Author: Green But Red

Translation: Ken, ChainCatcher

The cryptocurrency space is primarily composed of two types of tokens:

Those backed by hundreds of millions in venture capital

And those supported by users

Both have the potential for appreciation.

Only one side consistently determines who wins and loses, whose share gets diluted, and who gets eliminated first.

This series of articles does not compare different narratives.

It contrasts community-funded MetaDAO issuance with its VC-backed competitors to identify the true factors driving long-term token performance: structure, incentives, dilution, and who captures the upside.

1. Solomon vs. Ethena: The Yield Battle

Solomon (community-funded) and Ethena (venture capital-funded) are at the intersection of the three dominant forces shaping today's crypto finance:

The growing demand for "yield-bearing dollars"

The search for safer, more sustainable leverage

The migration of on-chain bond-like yields

Both aim to create efficient digital dollars, but their design philosophies are starkly different. One is synthetic, market-driven, while the other is backed by reserves and treasury-managed.

Two Models, Two Yield Engines

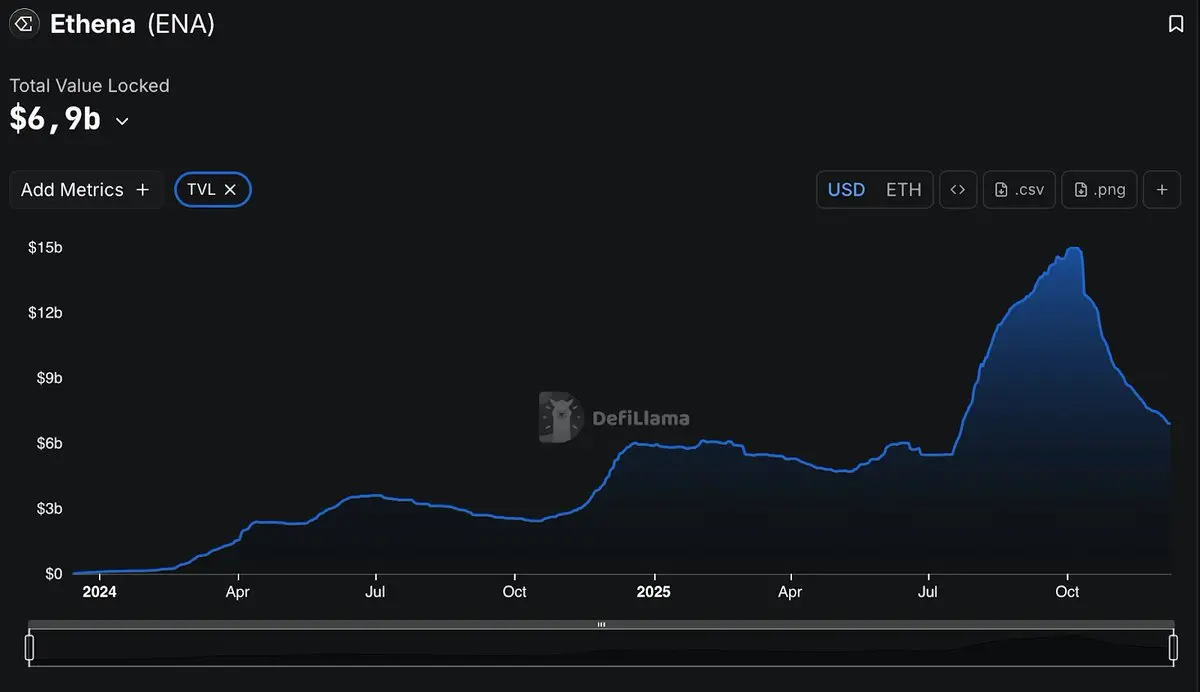

Ethena uses a delta-neutral structure to build its synthetic stablecoin. By hedging futures positions, it creates an asset pegged to the dollar that can generate floating yields directly tracking the financing rates of the derivatives market.

Research from both academia and industry consistently shows that these strategies can yield extremely high returns when market conditions are favorable. However, they are also highly dependent on liquidity and financing cycles. When financing dries up or negative yields occur, returns can plummet—sometimes dramatically.

In contrast, Solomon issues USDv, a reserve-backed stablecoin supported by a diversified on-chain treasury. Its yields come from a combination of staking, lending, and basis strategies, rather than perpetual futures.

The result is a lower nominal annual yield, but greater yield stability. Architecturally, Solomon resembles a tokenized digital asset management platform rather than a trading engine.

Market Perception Divergence

On the surface, both protocols promise the same thing:

A globally accepted crypto dollar.

However, the market positions them quite differently:

Ethena's trading is characterized by speed, high liquidity, and significant yield volatility.

Solomon's trading strategy is based on trust, capital preservation, and slow compounding.

Their long-term trajectories may ultimately answer a deeper question in the cryptocurrency market:

Will capital continue to chase the allure of synthetic yields, or will it turn towards the patience of on-chain reserves?

Token Comparison Snapshot — $SOLO vs. $ENA

$SOLO (Solomon)

Issue Price: $0.800

Current Price: $0.780

Performance: -2.5%

Largest Supporter: MetaDAO ($8 million)

Listing Status: DEX only (Solana)

TVL: N/A

Annual Revenue: N/A

Circulating Supply: 100%

Market Cap / FDV: $32 million / $32 million

CMC Ranking: Unranked

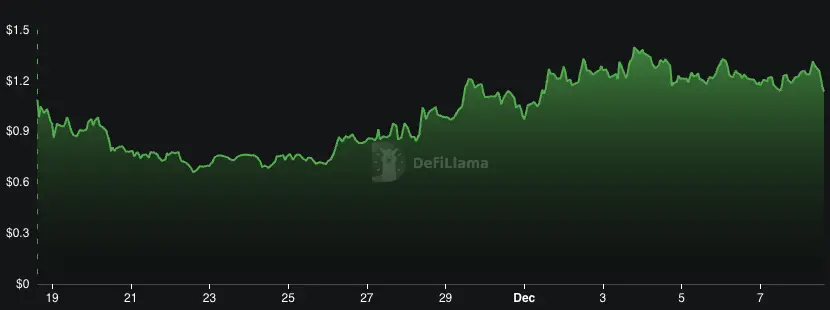

$ENA (Ethena)

Issue Price: $0.78

Current Price: $0.28

Performance: -64.1%

Largest Supporters: Dragonfly, Polychain, Pantera Capital (totaling $165 million)

Listing Platforms: Binance + multiple CEXs

TVL: $6.9 billion

Annual Revenue: $98 million

Circulating Supply: 51%

Market Cap / Final Price: $2.1 billion / $4.1 billion

CMC Ranking: #40

Conclusion

Ethena dominates in liquidity, exchange access, and raw trading volume—but at a cost, having suffered significant capital retracement and token dilution risk post-TGE.

Meanwhile, Solomon's liquidity market size is much smaller, with limited price discovery and currently no significant revenue—but it benefits from a fully circulating supply and structurally lower reflexive pressure.

This highlights the core contradiction between venture capital-scale stablecoin engineering and community-scale reserve finance—setting the tone for the comparisons to follow.

2. Paystream vs. Kamino Finance: The Liquidity Optimizer Battle

Paystream and Kamino operate as the routing layer of DeFi, abstracting the cumbersome manual operations of lending, liquidity mining, and incentive mining into streamlined automated products.

Their true advantage lies not just in higher nominal APYs.

It’s the risk-adjusted yield:

Venue diversification

Dynamic rebalancing

Automated liquidation and incentive management

In the same vertical.

Completely different heavyweights.

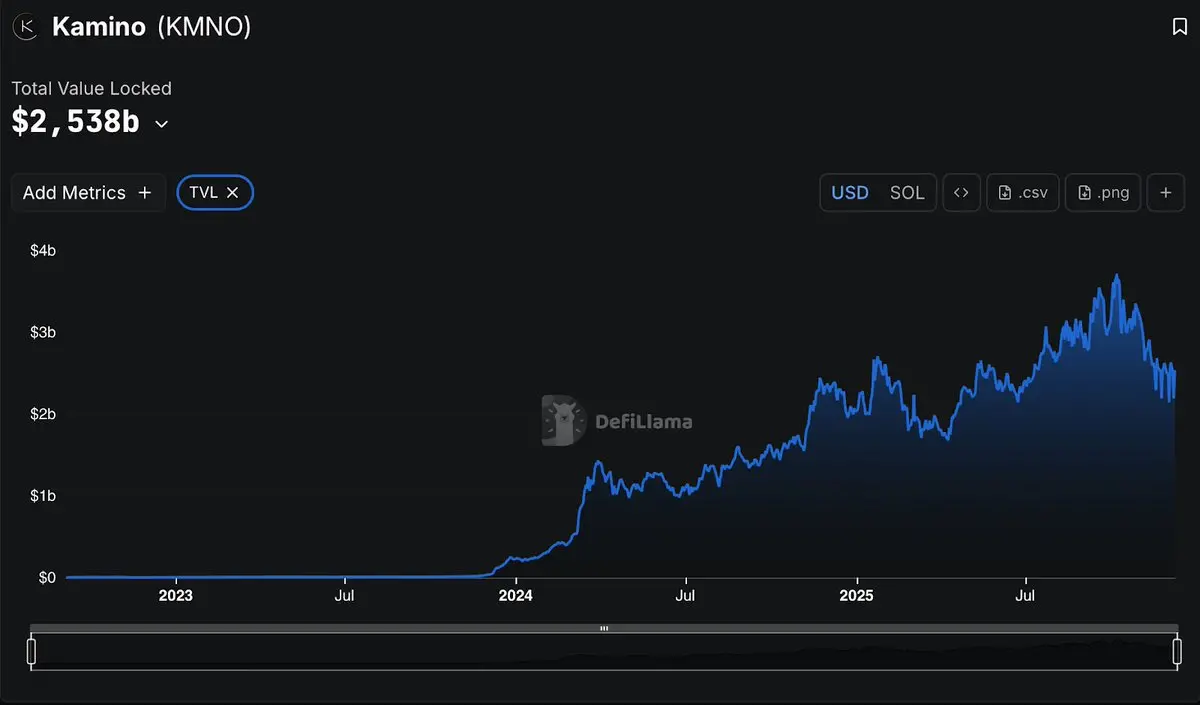

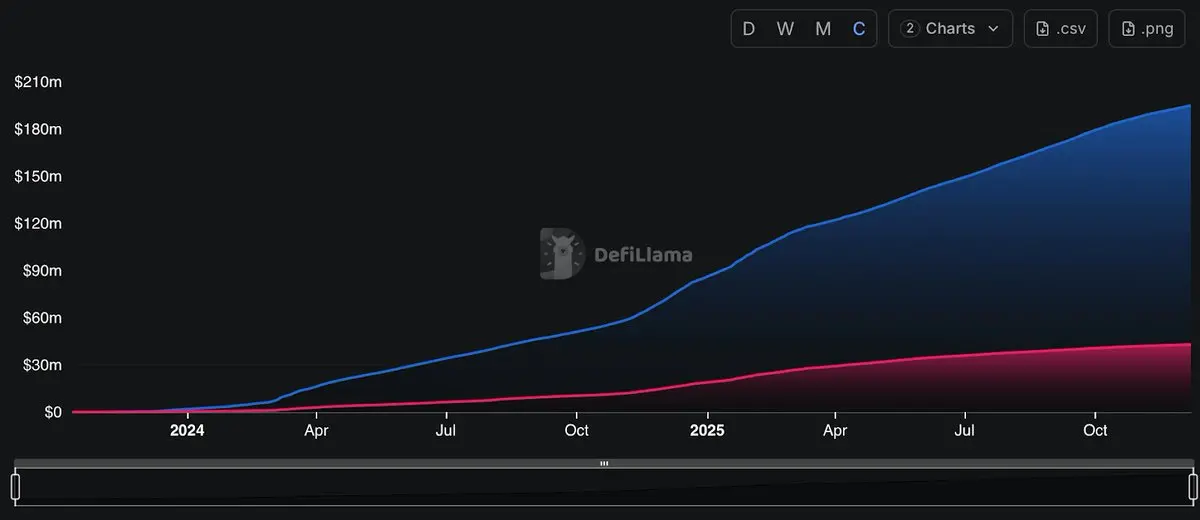

Kamino: The Heavyweight Optimizer

Kamino is the primary, on-chain native yield engine for Solana:

Deeply integrated with money markets and LST for large-scale throughput

Advanced automated concentrated liquidity

Intentional loans tailored for treasuries, funds, and structured vaults

It not only optimizes yields—it industrializes yield. Billions of assets are now flowing into Kamino, effectively turning Solana itself into a yield processing machine.

This is what it looks like when venture capital-scale infrastructure reaches escape velocity.

Paystream: The Lightweight Streamer

Paystream completely disrupts traditional architecture by embedding yield routing directly into the payment process:

Every bit of idle capital in the stream is immediately deployed into carefully curated strategies.

Lean design optimizes P2P efficiency and leveraged vaults

Actively shifts idle base liquidity from protocols like Kamino into higher turnover matches

Paystream does not own a balance sheet; it rides on top of it.

It does not aim to be the base layer.

It seeks to be the spread extractor.

Stack dynamics vs. market realities

Unlike the competition with stablecoins, this is not a winner-takes-all battle.

They can stack:

Kamino = VC-backed base layer

Huge TVL

Emission-driven growth

Institutional-level liquidity depth

Paystream = Community-funded routing layer

MetaDAO growth of about $750,000

Post-ICO retracement

Experimental but capital-efficient design

Kamino wins with scale and gravity.

Paystream competes on capital turnover and efficiency per dollar.

Broader Signals

This combination illustrates the actual development direction of DeFi yields:

From:

Manually flipping vaults

Chasing emission rewards

Static strategy sets

To:

Middleware battles

Strategic intelligence

Automated risk control

Native wallet and new bank integration

Kamino expands the base.

Paystream sharpens the edge.

Token Comparison Snapshot — $PAYS vs. $KMNO

$PAYS (Paystream)

Issue Price: $0.075

Current Price: $0.051

Performance: -32.3%

Largest Supporter: MetaDAO ($750K)

Listing Status: DEX only (Solana)

TVL (Total Locked Value): N/A

Annual Revenue: N/A

Circulating Supply: ~100%

Market Cap / FDV: $0.9M / $1.7M

CMC Ranking: Unranked

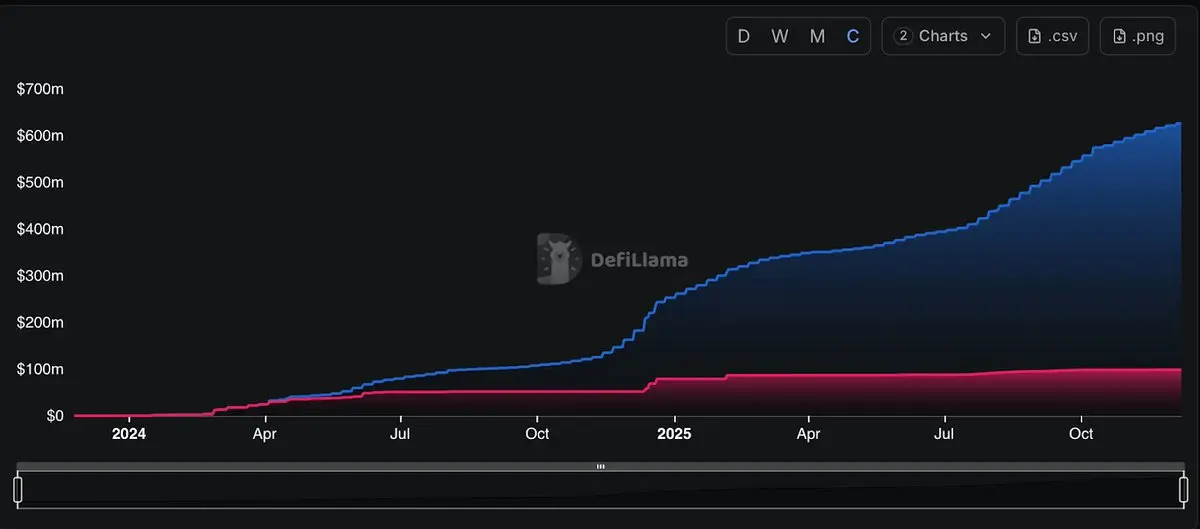

$KMNO (Kamino)

Issue Price: $0.04

Current Price: $0.06

Performance: +50%

Largest Supporter: Delphi Ventures, LongHash Ventures ($6M+)

Listing Status: Binance, MEXC, Gate + DEXs

TVL (Total Locked Value): $2.53B

Annual Revenue: $42.7M

Circulating Supply: 34%

Market Cap / FDV: $221M / $647M

CMC Ranking: #155

Conclusion

$KMNO wins significantly in terms of scale, liquidity, revenue, and institutional adoption—but still bears the heavy risks of unlocking and FDV ceiling.

$PAYS operates in a less liquid niche but benefits from:

Full circulation

Extremely high capital efficiency

And the asymmetric upside potential if embedded yield in payments becomes a true distribution wedge

The key to this showdown is not who can win today, but whether the routing layer can ultimately extract meaningful economic benefits from the yield giants.

3. ZKLSOL vs. Starknet: The Zero-Knowledge Battle

ZKLSOL and Starknet both rely on ZK—but they apply the technology to completely different problems.

One is built for transaction anonymity.

The other for scalable computational infrastructure.

The same mathematical principles.

Completely opposite priorities.

ZKLSOL: The Native Privacy Mixer for Solana

ZKLSOL provides transaction-level privacy protection directly on Solana:

Deposits are fragmented into a shielded pool

ZK circuits can prove the validity of transfers without exposing the sender, receiver, or amount.

Offers mixer-style anonymity and staking-style yield mechanisms for DeFi users

Conceptually, it is a combination of Tornado Cash and Solana's native liquidity hooks—purely expressing the argument that, regardless of regulatory pressure, private capital flows will always exist.

This is not a strategy taken to scale.

It is a bet against censorship on financial privacy.

Starknet: Scalability-First ZK Infrastructure

Starknet achieves zero-knowledge from the opposite direction:

General scalability, rather than default privacy protection.

Validity proofs generated by Cairo for Ethereum L2 execution

Privacy is an emerging feature of applications, not a core protocol guarantee.

The system hides the computational process, not user identities.

Starknet is designed as industrial ZK infrastructure—a settlement layer that can build both private and public applications, but never presupposes anonymity.

It pursues developer freedom and throughput, rather than financial confidentiality.

Broader ZK Divide

This showdown reflects the most profound divides in today's zero-knowledge research field:

Application-Level Privacy

Mixers, shielded pools, strict user anonymity

Maximum sovereignty, maximum regulatory pressure

Infrastructure-Level Zero-Knowledge

Aggregation, validity proofs, correctness guarantees

Developer flexibility, regulatory compatibility

ZKLSOL represents a permissionless privacy layer.

Starknet represents a fully zero-knowledge proof-based L2 architecture focused on scaling Ethereum itself.

Both are "ZK."

They just address different political and economic issues.

Token Assessment: Efficiency vs. Capital Flood

$ZKLSOL, despite receiving less than $1 million in funding, has only dropped 11.9% from its issue price of $0.097.

In contrast, $STRK, despite absorbing $282.5 million in venture capital (nearly 300 times its funding amount), has dropped 93.6% from its issue price of $2.34.

Here are the original results:

A streamlined capital structure retains options.

Significant early sell pressure from venture capital.

Scale advantages do not protect tokens from the effects of oversupply.

For now, privacy flows outperform bloated infrastructure betas.

Token Comparison Snapshot — $ZKLSOL vs. $STRK

$ZKLSOL

Issue Price: $0.097

Current Price: $0.085

Performance: -11.9%

Largest Supporter: MetaDAO / IDO (~$970K)

Listing Status: DEX only (Solana)

TVL (Total Locked Value): N/A

Annual Revenue: N/A

Circulating Supply: 50%

Market Cap / FDV: $1.05M / $2.1M

CMC Ranking: Unranked

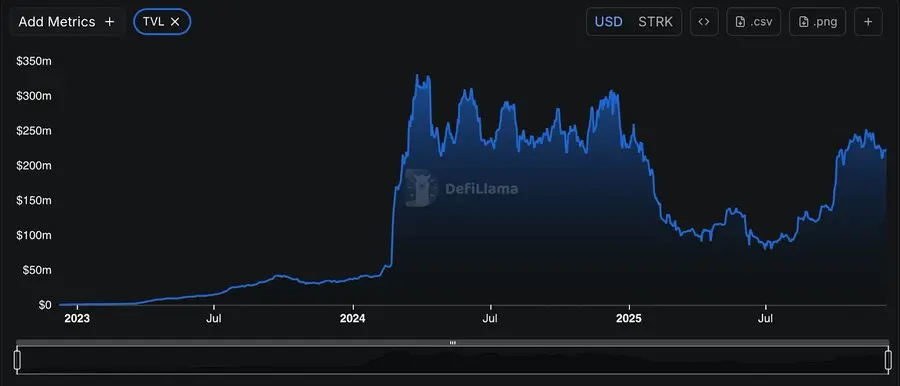

$STRK (Starknet)

Issue Price: $2.34

Current Price: $0.15

Performance: -93.59%

Largest Supporters: Paradigm, Sequoia, etc. ($282.5M)

Listing Status: Binance, Bybit + DEXs

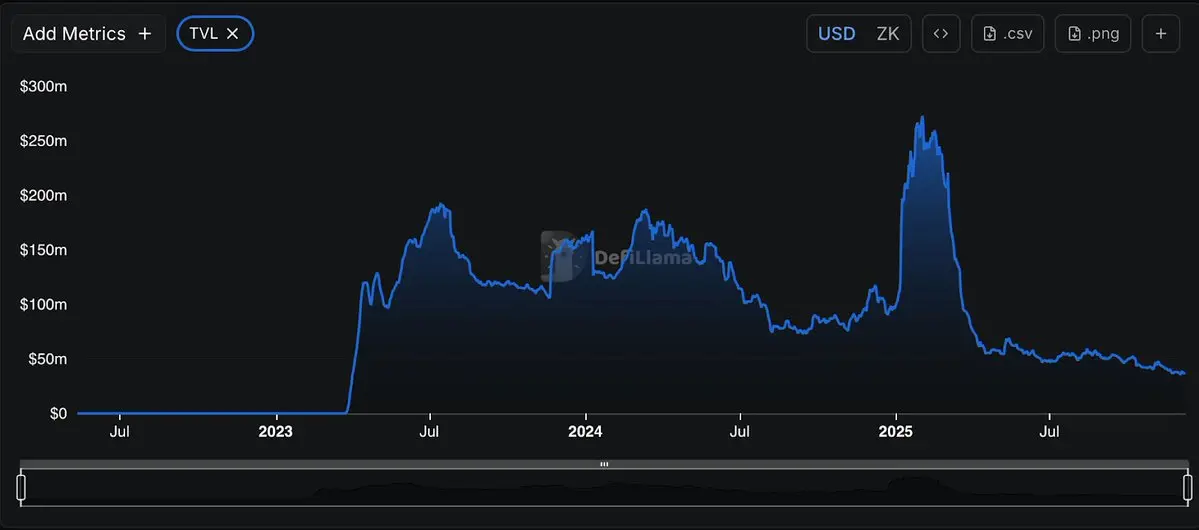

DeFi TVL: $222.45M

Annual Revenue: N/A

Circulating Supply: 48%

Market Cap / FDV: $545M / $1.13B

CMC Ranking: #88

Conclusion

$ZKLSOL remains a robust, streamlined privacy investment with minimal dilution pressure.

$STRK is a classic example of what happens when the scale of venture capital funding meets weak demand on the token side:

Massive infrastructure, real usage rates—and a catastrophic post-launch supply shock.

In the ZK market, capital efficiency currently trumps capital dominance.

4. Loyal vs. Arkham: The Intelligence Protocol Challenge

Crypto intelligence is becoming an independent asset class.

Not yield.

Not block space.

But raw information.

Loyal and Arkham represent two diametrically opposed ways of monetizing on-chain intelligence:

One views intelligence as a public utility owned by users.

The other sees it as proprietary institutional alpha.

The same market.

Opposing power structures.

Loyal: User-Centric AI

Loyal is building on-chain conversational agents to interpret wallets, protocols, and social dynamics without routing sensitive behavior through centralized Web2 intermediaries.

AI assistants optimized for user privacy and autonomy

Conceptually aligned with decentralized analytics like Ritual, Bittensor, and Dune

Intelligence is viewed as a connected public service, not a closed garden.

The stakes are simple:

If data is user-generated, then the intelligence layer built on that data should also belong to the users.

Loyal is not trying to invest more in data labeling than existing companies.

It is trying to surpass them in trust.

Arkham: Surveillance-Level Analysis

Arkham takes the opposite approach:

Maximum tagging, maximum attribution, maximum extraction.

Proprietary entity graphs

Active de-anonymization bounty markets

Transforming wallet behavior into institutional dashboards for the following metrics:

Trading advantages

Compliance tools

Investigative intelligence

This places Arkham in the same commercial lineage as Nansen, Chainalysis, and TRM Labs—monetizing blockchain transparency as a premium surveillance product.

Loyal attempts to protect identity information,

Arkham is designed to make them collapse.

Core Research Themes in Crypto Intelligence

This showdown reveals three structural truths about the intelligence market:

The real moat is data, not models

Address labels, entity graphs, and behavioral clustering are more important than LLM wrappers.

There is always a tension between the two:

Intelligence as a public good → open, user-owned, anti-censorship

Intelligence as alpha → closed, exclusive, monetized for institutions

Token value reflects attention and trust, not always TVL.

Adoption by influential users, perceived neutrality, and revenue consistency are more important than sheer sales.

This is the little-known battlefield behind most "AI x cryptocurrency" narratives.

Market Structure Conflict

This is not just a distinction between decentralization and centralization.

It is a conflict between the following two sides:

User-First Intelligence

→ Slow to monetize, hard to scale, high trust ceiling

Institutional Surveillance Intelligence

→ Quick to monetize, high compliance requirements, low trust tolerance

Both will exist.

But they will attract completely different capital and user bases.

Token Comparison Snapshot — $LOYAL vs $ARKM

$LOYAL (Loyal)

Issue Price: $0.250

Current Price: $0.212

Performance: -15.2%

Supporters: Community / IDO ($2.5M)

Listing Status: DEXs only

TVL: N/A

Annual Revenue: N/A

Circulating Supply: 100%

Market Cap / FDV: $2.3M / $6.09M

CMC Ranking: Unranked

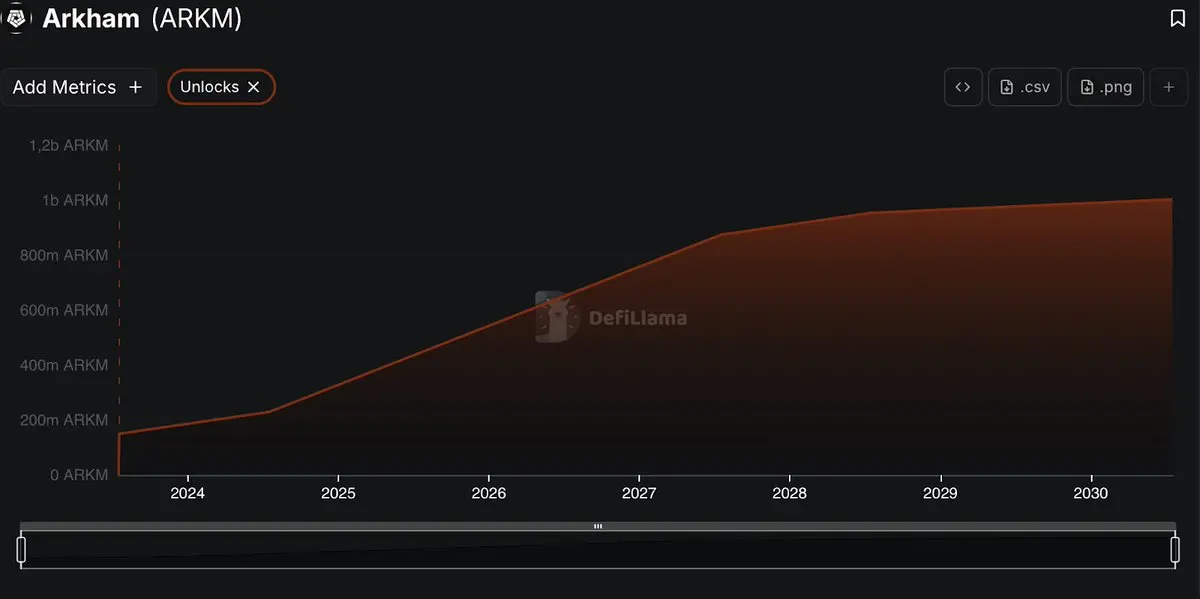

$ARKM (Arkham)

Issue Price: $0.65

Current Price: $0.248

Performance: -61.85%

Supporters: Ribbit Capital, Coinbase Ventures ($14.5M)

Listing Status: Binance, Gate, Bybit + DEXs

TVL: N/A

Annual Revenue: N/A

Circulating Supply: 23%

Market Cap / FDV: $51M / $226M

CMC Ranking: #426

Conclusion

$ARKM aims to expand institutional-level alpha and compliance intelligence—but with only 23% of the supply in circulation, it carries extremely high FDV and release excess risk.

$LOYAL remains a streamlined, fully circulating decentralized intelligence investment project—lower liquidity, slower monetization, but with higher structural consistency among users, data, and tokens.

This is not a debate about dashboards.

This is a war for control over the collective intelligence layer of cryptocurrency.

5. Avici vs Plasma: The Victory of Infrastructure

Web2 neobanks like Revolut and N26 encapsulate traditional banking systems in beautifully designed mobile applications.

The trend in cryptocurrency is quite the opposite.

It is not about perfecting closed systems, but about reconstructing "accounts + cards + yields" as an open on-chain financial stack—where balances, treasuries, and solvency are all publicly verifiable.

This is not a disruption of user experience.

This is an inversion of infrastructure.

Stack Inversion

The operational model of traditional fintech is:

Closed databases

Opaque balance sheets

Slow, permissioned settlements

Extracting yields through obscure money market structures

Crypto neobanks disrupt every layer:

Deposits → Tokenized dollars (USDC, USDT, USDv)

Balance sheets → Public, real-time supply chain transparency

Yields → DeFi protocols, rather than internal funding transparency

Users no longer just hold balances.

They possess auditable financial conditions.

Two Prototypes Emerge

This inversion creates two distinctly different paths to the same ultimate market.

Avici: Protocol-Native Neobank

Avici starts with DeFi and builds a fintech system on top of it:

On-chain governance and fund management

Credit cards, exit mechanisms, and credit scoring as modular add-ons

Capital formation occurs after product validation, not before.

This is a bottom-up banking model:

Protocol first, compliance second, user experience paramount.

It is optimized for:

Capital efficiency

Full token circulation

Direct connection between users and funds

Plasma: Capital-Intensive Fintech Company Transitioning to Cryptocurrency

Plasma takes the opposite path:

First, it raises significant venture capital

Has licenses, rails, and front-end distribution

Then expands into L1 tokens, tokens, and DeFi integration

This is full-stack control:

User experience, custody, compliance, liquidity, and token issuance are all centralized under one company roof—structurally similar to companies like Nexo.

It is optimized for:

Accelerated path to the mass market

Regulatory defense capabilities

Dominance in distribution

The cost is:

High dilution

Slow token supply release

Huge FDV backlog

True disruption: equity-like deposits

The real transformation is not cheaper effects or prettier applications.

It is this:

Yield-bearing stablecoin deposits

Revenue-sharing cards

On-chain solvency visible in real-time to users, regulators, and investors

Deposits no longer operate like liabilities.

They begin to function like productive financial assets.

This will break down the boundaries between:

Banking

Asset management

And on-chain capital markets

Strategic Questions

The focus of this debate is not on functionality.

The key is which capital structure can prevail in the long term:

Lean, community-funded protocol financing (Avici)

Or venture-scale, vertically integrated fintech companies (Plasma)

The former achieves compounding through user consistency.

The latter expands through distribution and regulation.

Token Comparison Snapshot — $AVICI vs $XPL

$AVICI (Avici)

Issue Price: $0.350

Current Price: $7.170

Performance: +1,948.7%

Supporters: IDO ($3.5M)

Listing Status: MEXC + DEXs

TVL: N/A

Annual Revenue: N/A

Circulating Supply: 100%

Market Cap / FDV: $70.62M / $70.62M

CMC Ranking: #3651

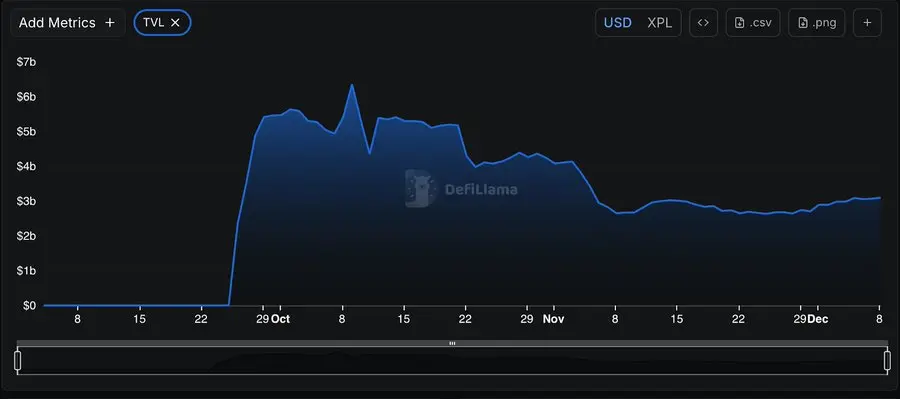

$XPL (Plasma)

Issue Price: $0.83

Current Price: $0.21

Performance: -75.3%

Supporters: Framework Ventures, 6th Man Ventures ($75M)

Listing Status: Coinbase, Binance + CEXs

TVL: $3.1B

Annual Revenue: N/A

Circulating Supply: 18%

Market Cap / FDV: $309M / $1.71B

CMC Ranking: #132

Conclusion

$AVICI is a textbook case of what happens when fully circulating tokens meet real user demand: price discovery is brutal, rapid, and positively reflexive.

$XPL shows the opposite trade-offs:

Huge TVL, strong distribution capabilities, regulatory positioning—but still facing severe dilution ahead, leading to weak token performance.

This is the new banking battle in cryptocurrency:

Transparent protocols vs. closed capital systems.

So far, the market favors alignment with existing strategies over excessive hoarding.

6. Umbra vs zkSync: Privacy and Scalability

Umbra and zkSync both rely on zero-knowledge cryptography, but they apply it to opposite economic goals.

Umbra is optimized for transaction confidentiality

zkSync optimizes infrastructure throughput

The same cryptographic toolbox.

Completely different outcomes.

Umbra: Pure Transaction Privacy

Umbra's sole design intent is to hide who pays whom and the payment amount.

Obscured addresses, viewing keys, and ZK circuits

Disrupting the identity association between sender and receiver during transactions and transfers

Conceptually, it lies between:

Tornado-style mixers

And protected DEX execution

It provides instant, default anonymity at the transaction layer—but also comes with some known trade-offs:

Simplicity that reduces user experience

Regulatory friction

Narrow composability

Umbra's goal is not to scale DeFi.

It seeks to maintain the flow of private capital in adverse environments.

zkSync: Scalability-First ZK Aggregation

zkSync applies ZK proofs to the opposite problem:

How to compress Ethereum at scale.

Validity proofs efficiently verify transactions in batches.

By default, it achieves transparent state through elastic chains and shared sequencers

The priorities of this roadmap include:

Throughput

Cost compression

Modularity

Developer tools

Privacy is not an inherent feature of the underlying architecture.

It may appear through:

Account summaries

Encrypted memory pools

Or higher-level privacy modules

But none of these are the main design constraints of zkSync.

zkSync hides computational costs.

It does not hide user identities.

ZK Privacy Paradox

Academic research is clear on one point:

True aggregate-level privacy requires encrypted memory pools, shielded pools, or trusted hardware—none of which are standard configurations in today's production aggregators.

Thus, this divergence is structural:

Umbra = Narrow, direct secrecy

Privacy is the product

Everything else is secondary.

zkSync = Broad composability and scalability

Privacy settings are optional

And pushed to higher layers

They are not substitutes.

They reflect different threat models.

Non-Converging Convergence

This is a deeper pattern prevalent in the ZK market:

Privacy tools primarily pursue anonymity.

Rollups primarily need throughput.

They may one day be able to interoperate—

But they will never be the same product.

Token Comparison Snapshot — $UMBRA vs $ZK

$UMBRA (Umbra)

Issue Price: $0.300

Current Price: $0.769

Performance: +156.3%

Supporters: IDO ($3M)

Listing Status: MEXC + DEXs (Solana)

TVL: N/A

Annual Revenue: N/A

Circulating Supply: 30%

Market Cap / FDV: $16.7M / $47M

CMC Ranking: #3730

$ZK (zkSync)

Issue Price: $0.32

Current Price: $0.04

Performance: -87.5%

Supporters: Andreessen Horowitz, Dragonfly, Paradigm ($458M)

Listing Status: Binance, Bybit + DEXs

TVL: $37M

Annual Revenue: N/A

Circulating Supply: 35%

Market Cap / FDV: $300M / $700M

CMC Ranking: #136

Conclusion

$UMBRA reflects what happens when a focused, conviction-driven privacy tool meets strong narrative demand: even with limited composability, the token retains asymmetric upside potential.

$ZK reflects the opposite extreme:

Massive venture capital, ambitious infrastructure scale—and a token still overshadowed by oversupply and slow demand formation.

This showdown reinforces the broader ZK theme of this article:

Capital efficiency consistently outperforms capital dominance.

In the privacy market, focus trumps scale—at least for now.

7. Omnipair vs Morpho: Lending Protocol Showdown

Omnipair and Morpho form the core of the next generation of cryptocurrency infrastructure:

Permissionless Credit

They transform DEXs and routers from simple trading venues into seamless lending and leverage channels—without banks, credit committees, or account-based gatekeeping.

This is an evolution from passive yield to native, composable leverage infrastructure.

From Compound to Modern Credit Markets

Early protocols like Compound and Aave created the first generation of on-chain banks:

Permissionless supply and borrowing for whitelisted assets

Risk management:

Over-collateralization

Liquidation bots

Algorithmic parameters replacing manual credit committees

Morpho advances this model by acting as a meta-optimizer for liquidity:

Directing funds to the most efficient trading venues (Aave, Compound, order books)

Retaining open access for retail and institutional users.

Maximizing capital efficiency while minimizing idle liquidity.

Morpho does not compete with money markets.

It transcends them and redefines how capital flows between them.

Omnipair: DEX as the Gateway to Credit

Omnipair disrupts the architecture again—merging spot trading and money markets into a single platform:

Transforming DEX positions into instant credit risk exposures

No accounts, no permissions

Providing composable leverage only at the point of exchange execution

Here, the DEX itself becomes the lending interface.

This transformation is deeper than it appears:

DEXs are no longer:

- Merely price discovery engines

But rather:

- The liquidity absorption valve for the entire credit system

Omnipair does not aim to dominate TVL.

It seeks to capture fee flows at the moment leverage demand arises.

Structural Summary

This showdown showcases the increasing maturity of DeFi lending:

From:

Isolated lending pools

Manual leverage stacking

Fragmented risk exposures

To:

Unified, permissionless credit infrastructure

Where:

Router resource utilization

DEX activates it

Optimizer distributes it

Morpho achieves backbone industrialization.

Omnipair weaponizes the entry point.

Token Comparison Snapshot — $OMFG vs $MORPHO

$OMFG (Omnipair)

Issue Price: $0.112

Current Price: $0.549

Performance: +389.9%

Supporters: IDO ($1.11M)

Listing Status: DEXs (Solana)

TVL: Growing (active lending pools)

Annual Revenue: N/A

Circulating Supply: 100%

Market Cap / FDV: $12M / $12M

CMC Ranking: #3767

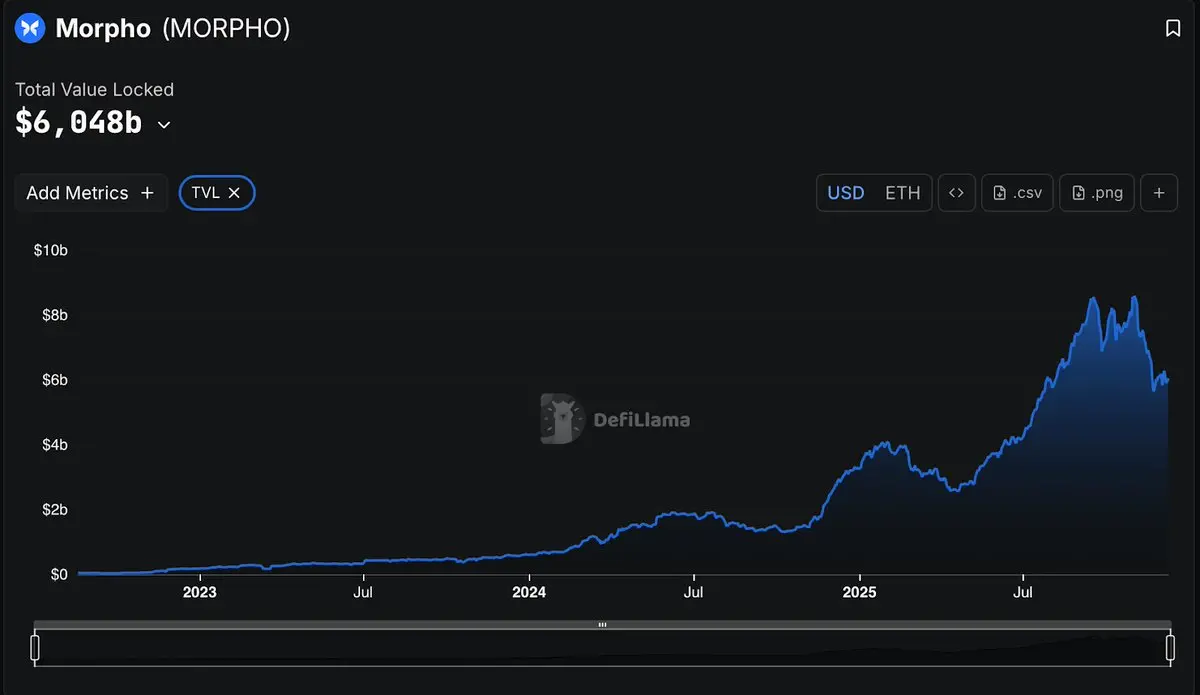

$MORPHO (Morpho)

Issue Price: $1.90

Current Price: $1.50

Performance: -21.05%

Supporters: a16z crypto, Coinbase Ventures, Pantera Capital ($69.35M)

Listing Status: Binance, OKX, Bybit, Coinbase + DEXs

TVL: $6B+

Annual Revenue: N/A

Circulating Supply: 36%

Market Cap / FDV: $458M / $1.22B

CMC Ranking: #100

Conclusion

$MORPHO dominates in scale, institutional adoption, and TVL attraction—but still bears the structural burden of FDV expansion and unlocking risks.

$OMFG is the opposite:

Fully circulating, ultra-lean, and precisely positioned at the most defensible surface of DeFi—the moment leverage is generated.

This reaffirms the financing model that runs throughout this text:

Capital efficiency trumps capital dominance.

Why do community-funded projects continue to succeed (so far)?

Community-funded projects implement a fair price discovery mechanism from the start:

No multi-year lock-up periods

No hidden cliffs

No board-engineered liquidity exits

SOLOMON, Avici, Umbra, Omnipair, and other companies in this study are not designed to achieve a 10x growth in fund size.

Their purpose is to:

Solve real user problems

Align token holders with the protocol's economy

Survive even without financial oxygen masks

This structural trade-off is now evident in the data:

Once-accelerated growth from venture capital has turned into an inherent liability at the token layer:

Large-scale issuance inevitably dilutes future equity.

Each unlocking triggers volatility events

Long-term holders are forced to become counterparties to early investors

In contrast, community-funded teams are compelled to achieve:

Capital discipline

Faster paths to utilization

Closer alignment between users, funds, and tokens

So far, the market has rewarded this constraint.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。