Author: Frank, PANews

In the fluctuating cycles of cryptocurrency, the standard for measuring the scale of an exchange often lies not in its expansion speed during favorable conditions, but in how stable it stands during adverse winds. Bybit's performance in 2025 not only exemplified this resilience but also unexpectedly staged a "counter-trend comeback."

On December 22, Bybit's 24-hour spot trading volume exceeded $9 billion, surpassing Binance to claim the top spot in the cryptocurrency industry's spot trading market share. Observing its recent trading volume curve, one can see an explosive rise in daily trading volume: starting from $2.2 billion on December 16, it broke through the $9 billion mark in just one week, with a weekly increase of over 4 times.

This performance is not a coincidence but a resilience dividend released by Bybit after undergoing extreme stress tests. For Bybit, 2025 was an extremely tumultuous year, completing a deep V reversal from the "survival test" under the shadow of a $1.4 billion hack at the beginning of the year to becoming the "king of spot trading" by the end of the year.

How did Bybit manage to rise against the wind in a market that was "wintering"? Reviewing the journey of this year not only allows us to re-recognize this highly "resilient" giant but also provides insight into the underlying logic of the reshaping of the cryptocurrency industry landscape.

From Resilience to Expansion, Challenger Transforms into "Defending Giant"

When mentioning Bybit, many early users still associate it with the derivatives newcomer founded by former forex veteran Ben Zhou in 2018, which entered the market with "extreme trading experience" and "perpetual contracts." However, entering its seventh year, Bybit is no longer the challenger of yesteryear; it has grown into a comprehensive platform covering spot, derivatives, Web3, and institutional business.

Bybit's transformation is visually reflected in the leap in user numbers. Over the past year, Bybit's global registered users surged from 50 million to over 79 million, with a nearly 60% increase in just one year.

This leap in scale not only means Bybit has a broader user base but also directly translates into its increasingly enhanced pricing power in the market.

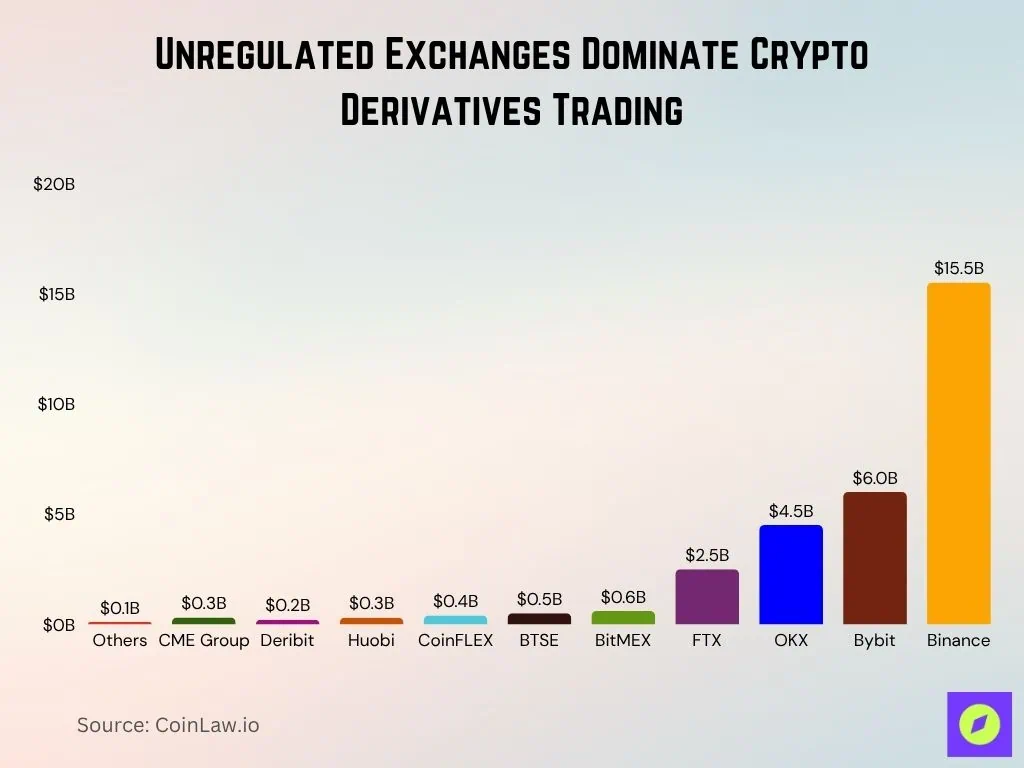

According to a report released by coinlaw.io in November, Bybit's average daily trading volume is about $6 billion, second only to Binance, ranking second in the market.

Since December, this growth has become even more pronounced. On December 7, Bybit's daily spot trading volume was about $1.4 billion, and by December 22, this figure had grown to a peak of $9.1 billion, with the maximum increase in the month reaching 5.5 times, topping all exchanges in trading volume. More importantly, this increase occurred while the entire market was in a downturn, further showcasing Bybit's resilience and competitiveness.

In addition to the booming retail market, institutional funds are also shifting towards Bybit. At a recent institutional gala in Dubai, a set of data disclosed by Ben Zhou was noteworthy: the platform's institutional assets under management have grown from $40 million in the third quarter to $200 million in the fourth quarter. As of December 22, Bybit's exchange assets ranked fourth among all exchanges at $19.5 billion.

With the rise of on-chain trading, a large amount of capital has begun to shift, and several cryptocurrency exchanges have started to layout on-chain trading. Bybit has also not confined itself to centralized business; by launching Bybit Alpha and incubating Byreal on the Solana chain, it has seized the opportunity of on-chain capital overflow.

Taking Byreal as an example, since its launch in October, it achieved over $1 billion in trading volume in just 10 weeks. At the beginning of December, Byreal ranked fifth in the 30-day fee and revenue list on the Solana DEX leaderboard by DefiLlama.

Moreover, Bybit's business lines have recently made significant progress. Through a strategic partnership with Mantle Network, it has expanded MNT into a multifunctional asset, supporting fee discounts, RWA tokenization, institutional leverage, and high-yield staking. On the compliance front, Bybit has obtained the EU MiCA license and a full license in the UAE, and recently announced its return to the UK market. In derivatives, the Bybit Card has launched real-time conversion payments and high cashback activities, integrating cryptocurrency into everyday consumption scenarios. These layouts further strengthen Bybit's positioning as a comprehensive and compliant platform, bridging DeFi innovation and TradFi capital inflow.

From the continuous expansion of user scale to topping spot market trading volume, and the strong explosion of on-chain markets and derivatives business. The data outlined here shows that Bybit is no longer just a "distinctive exchange," but a "behemoth" that has already seated itself at the top of the industry.

$1.4 Billion Black Swan Strikes, Bybit Stages Liquidity Miracle

However, for Bybit, this year was also a crucial year about survival and rebirth.

In February, Bybit's start could be described as "hell mode," as it unexpectedly faced the largest single hacking incident in cryptocurrency history, with $1.46 billion stolen. Such a high-profile black swan event did not crush Bybit; instead, it showcased a textbook-level crisis response, demonstrating a different kind of "resilience."

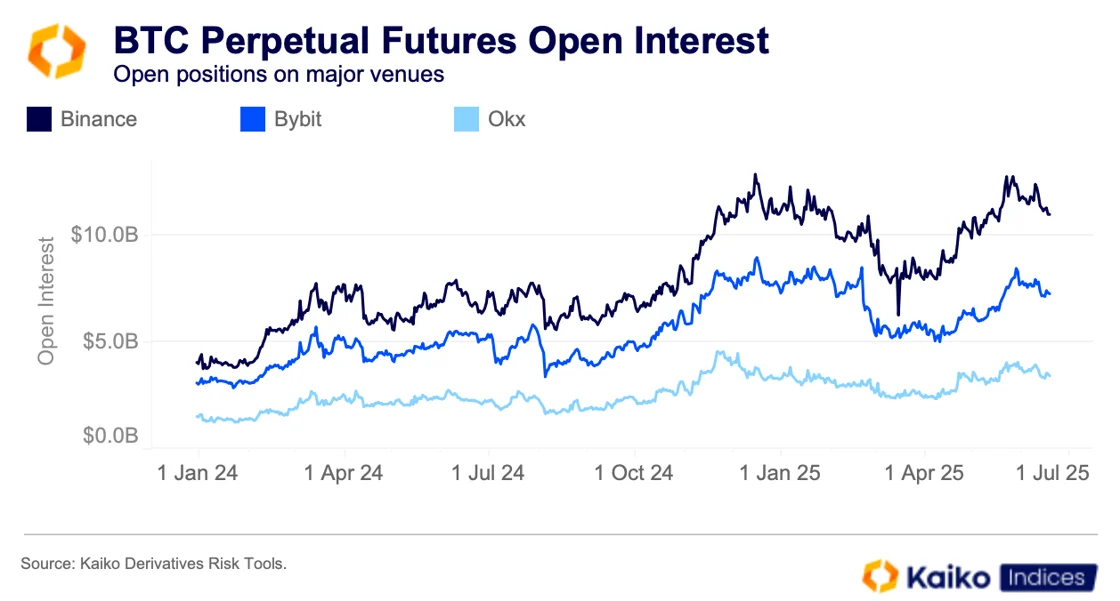

According to a report released by research firm Kaiko, Bybit's recovery speed after the hack exceeded industry expectations. The report noted that Bybit's Bitcoin liquidity returned to about $13 million per day within 30 days after the security incident, completely offsetting the liquidity gap caused by the attack.

In terms of exchange assets, after the hacking incident, a large amount of capital was withdrawn from the exchange due to panic, causing Bybit's exchange assets to drop by $3 billion, plummeting from $16.9 billion to around $13 billion. However, within just one month, Bybit's funds returned to pre-attack levels. By March 25, Bybit's exchange assets had risen back above $15.3 billion. In May, it successfully exceeded pre-attack levels and reached a historical high of $29.3 billion in October.

When the crisis occurred, such a massive loss raised concerns about Bybit's development. However, when it stated that it had sufficient funds for payouts, expectations may have been slightly adjusted. More importantly, for everyone, it might not have been too optimistic about Bybit's development this year, let alone whether it could return to the forefront of the industry or even top the market.

However, this ability to quickly recover under extreme pressure is rare in the cryptocurrency industry and has become an important validation case for Bybit's reliability. Behind a series of data is the premium of user trust in Bybit, which has established a solid brand moat. For traders, a platform that can withstand massive losses and adhere to rigid payouts has instead built a higher dimension of trust.

Continuous "Warm Offensive," Real Money for Growth

Exploring the profound reasons behind Bybit's growth, in addition to strengthening its security foundation, high-intensity incentive activities are the biggest driving force behind its recent rise in activity against the trend in the current sluggish cryptocurrency market.

Coinciding with its seventh anniversary, Bybit launched the "7UpBybit" event, with an official total prize pool of up to $2.5 million. Users can earn points and upgrade avatars through completing tasks and new gameplay to ultimately share in these prizes. On December 22, Bybit's official data showed that the reward distribution amount reached $230,000 within 24 hours. This incentive directly made Bybit one of the exchanges with high user activity recently.

In-depth cooperation with new projects (such as Airdrop + exclusive trading rewards) has also brought significant increments. For example, for the NIGHT project launched on December 9, Bybit introduced a dual Token Splash event with a total prize pool of 200 million NIGHT (worth several million dollars). Among them, new user deposits can share 80 million tokens as rewards, with the first 32,000 users on the rules averaging 2,500 tokens (worth about $250). The remaining 120 million tokens can be earned by generating over $500 in trading volume, with the highest share being able to receive 200,000 NIGHT tokens (worth about $20,000). Such reward amounts have a significant stimulating effect on ordinary retail investors; as of December 22, 64,000 users had participated in this event.

At the same time, such activities have also significantly stimulated Bybit's trading volume. On December 22, NIGHT's trading volume across the network exceeded $9.2 billion, with Bybit's daily trading volume reaching $7.1 billion, accounting for over 77% of the total network trading volume, making it the main liquidity carrier for NIGHT trading.

Of course, Bybit's recent ecological stimulation is not limited to this; a series of activities such as spending rewards through Bybit Card or Bybit Pay and high rewards from Bybit Earn will also be launched around Christmas. From trading, finance to payment, these intensive cash-splashing activities provide retail investors with a "subsidy" similar to a timely help in a quiet market. From a strategic perspective, while most platforms choose to shrink and defend during the market's quietest times, Bybit's real cash "subsidy" activities have instead become the most efficient customer acquisition method.

Looking back at Bybit's seventh year, from the darkest moments at the beginning of the year to the brilliant comeback at the end of the year, this is undoubtedly the most dramatic "Comeback Story" in the cryptocurrency industry and a watershed moment in Bybit's development history.

The ups and downs of this year have proven to the outside world that true giant status is not achieved through expansion in favorable conditions, but through the courage to withstand pressure and the determination to expand against the trend in adversity. Standing at the new starting point of 80 million users, Bybit is showcasing a new image of being more "resilient" and "innovative" to the market, and this tumultuous data bill may be Bybit's most effective way to flaunt its achievements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。