Author: Nancy, PANews

"There are so many good assets in the world, Bitcoin is no longer that sexy."

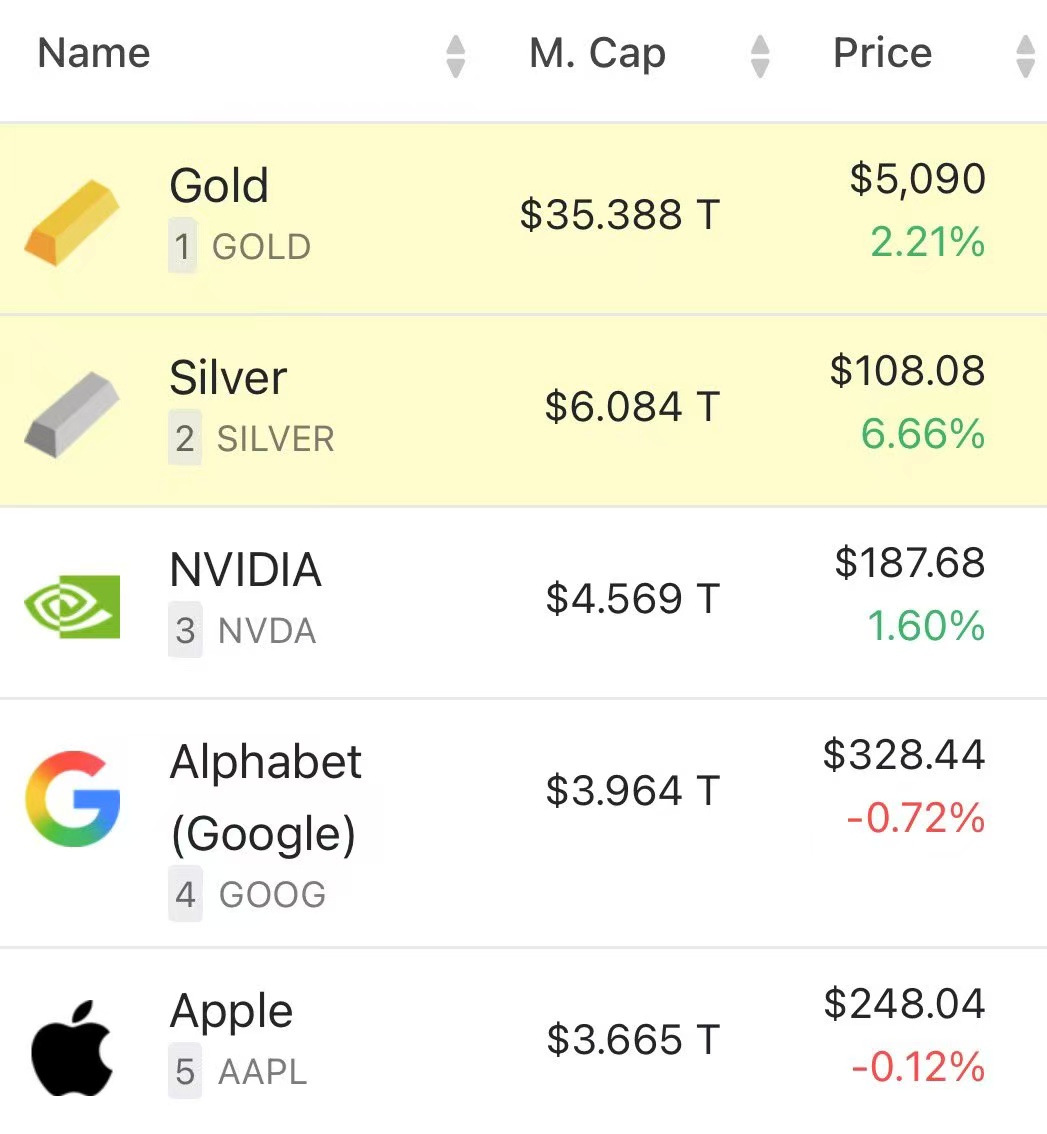

As gold breaks through $5,000 and enters a historic bullish trend, Bitcoin remains dormant, sparking a "debate" about Bitcoin within the crypto community. People can't help but ask, can its "digital gold" story continue?

Recently, crypto KOL @BTCdayu shared the perspective of a Bitcoin OG who has sold over 80% of his Bitcoin, bluntly stating that Bitcoin is facing a fundamental narrative shift. This viewpoint quickly sparked heated discussions within the community.

New Operators, New Pricing Logic

In the first half, Bitcoin was in the golden age of cognitive monetization, with the stage primarily belonging to a few early hoarders and infrastructure builders.

However, entering the second half, the game rules have fundamentally changed. With the approval of Bitcoin spot ETFs, large-scale allocations by companies like Strategy, and the U.S. government incorporating Bitcoin into its national strategic vision, Bitcoin has been forced to don the "formal attire" tailored by Wall Street.

In this cycle, Bitcoin has quietly completed a large-scale chip turnover, with early hoarders gradually exiting and Wall Street institutions entering en masse, transforming Bitcoin from a growth asset into a portfolio asset.

This means that the pricing power of Bitcoin has shifted from the offshore wild west to the onshore financial system dominated by the dollar. From trading channels and liquidity to regulatory frameworks, Bitcoin is aligning more closely with high-volatility, high-beta dollar risk assets.

Solv Protocol co-founder and CEO Meng Yan bluntly stated that the world has now entered an era of imperial competition, and the most important question is who wins and who loses. The purpose of U.S. regulation is not only to dollarize crypto assets but also to turn Crypto and RWA (real-world assets) into tools for the continued expansion of dollar hegemony in the digital age. If Bitcoin is just another mediocre dollar asset, then its prospects are indeed concerning. However, if crypto becomes the nuclear weapon system of the dollar digital economy, then BTC, as the nuclear-powered aircraft carrier within it, still has a promising future. For the U.S., the main issue now is that the level of control over Bitcoin is not high enough.

In the view of crypto KOL @Joshua.D, although Bitcoin has become a "dollar asset" highly correlated with U.S. stocks, its impact on price is more supportive than suppressive, with the interests behind it being ETFs, listed companies, and even national strategies. This "institutionalization" has actually added a layer of downside protection to Bitcoin, effectively raising the price floor.

However, while the entry of mainstream players has expanded the capital pool through compliant channels, Bitcoin is currently caught in an awkward asset positioning dilemma.

Some viewpoints suggest that if one is optimistic about the dollar system, buying U.S. stocks, U.S. Treasuries, or tech giant stocks not only offers better liquidity but also has real cash flow and higher certainty. In contrast, Bitcoin at this moment resembles a high-risk tech stock without cash flow, raising doubts about its cost-effectiveness; if one is bearish on the dollar system, logically, one should seek assets negatively correlated with the dollar. The Bitcoin that has been "transformed" by mainstream institutions is highly correlated with U.S. stocks, and when dollar liquidity contracts, it often collapses before U.S. stocks rather than hedging against risk.

In other words, Bitcoin is caught between safe haven and risk, neither acting as a safe haven like gold nor growing like tech stocks. Some even trace back data to argue that Bitcoin's current attributes are 70% tech stock + 30% gold.

This new identity is also beginning to affect Bitcoin's neutrality premium in geopolitics.

Against the backdrop of escalating global geopolitical risks and uncontrolled U.S. debt deficits, non-U.S. camps are accelerating their de-dollarization efforts. Gold, with thousands of years of credit accumulation and political neutrality, has returned to the center stage, with prices hitting new highs. In the eyes of non-U.S. countries, Bitcoin is no longer a borderless currency but a dollar derivative influenced by Wall Street's pricing power.

As a result, we see traditional hard currencies like gold returning to the center stage, while Bitcoin is mired in a prolonged sideways movement and tedious fluctuations, continuously eroding investors' holding confidence.

Even so, in the view of crypto KOL @Pickle Cat, there are a thousand Hamlets for a thousand people; crypto punks are the core demand for Bitcoin, which has been weakened due to "mainstreaming and traditional financialization." Where there is weakness, there will be strength. It's like democracy; its allure lies in its self-repairing mechanism, but the premise of repair is often that the system has touched some extreme state, prompting the public to truly realize it.

The Great Migration of Hash Power: Bitcoin Miners' "Defection"

In addition to the narrative shake-up on the demand side, changes on the supply side have also intensified market pessimism. As an important player in the Bitcoin network, miners are undergoing a capital migration of "abandoning Bitcoin for AI."

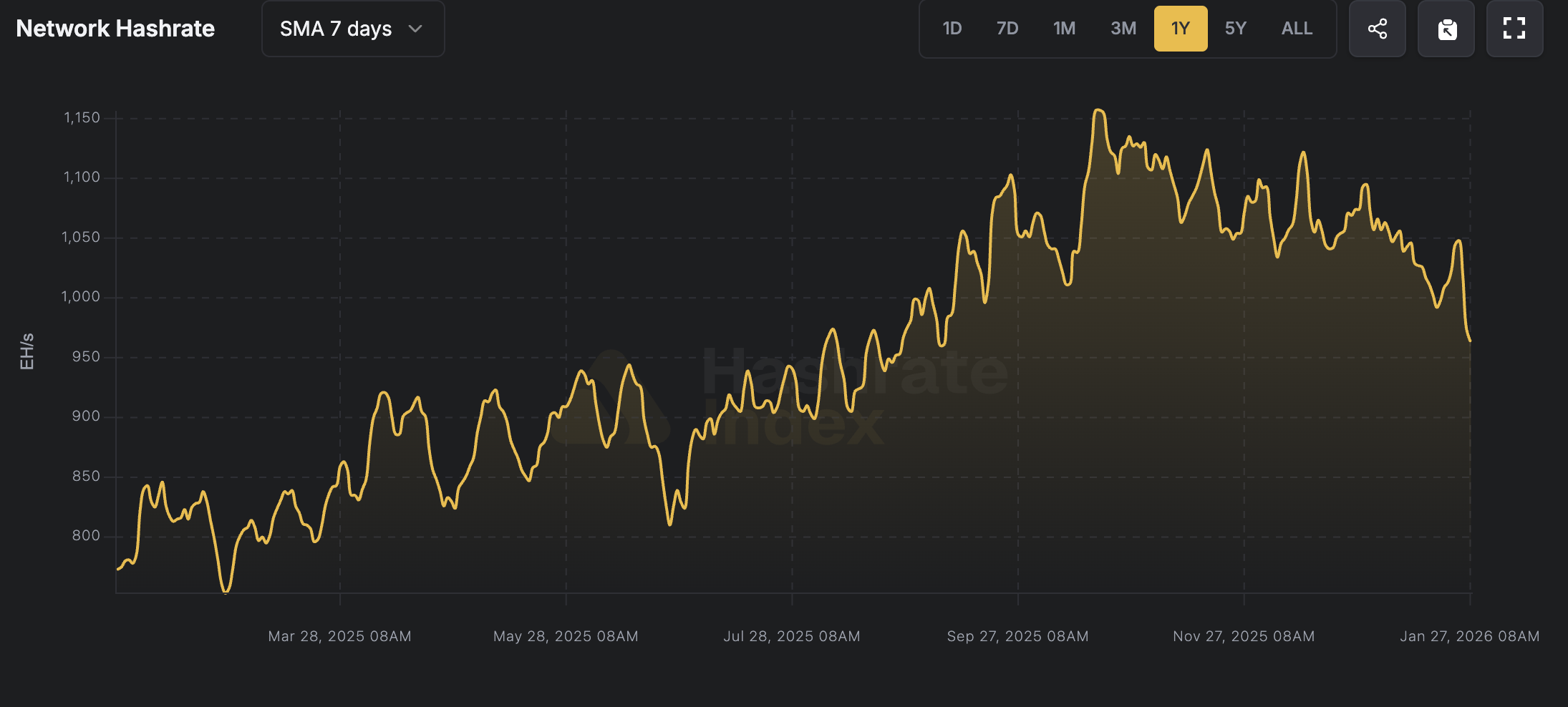

According to the latest data from Hashrate Index, the 7-day moving average of Bitcoin's total network hash rate has dropped to 993 EH/s, nearly a 15% decline from last October's historical high. Meanwhile, analysts at JPMorgan have pointed out that by December 2025, Bitcoin miners' daily block reward income per EH/s will fall to $38,700, marking a historical low.

The direct reason for the decline in hash power is the ongoing deterioration of the Bitcoin mining economy. The halving cycle has halved block rewards, combined with historically high mining difficulty, leading many mining machines to approach or even fall below the shutdown price. Miners' profit margins have been severely squeezed, with some forced to shut down to stop losses, while others are selling Bitcoin to alleviate cash flow pressures.

A deeper crisis lies in the fact that hash power has become the "oil" of the new era, changing the flow of hash power.

For many mining companies, compared to the highly cyclical, volatile, and unstable profit model of Bitcoin mining, AI data centers have long-term predictable demand and higher returns. More importantly, the large-scale power infrastructure, site resources, and operational experience they have accumulated over the long term are precisely the most scarce resources for AI computing clusters, making the transition more feasible.

As a result, Bitcoin mining companies like Core Scientific, Hut 8, Bitfarms, HIVE, TeraWulf, and Cipher Miner have collectively "defected." According to CoinShares' predictions, by the end of 2026, the proportion of mining revenue for these companies may drop from 85% to below 20%, shifting to reliance on AI infrastructure.

However, this transition is extremely costly. On one hand, traditional mining sites need to be upgraded to AI data centers, requiring large-scale infrastructure renovations at high costs; on the other hand, the prices of high-performance GPU servers remain high, and forming a large-scale hash power cluster requires significant upfront capital investment.

For mining companies in urgent need of transformation, Bitcoin, being the most liquid asset they hold, naturally becomes the most direct and efficient financing tool, leading them to continuously sell Bitcoin in the secondary market. This ongoing supply-side selling not only suppresses the coin price but further compresses the profit margins of remaining miners, forcing more to shut down or transition.

This "defection" of selling coins to buy shovels has, to some extent, drained liquidity and undermined market confidence.

However, Meng Yan pointed out that the transition of Bitcoin miners to AI computing infrastructure is actually a false proposition, more of a story fabricated by publicly listed mining companies to stabilize their stock prices amid shrinking profits. Aside from the reusability of electricity, there is almost no overlap between the hardware, network architecture, operational skills, and software ecosystem of the two, and they do not have any additional advantages compared to specialized AI data centers.

Joshua.D further pointed out that the main Bitcoin mining machines are ASIC miners, which can only mine; the only things that can transition are the sites and power facilities. Therefore, the decline in hash power is more about the survival of the fittest within the industry. Historical data shows that a decline in hash power often indicates the market is "popping bubbles," reducing future selling pressure rather than being a trigger for a crash. As long as the Bitcoin network can still produce blocks normally, fluctuations in hash power are simply market adjustment behaviors.

Folded Bitcoin: Standing at the Crossroads of New and Old Cycles

Now, Bitcoin has officially entered the mainstream, not only telling the old story of "digital gold" but also writing a new script for mainstream financial assets.

Bitcoin is shedding its purely speculative exterior and evolving into a reservoir of global liquidity, with mainstream acceptance opening the floodgates for compliant capital. This financialization access significantly enhances Bitcoin's survival capability and vulnerability.

Beyond the spotlight of Wall Street, in countries like Nigeria, Argentina, and Turkey, where inflation is severe, the usage rate of Bitcoin is experiencing explosive growth. There, Bitcoin is not just an asset but a lifeboat against the rampant issuance of fiat currency, safeguarding family wealth. This genuine demand from the grassroots proves that it remains a shield in the hands of ordinary people.

Undoubtedly, a folded Bitcoin is presenting itself before us.

It has bid farewell to the myth of sudden wealth from the western frontier era and shed the idealistic cyberpunk colors, now displaying characteristics of a more stable, even somewhat dull mature asset.

But this is not the end of digital gold; it is a sign of its entry into maturity. Just as gold underwent a long reconstruction of value consensus before becoming a central bank reserve, today's Bitcoin may be standing at a similar historical turning point.

Looking back at Bitcoin's development history, its narrative has always been changing. From the original concept of a peer-to-peer electronic cash system in Satoshi Nakamoto's white paper, enabling small, instant payments; to being viewed as a sovereign currency against fiat inflation; to evolving into "digital gold," a tool for storing value and combating inflation; and now, with Wall Street's involvement, Bitcoin's next potential narrative may point towards sovereign national reserve assets. Of course, this process is bound to be lengthy, but it is no longer a fantasy.

However, everything has cycles, and assets are no exception. According to the asset rotation rules of the Merrill Lynch clock, the global economic needle is turning to a favorable moment for commodities. Bitcoin has risen millions of times over the past decade and is entering a brand new macro cycle; it cannot be easily dismissed for its temporary price consolidation or phase of underperformance against gold and silver.

At this crossroads of new and old cycles, whether it is the exiting OGs or the entering institutions, all are voting for the future with real money. And time will provide the final answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。