Compiled by: Ken, Chaincatcher

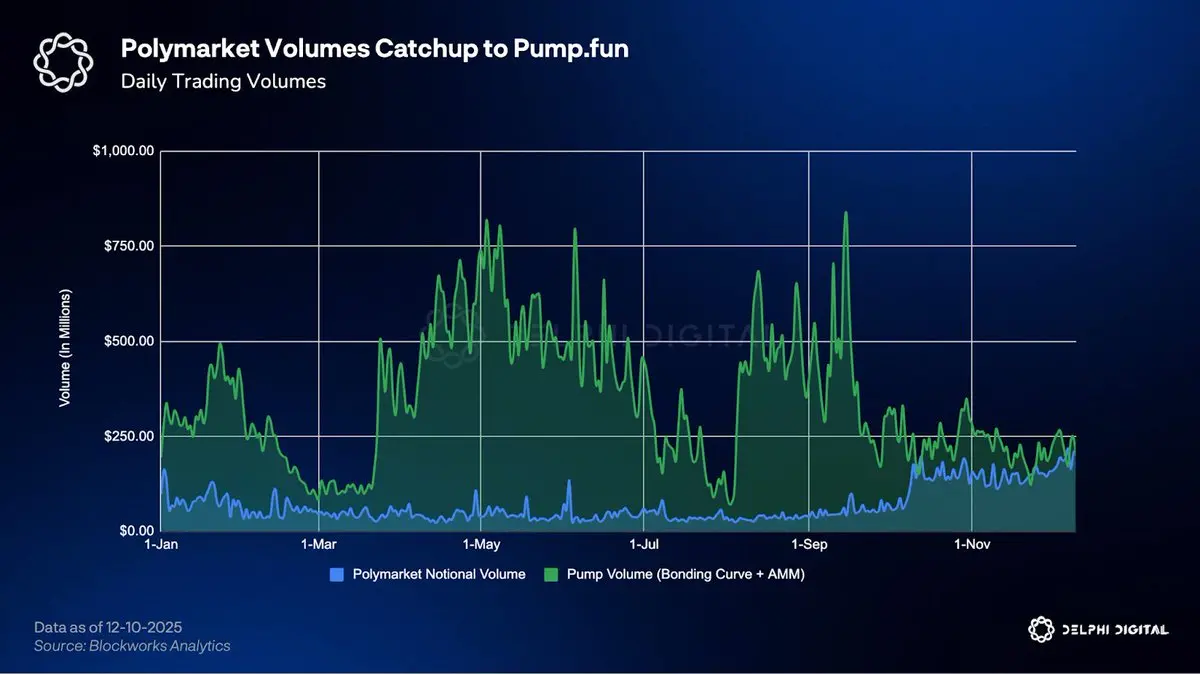

The prediction market has jumped from a niche area to a sector worth over $600 million. What are the development trends for the next phase?

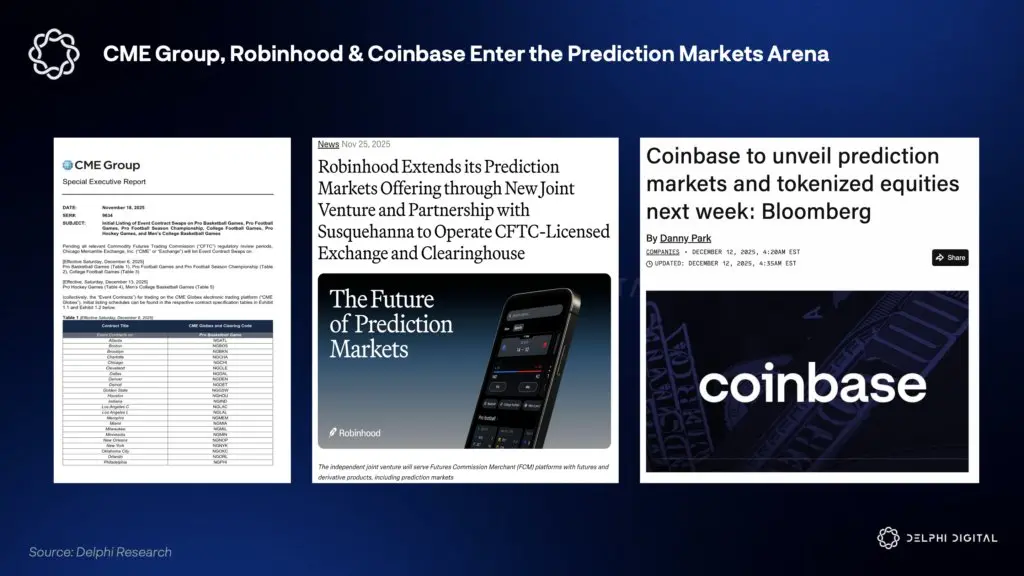

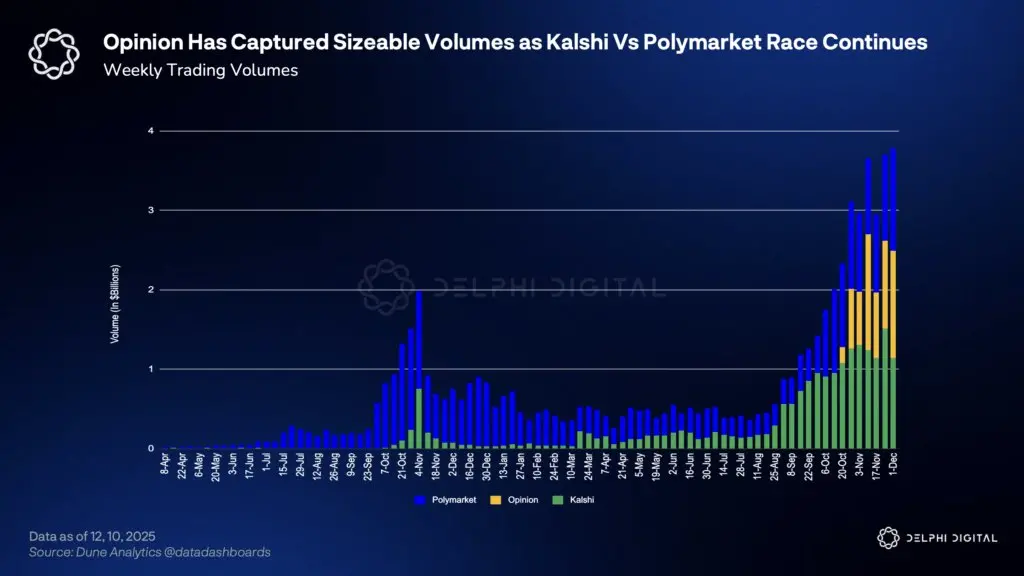

Giants are entering the market one after another: the Chicago Mercantile Exchange Group plans to launch sports markets, Coinbase is launching a prediction market, and Robinhood has acquired MIAXdx to provide an internal market, thereby reducing reliance on Kalshi. Meanwhile, Polymarket and Kalshi are competing for market share through aggressive expansion.

Polymarket's strategy: Build a crypto-native base with a CFTC-compliant framework to aggregate the largest liquidity.

Return to the U.S. market: It is about to regain approval from the U.S. Commodity Futures Trading Commission through its acquired licensed exchange and go live.

Web2 expansion: Reach new audiences through partnerships with UFC, NFL, and Yahoo Finance.

On-chain moat: Strengthen dominance through potential airdrop expectations and wallet integration, thereby improving user retention.

Kalshi's strategy: Utilize a compliance moat and order book liquidity to enter global and on-chain markets.

Global expansion: With $300 million in funding, Kalshi is expanding to 140 countries, challenging Polymarket's international advantage.

On-chain integration: Kalshi chooses not to compete directly with DeFi but to provide liquidity for Jupiter and gain additional trading volume through high-traffic on-chain hubs like Phantom.

Kingmaker Effect

Layer 1 and Layer 2 now have real economic incentives to compete for market share in prediction markets. Ecological funding programs targeting prediction market projects and the trading volume they bring are expected to emerge.

Generic prediction market platforms find it difficult to compete with existing liquidity giants. The real opportunity lies in building vertical markets tailored to specific user groups.

Prediction 1: "Perpetualization" of Options

Perpetual contracts simplify derivatives trading by eliminating expiration dates. Prediction markets can apply the same logic to options.

A market asking, "Will Bitcoin's closing price be above $150,000 on June 30?" is essentially a cash-settled binary option. There are no Greeks, no strike price chains, and no complex pricing models. Just a simple 0-100 probability that anyone can understand. By repackaging volatility into an easily understandable form through prediction markets, new demand for on-chain options will be driven.

Protocols like @Euphoria_fi are further advancing this concept by launching a "click-to-trade" interface designed to make users feel more like they are playing a game rather than operating a complex trading terminal.

Prediction 2: On-chain Native Risk Markets

Prediction markets are expected to become core infrastructure by filling the gap in native insurance. The market needs tools to hedge DeFi risk exposure. To achieve scalability, DeFi needs native, trustless ways to mitigate these risks.

Short-term (15/30-day cycle) markets like "Will stETH trade below 0.98 ETH for more than 1 hour in January?" allow users to hedge specific risks accurately.

Finding counterparties for these markets is very difficult. While LPs can earn a small amount of premiums, they face the tail risk of being wiped out. Nevertheless, platforms that can solve this problem will immediately attract those players who have locked up substantial funds in DeFi.

Prediction 3: Splitting

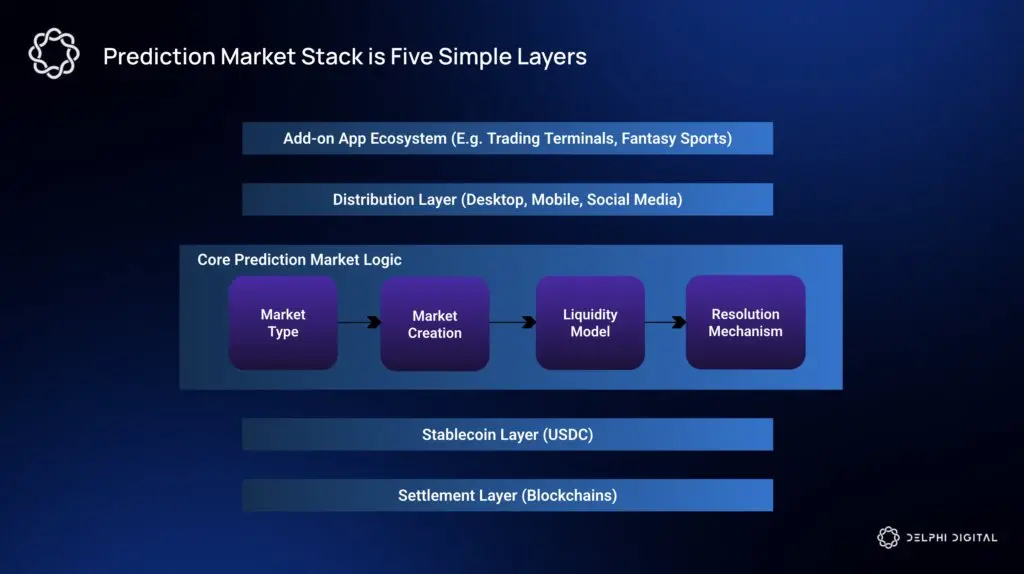

The real opportunity lies not in competing directly with Polymarket but in splitting the tech stack to serve different user types.

Professional users need tools to enhance their advantages and discover new opportunities in the ever-expanding market universe.

Aggregators: Unified dashboards for trading across multiple platforms. For example: @ConvergeMarkets, @KairosTradeX, @fireplacegg, etc.

Advanced analytics: Risk modeling, alternative data sources, and wallet tracking. Examples: @hash_dive, @Polysights.

The financial speculation market is vast, but the social entertainment market is even broader. Betting with friends is a natural human instinct. Today's interface design primarily targets traders rather than the broader mass market. An interface aimed at widespread adoption should optimize the transmission of "social signals" rather than just pursue profits.

The "super users" running these tools on a large scale may not even be human. Funds managed by AI Agents will monitor data streams in real-time, identify mispriced markets, and execute arbitrage at speeds far exceeding human capabilities. As these participants enter the market, the easily accessible arbitrage advantages in binary markets are expected to disappear.

As the simple advantages of prediction markets are arbitraged away, funds and users will shift to new mechanisms:

Impact markets: Pricing based on the consequences (impact) of outcomes rather than their likelihood of occurrence. (e.g., @lightconexyz)

Opinion markets: Markets where participants predict group sentiment rather than real-world outcomes. (e.g., @meleemarkets)

Virtual sports: Crypto-native versions (e.g., @footballdotfun) that turn player cards into tradable liquidity assets.

Future governance: Governance decisions driven by market predictions, i.e., predicting whether proposals will meet target metrics. (e.g., @MetaDAOProject)

Coordination markets: Protocols set a goal, and participants buy tokens and take actions to achieve that goal. If the goal is met, everyone can profit through returns and token appreciation. (e.g., @hyperstiti0ns)

Prediction markets are becoming more than just speculation; they are evolving into the infrastructure for options, insurance, and governance.

Recommended Reading:

RootData 2025 Web3 Industry Annual Report

The Power Shift of Binance: The Dilemma of a 300 Million User Empire

InfoFi Narrative Collapse, Kaito, Cookie, and Others Sequentially Shut Down Related Products

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。