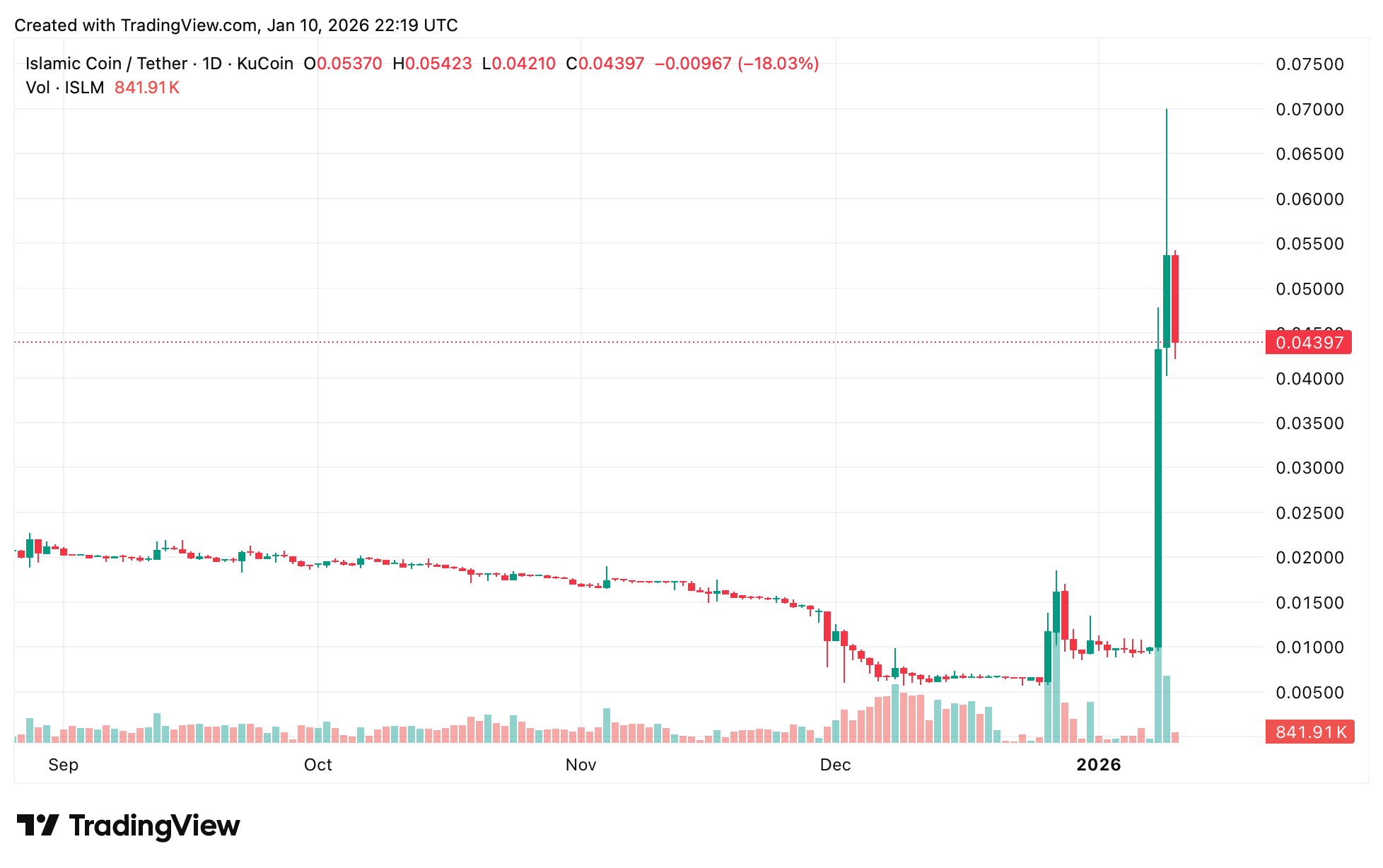

Islamic Coin (ISLM), the native utility token of the HAQQ network, ignited a massive market rally in early January 2026. The asset surged from a stagnant base of just under $0.01 on Jan. 8 to a peak of nearly $0.06 a day later, marking an explosive 470% gain within a 24-hour window.

While the price later stabilized in the $0.045–$0.05 range, the move effectively ended a long period of horizontal accumulation, propelling ISLM to the top of the week’s global performance charts. This price action catalyzed a shift in valuation as the Shariah-compliant asset’s market capitalization ballooned from approximately $23 million to over $120 million, reclaiming its position as a mid-cap contender after months of ranging in obscurity.

The primary fundamental driver for this vertical move was the official launch of Ethiq, the HAQQ network’s strategic Ethereum Layer 2 ( L2) solution. Announced via X, the HAQQ team positioned Ethiq as the “Unified Value Layer”—the liquidity and application anchor for the entire ecosystem.

The technical architecture of Ethiq offers institutional-grade security by inheriting the robustness of the Ethereum mainnet while leveraging the modularity and interoperability of the Optimism OP Stack. Furthermore, its full Ethereum Virtual Machine ( EVM) compatibility provides a seamless migration path for Ethereum developers to build Shariah-compliant decentralized applications ( dApps), all while serving as an economic engine designed to capture value from network activity and distribute it back to the HAQQ community.

Despite the successful technological rollout, ISLM remains a lightning rod for debate within both the crypto and Islamic finance sectors. While supporters champion its fatwa endorsement from globally respected scholars, the project continues to navigate a storm of criticism. Critics highlight a history of allegations involving fundraising transparency and past regulatory hurdles dating back to its 2023 launch.

Read more: Dubai Regulator Blocks the Sale and Distribution of Islamic Coin

The project has also faced scrutiny regarding potential links to illicit actors, a charge the HAQQ Association has vehemently denied. Furthermore, many purists slam the marketing of ISLM as an “ethics-first” asset, arguing that the inherent volatility and speculative nature of digital assets are fundamentally at odds with the spirit of Islamic finance.

While the momentum is undeniably strong, ISLM’s technical indicators signal a period of high-stakes price discovery. The peak at $0.06 pushed the relative strength index (RSI-14) into the 90+ range, indicating extreme overextension. Even with the minor retreat, the asset remains in deep overbought territory, suggesting that the initial fear of missing out (FOMO) phase is reaching saturation and a deeper mean reversion may be imminent.

Similarly, the moving average convergence divergence ( MACD) histogram confirms a powerful bullish crossover on the daily and weekly timeframes. However, the widening gap between the MACD and Signal lines reflects a parabolic “blow-off” structure, which typically precedes a phase of violent consolidation or a cooling-off period. Trading volume hit $8 million during the peak, its highest level in nearly two years, confirming that the rally was backed by capital inflow rather than thin liquidity.

In the short term, the technical outlook for ISLM remains decidedly bullish, with analysts eyeing a potential test of the $0.086 resistance if it can flip the $0.055 level into support. However, given the controversial narrative and the extreme verticality of the move, investors face a high risk of a sharp correction or a “ liquidity grab” as early buyers look to realize profits.

- What drove ISLM’s 470% surge? The launch of Ethiq, HAQQ’s Ethereum Layer 2, fueled the explosive rally.

- How did the market react worldwide? ISLM’s cap jumped from $23M to $120M, reclaiming mid‑cap status across global charts.

- Why is the project controversial? Critics cite past regulatory hurdles and fundraising transparency concerns despite fatwa endorsements.

- What’s the short‑term outlook for traders? Analysts warn of overbought signals and possible sharp corrections after the vertical move.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。