracts become the most universal risk expression tool; stablecoins play the role of cash; various trading and arbitrage strategies operate automatically on-chain 24/7, continuously combining. Assets are no longer "held," but are continuously called upon.

Racing Against Time

The window has opened, but time is limited for on-chain equity perpetuals. The biggest threat is not demand, but the formal release of onshore products. History has repeatedly proven that once regulators give the nod, distribution will quickly flow back to the existing broker system, with 0DTE options being the most direct example: after approval, they were rapidly absorbed and dominated by Robinhood.

More importantly, the countdown has already begun. The SEC and CFTC are systematically studying perpetual derivatives and their market structure and risks, which usually means that regulatory boundaries are being actively delineated. Meanwhile,

Bitnomial has become the first CFTC-compliant perpetual

Coinbase has also launched a 5-year futures contract with a funding mechanism, which is almost indistinguishable from perpetuals.

The reason offshore and on-chain players can still lead is simply that the products have not yet been standardized. Once the rules are formed, the advantages will quickly disappear. The real opportunity lies not with those waiting for certainty, but with those who quickly lock in users and liquidity while the window is still open, shaping the rules in collaboration with regulators as they run. Time is not a background variable; it is the core constraint that determines victory or defeat, and the countdown has already begun.

Just as Tether leveraged crypto's distribution capabilities to quietly push the dollar globally, today's on-chain economy is essentially doing the same thing—utilizing the liquidity and trading tools of the crypto market to deliver U.S. stocks and American assets in a higher frequency, higher leverage, and higher liquidity form to a broader range of participants. On-chain is not in opposition to off-chain; rather, it is rewriting the operational methods of the existing system with faster speed and stronger capital efficiency. The true watershed lies in whether one can timely capture this mechanism and complete the understanding and layout of the new continent on-chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。