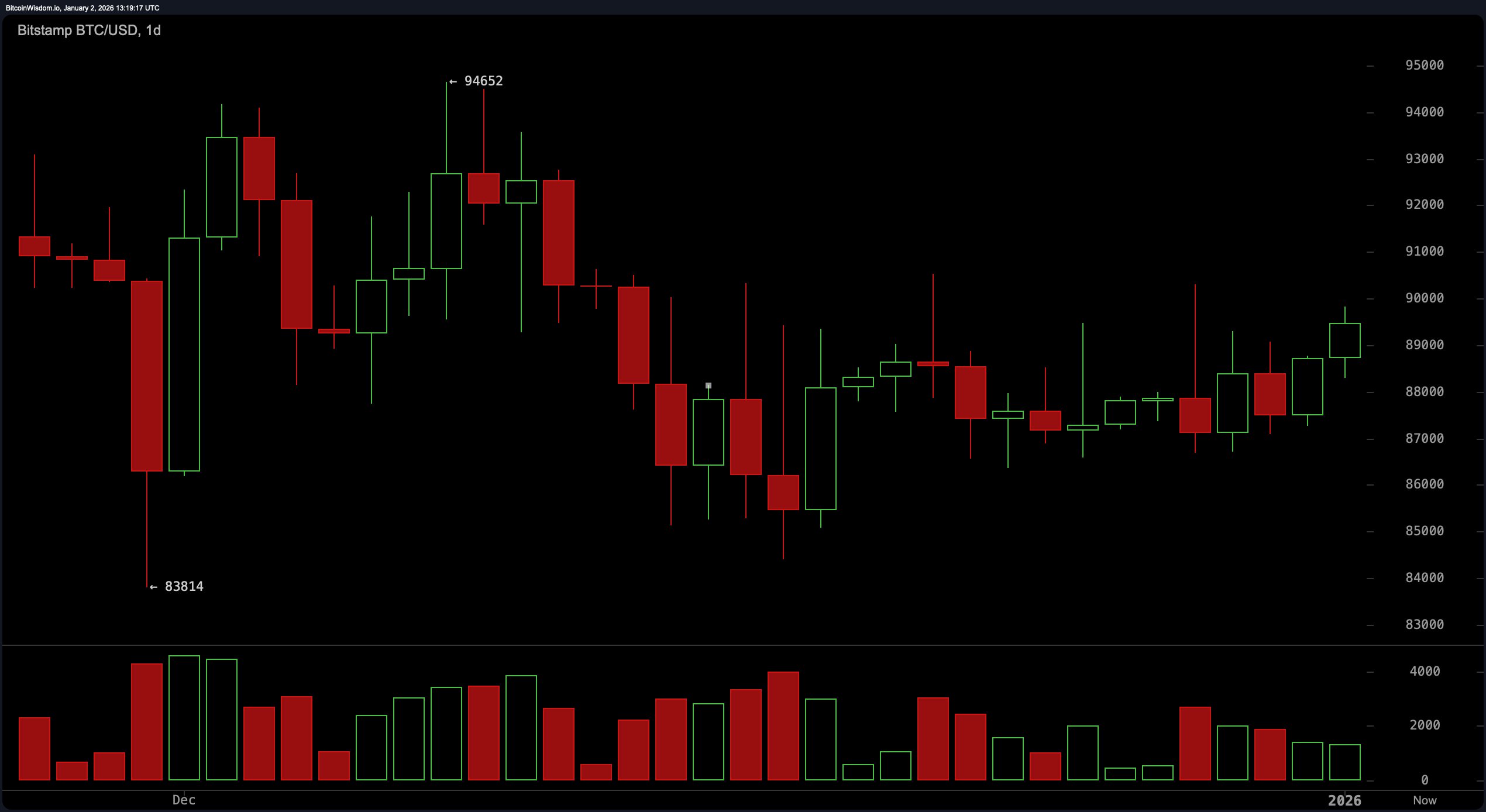

Bitcoin’s daily chart paints the picture of a hesitant phoenix. After a clear downtrend, the asset formed a rounded base and began a cautious climb, not unlike a hangover recovery from December’s sell-offs. Prices now hover around $88,500–$89,500, but the celebration might be premature.

While recent candles are showing bullish inclinations, the decrease in volume suggests a rally that’s running on fumes. Oscillators like the relative strength index ( RSI) at 52, the Stochastic at 64, and the commodity channel index (CCI) at a lofty 170 all read neutral, hinting that the market has yet to fully commit to a direction.

BTC/USD 1-day chart via Bitstamp on Jan. 2, 2026.

The 4-hour chart offers a more suspenseful narrative. After plunging to a low near $86,701, bitcoin staged a gradual recovery, eyeing its former glory at $90,307. Now parked near the resistance zone between $89,500 and $90,000, the price has been repeatedly turned away like an uninvited guest at the gates. Support lies at $87,000, a line that’s held firm but looks increasingly weary. While the momentum (10) indicator at 2,015 and the moving average convergence divergence ( MACD) level at −623 both hint at upward pressure, multiple rejections near $90k suggest bitcoin is going to need more than charm to break through.

BTC/USD 4-hour chart via Bitstamp on Jan. 2, 2026.

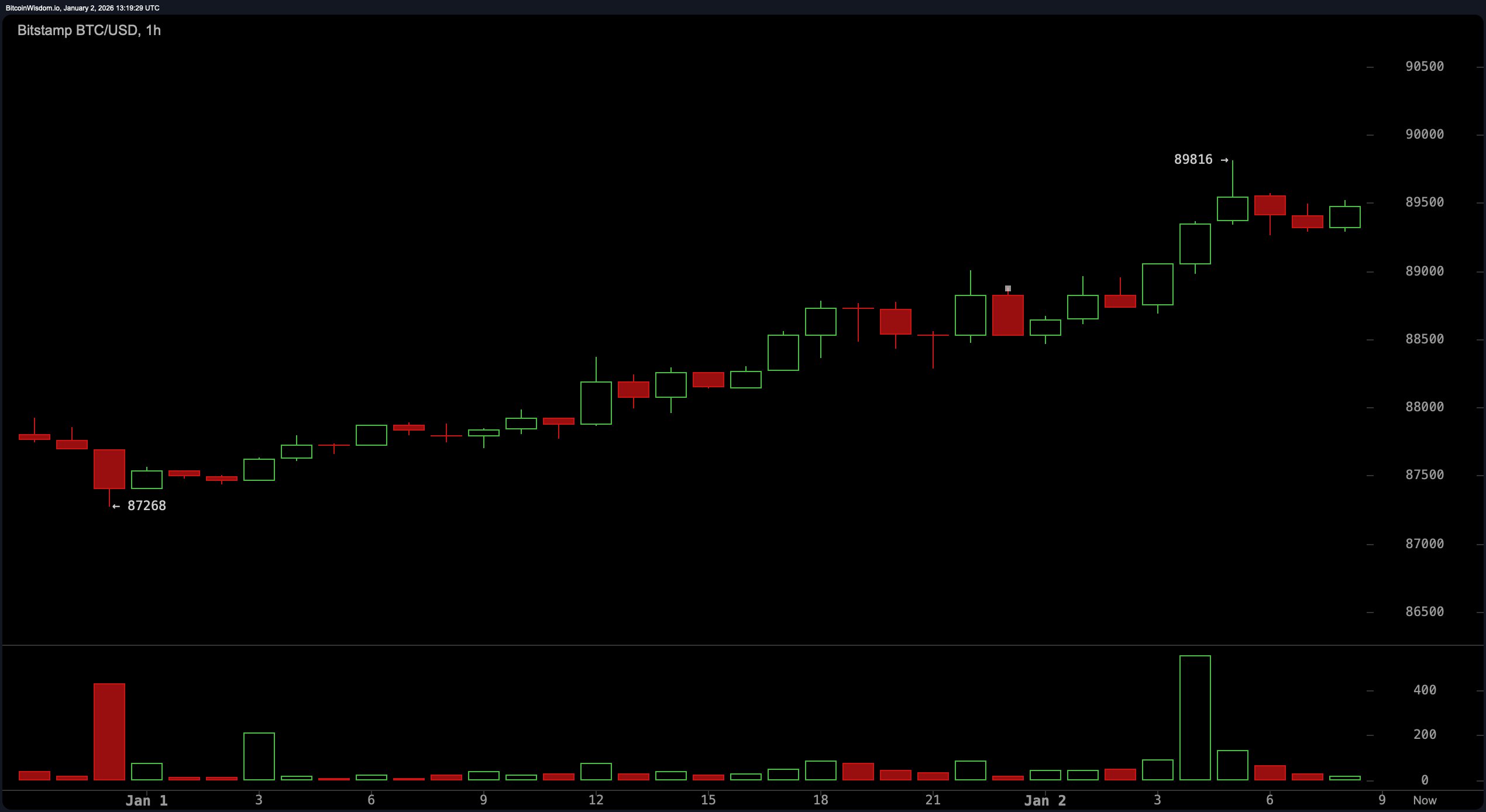

On the 1-hour chart, bitcoin looks like it’s been hitting the gym. Higher lows, higher highs, and a textbook bullish channel have defined its short-term price action. A Jan. 2 volume spike hinted at fresh buying interest, but subsequent consolidation suggests the bulls are catching their breath. Key zones to watch include minor support at $88,800–$89,000 and resistance in the $89,800–$90,000 band. A clean break above this level would validate the channel, while a drop below $88,000 could break the spell.

BTC/USD 1-hour chart via Bitstamp on Jan. 2, 2026.

Moving averages are as divided as a holiday dinner table. The 10-day and 20-day exponential (EMA) and simple moving averages (SMA) are all comfortably below the current price, reinforcing the short-term bullish case. The 30-day EMAs and SMAs are also supportive. But zoom out, and the tone shifts—50-day, 100-day, and 200-day EMAs and SMAs are shouting caution, with values well above the current level. The 200-day simple moving average (SMA), for example, looms overhead at $106,835, a hefty gap that puts the current recovery into perspective.

In sum, bitcoin’s price action on Jan. 2, 2026, is a masterclass in mixed signals. Oscillators are mostly non-committal, with only momentum and the MACD showing upside leanings. Short-term technicals exude confidence, while longer-term indicators temper that enthusiasm. The battle between bulls and bears is heating up around the $90k psychological zone—who wins may depend less on price and more on the volume that tags along. Strap in: 2026 looks ready to test every trader’s patience—and resolve.

Bull Verdict:

If the bulls can muster the volume to punch through the $90,300 resistance, bitcoin could reignite its path toward the recent high near $94,000. The alignment of short-term moving averages and bullish intraday structure signals that momentum is quietly gathering behind the scenes. A clean breakout, paired with sustained volume, could transform this slow crawl into a sprint.

Bear Verdict:

Despite the short-term optimism, the refusal to conquer the $90,000 threshold—and the looming resistance from long-term moving averages—casts a shadow on bitcoin’s ascent. Declining volume on rising prices is the classic red flag, and any break below $87,000 would likely unravel the fragile bullish structure. For now, the bears just need patience—the market might do the heavy lifting for them.

- Where is bitcoin trading as 2026 begins?

Bitcoin is trading around $89,431, testing resistance near the $90,000 level. - What key price levels should traders watch now?

Support sits near $87,000, with resistance tightening around $90,300. - Are technical indicators showing strong momentum?

Short-term indicators lean bullish, but long-term averages remain cautious. - Is bitcoin likely to break above $90,000 soon?

A breakout is possible if volume rises, but rejection risk remains high.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。