Written by: Seed.eth

As 2025 comes to a close, the crypto market has not produced any miraculous trends, instead bringing the exaggerated price predictions from the past two years back to reality.

First, let's talk about the current prices: As of 8 AM Beijing time on December 27, Bitcoin is approximately $87,423, and Ethereum is approximately $2,926.

With these numbers in front of us, looking back at previous predictions like "Bitcoin will hit $200,000" and "Ethereum will break $10,000" feels a bit awkward. Market volatility, policy shifts, and international situations… each of these reminds us: predictions are predictions, and market trends are market trends.

Now, let's review those "expert predictions" that we once revered but have now been "slapped in the face" by reality.

BTC: Mainstream Institutions Are Bullish

In 2023-2024, with the approval of ETFs, a shift in U.S. political winds, and improvements in macro liquidity, almost all heavyweight institutions and opinion leaders have publicly provided clear price anchors for BTC in 2025.

Michael Saylor (Strategy): $100,000 in 2025, eventually reaching $1,000,000

Prediction:

BTC $100,000 (2025)

Long-term target: $1,000,000

Saylor's judgment is not merely a price prediction but a comprehensive narrative of "Bitcoin as a digital capital network." Before 2025, he repeatedly emphasized that BTC would not fall below $60,000.

BTC did indeed reach new highs multiple times in 2025, but stabilizing above $100k did not materialize.

Mark Yusko (Morgan Creek CEO): $150,000 in 2025

Prediction: BTC $150,000 (2025)

Logical basis: Network effects/FOMO driven/new capital inflow

This is a typical "cycle top pricing model," assuming that this bull market will fully replicate historical amplitudes.

However, the problem is that the ETF brings about "structural changes," rather than simply "leveraging the cycle."

Tom Lee (Fundstrat Co-founder): $250,000

Prediction: BTC $250,000 (2025)

Core catalyst: He believes that changes in the U.S. political landscape and the government potentially holding Bitcoin are key catalysts. He stated that these developments indicate Bitcoin is becoming a legitimate alternative to traditional stores of value like gold.

Tom Lee's prediction was highly influential in 2024 but also heavily relied on the premise of "policy + sentiment + capital resonance."

Notably, Tom Lee has repeatedly lowered his BTC predictions in 2025 but still emphasized that new highs could be reached in the short term. In the past week, Sean Farrell, the head of digital asset strategy at his company Fundstrat, predicted in an internal report that BTC could fall to $60,000-$65,000 in the first half of 2026 (in a baseline scenario). This contrasts with Tom Lee's public optimism, which the company explained as differing views based on time frames.

Standard Chartered: Close to $200,000

Prediction: BTC $200,000 (2025)

Logical benchmark: Historical price increases after the listing of gold ETFs. The bank expects a large influx of funds into Bitcoin spot ETFs to drive this growth, similar to how gold prices quadrupled after the launch of the first ETF.

However, unlike gold, Bitcoin did not enter a one-way trend after the ETF launch but instead experienced more frequent pullbacks and repricing.

AllianceBernstein: $200,000

Prediction timeframe: September 2025

Additional judgment:

$500k in 2029

$1M+ in 2033

This is one of the few institutional predictions that provided a specific month as an anchor. Reality shows that time anchors are the easiest part of all predictions to fail.

InvestingHaven: $115,200 (bull market) / $75,000 (bear market)

Prediction method: Scenario analysis

This is one of the few models that provide ranges for both bull and bear markets. Even so, its bull market target for 2025 has not been fully realized, while the bear market range has been validated multiple times by the market.

Tim Draper (Venture Capitalist): $250,000 (revised)

As an early investor in companies like Tesla, Skype, Baidu, and Twitch, Draper previously predicted Bitcoin would reach this price in 2022, later revising the prediction timeframe to 2025.

Matthew Sigel (VanEck Research Director): $180,000

Prediction: BTC $180,000+ in 2025

Logic:

ETF inflow

Changes in the U.S. political cycle

But the reality is that the ETF has brought more of a bottom lift rather than a top explosion.

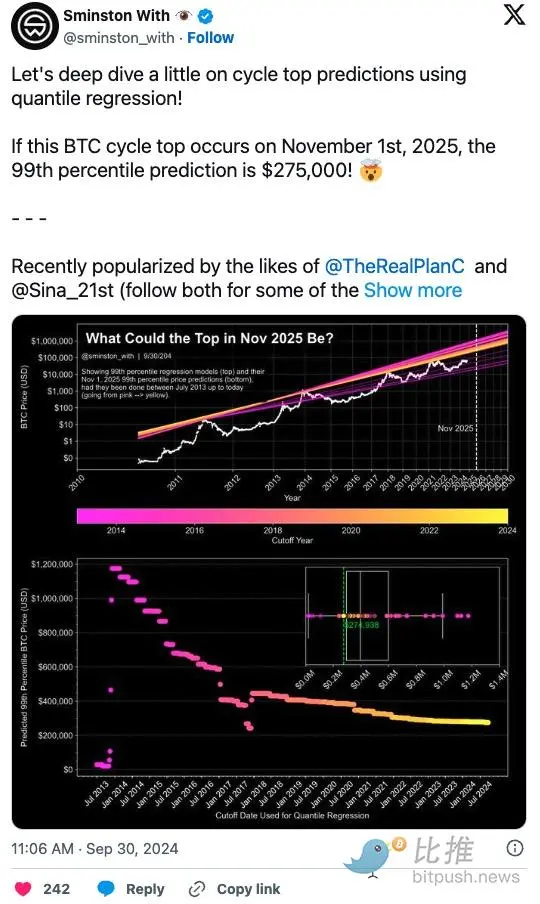

Sminston With (Crypto Researcher, PhD): $275,000

Bitcoin researcher Sminston With used quantile regression to predict the cycle top, believing it would arrive on November 1, 2025, when Bitcoin's price would reach $275,000.

By the end of 2025, this judgment had clearly failed.

Cathie Wood (ARK Invest): $1,000,000

Prediction:

Base case: $650,000 (2030)

Optimistic: $1,000,000+

Strictly speaking, this prediction has not yet been "slapped in the face," but it represents a long-term version of the same logic.

ETH: Price Refuses to Pay for the Narrative

In 2025, the fundamental narrative of ETH did not fail, but the price refused to pay for the narrative.

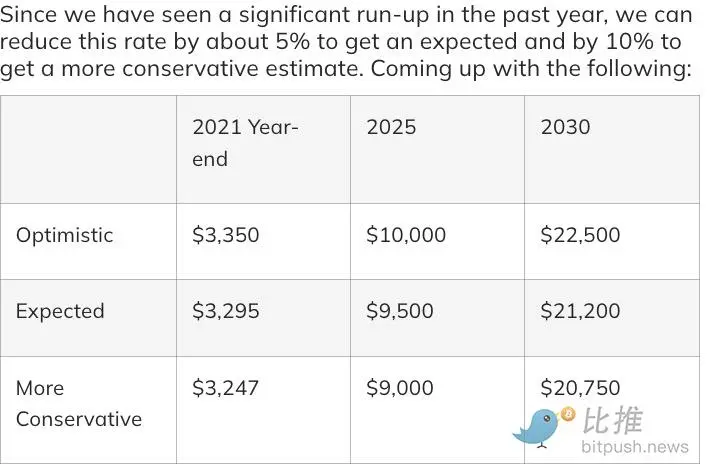

Deltec Bank:

2025: Optimistic $10,000 / Expected $9,500 / Conservative $9,000.

Standard Chartered: $14,000 "ETF + Upgrade" Path

Standard Chartered proposed in 2024 that ETH could reach $14,000 (2025), with one of the core catalysts being the ETF. However, by 2025, Standard Chartered raised its year-end ETH prediction to $7,500.

Finder analysts: In February 2024, 50 analysts predicted an average ETH price of $6,105 (2025).

VanEck predicts that by 2030, Ethereum's price will reach $11,800, citing network growth and adoption.

Bitwise: Predicted Ethereum would reach $7,000 by the end of 2024, alongside new highs for BTC and SOL.

Bankless: Believes that after Ethereum realizes its potential in 2025, the pessimistic price is $10,000, and the reasonable price is $15,000.

Summary

The 2025 market indeed prompts reflection—constantly trying to predict the future based on past experiences is becoming less effective in the crypto market. The once-popular "four-year cycle theory" has lost its explanatory power under the impact of large-scale capital flows from ETFs and a complex macro environment.

Market predictions are essentially about finding anchors amid uncertainty. But when the anchors themselves are drifting, who can guarantee accuracy every time? Facing 2026, perhaps what we need is not to rush to find the next "prophet," but to maintain patience and flexibility.

It should be noted that this article does not aim to deny the analytical value of professional institutions. In a market filled with information, rigorous research remains valuable. Ultimately, the market will always provide answers, and what we need to do is learn to coexist with predictions while maintaining independent thinking. After all, in this field, there can be many opinions, but the true answer is always just one—the market itself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。