Original: Arthur Hayes

Translation: Yuliya, PANews

Imagine a video call between U.S. President Trump and Venezuelan President Pepe Maduro, while Maduro is flying from Caracas to New York.

Trump: "Pepe Maduro, you are a bad guy. The oil from your country is now mine, long live America!"

Pepe Maduro: "Trump, you crazy man!"

*Note: Arthur Hayes refers to the Venezuelan president as "Pepe Maduro" instead of his real name Nicolás Maduro; "Pepe" is a common nickname for "José" in Spanish. Although Maduro's name is Nicolás.

For this historic, subversive, authoritarian, militarized event of the U.S. "kidnapping" or "legally arresting" a leader of a sovereign nation, various positive or negative labels can be attached. Countless AI-assisted writers will surely churn out lengthy articles to interpret these events and predict the future. They will judge these actions from a moral perspective and suggest how other countries should respond. However, this article has no intention of doing that; the core question is simple: Will the U.S. "colonization" of Venezuela drive the price of Bitcoin/cryptocurrency up or down?

The Only Political Rule: Reelection

To answer this question, we must understand a simple and brutal political reality: all elected politicians focus on one thing at all times—winning reelection. As for grand narratives like God or country, they must come after winning votes. Because if you don't have power, you can't bring about change, so to some extent, this obsession with reelection is rational.

For Trump, two elections are crucial: the midterm elections in 2026 and the presidential election in 2028. Although he does not need to run in 2026 and cannot run for a third presidential term in 2028, the loyalty and obedience of his political supporters depend on their respective prospects for reelection. Those who stray from the "Make America Great Again" (MAGA) camp do so because they believe that if they continue to follow Trump's directives, their future electoral prospects will dim.

So, how can Trump ensure that undecided middle voters cast the "right" vote for the Democrats (blue camp) or Republicans (red camp) in November 2026 and 2028?

Currently, it seems likely that the blue camp Democrats will regain control of the House of Representatives. If Trump wants to be the winner, he must act immediately. There is little time left for policy adjustments to change voter positions.

What Do Voters Care About? The Economy, Especially Oil Prices

So, how to please middle voters? All the flashy culture wars are insignificant compared to voters' wallets. The only thing voters care about is the economy, whether they feel wealthy or poor when voting.

For Trump, the simplest way to stimulate the economy is to turn on the printing press and boost nominal GDP. This can raise the prices of financial assets, pleasing the wealthy class who will "reward" him with campaign donations. However, in the U.S., one person, one vote means that if printing money leads to severe inflation and the cost of living for ordinary people skyrockets, they will vote the ruling party out of office.

Trump and U.S. Treasury Secretary Mnuchin have stated that they will keep the economy running hot. The question is, how will they curb inflation? The kind of inflation that could doom reelection chances is inflation in food and energy.

For ordinary Americans, the most sensitive inflation indicator is gasoline prices. Because the U.S. public transportation system is underdeveloped, almost everyone drives, and gas prices directly affect everyone's cost of living.

Therefore, Trump and his team "colonized" Venezuela for its oil.

When it comes to Venezuelan oil, many will quickly point out that the country has the largest proven reserves in the world. But how much oil is underground is not important; the question is whether it can be extracted profitably. Trump clearly believes that by developing Venezuela's oil resources, oil can be delivered to Gulf Coast refineries, and cheap gasoline will soothe the populace by suppressing energy inflation.

Whether this strategy is correct will be answered by the West Texas Intermediate (WTI) and Brent crude oil markets. With the increase in nominal GDP and the supply of dollar credit, will oil prices rise or fall? If GDP and oil prices rise in sync, the blue camp Democrats will win; if GDP rises while oil prices remain stable or fall, the red camp Republicans will win.

The best part of this framework is that oil prices will reflect the reactions of other oil-producing countries and military powers (most importantly Saudi Arabia, Russia, and China) to the U.S. "colonization" of Venezuela. Another advantage is that the market is reflexive. We know Trump will adjust policies based on stock prices, U.S. Treasury bonds, and oil prices. As long as stock prices continue to rise and oil prices remain low, he will continue to print money and pursue "colonization" policies to obtain oil. As investors, we can react within the same timeframe as Trump, which is the best-case scenario we can hope for. This reduces the need to predict the outcomes of complex geopolitical systems. Traders just need to read the charts and adapt.

Here are some chart data and statistical analyses that clearly show why Trump must boost nominal GDP while keeping oil prices low to win the election:

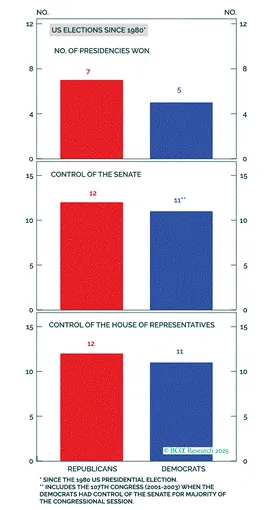

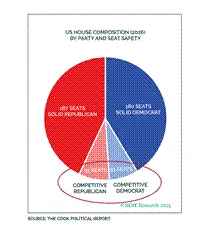

Political Landscape: The red and blue camps are evenly matched, with only a small portion of Americans determining which camp controls the government.

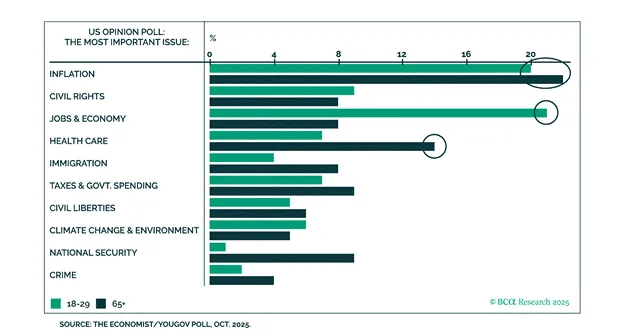

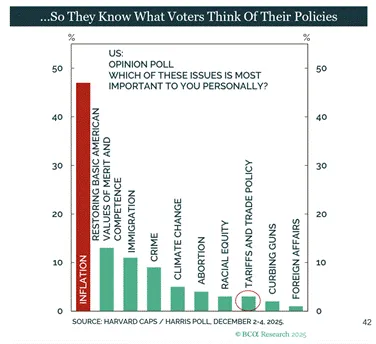

Voter Focus: The economy and inflation are the two biggest concerns for voters; everything else is irrelevant.

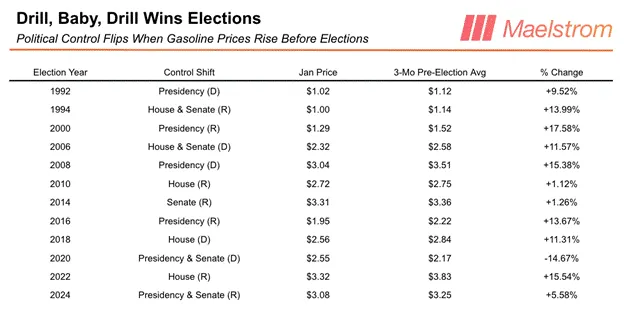

"10% Rule": When the national average gasoline price three months before the election rises by 10% or more compared to the average price in January of the same year, control of one or more government departments will change hands.

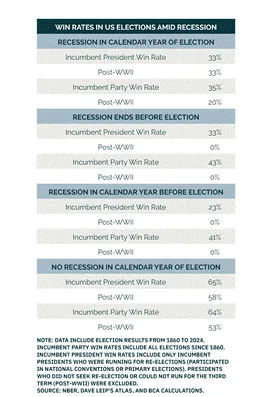

Election Prospects: If the economy does not enter a recession, the red camp has the best chance of winning the 2028 presidential election.

These charts clearly indicate that Trump must keep the economy running hot without causing gasoline prices to rise.

Bitcoin's Movement in Two Scenarios

We face two scenarios: one where both nominal GDP/credit and oil prices rise; the other where nominal GDP/credit rises while oil prices fall. How will Bitcoin react?

To understand this, one must first clarify a core point: the importance of oil prices is not because they affect mining costs, but because they have the power to force politicians to stop printing money.

Bitcoin consumes energy through proof-of-work (PoW) mining, making it a purely abstract monetary concept. Therefore, energy prices themselves are not related to Bitcoin prices, as the costs for all miners change synchronously, which does not alter the intrinsic value logic of Bitcoin.

The real power of oil prices lies in their ability to trigger political and financial disasters.

The Chain Reaction of Out-of-Control Oil Prices

If economic expansion leads to oil prices rising too quickly and too high, it will trigger a series of devastating chain reactions:

Out-of-control oil prices mean skyrocketing living costs for the populace, which will directly ignite voter anger, putting those in power at great risk of being ousted. To retain power, they must suppress oil prices at all costs (for example, by stealing oil from other countries or slowing down credit creation). The yield on 10-year U.S. Treasury bonds and the MOVE index, which measures volatility in the U.S. bond market, will tell us when oil prices are too high.

Investors face a tough choice: invest in financial assets or physical assets. When energy costs are low and stable, investing in financial assets like government bonds makes sense. But when energy costs are high and volatile, investing in energy commodities is wiser. Therefore, when oil prices reach a certain level, investors will demand higher yields from government bonds (especially 10-year U.S. Treasury bonds).

When the yield on 10-year U.S. Treasuries approaches 5%, market volatility may significantly increase, and the MOVE index may soar. Current U.S. politics struggles to curb deficit spending, and "free benefits" often dominate elections. However, as oil prices rise and yields approach critical levels, the market may face pressure. Due to the embedded leverage in the current fiat currency financial system, when volatility rises, investors must sell assets, or they will face total loss.

For example, the "Liberation Day" on April 2 last year and the subsequent Trump "TACO" (Tariff Action) on April 9 is one such instance. At that time, Trump threatened to impose extremely high tariffs, which would reduce the imbalances in global trade and financial flows, thus creating a strong deflationary effect. The market plummeted, and the MOVE index briefly soared to 172. The next day, Trump "paused" the tariffs, and the market bottomed out and rebounded sharply.

MOVE Index (white) compared to Nasdaq 100 Index (yellow)

In such matters, trying to precisely determine through historical data at what levels oil prices and 10-year yields would force Trump to tighten money printing is meaningless. We will know when we see it happen. If oil prices and yields rise sharply, then we should reduce our optimism about risk assets.

The current baseline scenario is that oil prices will remain stable or even decline, while Trump and Mnuchin will print money like crazy, just as they did in 2020. The reason is that the market will initially believe that U.S. control over Venezuelan oil will significantly boost daily crude oil production. Whether engineers can actually achieve millions of barrels per day in Venezuela is irrelevant.

What truly matters is that the speed at which Trump prints money will be faster than Israeli Prime Minister Benjamin Netanyahu's constantly changing justifications for striking Iran. If this logic is still not enough to convince people that now is the time to go long on all risk assets, just remember one thing: Trump is the most socialist-leaning U.S. president since Roosevelt. He printed trillions of dollars in 2020 and, unlike previous presidents, directly distributed money to everyone. You can be sure he will not lose the election due to insufficient money printing.

From the statements of Trump and his core team, we know that credit will expand. Red camp Republican lawmakers will engage in deficit spending, Mnuchin's Treasury will issue debt to finance it, and the Federal Reserve (whether Powell or his successor) will print money to buy these bonds. As Lyn Alden said, "Nothing can stop this train." As the quantity of dollars expands, the prices of Bitcoin and certain cryptocurrencies will soar.

Trading Strategy

Arthur Hayes' biggest losses last year came from trading the token PUMP after its launch. Additionally, remember to stay away from meme coins; the only profitable meme coin trade he made last year was TRUMP. On the positive side, most of the profits came from trading HYPE, BTC, PENDLE, and ETHFI. Although only 33% of trades were profitable, the position sizes were well controlled, and the average profit from winning trades was 8.5 times the average loss from losing trades.

Arthur Hayes plans to improve this year by focusing on areas he excels in, namely deploying large mid-term positions based on clear macro liquidity arguments, combined with a credible "altcoin" narrative. When trading "junk coins" or meme coins for entertainment purposes, he will reduce position sizes.

Looking ahead, this year's dominant narrative will revolve around "privacy." ZEC will become a bellwether in the privacy space. Maelstrom has already taken a large long position in this token for Q3 2025, planning to find at least one "altcoin" that can lead the trend in the privacy space and bring excess returns to the portfolio in the coming years. To achieve excess returns beyond BTC and ETH, he plans to sell some Bitcoin and Ethereum in exchange for more explosive "altcoins" in the privacy and DeFi sectors.

Once oil prices rise and lead to a slowdown in credit expansion, he will take the opportunity to lock in profits, accumulate more Bitcoin, and buy some mETH.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。