Author: zhou, ChainCatcher

2025 will be a year of dramatic differentiation in the global asset market.

Geopolitical conflicts, recurring inflation, the explosion of AI technology, and large-scale purchases by central banks are driving a strong return of traditional hard assets, while cryptocurrencies are under pressure in the tug-of-war between institutional expectations and macro realities.

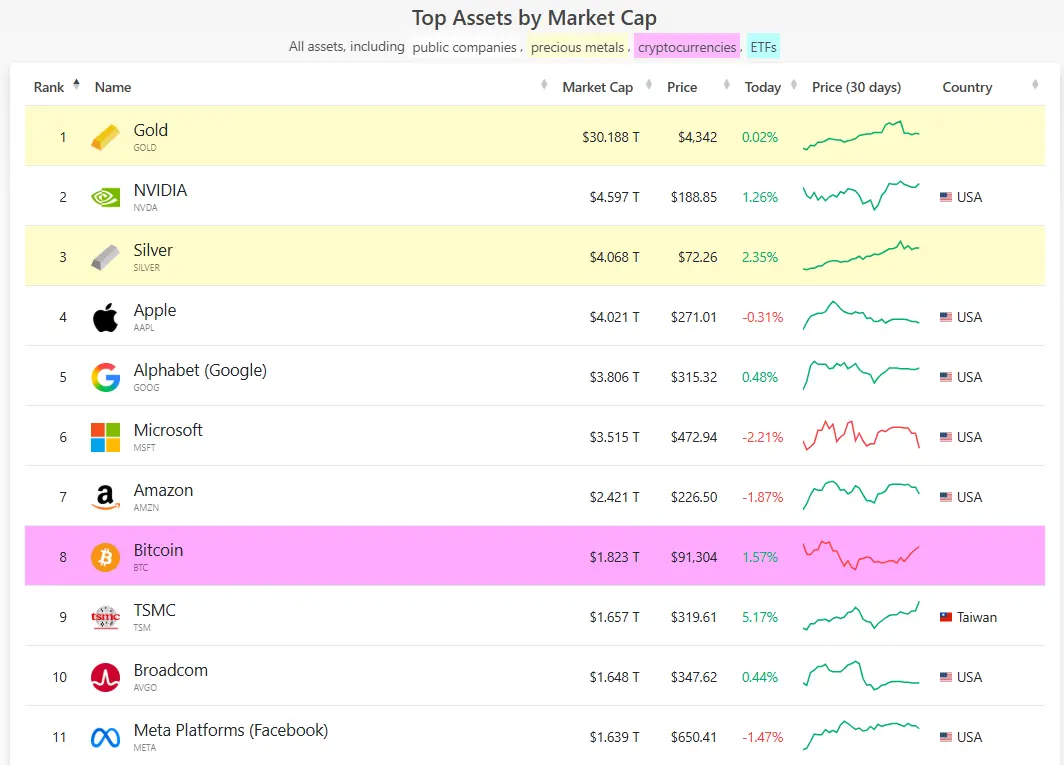

Top Ten Global Asset Changes in 2025: Gold Dominates, Silver Rises, Bitcoin Peaks and Falls Back

According to CompaniesMarketCap data, the ranking of the top ten global assets in 2025 shows profound structural adjustments. Gold leads with a theoretical market value of about $30 trillion, while silver's market value approaches $4 trillion, placing it in the top three. Technology stocks occupy the middle of the ranking, while Bitcoin's market value is about $1.8 trillion, dropping to eighth place.

Hard Assets Gold and Silver Dominate the Year’s Narrative

As the king of safe-haven assets, the price of gold soared from $2,630 at the beginning of the year to $4,310 by year-end, marking an increase of over 65%, the highest in 46 years. Driven by central bank purchases and geopolitical risk aversion, its market value nearly doubled, surpassing the total of all listed companies. Silver emerged as the biggest dark horse of the year, with its price skyrocketing from $29 at the beginning of the year to $72, achieving a 150% increase that far exceeded gold. In addition to its safe-haven attributes, the explosive growth in industrial demand from photovoltaics and AI computing power propelled silver from a marginal asset into the global top three.

AI-Related Tech Stocks Strong but Entering a Digestive Phase

NVIDIA, as the leading chipmaker, saw its market value grow by 30% to $4.6 trillion, briefly surpassing the $5 trillion mark during the year. TSMC and Broadcom benefited from the demand for computing power, with both their market values climbing from $1 trillion to $1.6 trillion, an increase of 60%. Although the AI sector as a whole reached historical highs, its growth rate became more stable, reflecting a more cautious market assessment of productivity realization.

Bitcoin Peaks and Falls Back, Relatively Weak

Although Bitcoin surged to $126,000 mid-year, briefly entering the global top five in market value, the flash crash and volatility in the fourth quarter brought its year-end price back to around $88,000. The annual return rate was -8%, marking the first time Bitcoin recorded negative returns in the year following a halving cycle.

Established Tech Giants Perform Steadily but Generally Lack Explosiveness

Alphabet recorded a 52% increase thanks to the integration of Gemini AI, raising its market value to $3.8 trillion. Amazon, Microsoft, and Apple saw increases ranging from 14% to 33%. Despite their dominance in search, cloud computing, and consumer electronics, overall growth has significantly slowed. Meta, with its Llama model and record interaction on social platforms, increased its market value to $1.67 trillion, competing closely with Broadcom for the tenth spot by year-end.

It is worth mentioning that in the reshuffling of asset rankings in 2025, several traditional giants were pushed out of the top ten. Among them, Eli Lilly, which previously led due to the weight-loss drug boom, fell to around 15th place due to the siphoning effect of AI themes leading to slowed growth. Additionally, companies like Tesla and Saudi Aramco were close to or briefly entered the top ten at the beginning of the year but fell to the 15-20 range by year-end due to intensified EV competition, oil price fluctuations, and explosive growth in tech/precious metal assets. This series of changes highlights the structural shift of global capital between the foundational AI computing power and the safe-haven demand for hard assets.

Overall, the turning point in the global asset market in 2025 lies in the suppression of tech stock market values by hard assets. Tech stocks faced bubble concerns at historical highs, while Bitcoin experienced a transition from frenzy to fatigue in its high-open, low-close trajectory, becoming a relative loser for the year.

Why Did Bitcoin Perform Worse Than in Previous Years? The Narrative Shifted from Frenzy to Fatigue

Bitcoin's performance in 2025 exhibited a typical pattern of initial rise followed by decline. At the beginning of the year, driven by expectations of pro-crypto policies, large-scale inflows into institutional ETFs, and macroeconomic easing, its price started at the $90,000 mark and reached a historical high of $126,000 in October, with its market value briefly surpassing $2.4 trillion.

However, the situation took a sharp turn in the fourth quarter, with a severe flash crash driving the price down to a low of $84,000, ultimately closing the year at around $88,000, resulting in an approximate -8% return. Compared to gold's 70% and silver's over 140% increases, Bitcoin's relative weakness reflects its vulnerability in a complex macro environment.

Several factors contributed to this performance.

First, tightening macro liquidity and pressure from the reallocation of funds. In the second half of the year, the Federal Reserve's interest rate cuts were slower than expected, coupled with the Bank of Japan maintaining a rate hike stance, leading to tightening global liquidity. Funds were forced to withdraw from high-volatility assets and flow into safer assets like gold, silver, or productivity-oriented equity markets. Meanwhile, Bitcoin's correlation with U.S. stocks surged from 0.23 at the beginning of the year to over 0.86 by year-end, gradually losing its appeal as an independent asset allocation.

Second, selling by long-term holders and leveraged liquidations amplified market volatility. In 2025, the old whale group sold a record 1.6 million Bitcoins, creating sustained supply pressure. The flash crash on October 10 erased months of gains in a very short time, triggering a chain reaction in the derivatives market. Matrixport noted that since the peak in October 2025, the leverage corresponding to the open interest of BTC and ETH futures has been cleared by nearly $30 billion, with excessive leverage making it difficult for the market to quickly restore confidence after the crash.

Furthermore, the slowdown in institutional adoption further exacerbated downward pressure. Although Bitcoin ETFs maintained net inflows throughout the year, there were billions of dollars in withdrawals in the fourth quarter. The pace of corporate accumulation was also significantly constrained, and as the stock prices of some companies holding digital assets (DAT) fell, the market saw a phase of selling Bitcoin. The cooling of institutional sentiment directly suppressed year-end market performance, preventing Bitcoin from continuing its previous year's brilliance in 2025.

What is the Future of Bitcoin?

Despite Bitcoin recording negative returns in 2025 and breaking the traditional four-year cycle expectations, the consensus at the institutional level remains optimistic. The market generally believes that this year's deep adjustment is paving the way for a more sustainable and institution-driven upward trend in the future.

With the arrival of 2026, as global macro liquidity gradually improves and the regulatory environment becomes clearer, Bitcoin is expected to end its current period of volatility and return to a growth trajectory, potentially challenging new historical highs.

According to various media summaries, current public forecasts show that analysts such as Tom Lee, Standard Chartered, and Bernstein are generally bullish, but there are also divergences.

Mainstream target prices mostly fall around $140,000 to $170,000, for example:

J.P. Morgan, based on a volatility-adjusted gold-to-Bitcoin model, estimates a theoretical fair value of about $170,000, believing Bitcoin still has significant upside potential.

Standard Chartered and Bernstein set their end-of-2026 targets around $150,000, emphasizing that ETF inflows, structural support after the slowdown in corporate treasury adoption, and long-term inflows of institutional capital will dominate the cycle.

Grayscale defines 2026 as the dawn of the institutional era, expecting Bitcoin to reach a new historical high in the first half of the year, ending the traditional four-year cycle and shifting to a robust upward trend driven by sustained institutional demand.

Bitwise believes that ETFs will absorb over 100% of new supply, further strengthening price support, and predicts that 2026 will belong to the bulls. Citigroup's baseline scenario is $143,000, with a bullish scenario reaching $189,000.

Beyond these mainstream views, there are also more aggressive perspectives, such as Cardano founder Charles Hoskinson predicting Bitcoin could reach $250,000, citing the fixed supply of Bitcoin and the continuous growth of institutional demand as powerful driving forces.

However, there are also significant bearish voices in the market. Mike McGlone from Bloomberg Intelligence is the most pessimistic, believing that in a deflationary macro environment, Bitcoin could fall to $50,000 or even $10,000, particularly emphasizing the mean reversion risk faced by speculative assets.

Matrixport believes that 2026 will be a year of high volatility rather than a smooth trend. Influenced by changes in the Federal Reserve leadership, a weak labor market, and policy risks in an election year, the market will face a dense window of risk events. The institution advises investors to remain flexible and actively manage positions, accurately grasping market exposure before and after key policy events.

Overall, despite significant divergences in forecast data, mainstream institutions generally agree that 2026 will be a year of structural rebound for Bitcoin. ETFs as a permanent demand engine, regulatory clarity, and accelerated corporate/institutional allocation will become core catalysts. In the short term, Bitcoin prices may bottom out in the $80,000 to $100,000 range, but as the macro environment shifts and funds flow back, the probability of an upward breakout is significantly increasing.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。