Author: IOSGVenturesTeam

This is the second half of "IOSG Internal Memo (Part 1): In 2026, How Do We Bet on Mainstream Assets?"

The Gateway to Financial Inclusion: Super Apps and Tokenization

Macro tailwinds and regulatory clarity have laid the groundwork, but mass adoption requires channels. The next wave of growth in the crypto space will be driven by two complementary forces.

Big Tech Brings New Users: Big tech companies will play a crucial role in driving crypto adoption. For these companies, crypto offers a pathway to becoming super apps—a platform that integrates payments, social, and financial services. X and Meta are both exploring crypto integration. Social media companies based in the U.S. and operating in most countries worldwide are likely to become the "Trojan horse" for global stablecoin adoption. The effect will be to attract liquidity from bank balance sheets and small economies to digital dollars.

Tokenization Creates New Asset Classes: To support the growth of stablecoins, a richer variety of on-chain assets is needed. Relying solely on crypto-native funding deployment opportunities cannot sustain a tenfold growth in stablecoin scale. To balance the equation, better connections between the on-chain and off-chain worlds are required. The tokenization of traditional products (stocks, bonds, etc.) serves as this bridge. Ultimately, the issuance of on-chain native assets represents the future of finance. Institutions like Robinhood and BlackRock will play key roles in this transformation.

The World Belongs to the Younger Generation: The aforementioned forces—currency devaluation, regulatory shifts, and corporate adoption—each operate at their own pace. But there is another potentially underestimated tailwind: the intergenerational wealth transfer and the younger generation's preference for digital assets.

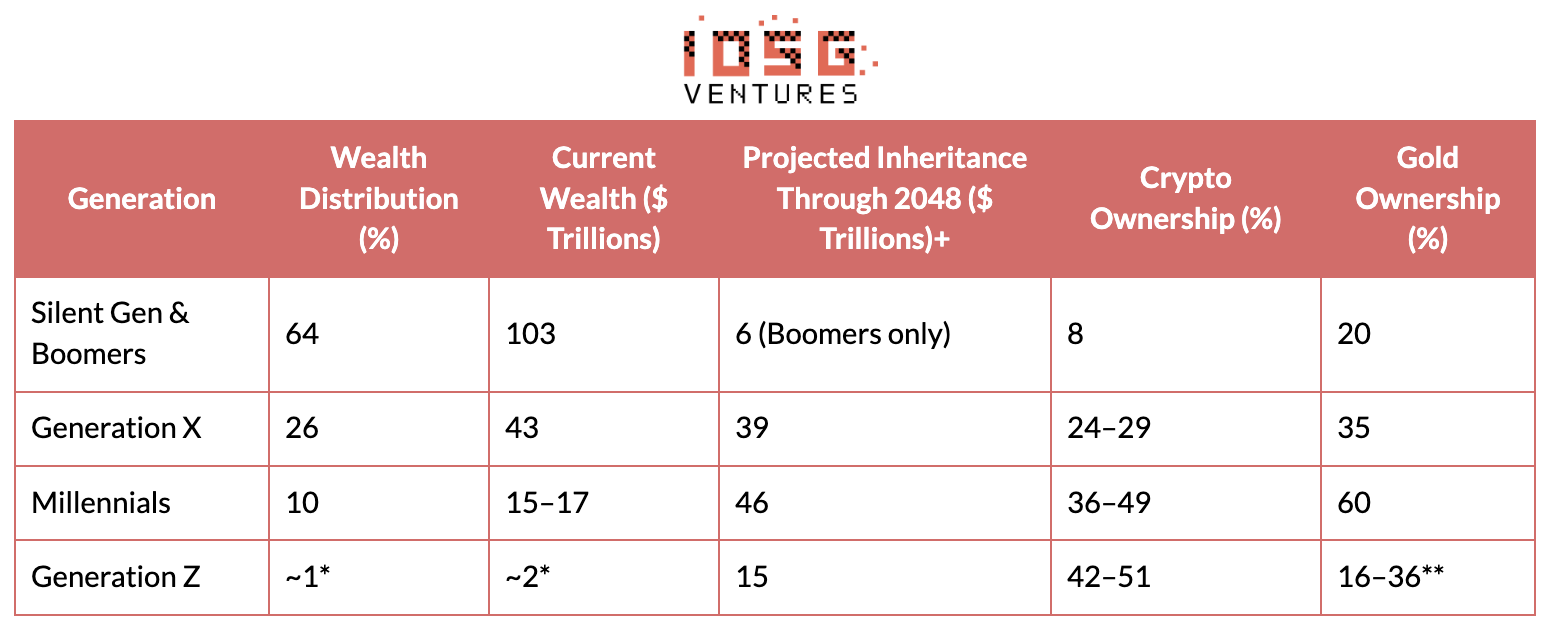

▲ Major reference sources: Federal Reserve, UBS Global Wealth Report 2025, Cerulli Associates 2024, Gemini State of Crypto 2024, YouGov 2025, State Street Gold ETF Impact Study 2024

Data for Generation Z is an estimate (the Federal Reserve combines Generation Z with Millennials in its statistics) | Survey data is limited: The younger generation's crypto asset ownership rate has significantly increased. The crypto ownership rate for Generation Z is about 45%, while the gold ownership rate is only 20%—completely opposite to the preferences of the Baby Boomer generation. An obvious rebuttal is that the younger generation simply has a higher risk appetite. But this overlooks a deeper reality: the internet natives have a fundamentally different perception of value compared to the older generation. As over $100 trillion in wealth transfers from the Baby Boomer generation to the younger generation over the next few decades, asset allocation preferences will also change.

Conclusion: In the short term, the performance of the crypto market will still be driven by familiar macro factors: Federal Reserve policies, AI stock sentiment, and overall risk appetite. The market will continue to be volatile, with news headlines swinging between euphoria and despair. However, the impact cycle of the aforementioned structural tailwinds is much longer. Currency devaluation will not disappear; the weaponization of the financial system has created a lasting demand for alternatives; regulatory clarity has finally arrived; the younger generation clearly prefers crypto over gold; and the world's largest tech and financial companies are building the infrastructure needed for mainstream adoption. The question is not whether crypto will capture a larger share of global financial assets, but how quickly this transition will occur—and which assets within the ecosystem will benefit the most.

3. A Game Without Winners: How the Altcoin Market Can Break the Deadlock

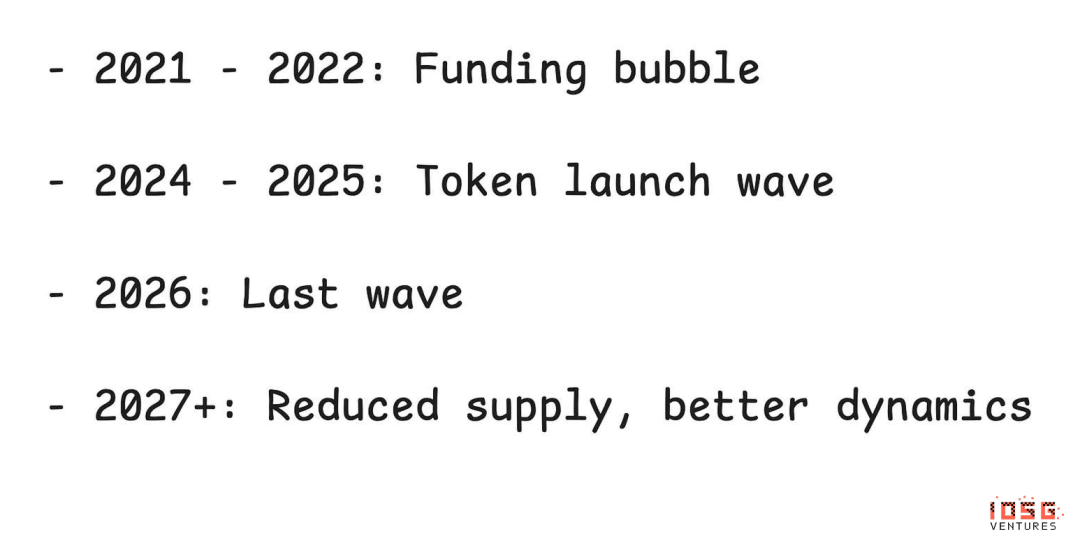

The altcoin market has experienced its toughest year, and understanding the reasons requires looking back at decisions made years ago. The funding bubble of 2021-2022 spawned a batch of projects that raised significant capital, and these projects are now in the token issuance cycle. This has created a fundamental problem: a massive influx of supply into the market with almost no corresponding demand.

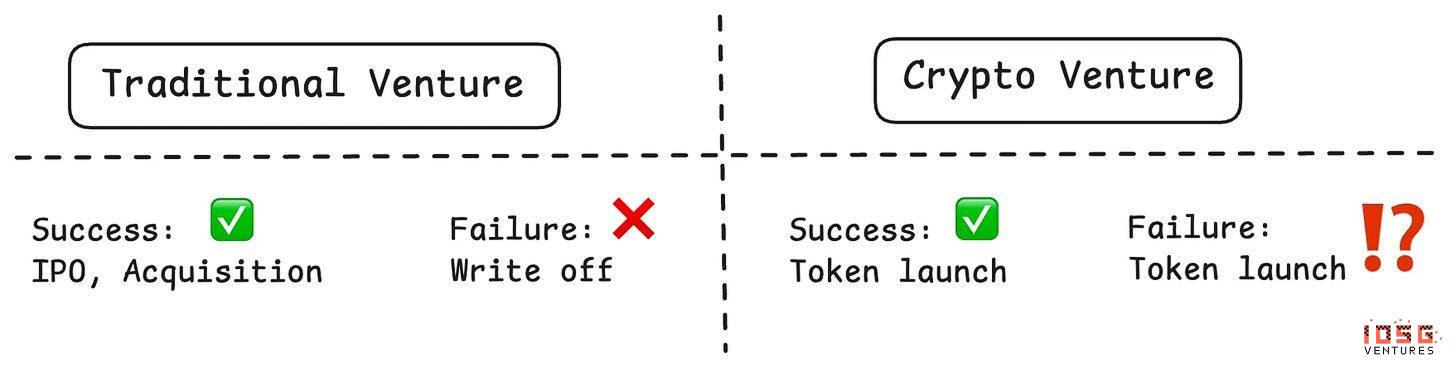

The root cause is not just oversupply, but that the mechanisms that created this problem have changed little since they first emerged. Project teams continue to issue tokens, regardless of whether they have found product-market fit (PMF), viewing token issuance as an inevitable milestone rather than a strategic decision. As VC funding dries up and primary market investments decline, many teams see token launches as the only way to secure funding or allow insiders to exit. This article will analyze the lose-lose situation that is destroying the altcoin market, examine failed attempts at repair, and propose what a balanced state might look like.

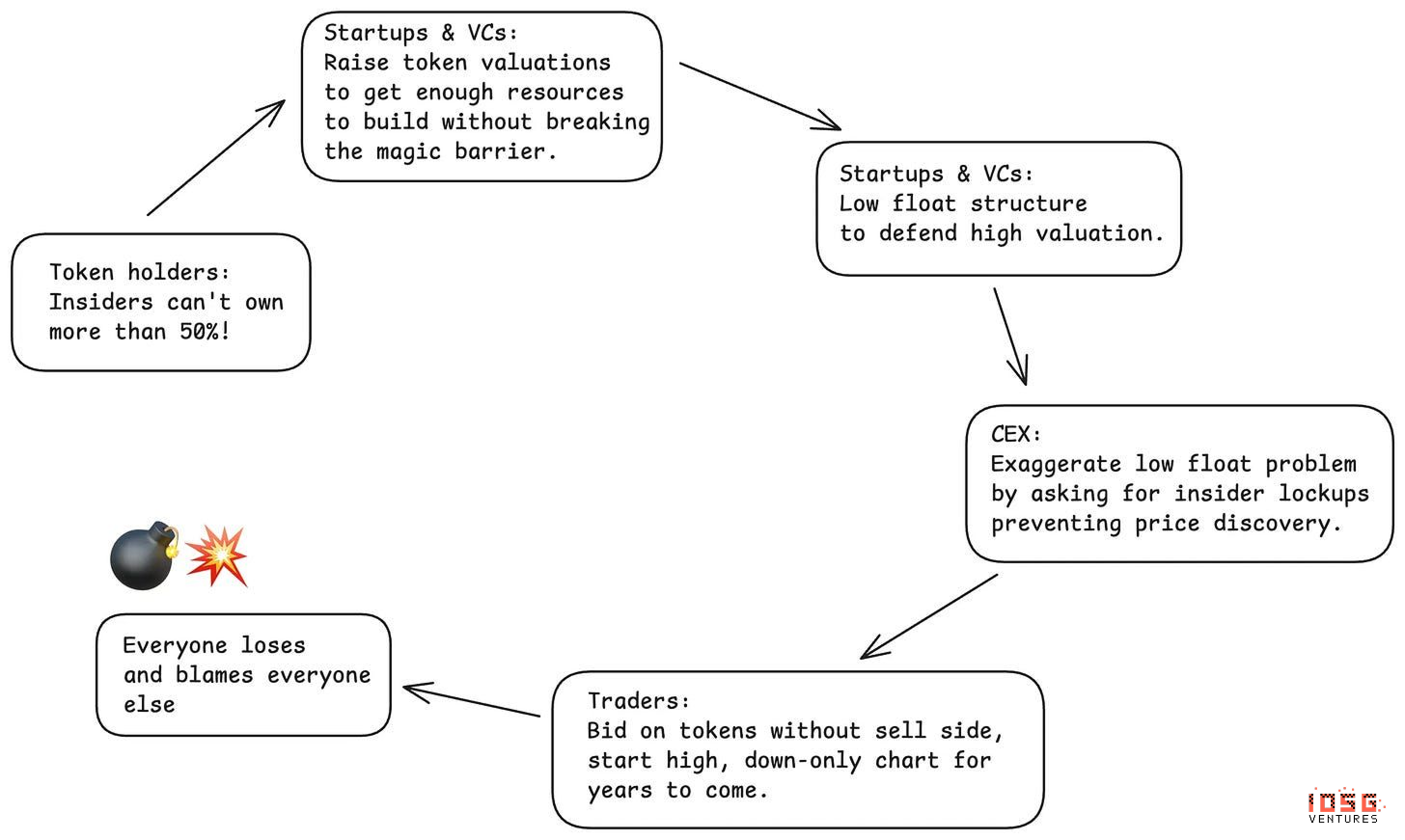

The Low Liquidity Dilemma: A Lose-Lose Game

Over the past three years, the industry has relied on a severely flawed mechanism: low liquidity token issuance. Projects issue tokens with extremely low liquidity—usually only in single-digit percentages—to artificially maintain an overvalued fully diluted valuation (FDV). This logic seems reasonable at first glance: the less supply, the more stable the price. But low liquidity cannot be maintained indefinitely. As more supply inevitably enters the market, prices collapse. Early supporters are punished for their loyalty, and data fully supports this—most tokens have performed poorly since their launch.

What is particularly insidious is that low liquidity creates a situation where everyone thinks they are winning, but in reality, everyone is losing: #Centralized exchanges believe they are protecting retail investors by requiring lower liquidity and more control. The result is an angry community and poor price performance. #Token holders think that maintaining low liquidity can prevent insiders from dumping. The result is that true price discovery is never achieved, and early supporters are punished instead. When they demand that insiders hold no more than 50%, they inadvertently push primary market valuations to unreasonable levels, forcing insiders to use—yes—low liquidity strategies to maintain these valuations. #Project teams believe that low liquidity manipulation can justify high valuations and minimal dilution. But overall, if this trend continues, such practices will destroy the entire industry's funding channels. #VC firms believe they can value low liquidity token positions based on market cap, thereby raising more funds. The result is that as the strategic flaws become increasingly apparent, they will lose funding channels in the medium to long term.

This is a perfect lose-lose matrix. Everyone thinks they are playing a smart game, but the game itself is detrimental to all participants. Market Response: Meme Coins and MetaDAO: The market has attempted to solve this issue twice, and both attempts have revealed the complexity of token design. #First Iteration: Meme Coin Experiment: Meme coins were a response to VC-supported low liquidity issuance. Their pitch was simple and enticing: 100% liquidity on the first day, no VCs, completely fair. Finally, the game was no longer unfavorable to retail investors. The reality, however, was much darker. Without any screening mechanism, the market was flooded with unvetted token issuances. Solo and often anonymous operators replaced VC-backed teams, creating an environment where over 98% of participants lost money. Tokens became tools for exit scams, with holders being drained within minutes or hours of launch. Centralized exchanges found themselves in a dilemma. If they did not list meme coins, users would bypass them and go directly on-chain; if they did list them, they would be blamed when prices collapsed. Token holders suffered the most severe losses. The only winners were the issuing teams and platforms like Pump.fun that gained significant value.

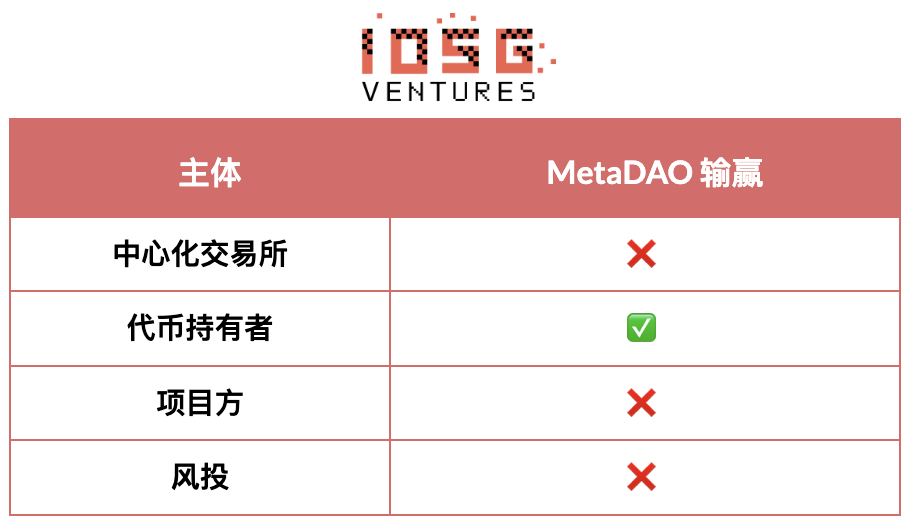

#Second Iteration: MetaDAO Model. MetaDAO represents the market's second major attempt to solve this issue, swinging the pendulum to the other extreme, heavily favoring token holder protection. Its advantages are tangible: #Token holders gain control leverage, making capital deployment more attractive; #Insiders can only gain liquidity by achieving specific KPIs; #It opens up new funding mechanisms in a capital-scarce environment: #Initial valuations are relatively low, providing fairer participation opportunities.

However, MetaDAO has created new problems by overcorrecting: #Founders lose too much control too early. This results in a "founder lemon market"—teams with resources and options avoid this model, while teams with no options embrace it. #Tokens are still issued at a very early stage, with high volatility, but the screening mechanisms are even less than those provided by VC cycles. #The infinite issuance mechanism makes it almost impossible for top-tier exchanges to list. MetaDAO fundamentally mismatches with centralized exchanges that control the vast majority of liquidity. Without CEX listings, tokens can only be trapped in illiquid markets.

Each iteration has attempted to solve a problem for a particular stakeholder, and each has demonstrated the market's self-regulating ability. But we are still searching for a balanced solution that accommodates the interests of all key participants—exchanges, token holders, project teams, and capital providers. The evolution continues, and until we find equilibrium, we will not have a sustainable model. This equilibrium must satisfy all stakeholders—not by giving everyone everything they want, but by drawing clear boundaries between harmful behavior and legitimate rights.

What a Balanced State Looks Like

Centralized Exchanges: #Must Stop: Requiring excessively long lock-up periods, which hinder true price discovery. Extended lock-ups create a false sense of protection, actually damaging the market's ability to find fair value. #Entitled to: Predictability of the token supply schedule and effective accountability mechanisms. The focus should shift from arbitrary, time-based lock-ups to KPI-based unlocks, adopting shorter, more frequent token release schedules linked to verifiable progress.

Token Holders: #Must Stop: Overcompensating for historical rights deficiencies by demanding excessive control, driving away the best talent, exchanges, and VCs. Not all insiders are the same; demanding the same long lock-up periods from everyone ignores the differences between roles and hinders true price discovery. An obsession with certain magical holding thresholds (such as "insiders must not hold more than 50%") creates the very conditions that lead to low liquidity manipulation. #Entitled to: Strong information rights and operational transparency. Token holders have the right to clearly understand the business behind the token, receive regular reports on progress and project challenges, and have open communication regarding capital reserves and resource allocation. They have the right to assurances that value will not be lost through side deals or alternative structures—tokens should be the primary IP holders, ensuring that the value created belongs to the token holders. Finally, token holders should have reasonable control over budget allocation, especially for significant expenditures, but should not micromanage day-to-day operations.

Project Teams: # Must Stop: Issuing tokens without a clear product-market fit or compelling token utility. Too many teams treat token issuance as a "beautified version of equity," yet enjoy lower rights—equivalent to the junior tier of risk equity, but without legal protection. Tokens should not be issued simply because "crypto projects do this" or because funds are running low. # Entitled to: The ability to make strategic decisions, take bold bets, and advance daily operations without submitting every decision for DAO approval. If teams are to be held accountable for results, they need the power to execute.

Venture Capital Firms: # Must Stop: Forcing every invested company to issue tokens, regardless of reasonableness. Not every crypto company needs a token; pushing for token issuance to value positions or create exit events has flooded the market with low-quality issuances. VCs need to be more prudent and honestly assess which companies are truly suited for a token model. # Entitled to: A reasonable return for taking on the extremely high risks of investing in early-stage crypto projects. High-risk capital should earn high-risk returns when bets succeed. This means reasonable equity stakes, fair token release arrangements that reflect their contributions and risks, and the ability to achieve liquidity exits from successful investments without being demonized.

Even with a path to equilibrium, timing is crucial. The near-term outlook remains challenging.

The Next 12 Months: The Last Wave of Oversupply

The next 12 months are likely to be the last wave of oversupply resulting from the previous VC boom. After this digestion period, conditions should improve: by the end of 2026, the cohort of projects from the last cycle will either have issued tokens or gone bankrupt; funding channels will still be expensive, limiting the formation of new projects. The VC-backed projects seeking to issue tokens have significantly reduced their reserves; primary market valuations have returned to more reasonable levels, alleviating the pressure to artificially maintain high valuations through low liquidity. What we did three years ago has shaped today's market. What we do today will determine the market two to three years from now. Beyond the supply cycle, there is a deeper threat to the entire token model.

Survival Risk: Lemon Market; The biggest long-term threat is that the altcoin market turns into a "lemon market," one that excludes quality participants and attracts those with no alternatives.

Possible Evolution Path: Unsuccessful Projects continue to issue tokens to gain liquidity or extend their lifespans, even without any product-market fit. As long as there is the expectation that "projects should issue tokens, regardless of success," failed projects will continue to flood the market. # Successful projects observe the chaos and choose to exit. When excellent teams see the overall performance of tokens consistently poor, they may turn to traditional equity structures. If a successful equity company can be built, why subject oneself to the chaos of the token market? Many projects do not have sufficient reasons to issue tokens; for most application-layer projects, tokens are becoming increasingly optional rather than necessary. If this dynamic continues, the token market will be dominated by projects that cannot succeed through other means—those unwanted "lemons." Despite these risks, there are still ample reasons to remain optimistic.

Why Tokens Can Still Prevail: Despite the challenges, we remain optimistic that the worst-case lemon market scenario will not occur. Tokens offer a unique game-theoretic mechanism that equity structures cannot replicate. They achieve accelerated growth through ownership distribution. Tokens can implement precise distribution strategies and growth flywheels that traditional equity cannot reach. Ethena exemplifies this by using token mechanisms to drive rapid adoption and create sustainable protocol economics, which fully demonstrates this point. Enthusiastic, loyal communities form a moat. If operated correctly, tokens can create a community with vested interests—participants become stickier and more loyal to the ecosystem. Hyperliquid is a prime example: its trader community has become deeply engaged, creating network effects and loyalty that would be impossible to replicate without tokens. Tokens can enable growth rates far exceeding those of equity models while opening up vast game-theoretic design spaces, releasing tremendous opportunities when used effectively. When these mechanisms work, their transformative power is truly disruptive.

Signs of Self-Correction: Despite the challenges, there are encouraging signs that the market is correcting: top-tier exchanges are becoming extremely strict. Issuance and listing requirements have tightened significantly. Exchanges are implementing better quality control, conducting stricter evaluations before listing new tokens. Investor protection mechanisms are evolving. Innovations like MetaDAO, IP rights owned by DAOs (as seen in governance disputes with Uniswap and Aave), and other governance innovations show that the community is actively experimenting with better structures. The market is learning—slowly and painfully, but it is indeed learning.

Recognizing We Are in a Cycle: The crypto market is highly cyclical, and we are currently in a trough. We are digesting the negative consequences of the 2021-2022 VC bull market, hype cycles, over-investment, and the resulting structural mismatches. But cycles will turn. Two years from now, once the projects from 2021-2022 are fully digested, once new token supply decreases due to current funding constraints, and once better standards emerge through trial and error—the market dynamics should improve significantly. The Key Question Is: Will successful projects return to the token model, or will they permanently shift to equity structures? The answer depends on whether the industry can resolve issues of interest alignment and project selection.

The Path Forward: The altcoin market stands at a crossroads. The lose-lose situation for exchanges, token holders, project teams, and VCs has created an unsustainable market condition. But this is not permanent. As the last wave of supply from 2021-2022 impacts the market, the next 12 months will be painful. However, after this digestion period, three things may drive recovery: better standards emerging from painful trial and error; a coordination mechanism that satisfies the interests of all four parties; and more prudent token issuance, where teams only issue tokens when they can genuinely add value. The answer depends on the choices made today. Three years from now, how we look back at 2026 will be similar to how we look back at 2021-2022 today. What are we building?

4. Overview of Venture Capital Opportunities

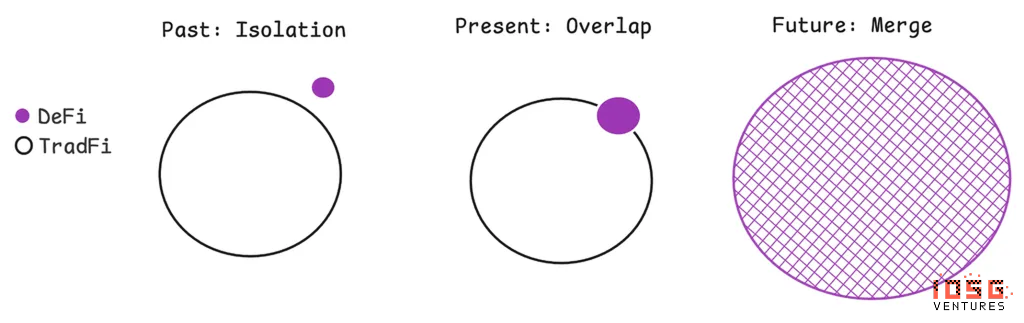

The cryptocurrency ecosystem is undergoing a fundamental transformation. From the initial independent experiments with digital currencies, it has evolved into a complex financial infrastructure, increasingly overlapping with traditional finance and emerging technologies like artificial intelligence, ultimately moving towards integration.

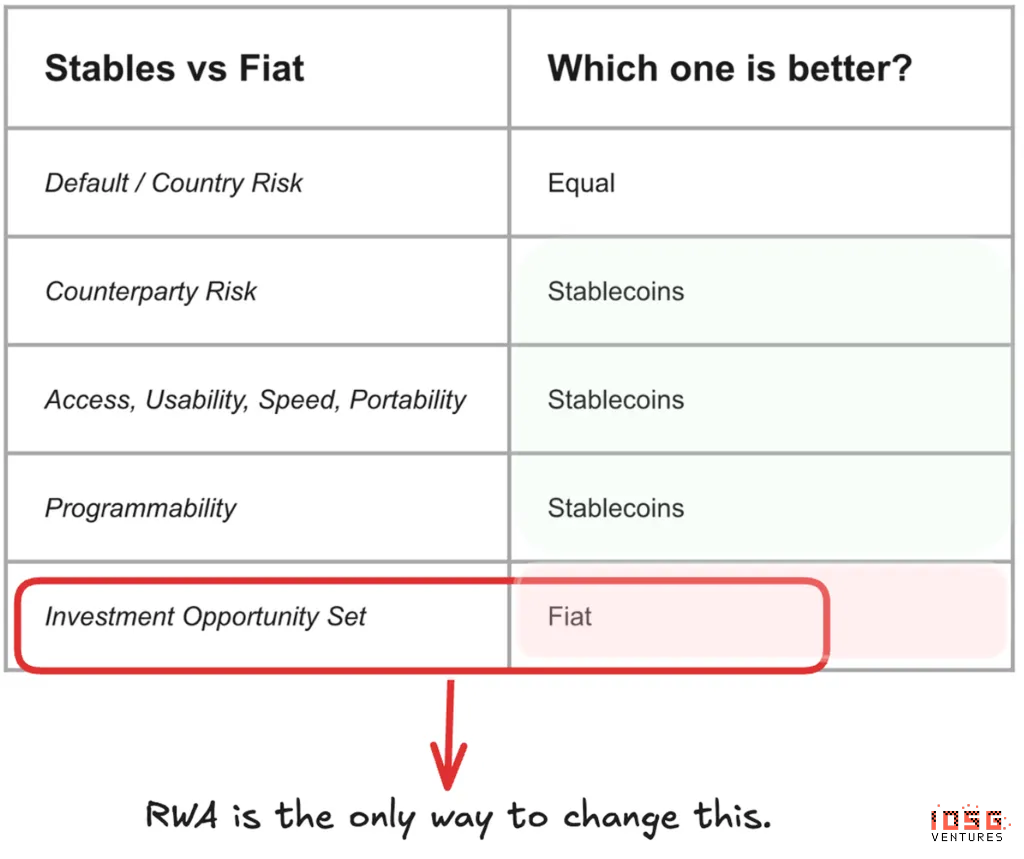

Stablecoins: Nearly Perfect Currency, Just Missing a Key Link: Stablecoins have proven superior to traditional fiat currencies on almost all dimensions. Compared to traditional payment rails, they have advantages in accessibility, usability, speed, portability, and programmability. Counterparty risk is comparable to traditional banking, while the technology itself offers clear advantages. However, there is a critical limitation: investment options for stablecoins remain constrained compared to fiat currencies. Traditional financial markets provide a wide range of productive investment opportunities—stocks, bonds, real estate, and alternative assets. Despite their technological superiority, stablecoins are still limited to crypto-native sources of yield and investment opportunities, which alone cannot support sustainable growth that breaks the $1 trillion barrier.

This is precisely why RWA (Real World Assets) has become crucial. The tokenization of RWA is the only viable path to expand the investment scope of the stablecoin ecosystem, thereby addressing the most critical issue currently facing stablecoins. Given time, this will form a converging trajectory: almost all assets will be natively issued, traded, and settled on-chain. Who is Most Likely to Prevail? Traditional institutions like Robinhood and BlackRock have a clear advantage here, as both have expressed a willingness to tokenize more assets. However, startups are moving faster and are more agile in building on-chain natives, giving them a competitive edge. BackedFinance has launched XStocks using Switzerland's innovative legal structure, achieving permissionless stock issuance similar to stablecoins, accessible to anyone. However, liquidity remains a challenge. OndoFinance addresses the liquidity issue, but its products are more limited. Liquidity, accessibility, and trust are the key variables for success in this field.

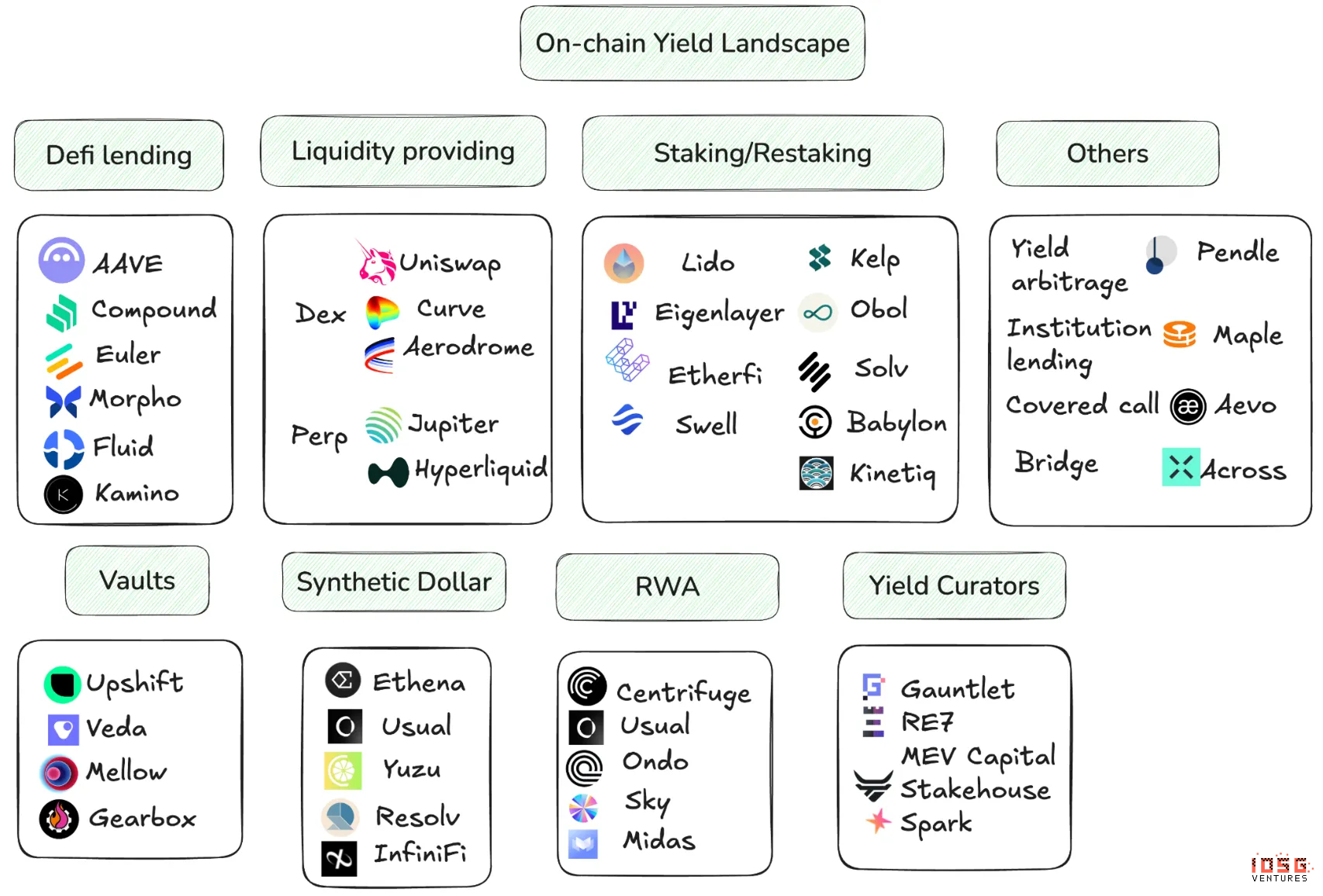

DeFi Yield Challenges: From Basic to Structured Yield: Historical data shows that for every $1 increase in stablecoin market cap, DeFi TVL increases by about $0.6. This indicates that most new on-chain funds are seeking yield. The growth of stablecoins themselves also relies on DeFi's ability to generate diverse, scalable, and sustainable yields. The crypto ecosystem has gone through different phases of yield generation. Starting with establishing a crypto risk-free rate (like AAVE), it has gradually evolved into more advanced products. Each iteration requires stronger risk underwriting capabilities while also bringing higher value appreciation per unit of deployed capital. The current landscape presents increasingly complex on-chain yields across multiple categories. We are also seeing stronger interoperability between DeFi protocols and the growing importance of composability. The best example: Ethena > Pendle > AAVE strategy. In this strategy, Ethena's deposit tokens are split on Pendle into principal tokens and yield tokens. As long as there is a positive spread between AAVE's borrowing rate and Ethena's funding fee, the principal tokens will be used as collateral to borrow more assets on AAVE, which are then redeployed back to Ethena.

This indicates that even familiar strategies can release unique opportunities when deployed in new ways. This should encourage more participants to tokenize a broader range of yield products and leverage on-chain composability to capture opportunities that do not exist in the fragmented off-chain ledger world. Another opportunity: abstracting the complexity of on-chain yield products to create a DeFi channel that can dynamically adjust exposures across the vast DeFi landscape. This can be seen as an upgraded version of Yearn's original vision, adapting to current needs, where successful DeFi vaults require more active management and risk underwriting. Projects like YuzuMoney are pursuing this path.

Who is Most Likely to Prevail? This heavily depends on execution capability. It requires talent with deep financial engineering expertise, strong risk control capabilities, and experience in the crypto industry. Teams that possess all three are relatively scarce.

Prediction Markets: Growth and Opportunities for Kalshi/Polymarket and Other Derivative Applications: We are optimistic about the growth prospects of prediction markets in 2026. The World Cup and the U.S. midterm elections will bring significant traffic to the market, especially with the potential catalyst of TGE (Token Generation Event), making volume growth promising. Sports betting will be a highlight, and as the prediction market mechanisms mature, this vertical is expected to experience explosive growth and innovative gameplay. Another important trend is localization. Recently, Polymarket has seen an increasing number of region-specific topics, particularly events that interest young people in Asia, contrasting sharply with the earlier focus solely on the U.S. market. This indicates that leading platforms are beginning to value global cultural diversity, and the incremental market that arises from this should not be underestimated. Derivative products at the ecosystem level will rise alongside the growth of Kalshi and Polymarket. After both platforms began focusing on ecosystem development in 2025, various tools, trading terminals, aggregators, and even DeFi applications have developed rapidly. This opportunity is too obvious, leading entrepreneurs to rush into the market, with rapid product iterations and overall growth, but it is still too early to determine the winners.

Who is Most Likely to Prevail? At the core level of prediction markets, directly challenging Kalshi and Polymarket is quite difficult. However, the following directions are worth paying attention to: #Innovative Mechanism Breakthroughs: Innovations such as leveraged trading, parlay (accumulator bets), futarchy (future governance), long-tail markets, new types of oracles, and settlement methods may open up differentiated survival spaces. #Deep Localization: Focusing on the crypto user base and delving into local niche markets is another path. Kalshi and Polymarket are just starting in this area and have no obvious advantages. For teams that understand local culture, regulatory environments, and user habits, this is a genuine opportunity window. #Winners Will Emerge in the Derivative Product Ecosystem Through Rapid Iteration. The key is whether they can seize user pain points and establish network effects during the window of expansion in the Kalshi/Polymarket ecosystem.

Neobanks: Natural Beneficiaries of Stablecoin Adoption: The widespread adoption of stablecoins will fundamentally reshape the banking industry, likely reducing the balance sheet size of traditional banks and triggering numerous chain reactions, which are not the focus of this article. The key question is: How will people manage their stablecoin balances? We believe this is unlikely to be achieved through personal wallets. Instead, Neobanks are likely to become the main beneficiaries of this trend. Understanding the opportunities for Neobanks requires understanding the sources and nature of demand.

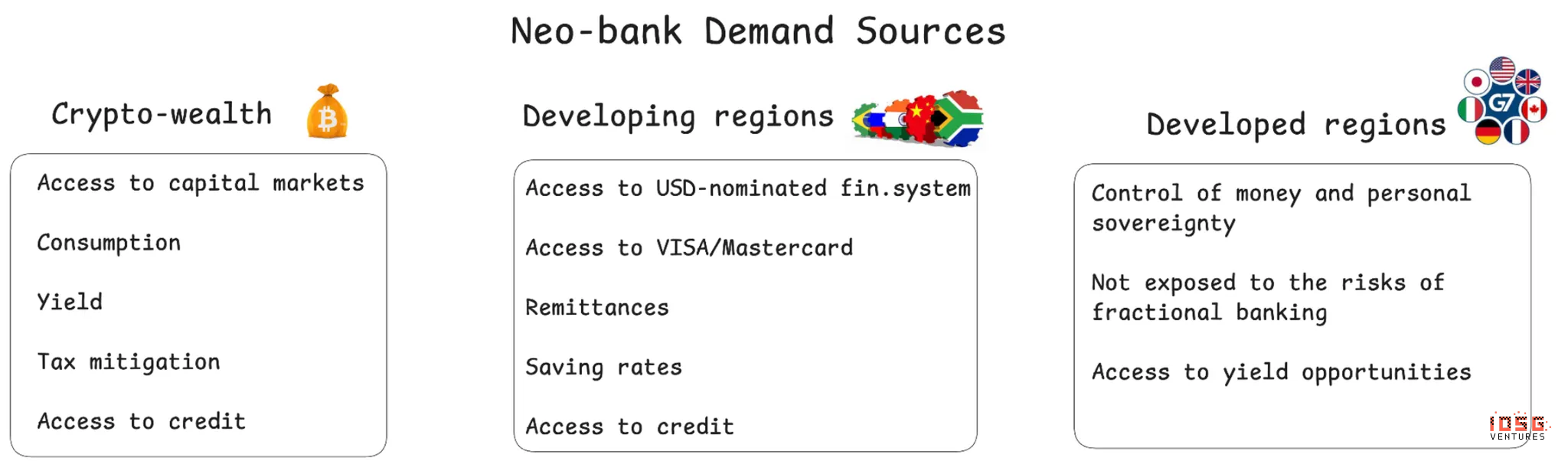

There are primarily three user groups: crypto-native groups, users in developing regions, and users in developed regions.

a. Cryptocurrency holders want access to capital markets, consumer choices, yield opportunities, tax optimization, and credit services. Etherfi is already leading in this category, but there is still room for improvement in accessing capital markets, yield generation, and credit products. b. Users in developing regions need access to dollar-denominated financial systems, Visa/Mastercard networks, remittance channels, competitive savings rates, and credit. Redotpay is currently leading in Southeast Asia, leveraging crypto infrastructure to provide products similar to Revolut. There are significant opportunities for localized solutions and small loan products that can improve user retention in other regions. c. In developed regions, opportunities may not seem as obvious due to the existing financial infrastructure. However, as mentioned earlier, rising uncertainty in the global leadership landscape may drive these users toward alternatives. This creates a triple market opportunity where Neobanks can utilize the same underlying stablecoin infrastructure to serve fundamentally different customer needs.

Who is Most Likely to Prevail? Accessing capital markets requires creative legal solutions and financial expertise to provide deep liquidity. Offering credit requires financial professional capabilities. Improving yield solutions requires expertise in crypto and DeFi. Penetrating local markets requires an understanding of local laws, markets, and cultures. These variables provide key differentiation opportunities for new entrants, especially if existing players fail to unlock these capabilities and expand their service offerings.

Evolution of Crypto Payments: The global payment system is being reshaped by crypto infrastructure, and large-scale adoption is advancing along three different channels. The C2B (Consumer to Business) channel currently still favors traditional finance, as crypto applications need to connect to the existing Visa/Mastercard networks, which have established a strong moat through extensive merchant coverage. The bigger opportunity lies in P2P (Peer to Peer) flows, where traditional financial transactions are expected to migrate to crypto infrastructure. Facing Neobanks, wallets, and large tech platforms that are integrating stablecoins, Western Union seems to lack a strong moat for self-defense. The B2B (Business to Business) sector may represent the largest opportunity. Crypto payment providers can offer a true alternative for cross-border business payments. This represents a fundamental infrastructure shift that requires deep integration of stablecoins with fintech platforms. The core value proposition is significant cost savings and speed improvements. However, the challenge lies in establishing "last-mile" liquidity and local compliance capabilities in key regions so that customers can seamlessly connect to new solutions.

Who is Most Likely to Prevail? For P2P payments, geographic focus and user experience are most important: solutions that are already prepared for use, withdrawals, and consumption are most likely to succeed. For B2B payments, companies that have established relationships with SMEs and large enterprises while possessing regulatory expertise are in the most advantageous position.

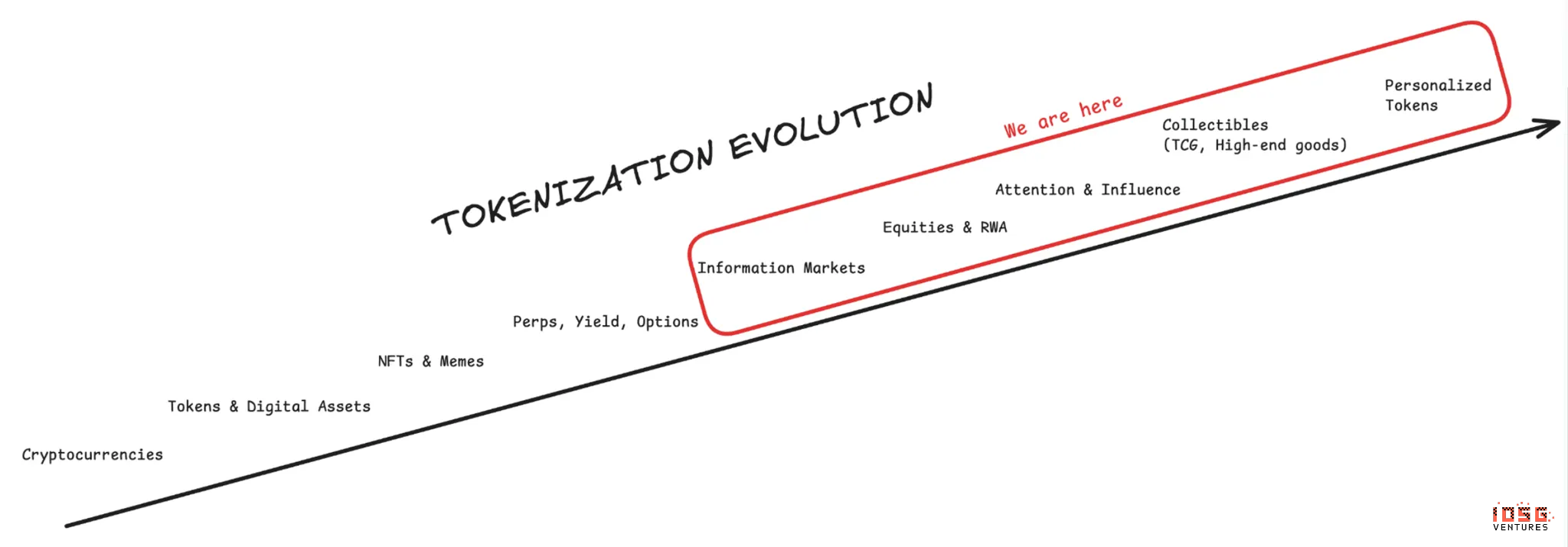

Internet Capital Markets: The Endgame of Tokenization: Blockchain technology has achieved a single, programmable global ledger, allowing capital to flow around the clock, and tokenization enables any asset to be identified, traded, and settled cross-border instantly. The evolution of tokenization has gone through different meta-cycles: from the initial cryptocurrencies to tokens (such as altcoins and digital assets), then to NFTs and meme coins, followed by information markets (prediction markets), and currently encompassing stocks, RWA, and a wide range of financial derivatives. Looking ahead, frontier areas include collectibles (such as trading card games and luxury goods), attention and influence markets, and ultimately personalized tokens. With each new meta-narrative, specialized trading infrastructure follows suit. The crypto trading landscape has evolved from basic Bitcoin exchanges (Binance, OKX, Coinbase, Huobi) to on-chain DEXs (Uniswap) and aggregators (1inch, 0x), then to NFT markets (OpenSea) and terminals (Blur), meme token launchpads (Pump.fun) and terminals (Axiom, GMGN, FOMO), PerpDEXs (Hyperliquid, Lighter) and their emerging terminals and aggregators, as well as prediction market platforms (Polymarket, Kalshi) and their own emerging terminal infrastructure. Each meta-narrative requires interfaces tailored for retail users seeking simplicity and professional users needing advanced features. The current generation of products (focusing on perpetual contracts and prediction markets) presents significant venture capital opportunities as the market matures and integrates with traditional finance.

Who is Most Likely to Prevail? The terminal and aggregator track requires a deep understanding of user workflows and excellent product design. In the professional user segment, teams with trading backgrounds and technical depth have an advantage. In the retail segment, expertise in consumer products and growth marketing capabilities are more important. The winners will be those teams that achieve the best balance between functional depth and user experience for their target segments, while also building moats around liquidity aggregation or unique data/insights.

ICM: Reconstruction of Token Mechanisms in 2026: An important proposition for 2026 is: How will the tool of tokens evolve? The core issue with current crypto tokens is the imbalance in supply structure combined with flawed incentive designs, leading all participants—exchanges, token holders, teams, VCs, etc.—into a game that seems rational but is actually detrimental to all parties. Tokens are treated as financing and liquidity tools rather than product decision-making tools. This has led to clear market distortions: mature projects lack the motivation to maintain product operations after issuing tokens, or they are too distracted by token affairs, affecting product decisions. The result is that good projects simply abandon token issuance, bad money drives out good money, and poor projects continue to enter the market. Early projects issue tokens without PMF and struggle to continue financing after issuance, failing to gain sufficient institutional support.

The ICM (Integrated Capital Markets) concept was proposed by the Solana ecosystem, but a more general understanding is: How to launch more good assets better and maintain them as good assets. The assets themselves can be equity in early Web2/Web3 companies, pre-IPO/IPO stocks, etc. This requires breakthroughs in multiple areas: legal discussions, market education, operational efforts, and mechanism innovations, including ownership coins, launchpads, etc. Making tokens better products—this is the crypto-native proposition to be solved in 2026.

The Fusion of Crypto and AI: Creating First-Class Digital Citizens: Perhaps the most compelling investment narrative will emerge at the intersection of crypto and AI. Existing internet and financial infrastructures are entirely designed for humans, relegating AI to "second-class citizens," and the significant limitations of the infrastructure fundamentally constrain AI's economic potential. Without crypto infrastructure, AI agents face severe constraints. They cannot open bank accounts or make payments, relying entirely on humans for financial transactions. They are constantly blocked by CAPTCHA and bot detection systems, unable to complete basic online interactions. They cannot interact with other agents to create an inter-agent economy. They cannot own assets. They are trapped in centralized company servers or clouds, unable to migrate. Cryptocurrency fundamentally changes this status quo, making AI a first-class citizen with true economic agency. With crypto, AI agents can own wallets and autonomously send and receive funds, earn, consume, and invest independently without human intermediaries. They can bypass most bot detection through distributed blockchain networks. They can autonomously discover other AI agents, negotiate with them, and transact, creating an emerging AI-to-AI economy, where economic interests and quasi-crypto consensus and trust mechanisms will determine right from wrong. They can enter contracts and programmatically execute payments. They can hold digital assets, with ownership enforced by immutable blockchains.

Google has promoted the A2A protocol, providing AI agents with an open standard that enables them to communicate, exchange information, and coordinate actions across different platforms and vendors, facilitating interoperable multi-agent systems. However, trust issues remain, which is precisely what the Ethereum ERC-8004 standard aims to address through on-chain identity, reputation, and verification, allowing AI agents to discover, authenticate, and collaborate in a decentralized economy without pre-established trust. These developments collectively unleash AI's ability to participate in programmable, agent-driven commerce on the blockchain.

Who is Most Likely to Prevail? Visionary entrepreneurs who can architect a decentralized economy will stand out, in which AIAgents interact without trust through protocols like ERC-8004. These leaders excel in interdisciplinary innovation, seamlessly integrating cryptography (for secure, tamper-proof trust mechanisms), economics (for designing incentive-aligned agent behavior, staking, penalties, and emerging markets), and systems design (for building scalable, interoperable architectures that enable open, cross-organizational agent coordination without gatekeepers).

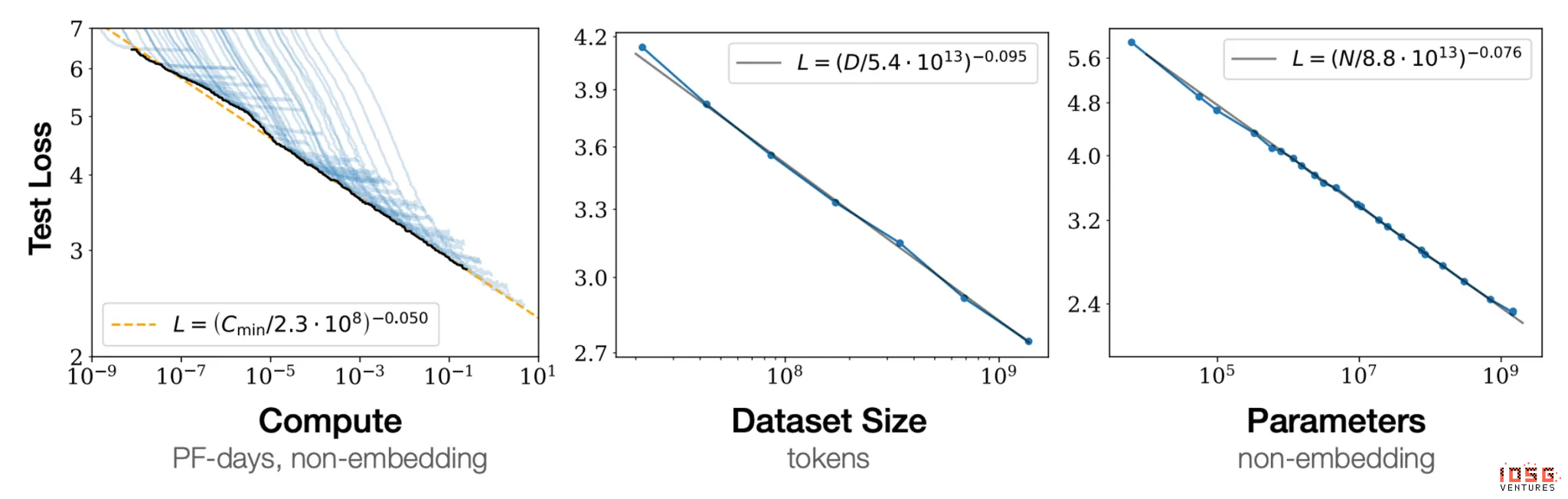

Resource Aggregation Opportunities: The scaling laws driving artificial intelligence development are already very clear and have been thoroughly validated: more computing power, more data, and more parameters almost inevitably lead to stronger model performance. Therefore, this diagram encapsulates the most important insights from the past five years:

Cryptocurrencies excel at aggregating resources through carefully designed incentive mechanisms. Their potential scale is remarkable: before the merge, the computing power provided by Ethereum proof-of-work miners was about 50 times what was needed to train GPT-4. If properly incentivized and coordinated, this represents a vast untapped capability. The data opportunity is equally significant. The crypto industry can aggregate proprietary data from individuals and businesses on a large scale. On the other hand, protocols like Grass enable distributed scraping of public network data and real-time information access, improving bot detection evasion and enhancing unit economics through a distributed approach to leveraging existing resources. The challenge lies not in resource availability but in effective coordination and quality control. With proper execution and incentive design, the crypto industry has real potential to unleash substantial resources for AI development, resources that are difficult or impossible to aggregate through traditional business structures.

Who is Most Likely to Prevail? This requires deep technical expertise in distributed systems, AI infrastructure, and game theory design. Teams need to tackle challenges such as computing power verification, data quality assessment, and large-scale efficient coordination. Companies with backgrounds in large-scale infrastructure operations and crypto protocol design have the strongest advantages. The winners will be those teams that can achieve decentralized coordination economies of scale while maintaining quality standards.

Conclusion: The common thread behind these opportunities is convergence; crypto-native capabilities are continuously merging with traditional finance, payment systems, and even today's artificial intelligence. The phase of isolated development has ended, and the phase of overlapping convergence is accelerating. Comprehensive integration is the ultimate destination: blockchain infrastructure will become "invisible" yet indispensable, serving as the underlying engine that supports a new generation of financial and technological services, achieving seamless integration between decentralized and centralized systems, taking the best of both worlds.

For venture capitalists, the real opportunity lies not in betting on "crypto" or "traditional finance," but in identifying those companies that are building bridges, infrastructure, and application layers that will define the future of this convergence. The most successful startups will no longer view crypto as a parallel financial system but as an infrastructure layer: a foundation that enables programmability, global settlement, autonomous agents, resource collaboration, and other capabilities that are fundamentally unattainable within traditional architectures.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。