Author: Zhou, ChainCatcher

Recently, the name Lighter has been trending in the community, whether it's discussions about valuation, calculations of yield from points farming, guesses about TGE timing, or pre-market price fluctuations, the sentiment is exceptionally strong.

Exchanges like Binance and OKX have announced the launch of pre-market trading for the LIT token, and the Polymarket prediction market shows that the probability of its post-TGE valuation exceeding $3 billion is over 50%. The on-chain signal of 250 million LIT tokens being transferred has ignited FOMO sentiment completely. Everything seems to be falling into place, and Lighter is undoubtedly one of the most anticipated projects in the crypto market by the end of the year.

However, while everyone is calculating how many LIT tokens can be exchanged for points and how much the price will rise after TGE, a more fundamental question has been overlooked: how much of this airdrop frenzy is real growth, and how much is just a fleeting illusion of incentive bubbles? Does the Perp DEX track truly possess sustainable value?

Valuation Anchors and the Zero Fee Trap

In the fierce competition of the Perp DEX track in 2025, Lighter has carved out a unique expansion path. Compared to Hyperliquid, which breaks through with extreme operational capabilities and a fair narrative without VC backing, and Aster, which benefits from brand premium backed by the Binance ecosystem, Lighter has chosen to deeply embrace top-tier capital.

According to RootData, Lighter completed a massive $68 million financing round in November this year, led by Founders Fund and Ribbit Capital, with participation from Robinhood. Its Pre-TGE valuation has reached as high as $1.5 billion, and prior to this, established institutions like Dragonfly and Haun Ventures had already endorsed it.

From a financial metrics perspective, Defillama shows that Lighter's open interest (OI) has reached $1.572 billion, with monthly revenue of $10.27 million, and an annualized revenue approaching $125 million. In terms of trading volume, Lighter recorded $227.19 billion in the past 30 days, even surpassing the benchmark of the track, Hyperliquid ($175.05 billion) and Aster ($189.03 billion), and was once recognized by the market as a dark horse in this year's perp DEX.

Market analysis suggests that Lighter's ambitions go far beyond being a simple perpetual contract exchange; it aims to build decentralized trading infrastructure, intending to connect brokers, fintech companies, and professional market makers. On the retail side, Lighter implements a "zero-fee" strategy similar to Robinhood, but it has a latency of 200-300 milliseconds, which undoubtedly creates excellent arbitrage opportunities for high-frequency market makers. Ordinary retail investors, drawn by the "low fees," may avoid explicit transaction fees but could end up paying several times the normal trading costs due to implicit slippage.

As a result, there is some controversy in the market regarding its business model, and its valuation logic extends beyond a simple comparison of Perp DEX dimensions. Although Polymarket shows that its post-TGE valuation expectation falls within the range of $2 billion to $3 billion, whether it can sustain a long-term institutional narrative remains a question mark.

On the other hand, historical experience has repeatedly proven that "launching is peaking" has become an inescapable fate for star VC projects. Data from 2025 shows that high-profile "VC-backed projects" have severely disconnected performance and valuation in the secondary market. For example, the Humanity Protocol, valued at $1 billion by VCs, currently has a market cap of about $285 million, Fuel Network is around $11 million, and Bubblemaps is about $6 million, with discrepancies reaching several dozen times. Other projects like Plasmas and DoubleZero also have market caps remaining at only 10% to 30% of their VC valuations.

In the face of "vanity metrics" driven by capital, Lighter may just be the next case study.

The False Prosperity of Perp DEX

The ongoing concerns about Lighter essentially reflect the deep-seated bottlenecks of the entire Perp DEX track.

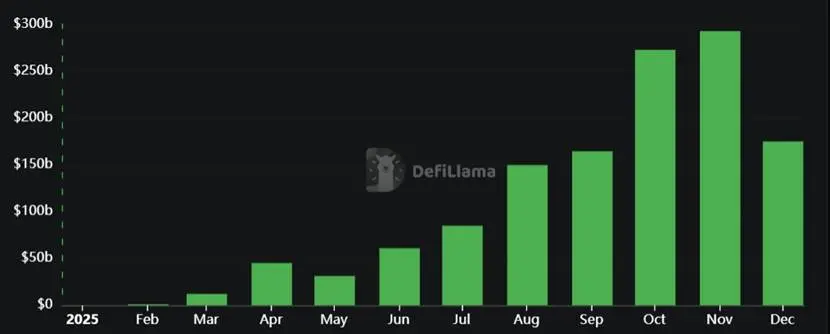

First, the core user group of Perp DEX should be leveraged traders and institutional arbitrageurs, but the actual activity level falls far short of the narrative. According to DeFiLlama data, even when the entire track's monthly trading volume hit a historical high of $1.2 trillion in October, the number of globally active addresses (referring to effective users with directional positions daily) only maintained a scale of tens of thousands to a hundred thousand, which presents a significant gap compared to the hundreds of millions of users on CEX platforms like Binance and Bybit.

The reason behind this is that while users choose DEX for low fees and on-chain privacy, most retail investors' capital sizes are not sensitive to privacy. Moreover, as the frontrunner Hyperliquid has established a deep liquidity moat with its self-built Layer 1, new players find it challenging to break through in the same dimension.

The limitation of the user base leads to the track's growth being highly dependent on "temporary farmers" rather than loyal users. A CoinGecko report pointed out that by the end of 2025, airdrop interaction (Airdrop Farming) became prevalent, with users flocking in mostly to earn points rather than for long-term trading, resulting in retention rates generally halving after TGE (token generation). For instance, while Lighter's Season 2 attracted over 500,000 new users, analysis shows that 80% were multi-wallet Sybil (witch) accounts, and the number of genuinely active addresses is far less impressive than it appears.

Secondly, the awkward state of the track is reflected in the "short-term cycle" formed by the interests of multiple parties: project parties urgently need TVL and trading volume to support valuation narratives, inducing traffic through points and zero fees; VCs bet on high valuations seeking exits; while farmers rush to score points and cash out after airdrops.

Forklog analysis states that while the "interest roulette" has inflated the surface data, it is essentially a short-term game among various parties, rather than an ecological win-win. A typical case is Aster, which, after adjusting its points multiplier in November 2025, saw 400,000 wallets quickly migrate to Lighter, directly causing gas fees to surge and the platform's depth to collapse.

Stephan Lutz, CEO of BitMEX, warned that the Perp DEX craze may be difficult to sustain, as CEX still controls 95% of the open interest (OI) share, and the DEX model overly relies on incentive mechanisms, making its business logic extremely fragile. A mid-2025 report from 21Shares also emphasized that although the Perp DEX market share rose from 5% at the beginning of the year to 26%, this growth driven by bullish market sentiment is accompanied by severe fragmented competition.

Additionally, the apparent explosion in trading volume for Perp DEX is a product of users being incentivized by points. By the end of 2025, the airdrop mining craze for non-token Perp DEX surged, which also explains why both Lighter and Aster's monthly trading volumes could exceed $180 billion. Although Aster has issued tokens, it has to maintain surface growth through continuous reward activities, and the model of "subsidizing for retention" is akin to overdrawing the future.

It has been proven that the gloss created by capital and maintained by points often faces brutal valuation corrections after TGE. Looking back at similar projects backed by top VCs like Vana, although its FDV briefly skyrocketed after TGE in 2024, it subsequently halved by 70% due to the loss of incentive support, quickly becoming a "ghost project" with depleted liquidity. The current data frenzy of Lighter and Aster mirrors the path of these VC projects with valuation discrepancies.

In the current market landscape, the head effect of Perp DEX has basically solidified, with Hyperliquid firmly in the lead due to its early endogenous revenue and depth, while remaining players can only seek differentiated survival in extremely narrow sub-tracks such as mobile optimization, insurance mechanisms, or RWA integration.

Ultimately, the Perp DEX track is still in a stage of stock game, and for small retail investors with low sensitivity to privacy, DEX still lacks sufficient migratory motivation. Beneath its surface bustle, the real value may be far more pale than the data suggests.

Conclusion

In the prosperous logic woven by points, VCs, and airdrops, Perp DEX seems to be trapped in a self-sustaining illusion. However, when the tide of subsidies recedes, those "dark horses" lacking real user stickiness and relying solely on capital narratives will ultimately reveal their true form in the liquidity test of the secondary market.

The story of Lighter continues, but it reminds crypto investors that the DeFi track has never lacked for lively feasts; what it lacks is the truth that can endure through the bubbles. In the pursuit of the next shining moment, it may be wise to ask oneself cautiously: who is this celebration really for?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。