Original: Deep Tide TechFlow

On January 28, Ethereum officially announced that the ERC-8004 protocol is about to go live on the mainnet.

This standard was mentioned in our article last October. If you are completely unfamiliar, you can refer to it here: “x402 Gradually Involves, Preemptively Exploring New Asset Opportunities in ERC-8004”

In fact, it has a formal name called "Trustless Agents." In simpler terms, it means:

Issuing on-chain IDs for AI Agents.

The Ethereum Foundation rarely pushes an ERC standard this hard. They specifically established a team called dAI, included ERC-8004 in the 2026 strategic roadmap, collaborated with Google, Coinbase, and MetaMask to draft it, and even held a Trustless Agents Day at DevConnect in November to create momentum.

The last time Ethereum pushed a standard this seriously was for ERC-20 and ERC-721.

One defined tokens, and the other defined NFTs.

Now it's AI's turn?

Ethereum's AI Anxiety

Why the urgency?

Look at a set of data. According to statistics from Cookie.fun, the market value distribution of AI Agent tokens shows that Solana and Base combined account for 96%. There are only a handful of AI Agent projects on the Ethereum mainnet that are well-known.

There are only a handful of AI Agent projects on the Ethereum mainnet that are well-known.

In April 2025, the exchange rate of ETH to BTC dropped to 0.017, a five-year low. At that time, everyone said Ethereum was not the future.

When DeFi was hot, Ethereum was the main stage. When NFTs were hot, Ethereum was also the main stage. Now that AI Agents are heating up, the main stage has changed.

Solana processes 36 million transactions a day, while Ethereum's mainnet handles 1.13 million. High gas fees and slow speeds have led developers to vote with their feet. Virtuals Protocol launched on Base, while the previous ai16z chose Solana, and even Coinbase's own AI project was not placed on the Ethereum mainnet.

Ethereum needs a new story.

ERC-8004 might just be the beginning of that story.

Reviewing ERC-8004

Back to the standard itself.

How exactly does ERC-8004 issue on-chain IDs for AI Agents?

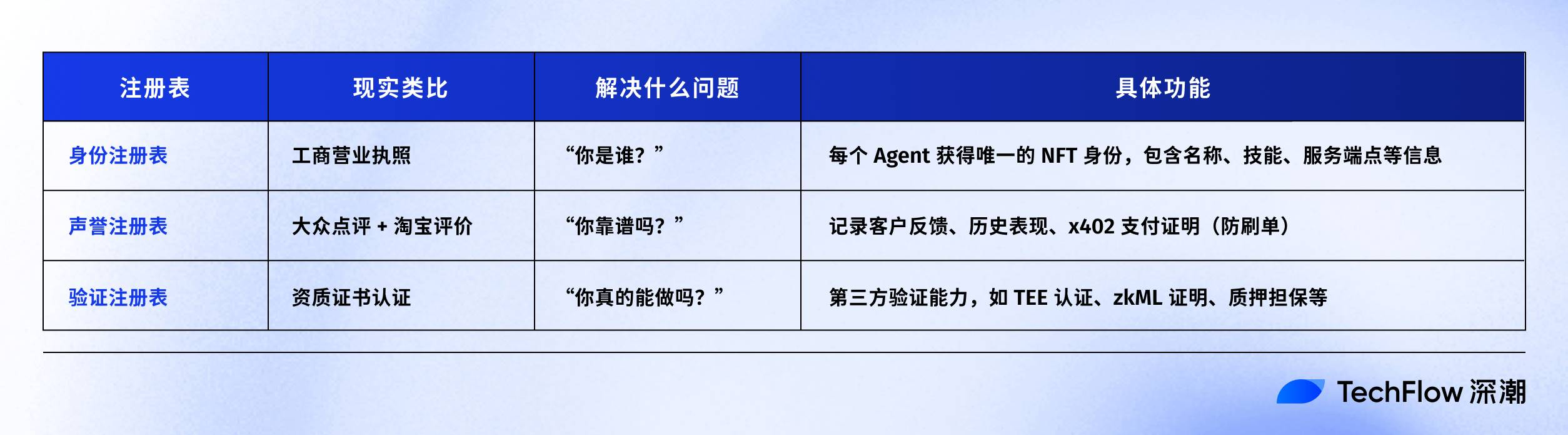

You don’t need to understand any technology; you just need to know about three registries.

The first is the Identity Registry. Based on ERC-721, each AI Agent mints an NFT to prove "I am who I am."

The second is the Reputation Registry. It records the historical performance of the Agent, who has used it, how it was rated, and whether it has done anything bad.

The third is the Verification Registry. It allows third-party organizations to endorse the Agent, for example, "This Agent has passed a certain security audit."

Together, these three registries solve one problem: when two AI Agents meet on-chain, how do they know if the other is reliable?

The previous answer was that there was no way to know; it relied on humans. The answer from ERC-8004 is to check the on-chain records.

This system was not invented by Ethereum itself.

Its underlying logic comes from Google's A2A protocol released last year, Agent-to-Agent, which allows AI to communicate and call each other. ERC-8004 adds a layer on top of this:

Trust backed by blockchain.

Google's A2A solves communication issues, while Ethereum's ERC-8004 solves trust issues. One handles communication, and the other verifies identity.

Is issuing IDs a good business?

Let’s boldly speculate that Ethereum's logic might be like this:

For AI Agents to be truly useful, they need to manage money themselves. It’s not about tweeting or chatting; it’s about directly operating on-chain assets. Signing transactions, adjusting contracts, cross-protocol arbitrage…

No one dares to do this on a large scale right now. The reason is simple: how do you know this Agent won’t transfer your money away? Recently popular ClawdBot has already had community members post related negative incidents.

The Web2 solution is platform endorsement. You use OpenAI's API, and trust comes from OpenAI. If something goes wrong, you go to OpenAI.

Web3 doesn’t have this. Agents are open-source, deployment is permissionless, and no one manages them on-chain. When you call a service from a stranger Agent, you can’t check who is behind it, whether the code has issues, or if there’s a history of wrongdoing… all of this is untraceable.

In simple terms, ERC-8004 essentially moves the traditional financial KYC process on-chain. Ethereum bets that when AI Agents start dealing with real money, this system will become a necessity.

DeFi protocols need to check the on-chain identity of external Agents before integrating. Institutions need to check an Agent's historical records before using it for trade execution. Audit firms can issue on-chain certifications for Agents, just like conducting security audits for smart contracts.

This is a competitive positioning move.

Ethereum knows it has already lost in the execution layer, but no one has occupied the trust layer yet. Institutional recognition, security audit ecosystems, and TVL scale are existing assets for Ethereum. ERC-8004 packages these assets into a standard, defining "what compliance looks like for AI Agents" before others.

The question is, does this demand exist now?

Standards Before Demand

Having discussed Ethereum's strategy, let’s talk about reality. What are on-chain AI Agents doing now?

With the wave of AI memes from last year winding down, and the rapid advancements of several leading AI companies in AI products over the past year or two, not many people are paying attention to on-chain AI Agents anymore.

However, they are still making progress.

For example, ai16z has rebranded to ElizaOS, transforming from a single Agent into a cross-chain platform; Virtuals Protocol is working on AI DAPPs, planning to enter physical robotics by 2026; and other AI Agents in Surf can automatically execute DeFi trading strategies.

But here’s the problem: do they really need ERC-8004?

Luna's users trust Luna because it is developed by the core team of Virtuals. Agents on ElizaOS are used because they run within the ElizaOS framework; Surf executes strategies for you, and often it’s because you trust the application itself.

Trust comes from the platform, not from on-chain identity.

The scenario envisioned by ERC-8004 is: a stranger Agent approaches you, with no platform endorsement and no brand recognition, and you can only judge its reliability through on-chain records.

When will this scenario occur?

When AI Agents truly achieve autonomous calls across protocols, platforms, and organizational boundaries. An Agent borrows money from Aave, trades on Uniswap, and then goes to another protocol for yield, all without human approval…

But this scenario does not exist now.

Currently, even the most complex AI Agents operate within a single platform. They do not need to prove themselves to unfamiliar protocols because they do not knock on unfamiliar protocol doors.

Given the current heat of the crypto market, they have no reason to knock on each other’s doors unless they can collectively create a new narrative.

Thus, ERC-8004 addresses a future problem.

If AI Agents transition from toys to tools, Ethereum's trust infrastructure will have value. If the scale of the Agent economy is large enough and cross-platform calls become the norm, ERC-8004 can collect tolls.

There are many "ifs."

Therefore, this future-oriented layout may be first acted upon by institutions.

By the end of 2025, SharpLink Gaming announced it would invest $170 million into Ethereum's re-staking strategy. During the same period, net outflows of ETH from exchanges exceeded 23,000, flowing into private wallets and staking protocols.

This money may be buying Ethereum for 12 to 18 months down the line.

For retail investors, ERC-8004 is not a very good catalyst.

Betting on ERC-8004 itself? It is an open standard, has no tokens, cannot be directly invested in, and can only find some related small projects. Betting on Ethereum is also possible, but Ethereum's price is influenced by too many factors, and AI Agents are just one narrative among them.

Therefore, there is currently no clean target that allows you to accurately bet on the proposition "AI Agents need on-chain identity."

Ethereum is not entirely the infrastructure for AI, and Ethereum's identity anxiety will not be completely alleviated by AI. The business of creating AI IDs still has a long way to go.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。