Author: Jae, PANews

As precious metals like gold and silver soar collectively, and AI leads tech stocks to new highs, cryptocurrencies are absent from this asset rotation feast. Faced with a prolonged liquidity drought and a narrative vacuum, crypto traders are no longer satisfied with betting in a single lane. They want to open a door that conceals a wealth of traditional assets, and Gate TradFi has handed them the key.

Today, the crypto space is accelerating towards an all-asset era. With mainstream assets like gold, foreign exchange, commodities, and U.S. stocks being successively brought on-chain, the boundaries of traditional finance are continuously being broken. Meanwhile, the increasingly clear regulatory environment and the iterative upgrade of underlying technologies are significantly lowering the barriers and frictions for cross-border capital flows.

In this context, an urgent demand has emerged: Can crypto players seamlessly trade financial assets in both the crypto market and traditional market on a single platform with the same amount of money?

Gate TradFi has provided its answer, attempting to reconstruct the trading experience of stocks, indices, foreign exchange, and commodities within its native app, leveraging the efficiency logic of the crypto industry to allow global liquidity to flow freely within a single account.

Massive Migration of Funds to RWA, Driven by Institutional Demand and Investment Preferences

Entering 2026, cryptocurrencies have gradually shed their label as alternative assets and are becoming part of the global financial market.

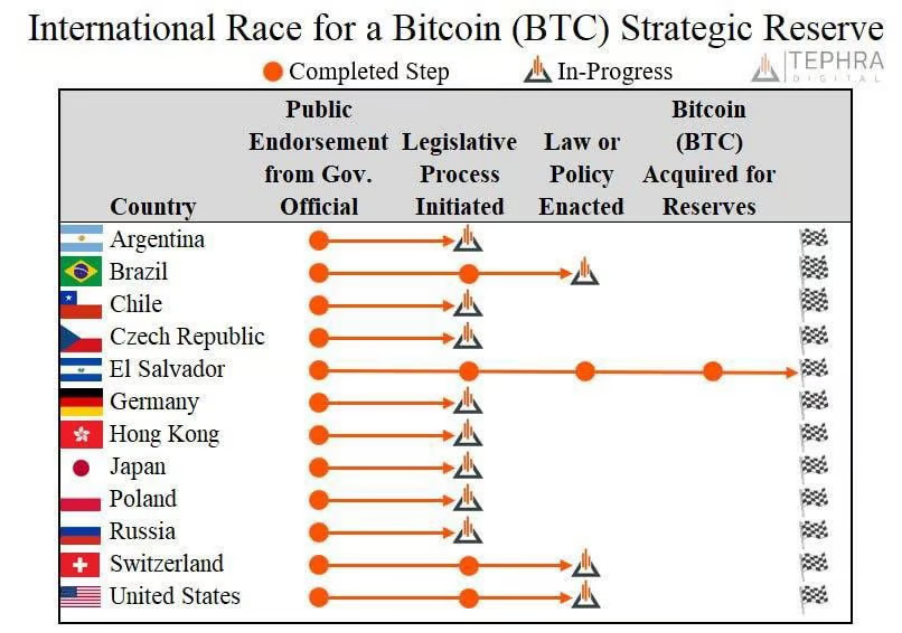

As cryptocurrencies gain acceptance in the mainstream market, especially with Bitcoin being included in the strategic reserves of some sovereign nations, the boundaries between this asset and traditional assets like precious metals and stocks are becoming increasingly blurred, fundamentally changing the logic of macro fund allocation.

The most direct manifestation of this integration is the explosive growth of the RWA (Real World Assets) sector. As of January 15, 2026, the total value of global tokenized assets has exceeded $20 billion, setting a new historical high.

Compared to $900 million at the beginning of 2022, RWA has achieved over 20 times growth, indicating strong investor interest in traditional assets on-chain. Notably, the growth of tokenized assets like commodities and stocks is particularly significant, with a total value exceeding $5 billion.

Currently, the TVL of RWA protocols has surpassed DEX, becoming the fifth largest category in DeFi. This also confirms that the crypto space is evolving into a new scenario for the circulation and settlement of global traditional assets.

For traditional institutions, RWA is no longer just a technical experiment, but a real choice for capital seeking higher transparency, liquidity, and portfolio flexibility.

As regulations become clearer and compliance structures improve, more institutions are expected to join the RWA battlefield. According to predictions from institutions like BlackRock, by 2030, the market size of the RWA tokenization market will soar to $16 trillion.

In addition to institutional demand for on-chain assets, one of the direct drivers of the RWA explosion is the recent extreme divergence in global asset performance. While precious metals like gold and silver continue to rise, global stock markets have entered a bullish trend, leaving the crypto market, which is in a slump, as an "outsider" in the global bull market, prompting investors to turn their attention to traditional assets.

This yield gap forces on-chain capital to shift its focus to traditional assets. Investors urgently need to capture the dividends of U.S. stocks and gold through the RWA channel.

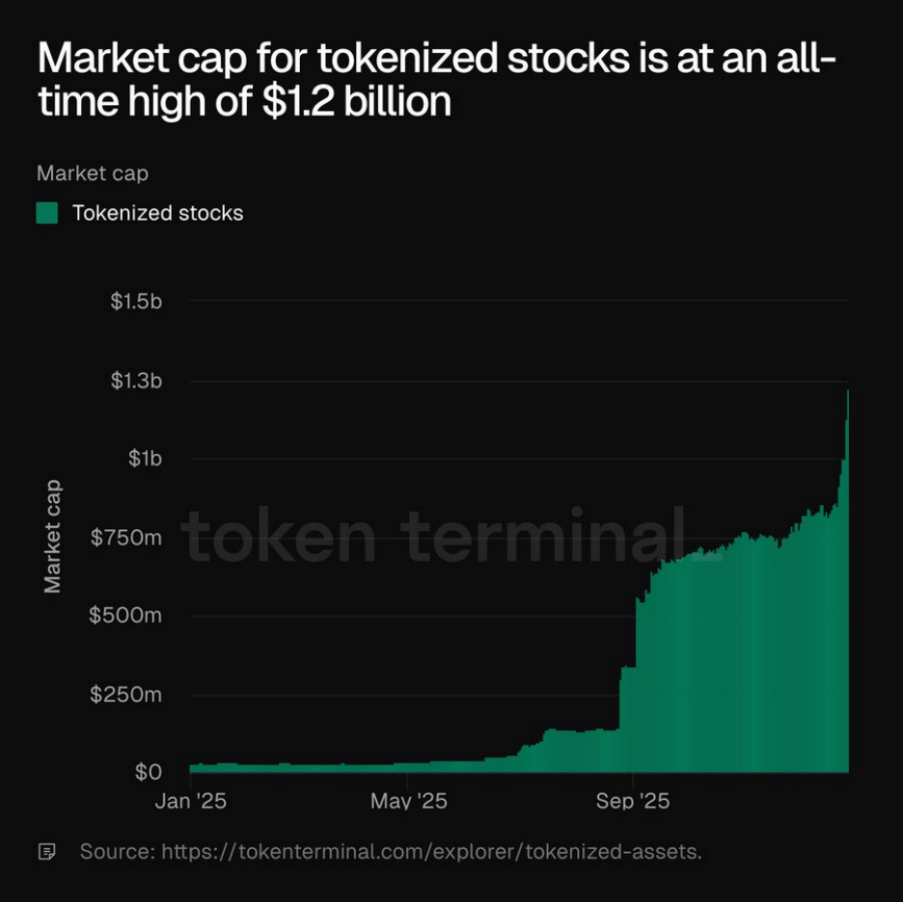

For example, data from Token Terminal and RWA.xyz shows that the total market capitalization of tokenized stocks has climbed to a record $1.2 billion; the tokenized commodities market has exceeded $4 billion, growing about 15% in the past month.

Among them, BlackRock's BUIDL fund has surpassed $1.7 billion in just one year, becoming the world's largest tokenized money market fund. Ondo's tokenized silver SLV has seen its market cap rise over 80% in 30 days to nearly $22 million.

Moreover, the complexity of the current macroeconomic environment has reached new heights. Changes in the leadership of the Federal Reserve, policy disruptions from the White House, and geopolitical conflicts have led to market pricing no longer following a single logic, but rather painting a turbulent asset map.

Reports from Reuters indicate that trade intervention measures by the Trump administration, including import restrictions on foreign-manufactured drones and key components, are triggering a new round of fluctuations in inflation expectations.

Under these conditions, the frequency of asset rotation is increasing. Investors need to pay attention not only to the growth curve of the crypto market but also to the performance of traditional market returns.

In this environment, crypto users urgently need a richer array of assets to meet their macro trading needs. They are no longer satisfied with betting on the next hundredfold MEME coin but require tools to manage the risks of their entire investment portfolio, including hedging against U.S. stock pullbacks, dollar fluctuations, or surging oil prices.

Addressing Three Major Pain Points in Cross-Market Trading, Creating a Unified Account with USDx

Although asset integration is an inevitable trend, for most crypto users, the trading experience across traditional and crypto markets is still fraught with "friction."

Cryptocurrency exchanges are the primary entry point for most users and an excellent testing ground for TradFi products. However, when accessing traditional assets, these platforms face three major challenges:

Fragmented assets and chaotic accounts: The separation of crypto accounts and securities accounts leads to low capital utilization, preventing cross-market margin sharing, and different accounting logics make real-time account synchronization difficult;

Low settlement efficiency and high costs: Traditional asset deposits and withdrawals typically involve T+2 settlement and expensive cross-border wire transfers and currency exchange fees, which cannot meet the immediate demands of crypto users;

Ununified risk control systems: The risk control standards for crypto assets and traditional assets are difficult to balance, leading to unnecessary liquidation risks.

In the face of these industry ailments, Gate TradFi has introduced a unified account logic based on USDx, providing targeted solutions.

Gate TradFi allows users to flexibly participate in the global traditional financial market with minimal capital costs through a contract for difference (CFD) model, where users trade price fluctuations rather than actual buying or holding of assets, with no expiration or delivery date.

In this model, the margin for CFDs is denominated in USDx, which is not a new cryptocurrency or fiat currency but merely an accounting unit within the account, pegged 1:1 to USDT. When users exit a trade, USDx will automatically convert back to USDT.

The design of USDx addresses the three major pain points of accounting logic, settlement efficiency, and risk control systems:

Accounting independence and transparency: Assets transferred to the TradFi account will be displayed in USDx, independent of the total assets in the main account. This isolation system helps mid-to-high-frequency traders and multi-strategy users more clearly calculate the profit and loss of TradFi assets without confusion with crypto holdings.

Instant settlement and zero costs: The fiat deposit and withdrawal processes of traditional brokers are lengthy and costly, involving bank fees and exchange rate losses. USDx allows crypto users to invest more funds in the traditional market with zero delay and zero additional costs.

Unified standards: Unified assets, unified reports, and unified risk control. Especially for mid-to-high-frequency investors, fragmented bills are a nightmare for review. Gate TradFi supports a unified reporting system, allowing users to view the volatility risks of crypto assets and the margin levels of traditional assets on the same screen.

This unified structure not only enhances capital utilization efficiency and lowers the entry threshold but also upgrades risk control. All assets (crypto and TradFi) are managed under a single account system, enabling the platform to monitor users' cross-market position risks in real-time, preventing systemic liquidations caused by significant shocks in a single market.

A Product Philosophy with More Native Crypto Genes, Breaking Financial Dimensional Walls with a Universal Account

Addressing industry pain points is just the foundation for attracting users; a quality experience is key to retention. Compared to other platforms, Gate TradFi showcases a distinctly different product philosophy.

First, Gate TradFi is committed to creating a one-stop trading entry for global markets, providing crypto users with the lowest barrier path to access diverse asset exposures.

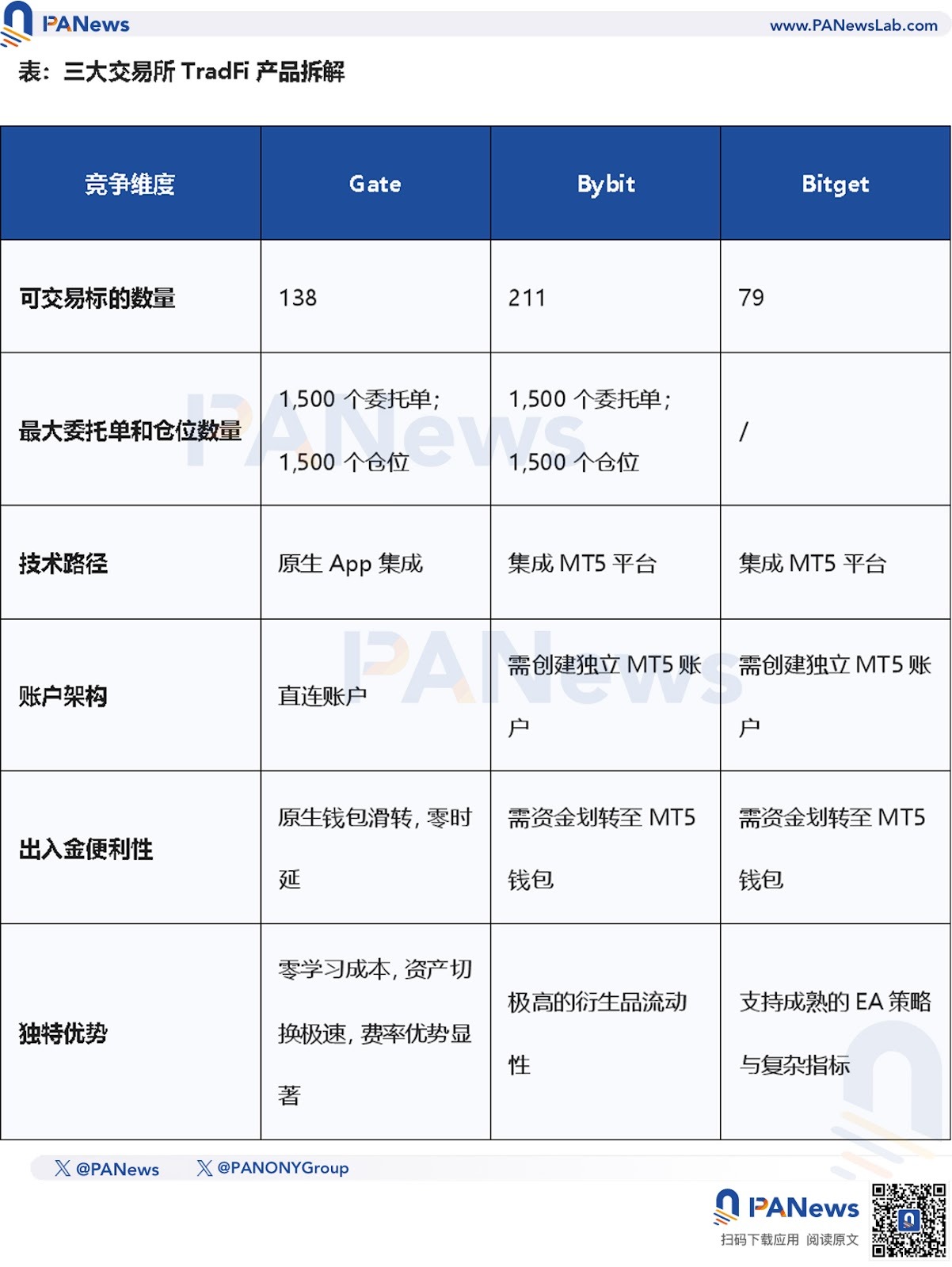

Gate is not the only player seizing the trend. Exchanges like Bybit and Bitget offer TradFi trading by integrating the MetaTrader 5 (MT5) platform, but this is a "professional yet cumbersome" route.

As the standard terminal for traditional financial trading, MT5 supports complex algorithmic strategies. By integrating MT5, exchanges can attract traders accustomed to traditional brokerage operations and those with mature quantitative strategies to smoothly enter the crypto ecosystem.

However, the MT5 platform requires users to create independent accounts, transfer funds separately, and familiarize themselves with a completely different interface. This operational process is more suitable for experienced financial veterans.

In the current market environment, the most expensive cost is the switching between platforms and time. Gate TradFi has chosen a more thorough "native integration" approach, embedding its functions within the main app, with spot and contract trading existing on the same product tree, without relying on third-party plugins or platform redirects.

At the same time, Gate TradFi has specifically optimized the UI for crypto users. Switching asset classes is as convenient as switching between BTC and ETH in a perpetual contract dropdown menu, balancing independent account records with a unified operational interface. This will truly achieve the effect of one-click direct connection from crypto accounts to traditional financial markets, enabling "digital assets + traditional assets" portfolio management.

This resembles a form of genetic selection. MT5 integration connects two worlds, while Gate TradFi attempts to merge them. The former serves professional traders coming from traditional finance, while the latter aims to empower all crypto-native users looking to expand their battlefield.

Second, Gate TradFi precisely covers the mainstream trading varieties preferred by crypto users, with its future asset pool expected to continue expanding, showing considerable growth potential.

Precious metals: Focus on supporting gold (XAU/USD). In the context of frequent geopolitical conflicts in 2025, gold's attributes as a traditional safe-haven asset are increasingly enhanced, making it the preferred choice for users hedging against portfolio volatility;

Foreign exchange (FX): Covers major currency pairs such as the U.S. dollar, euro, and yen. With leverage of up to 500 times, users can participate in the most liquid global markets with minimal margin;

Indices: Supports NASDAQ 100 (NAS100) and S&P 500 (SPX500). This allows crypto users to bet on the beta returns of U.S. stock indices with one click, without needing an overseas securities account;

Tech stocks: Focuses on highly recognized targets like Tesla, allowing for flexible long or short positions through CFDs.

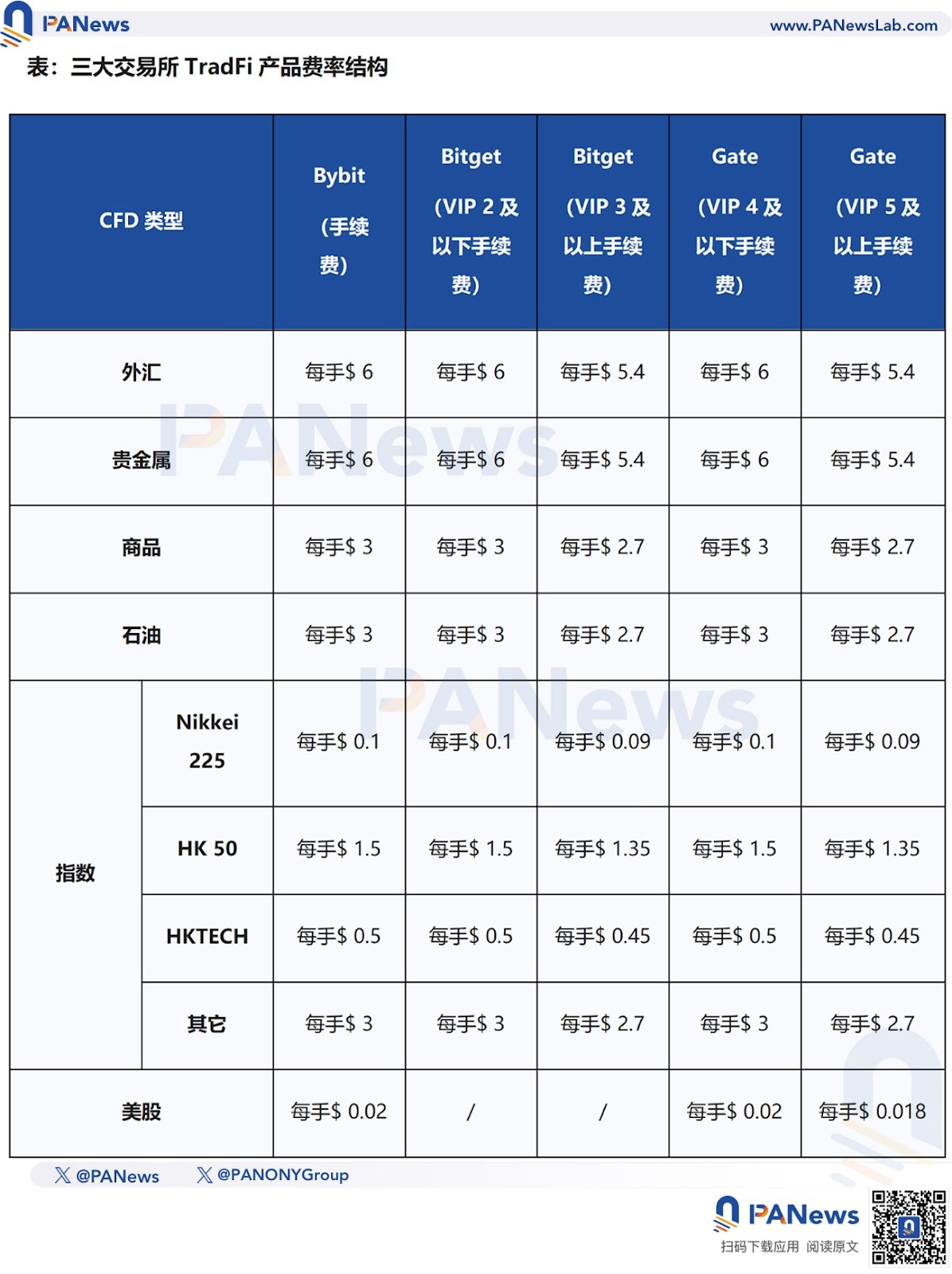

Finally, Gate TradFi balances low fees with high capital efficiency, demonstrating strong effectiveness in trading costs. According to official documentation, Gate has a more significant rate advantage and offers exclusive VIP rate tiers. Particularly in the derivatives market, it has maintained competitive maker and taker rates over the long term.

For medium to long-term capital, Gate's fee structure is also more competitive. When large amounts of capital are used for index arbitrage, the cost-saving effect will be exponentially amplified. This low-cost strategy is irresistibly attractive to quantitative users who frequently adjust their positions and day traders pursuing high turnover rates.

It is worth mentioning that CFDs do not hold physical assets but only trade the price fluctuations of assets, and the long and short positions of the same trading pair will hedge the margin based on the number of contracts. For example, holding a long position of 100 contracts and a short position of 100 contracts will result in a margin requirement of 0. Therefore, Gate TradFi also has a relatively high capital efficiency.

In horizontal comparison, compared to Bitget TradFi, Gate TradFi offers a greater number of tradable assets; compared to Bybit TradFi, Gate TradFi has a more advantageous fee structure.

With just one Gate account, users can simultaneously trade cryptocurrencies and TradFi assets, and the operational process for trading TradFi CFDs is identical to that of trading perpetual contracts, resulting in an almost zero learning cost.

This effectively resolves the issue of cognitive friction. Users no longer need to switch their mindset: they are cryptocurrency traders on platform A and stock traders on platform B. In Gate TradFi, they are always traders who profit from volatility, just with different underlying assets.

This efficiency advantage will provide users with the opportunity to hedge against macro fluctuations through TradFi trading, outlining a "second investment growth curve" beyond crypto trading.

Imagine when the Federal Reserve suddenly releases unexpectedly high non-farm payroll data, users can close their long BTC perpetual contracts and immediately open a short position in XAU (gold) or a long position in the Nasdaq within the same minute, without having to maneuver between different brokerage apps.

All operations are completed within seconds, with no need for cross-platform transfers, maximizing capital utilization. This is not just convenience; it represents a new level of strategic freedom. Those who can reallocate assets the fastest will be able to control risks and even seize opportunities. This second-level asset allocation capability will become one of the largest sources of Alpha in turbulent markets.

The year 2026 is destined to be a watershed moment. The crypto industry is moving away from frenzied speculation towards profound value creation and financial integration. When TradFi and crypto are no longer separated, the launch of Gate TradFi is not merely a simple product iteration or technological innovation; it is a precise capture of market sentiment and a strategic genetic recombination aimed at redefining the future of finance.

In this experiential revolution, users will bid farewell to the old era of repeated friction between fiat currency, banks, and exchanges, entering a new era of "one account, one type of margin, full asset participation."

For those accustomed to the speed of crypto, traditional finance is no longer the cumbersome, slow, high-threshold "antique," but an efficient hedging tool that can be called upon at any time.

The launch of Gate TradFi also points to a more fundamental trend: the barriers between asset classes are dissolving in the digital world. Assets are no longer fragmented by geographical location or technology stack; liquidity can freely migrate across the divide between crypto and traditional finance. The trading logic of future investors will no longer be limited by platforms but will fully serve their strategies.

In the overarching trend of everything going on-chain, cryptocurrency exchanges are becoming the all-in-one trading entry point of the digital age.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。