Author: zhou, ChainCatcher

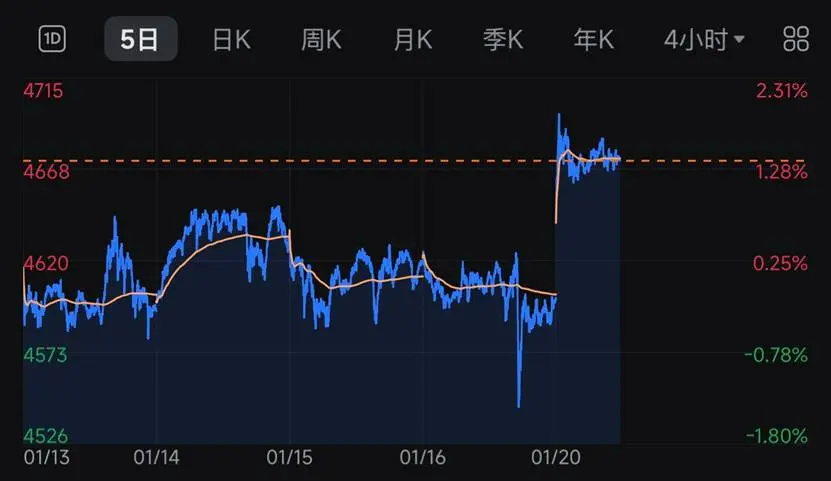

At 7 AM Beijing time on January 19, as the gold spot market opened, its price gapped up, rising about 2% to above $4,690, setting a new historical high.

Meanwhile, the cryptocurrency market faced a severe setback: Bitcoin fell below $92,000, Ethereum dropped below $3,200, and SOL fell over 6% to reach $130, nearly erasing its gains for the year.

The root cause of this cryptocurrency market crash can be attributed to the dual impact of "macroeconomic policy headwinds" and "market leverage liquidation."

EU Tariff Escalation and Uncertainty in Fed Chair Selection

First, on January 17 (Saturday), Trump announced via Truth Social that starting February 1, 2026, a 10% tariff would be imposed on all goods imported from eight European countries/regions, including Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland; if no agreement is reached on the "complete purchase of Greenland," the tariff would increase to 25% starting June 1.

This move is seen as a signal of escalating geopolitical tensions and trade wars, prompting several EU countries to urgently consider implementing counter-tariffs on U.S. goods, involving a scale of about €93 billion.

Data from Polymarket shows that a major player has bet $160,000 that the U.S. will definitely acquire Greenland this year, with the current probability at 21%.

As a result, the cryptocurrency market, as a high-risk asset, was hit hard, and European stock markets opened lower across the board. However, institutional views generally believe that while this event may temporarily heighten risk aversion, its long-term impact is limited.

Jane Free, an analyst at Rabobank, pointed out that while there is no panic in the market, strong demand for safe-haven assets may drive gold to consolidate and rise. Michael Brown from Pepperstone views this as Trump's old tactic of escalating threats followed by compromise, leading to significant short-term volatility, but with stronger bullish reasons for precious metals and buying opportunities in stocks at lower prices.

Additionally, the uncertainty surrounding the selection of the Fed chair has further negative implications. Kevin Hassett, the White House economic advisor and director of the National Economic Council, recently stated that Trump is more likely to want him to remain in his current position, which the market interpreted as Hassett essentially withdrawing from the race for the next Fed chair.

The market had originally expected the dovish Hassett to take the position, but data from Kalshi and Polymarket shows his probability has dropped to about 15%-16%, while the hawkish Kevin Warsh's probability of taking over has surged to about 60%. Previously, the two were seen as evenly matched.

Analysts say that a hawkish leadership could mean a slowdown in interest rate cuts and tighter liquidity, directly pressuring Bitcoin, which relies on a loose environment. Although Warsh has previously invested in crypto companies and served as an advisor to institutional crypto bank Anchorage, analysts believe his monetary policy stance is not as dovish as Hassett's. Aurelie Barthere, chief research analyst at Nansen, pointed out that Hassett originally had a higher level of support for the crypto market.

Long Position Liquidation and Technical Correction

Internal factors within the cryptocurrency market have also amplified its decline. Last week, Bitcoin made several attempts to break above $98,000, accumulating a large number of high-leverage long positions. Once the price fell below the key support level of $95,000, it triggered a chain reaction of stop-loss orders, accelerating Bitcoin's price drop to around $92,000.

According to Coinglass data, within the first hour of the morning's sharp decline, the total liquidation across the network reached $551 million, with long positions accounting for as much as $533 million. As of the time of writing, $815 million had been liquidated within 12 hours, with long positions making up $770 million.

CryptoQuant analyst Mignolet stated that the current market is experiencing the strongest selling premium in recent times. Since the U.S. ETF market had not yet opened when Bitcoin plummeted this morning, this selling pressure came from U.S. whales operating outside of ETFs.

At the same time, Bitcoin's price has approached the average purchase cost of short-term holders ($99,460), with the price difference narrowing to just 4%. Crypto Quant analyst Axel noted that historically, areas near cost benchmarks are often accompanied by increased volatility and become reaction zones for the market, which could either continue the trend or trigger a reversal, meaning it could either return to a premium state or face a new wave of selling pressure.

Previously, CoinKarma analyzed that when BTC approached $98,000, selling pressure was evident, with liquidity relatively balanced, suggesting that early-year bulls might consider taking profits and waiting for clearer signals to re-enter.

Ryan Lee, chief analyst at Bitget, stated that rising macro uncertainty, combined with profit-taking after significant previous gains, has led investors to adopt a more cautious strategy across various markets, including stocks, commodities, and digital assets. It is expected that Bitcoin will maintain a range-bound fluctuation in the second half of January, with support potentially forming around $85,000.

From this perspective, whether from technical indicators (such as selling pressure and liquidity) or leverage liquidation and cost pressure, the market needs a deep correction to cleanse floating capital and high leverage.

Min Jung from Presto Research also pointed out that the cryptocurrency market is relatively weak compared to other assets. Although concerns over U.S.-EU trade dominate sentiment, risk assets like the South Korean KOSPI are flat or rising. This indicates that there are significant internal weakness factors in the cryptocurrency market, with investors more inclined to allocate to other risk assets. In the context of most markets rising, crypto assets remain the underperformers.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。