Author: zhou, ChainCatcher

At the beginning of 2026, the dramatic fluctuations in Bitcoin prices have once again brought crypto market maker Wintermute into the spotlight.

During the global market's weakest liquidity window over New Year's, Wintermute frequently injected large amounts into Binance, sparking strong community suspicions of "institutional secret dumping."

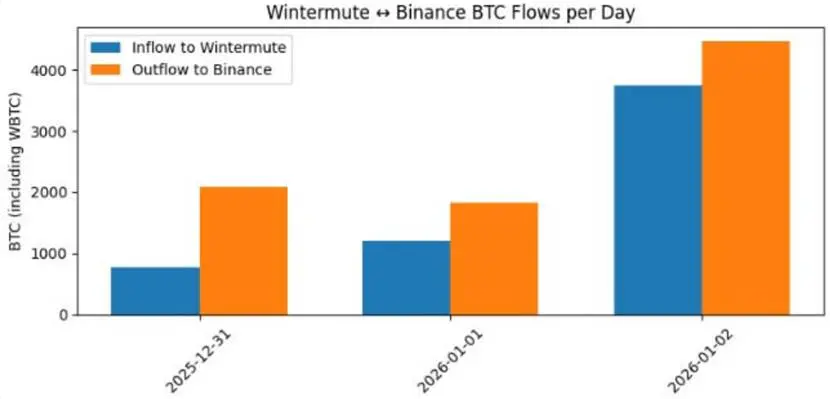

On New Year's Eve, Bitcoin's price hovered around $92,000. On-chain monitoring data showed that Wintermute net deposited 1,213 Bitcoins into Binance that day, worth approximately $107 million.

The timing of the transfer coincided with the late-night rest period for European and American traders and the closing phase of the Asian trading session, which is recognized as a time of extremely low liquidity. Under the pressure of this selling, Bitcoin's price quickly fell below the $90,000 mark.

In the following two days, Wintermute continued to maintain a high-frequency net deposit trend. On January 1 and January 2, the institution net flowed into Binance approximately 624 and 817 Bitcoins, respectively.

In just three days, it cumulatively injected 4,709 Bitcoins into Binance, withdrew 2,055 Bitcoins, resulting in a total net deposit of 2,654 Bitcoins. Meanwhile, Bitcoin's price accelerated downward on January 2, reaching a temporary low near $88,000.

This series of actions has once again led the market to question the role of market makers. Investors supporting the "manipulation theory" believe this is a case of institutions using their technical advantages to precisely hunt retail investors.

Malicious Dumping or Routine Inventory Management?

In fact, this is not the first time Wintermute has found itself in the whirlpool of public opinion.

Looking back at its past trajectory, Wintermute's financial presence has repeatedly appeared before major market shocks.

For example, on October 10, 2025, the crypto market experienced an epic liquidation of up to $19 billion, and just hours before the crash, Wintermute was monitored transferring a massive $700 million in assets to exchanges.

Additionally, from the SOL crash in September 2025 to the earlier governance proposal turmoil of Yearn Finance in 2023, this leading market maker has faced multiple accusations of "pump and dump."

In response to accusations of market manipulation, Wintermute and its supporters hold entirely different positions. The core dispute in this tug-of-war lies in how to precisely define the red line between "legitimate market making" and "malicious guidance."

Critics argue that market makers deliberately choose liquidity-dry holiday windows to inject spot liquidity, intending to artificially create selling pressure that precisely triggers retail stop-loss chains.

With deep cooperative relationships with mainstream exchanges and insights into market microstructure, market makers can easily create volatility through large orders during low liquidity periods, thus profiting from the washout.

However, Wintermute CEO Evgeny Gaevoy dismissed this as a "conspiracy theory." He emphasized in interviews that today's market structure is no longer comparable to the bankruptcy periods of Three Arrows Capital and Alameda in 2022. The current market system has greater transparency and more robust risk isolation mechanisms, and institutional capital allocation is primarily aimed at adjusting inventory or hedging risks.

Gaevoy stated that when there is a severe imbalance in buy and sell orders on exchanges, market makers must transfer positions to maintain liquidity supply. This behavior may objectively amplify short-term volatility, but subjectively, it is not intended for harvesting.

In fact, the ongoing controversy stems from the lack of a recognized judgment standard in the crypto market.

- In traditional securities markets, using financial advantages for false orders or deliberate price manipulation is a clear criminal offense;

- But in the 24/7, highly algorithmic world of crypto, how can one prove whether an institution's large transfers are for market rescue or arbitrage?

This lack of a judgment dimension keeps leading market makers like Wintermute in a tight spot of public opinion—viewed as the cornerstone of market liquidity while also recognized as an undeniable "invisible hand."

Exchanges and some industry analysts tend to believe that market makers are a "necessary evil" in the market ecosystem. Without such leading players providing bid-ask quotes, the volatility of cryptocurrencies could spiral out of control, potentially triggering systemic slippage disasters.

However, from the perspective of ordinary investors, institutions wielding capital, algorithms, and information have an overwhelming advantage, which, in an environment lacking rigid regulatory constraints, is bound to become a tool for improper profit-seeking.

The "Cyber Prisoner's Dilemma" Created by Transparency

While analyzing Wintermute's micro-operations, this New Year's turmoil has actually exposed a long-standing, almost paradoxical contradiction in the crypto world: the absolute transparency we pursue is increasingly becoming a soft spot for institutional games and a source of market noise.

In traditional finance, the position adjustments, inventory management, and internal capital allocations of institutions like BlackRock or Goldman Sachs are difficult for outsiders to glimpse unless they appear in quarterly reports or regulatory disclosures.

But in the world of blockchain, the privacy barrier has disappeared.

The essence of blockchain is openness and immutability, designed to prevent fraud and decentralization. However, as we have seen, every inflow and outflow related to BlackRock's ETF addresses, and every transfer from Wintermute to Binance's hot wallet, is like a public performance in a transparent glass house.

Institutional giants must accept the fact that every operational dynamic they undertake will be interpreted by monitoring tools as highly directional "dumping warnings" or "positioning signals."

Has this transparency truly brought fairness? The crypto world has long touted "everyone is equal before data," but the reality is that this extreme transparency has instead spawned more misinterpretations and collective panic.

For retail investors, the matching engines and order logic of institutions within centralized exchanges are difficult to discern; they often can only infer results through on-chain traces. Due to information asymmetry, any on-chain anomaly can be interpreted as a conspiracy theory, further exacerbating irrational market fluctuations.

Conclusion

When everyone in the market is focused on the wallet addresses of BlackRock and Wintermute, what we are trading may no longer be the value of Bitcoin itself, but rather suspicion and emotion.

The information gap is dead, but the cognitive gap lives on.

For investors, although the current market risk isolation has become more mature and is no longer prone to chain explosions, the sense of powerlessness that "data is visible, but the truth is opaque" seems to have never disappeared. In the extreme game of trading in crypto's deep waters, only by establishing an independent cognitive system that penetrates surface fluctuations can one find a sense of certainty that belongs to oneself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。