Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

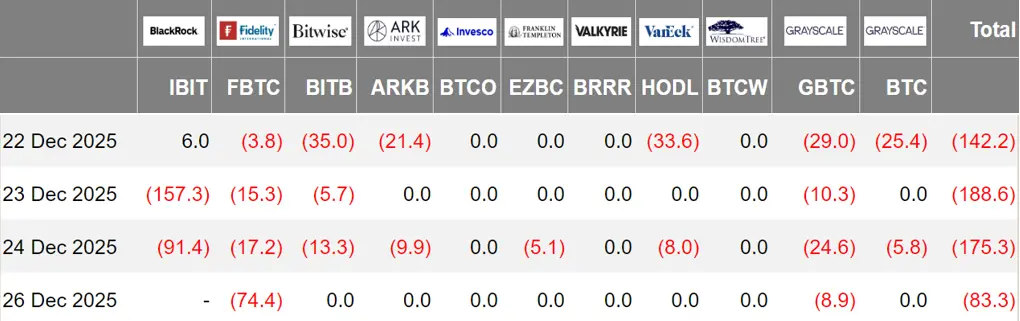

US Bitcoin Spot ETF Net Outflow of $589 Million

Last week, the US Bitcoin spot ETFs experienced a net outflow over four days, totaling $589 million, with a total net asset value of $11.383 billion.

Eight ETFs were in a net outflow state last week, with outflows primarily from IBIT, FBTC, and GBTC, which saw outflows of $242 million, $110 million, and $72.8 million, respectively.

Data Source: Farside Investors

US Ethereum Spot ETF Net Outflow of $80.3 Million

Last week, the US Ethereum spot ETFs had a net inflow over three days, but the total net outflow was $80.3 million, with a total net asset value of $1.786 billion.

The outflow was mainly from Grayscale's ETHE, which had a net outflow of $47.6 million. Four Ethereum spot ETFs were in a net outflow state.

Data Source: Farside Investors

No Fund Inflows for Hong Kong Bitcoin Spot ETF

Last week, the Hong Kong Bitcoin spot ETF had no fund inflows, with a net asset value of $332 million. The issuer, CSOP Bitcoin, reduced its holdings to 291.2 BTC, while Huaxia maintained 2410 BTC.

The Hong Kong Ethereum spot ETF had a net inflow of 293.15 ETH, with a net asset value of $9.581 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of December 26, the nominal total trading volume of US Bitcoin spot ETF options was $683 million, with a nominal total long-short ratio of 2.62.

The market's short-term trading activity for Bitcoin spot ETF options has decreased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 44.93%.

Data Source: SoSoValue

Overview of Crypto ETF Dynamics Last Week

Amplify ETFs Launch ETFs Focused on Stablecoins and Tokenization

According to CoinDesk, Amplify ETFs launched two new ETFs, providing investors with opportunities to invest in companies behind stablecoins and tokenized assets, as well as cryptocurrencies.

These two new ETFs are the Amplify Stablecoin Technology ETF (STBQ), which tracks the MarketVector Stablecoin Technology Index and holds 24 types of assets, primarily providing exposure to XRP, SOL, ETH, and LINK; and the Amplify Tokenization Technology ETF (TKNQ), which focuses on the digitalization of physical assets, tracking the MarketVector Tokenization Technology Index and holding 53 types of assets.

Both funds are listed and traded on the NYSE Arca.

Data: Franklin Templeton XRP Spot ETF Holdings Exceed 100 Million for the First Time

Franklin Templeton officially updated the holdings data of its XRP spot ETF, which has now exceeded 100 million XRP for the first time, reaching 101,552,283.62 XRP (custodied by Coinbase Custody), with a market value of $192,683,271.89.

Additionally, the total net asset size of the ETF is currently $183.41 million, with a current circulating share count of 8,900,000.

Views and Analysis on Crypto ETFs

Sonic: ETF Issued Only When S Price Exceeds $0.5, Not Exceeding $50 Million

Sonic Labs released an announcement updating its ETF token allocation execution plan. Previously, the Sonic community authorized a maximum value of $50 million in S tokens for a potential US-listed ETF to facilitate its entry into the regulated US market. However, after the proposal was passed, due to the overall weakening market environment and the significant decline in S price, Sonic Labs decided to postpone execution, during which no related tokens were minted to avoid increasing supply at unfavorable price levels.

The announcement stated that if the original plan were executed at the current price, it would require issuing over 600 million S tokens, which deviates significantly from the intent of the governance proposal; therefore, this plan will not be adopted. To better align with the interests of token holders, Sonic Labs clarified new execution constraints: S tokens will only be minted for ETF allocations when the S price exceeds $0.5, corresponding to a maximum of 100 million tokens; the total token value has a strict upper limit of $50 million, prioritizing the issuance of fewer tokens at higher price levels; any execution deviating from these conditions will not occur.

Sonic Labs also emphasized that the S tokens used for the ETF will be locked within regulated products and will not enter secondary market circulation, nor will they increase market selling pressure. The team stated that a US-listed ETF remains a long-term strategic focus, aiming to provide compliant Sonic exposure for institutional investors, and any future adjustments will continue to be communicated clearly through governance processes.

Glassnode posted on social media that since early November, the 30-day moving average (30D-SMA) of net inflows for Bitcoin and Ethereum ETFs has turned negative and continues to this day. This persistence indicates that institutional investors are in a phase of low participation and some are exiting, further confirming the trend of overall liquidity contraction in the crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。