Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

In the new week, the precious metals market took center stage. After spot silver broke through $84/ounce to set a new historical high, it faced profit-taking pressure, quickly plummeting and turning into a daily decline, ultimately fluctuating around $78. This "roller coaster" market directly impacted related financial products, with spot gold retreating from nearly $4550, its historical high, and both platinum and palladium seeing declines close to or exceeding 7%. Beyond the traditional logic of expectations for Federal Reserve interest rate cuts and central banks' continued gold purchases, the market began to price in a new narrative of "commodity control," highlighting the increasing importance of geopolitical factors and supply chain security, especially after China announced it would implement export licensing for silver starting January 1, 2026, further intensifying global physical supply tension. However, market divergences also intensified, with the Chicago Mercantile Exchange (CME) raising silver futures margin requirements twice within two weeks, raising concerns about a repeat of the 2011 silver price crash caused by similar measures. Institutions like Goldman Sachs remain optimistic about gold continuing to strengthen in 2026, with target prices potentially exceeding $4900, while UBS and Capital Economics warn that precious metal prices have diverged from fundamentals, accumulating risks of a correction, with Capital Economics even predicting that silver prices may fall to $42 by the end of next year. For silver, despite strong industrial demand in areas like solar energy, analysts point out that if prices reach $134/ounce, it could lead to demand destruction; copper, as a potential substitute, poses little threat in the short term due to the need for at least four years for factory renovations. Institutions like Guojin Securities believe that the investment theme for 2026 is already emerging in the commodity, industrial chain, and foreign exchange markets, indicating that in a scenario where investment exceeds consumption, the trading range for bulk commodities is extending, highlighting China's manufacturing advantages, and industrial resource products resonating with AI investments and the global manufacturing recovery are worth attention.

In contrast to the dramatic fluctuations in the precious metals market, the cryptocurrency market is generally permeated with caution and low sentiment, even as Bitcoin once again broke through $90,000 today. Most analysts hold a cautious outlook for the future, with analyst Killa stating that although there may be a short-term rebound, the overall direction remains downward, seeking support below $70,000, and judging that the current cycle has ended. Ali Charts expressed a similar view, suggesting that in the context of a net capital outflow of $4.5 billion and nearly $1 billion in net outflows from Bitcoin ETFs over the past two weeks, any rebound may be a "dead cat bounce" lacking support from spot demand. A report from 10x Research also noted that current trading volumes in the crypto market are 30% lower than normal, with the market appearing calm on the surface but actually fraught with undercurrents, making it particularly fragile. However, there are also bullish voices in the market. Analyst Astronomer pointed out through liquidity analysis that the market has built sufficient short liquidity in the $94,000 to $95,000 range, creating conditions for a price surge towards the $112,000 target. Michaël van de Poppe anticipates that as funds rotate from the overheated precious metals market to the crypto market, Bitcoin is expected to approach $100,000 within the next week. Analyst Plan B referenced historical data showing that during the 2021 bull market, prices still reached new highs after experiencing a correction of over 50%, suggesting that the current pullback may just be a normal correction within the cycle. Samson Mow even proposed the bold assertion that "2025 is the bear market," predicting that Bitcoin may enter a decade-long bull market. On the technical side, analysts are closely monitoring key price levels, with Ardi noting that whether Bitcoin can effectively break through the resistance range of $90,000 to $94,600 and maintain support in the $80,000 to $86,300 range will be crucial for determining future market direction.

Ethereum, despite breaking through $3,000 again, is met with cautious market sentiment. On-chain analyst Murphy provided a deeper analysis, arguing that the main contradiction facing Ethereum is not the pressure from trapped positions above, but rather the overly dispersed profit-taking structure below. He pointed out that $2,700 is currently one of the few strong support areas that can form consensus; if it is lost, the price may enter a "vacuum zone" lacking effective support, with the nearest gap below being between $1,800 and $2,600. Nevertheless, he also observed that whales holding over 100,000 ETH are accumulating near $2,700, reflecting a "long-term optimistic, short-term cautious" stance. For short-term trends, technical analyst CyrilXBT described Ethereum as a "coiled spring," believing it needs to break through $3,345 to release upward momentum. Michaël van de Poppe provided specific key price levels: $2,775 is a critical support level that must not be broken, or it may trigger a chain reaction of declines; conversely, if it breaks through the $3,000 resistance, it is expected to quickly challenge $3,650.

Currently, the market is most concerned about the TGE of the decentralized perpetual exchange Lighter, which is widely expected to take place on December 29. According to the airdrop details released, the team confirmed that the airdrop will account for 25% of the total supply, distributed directly to users' wallets without the need for claims. The team also clarified that recent large token transfers were for safeguarding the shares of investors and the team. Meanwhile, the public chain project Flow experienced a security incident over the weekend, where an attacker exploited a vulnerability in its execution layer to transfer approximately $3.9 million in funds, causing validation nodes to temporarily suspend operations to deploy a fix; the project team stated that user balances were unaffected by this incident, and there is no repayment risk for the protocol. Additionally, the ZEROBASE token ZBT briefly surpassed $0.20, with a 24-hour increase of up to 78%.

2. Key Data (as of December 29, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $89,989 (YTD -3.25%), daily spot trading volume $31.45 billion

Ethereum: $3,033 (YTD -9.2%), daily spot trading volume $28.28 billion

Fear and Greed Index: 24 (Fear)

Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

Market share: BTC 59.1%, ETH 12%

Upbit 24-hour trading volume ranking: BTC, ZBT, XRP, ETH, 0G

24-hour BTC long/short ratio: 50.99% / 49.01%

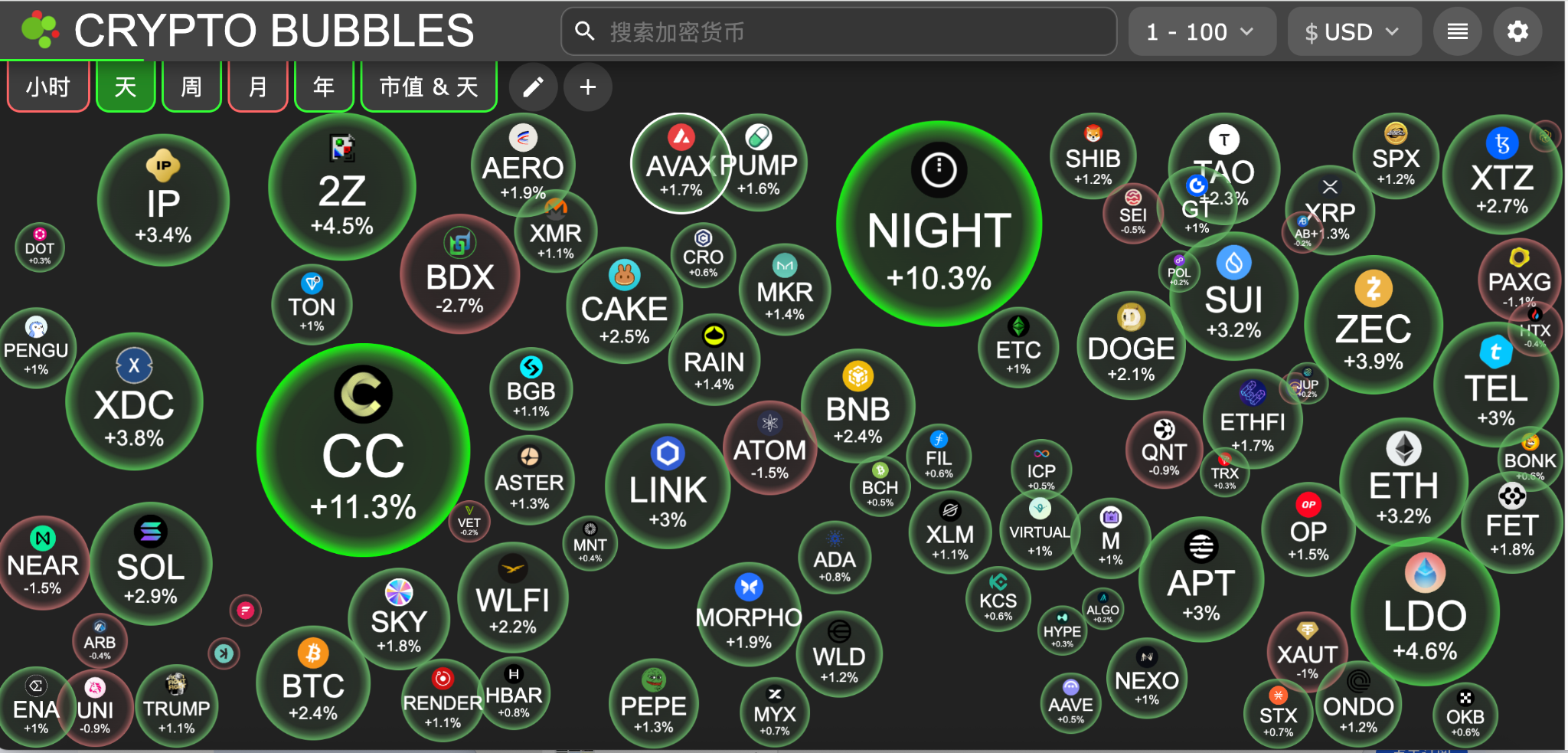

Sector performance: The crypto sector generally rose, with the SocialFi sector up over 3%, while only the Layer 2 sector saw a slight decline.

24-hour liquidation data: A total of 61,926 people were liquidated globally, with a total liquidation amount of $151 million, including $41.87 million in BTC liquidations, $35.69 million in ETH liquidations, and $6.55 million in ZEC liquidations.

3. ETF Flows (as of December 26)

Bitcoin ETF: Net outflow of $782 million last week, with BlackRock's IBIT leading with a net outflow of $435 million.

Ethereum ETF: Net outflow of $102 million last week, with BlackRock's ETHA leading with a net outflow of $69.42 million.

Solana ETF: Net inflow of $13.14 million last week.

XRP ETF: Net inflow of $64 million last week.

4. Today's Outlook

Binance will delist FDUSD margin trading pairs such as EIGEN/FDUSD and ARB/FDUSD on December 30

Web3 game studio ChronoForge will shut down on December 30 due to funding shortages

Shanghai Futures Exchange: Starting from the close on December 30, the price fluctuation limits for gold and silver futures contracts will be adjusted to 15%, along with adjustments to margin ratios.

Guotou Silver LOF: The A-class regular investment limit is reduced back to 100 yuan, and C-class shares will begin to suspend subscriptions, effective December 29.

May Day Vision and Lin Qingxuan are expected to be listed on the Hong Kong stock market on December 30.

Hyperliquid (HYPE) will unlock approximately 9.92 million tokens at 3:30 PM on December 29, with a circulation ratio of about 2.87%, valued at approximately $256 million;

Kamino (KMNO) will unlock approximately 229 million tokens at 8 PM on December 30, with a circulation ratio of about 5.35%, valued at approximately $11.8 million;

Slash Vision Labs (SVL) will unlock approximately 234 million tokens at 8 AM on December 30, with a circulation ratio of about 2.96%, valued at approximately $6.8 million;

Zora (ZORA) will unlock approximately 166 million tokens at 8 AM on December 30, with a circulation ratio of about 4.17%, valued at approximately $6.7 million.

Today’s top gainers among the top 100 cryptocurrencies: Canton Network up 11.3%, Midnight up 10.3%, DoubleZero up 4.7%, Lido DAO up 4.5%, Zcash up 3.9%.

5. Hot News

Suspected Trend Research has purchased 11,520 ETH again, worth $34.93 million

Hyperliquid's revenue last week was only $9.16 million, hitting a new low since early May

A whale withdrew 2,218 ETH, 37.1 million SKY, and 4,772 AAVE from Kraken 7 hours ago

100 million UNI have been burned from the Uniswap treasury, worth $596 million

Flow suffered a hack resulting in a loss of $3.9 million, but user deposits were unaffected

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。