How do cryptocurrencies perform in a changing world order?

Author: Ignas

Translated by: Baihua Blockchain

Macroeconomic Background: U.S. Stock Market Bubble and Debt Deleveraging

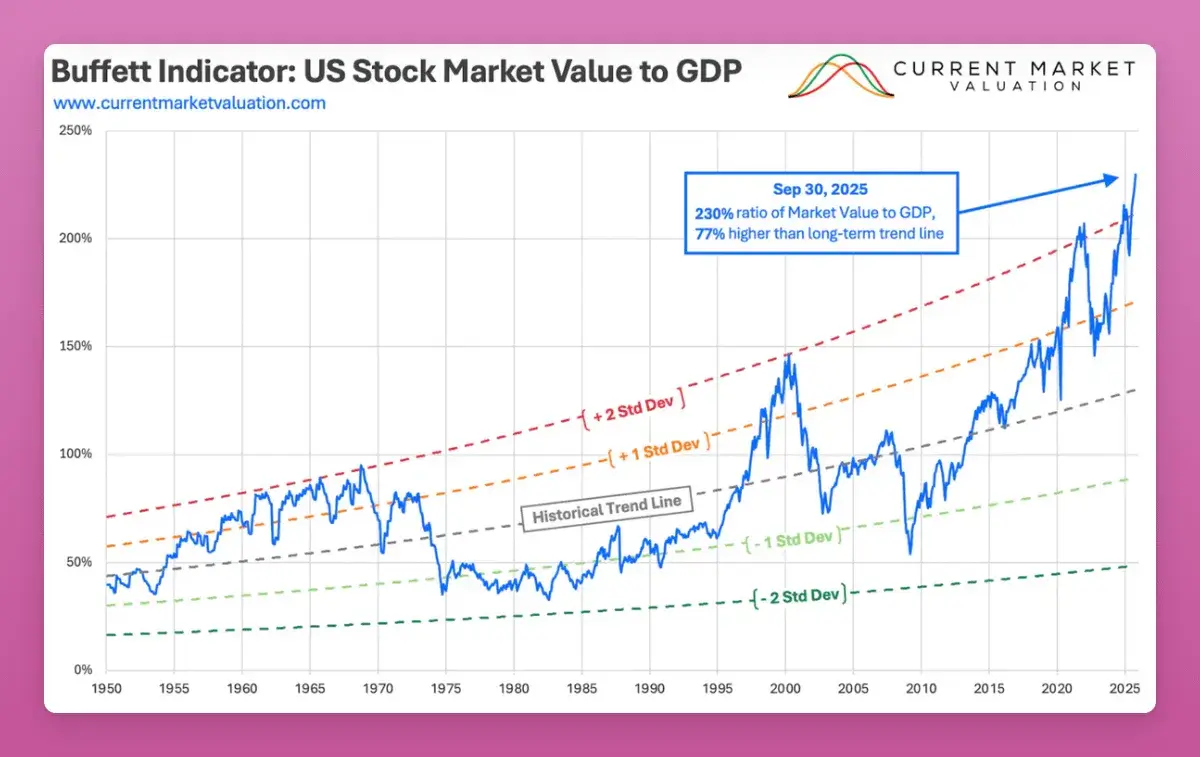

The U.S. stock market is currently in the "bubble" zone, with valuations reaching levels seen at the peak of the 1999 internet bubble.

Data source: Gemini. So please view this data with caution, as I am too lazy to verify it myself.

Data source: Gemini. So please view this data with caution, as I am too lazy to verify it myself.

Key Point: The current U.S. stock market Price-to-Earnings (P/E) Ratio is 40.5, higher than the 32 times seen before the Great Crash of 1929. According to Warren Buffett's most valued metric—the total market capitalization to GDP ratio, which has now reached 230%, 77% above the long-term trend (the ratio was 130% in 1929).

Some call it a "currency devaluation trade," believing that the dollar is losing purchasing power and that the world needs inflation to resolve debt. However, the notion that "devaluation trades are real" may be a "non-explicit lie."

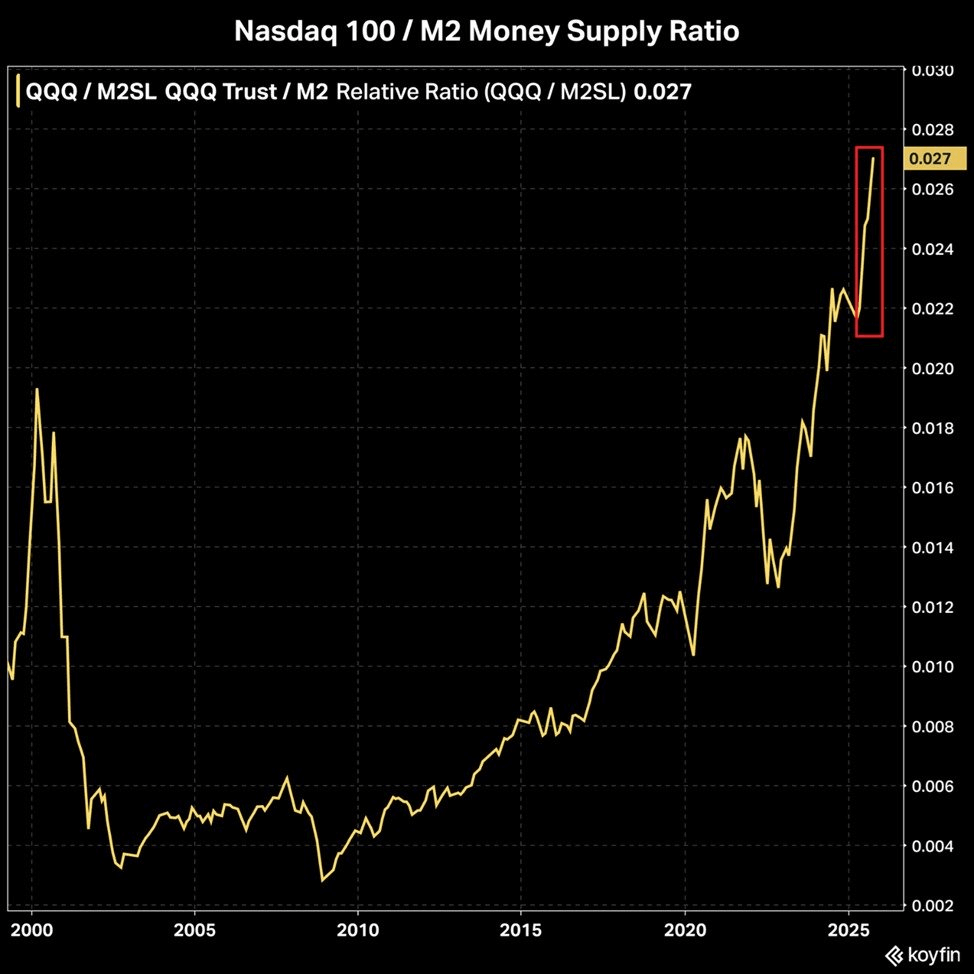

The Kobeissi Letter points out: The ratio of the Nasdaq 100 index to the M2 money supply has reached a historic high of 0.027.

Since the end of 2022, the Nasdaq has risen 141%, while M2 has only grown by 5%. This means that the speed of stock price increases is 28 times faster than the speed of new money creation.

There is widespread "economic anxiety," with a desire for stability, ownership, and upside opportunities. Therefore, most people turn to stocks and equities. While retail investors are currently unwilling to allocate 100% of their positions to altcoins, the outlook for Bitcoin (BTC) may be different.

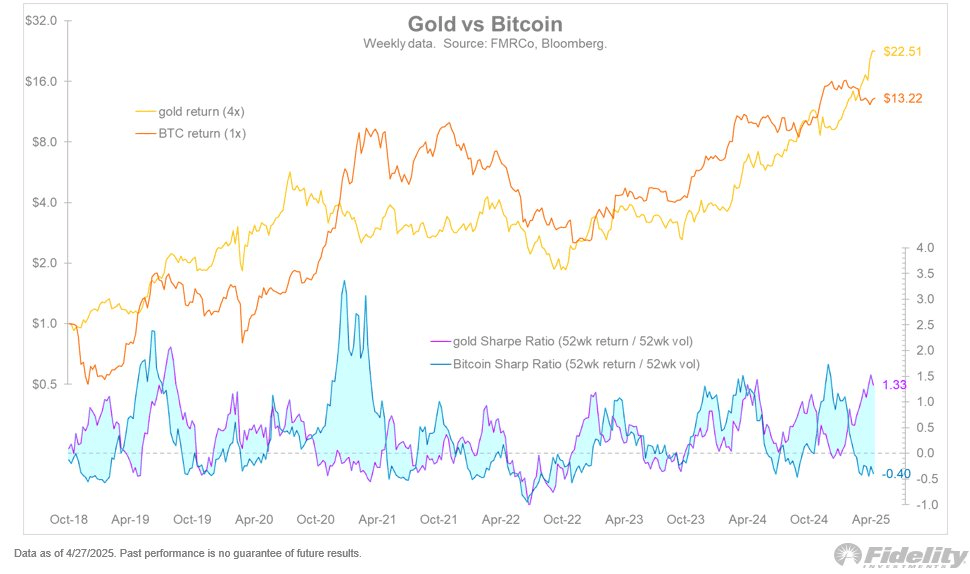

Non-Explicit Truth: I view BTC as a "safe-haven asset." It is a tool to hedge against macro uncertainty, the collapse of the international order, and fiat currency devaluation. Many still mistakenly see it as a "risk asset" (Risk-on). This narrative conflict suppresses prices, and once the "great rotation" is complete, BTC will solidify its status as a safe haven akin to digital gold. However, the significant risk is that if the stock market crashes, cryptocurrencies may fall alongside it.

Explicit Truths and Lies

Lie: Retail Investors Have Come Back to Save the Day

Retail investors have been repeatedly "rekt" in the ICOs of 2017, NFTs of 2021, and meme coins in 2024, as they have been drained of exit liquidity.

Prediction: The next wave of trillion-dollar funds will come from traditional financial (TradFi) institutions.

Institutional Preference: Institutions will not buy vaporware. They value tokens with "dividend attributes" (fee switches, real yields), clear product-market fit (stablecoin issuers, prediction markets), and regulatory compliance.

Potential Risk: If tokens cannot capture value, institutions will bypass tokens and directly purchase equity in development companies (e.g., Coinbase acquiring the Axelar team instead of the token).

Truth: Quantum Risk is Real

This includes two levels: technical risk (quantum computers cracking blockchains) and cognitive risk (panic triggered by narratives).

There is no need for quantum computers to actually steal addresses; just an announcement from IBM or Google about a "quantum breakthrough" is enough to trigger a 50% drop.

Response: Ethereum is preparing for post-quantum cryptography (PQC) through "The Splurge" roadmap, while Bitcoin may fall into "civil war" over whether to hard fork to upgrade its signature algorithm.

Truth: Prediction Markets Are Just Getting Started

By 2026, prediction markets (PMs) will become larger, broader, and smarter.

AI Integration: AI agents will scan internet signals for trading, far surpassing human efficiency.

Core Challenge: Who decides the "truth"? As scale increases, resolving disputes (like those of UMA) will require decentralized oracles and LLM (large model) arbitration.

Lie: Airdrops Are Dead

If competition decreases because CT (Crypto Twitter) believes airdrops are dead, that may actually be better. Airdrops from major projects like Polymarket, Base, OpenSea, and MetaMask will still be generous rewards.

Lie: Memecoins Are Over

Financial nihilism will not disappear. The volatility of memecoins and their characteristic of "no need to research fundamentals" still hold a fatal attraction for retail investors seeking thousand-fold returns.

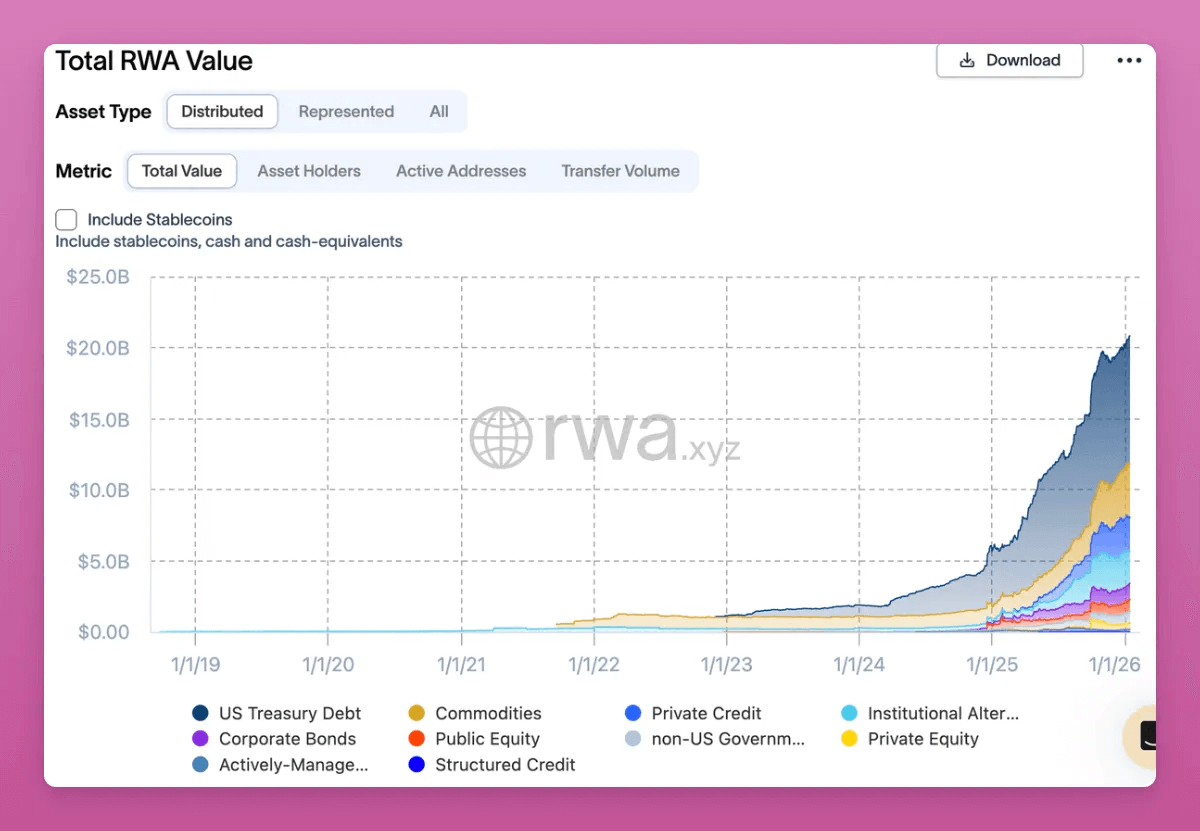

Dominant Trend in 2026: Real World Assets (RWA)

RWAs (tokenized assets) are not speculative hype but a long-term transformation driven by institutional funds.

Valuation Prediction: Boston Consulting Group (BCG) predicts it will reach $16-30 trillion by the 2030s. Larry Fink of BlackRock believes "every asset will be tokenized."

Focus Targets:

LINK: Capturing the data layer.

PENDLE: Institutional fixed income and retail yield speculation.

ETH: Capturing 65-70% of RWA value on-chain, serving as the institutional settlement layer.

Non-Explicit Truths and Lies

Non-Explicit Truth: Ethereum L1 is Expanding (Directly)

With the maturity of ZK-EVM and the Fusaka upgrade, Ethereum L1's gas limit is expected to exceed 100 million by 2026.

Impact: More L1 activity means higher fee destruction and deflationary pressure, and the "ultrasound money" narrative may re-emerge.

Anti-Quantum: Ethereum's proactive layout against quantum risk makes it more attractive while Bitcoin is mired in debate.

Non-Explicit Lie: All Regulatory Clarity is Positive

GENIUS Act: Clearly prohibits interest-bearing stablecoins. While this seems bearish, it will force funds to flow into DeFi protocols like Aave to earn yields, thereby promoting DeFi adoption.

Compliance Costs: Europe's MiCA Act leads to high compliance costs for small companies, which actually helps traditional giants eliminate competitors and stifles innovation.

Non-Explicit Lie: Privacy is Just a Short-Term Narrative

Current Situation: Privacy coins (Monero, Zcash) are being banned globally (UAE, EU, South Korea).

Truth: Institutions are extremely thirsty for privacy. They do not want their complex trading strategies monitored in real-time on public chains.

Opportunity: The Canton Network (backed by Goldman Sachs and BlackRock) and Ethereum's Aztec (privacy L2) will become focal points.

Non-Explicit Truth: The Four-Year Cycle Theory Has Ended

Bitcoin has evolved into a macro asset, influenced more by global liquidity (M2) than by halving cycles.

Evidence: Miner output has been easily absorbed by ETFs, with Bitcoin's correlation to global M2 reaching 83%.

Lag Effect: Bitcoin typically lags gold by 60-150 days, and the rise in 2026 may come more from a catch-up to gold.

Non-Explicit Truth: Digital Asset Financial Companies (DATs) Are a Net Positive

Although Standard Chartered has lowered its target price, believing the buying momentum for DATs (like MicroStrategy-style companies) has dried up.

ETH DATs: Unlike BTC, Ethereum financial companies (like BitMine) will stake their held ETH and engage in DeFi, turning it into productive infrastructure.

Altcoin DATs: For altcoins that cannot access ETFs, DATs are the only "IPO moment" for institutions to gain compliant exposure.

Non-Explicit Lie: The Return of ICOs Solves the Token Issuance Model

ICO 2.0 platforms (like Legion, Echo) promise fairness but are still subject to KYC, reputation scores, and insider restrictions. Value still flows to those who control trading flows and the rules of the game.

Non-Explicit Truth: "All Crypto Card Companies Will Eventually Go Bankrupt"

Reason: They operate on Visa/Mastercard, which are essentially centralized and easily replicable.

Threat: Once new banks like Revolut support direct stablecoin payments, or Base applications enable direct peer-to-peer payments, crypto cards will lose their space for survival. The only survivors will be those that transform into "neobanks" and establish their own payment networks.

Article link: https://www.hellobtc.com/kp/du/01/6202.html

Source: https://www.ignasdefi.com/p/crypto-truths-and-lies-for-the-year-647

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。