Author: Nancy, PANews

The curtain of 2025 is slowly falling. Looking back at this year, the crypto world has undoubtedly reached a watershed moment, officially bidding farewell to the past wild gold rush era, trading in T-shirts for suits, and knocking on the doors of mainstream finance.

In this annual examination of the transition from crypto to the mainstream world, this article from PANews reviews the annual reports of 11 leading projects, covering public chains, DeFi, stablecoins, cross-chain, and AI sectors. They are not merely satisfied with performance metrics in an arms race but have collectively turned towards compliance, practicality, and deep cultivation of scalability. However, the completion of infrastructure has yet to directly lead to a great prosperity of crypto applications, as the industry still faces issues such as homogenization, value capture difficulties, and insufficient product-market fit. Looking ahead to 2026, these projects are aiming at enhancing liquidity integration capabilities, breaking through into new scenarios, and developing sustainable economic models.

Circle: Identity "Normalization" and Three Major Strategies

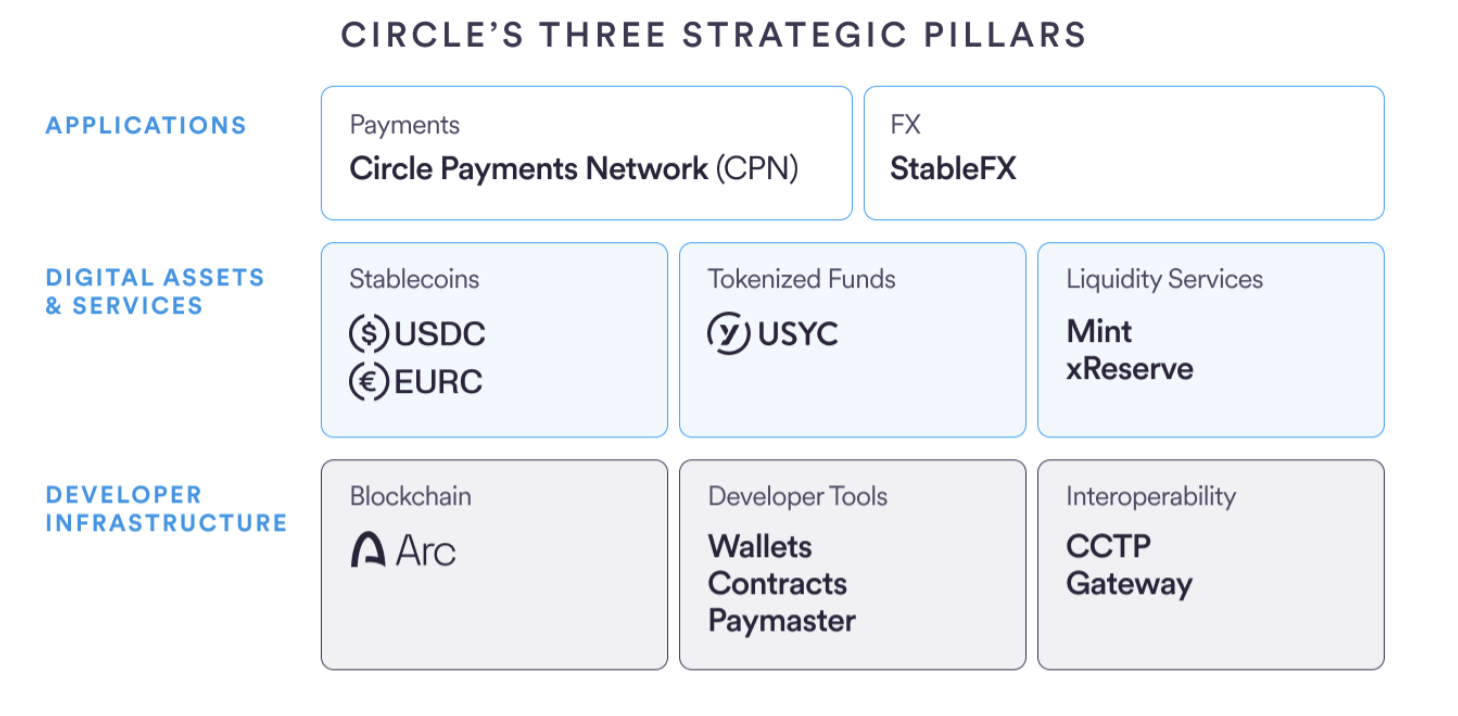

This year, with the clarification of regulations in major global markets, Circle has pushed programmable money and on-chain commerce from the fringes of experimentation into the mainstream of global finance, focusing on three core strategic components: assets, applications and services (such as Circle Payment Network CPN and Circle StableFX), and infrastructure Arc.

In terms of assets, Circle includes USDC, EURC, and USYC. Among them, the market capitalization of USDC has increased from $44 billion at the beginning of the year to $77 billion, with on-chain transaction volume exceeding $50 trillion and native support across 30 blockchains; EURC's market capitalization has risen from €7 million at the beginning of the year to over €300 million, becoming the largest euro stablecoin; USYC's asset management scale has grown to $1.54 billion, making it the second-largest TMMF (tokenized money market fund) globally.

Facing the risk of a singular profit model, Circle began exploring diversified applications and services this year, launching CPN, CCTP, Gateway, Circle xReserve, Mint, StableFX, and Circle Wallets. For example, the payment network CPN has over 25 design partners and allows the use of stablecoins like USDC and EURC to facilitate predictable, internet-native settlements without traditional intermediaries; CCTP enables users to transfer native USDC across 17 supported blockchains, having processed over $126 billion in cumulative transaction volume and over 6 million cross-chain transfers; Circle Wallets directly embed USDC wallets into applications, supporting both developer-controlled and user-controlled modes.

At the same time, Circle is targeting infrastructure, with the launch of the L1 blockchain Arc this year aimed at becoming an open, institutional-grade internet-native infrastructure tailored for lending, capital markets, foreign exchange, and payments, attracting over 100 startup and design participants.

Currently, Circle's institutional and commercial adoption is accelerating, involving consumer banking, cross-border payments, payroll, small business finance, and remittances, with partner institutions including Intercontinental Exchange, Deutsche Börse, Visa, Mastercard, BlackRock, HSBC, Goldman Sachs, Nubank, Binance, and others. Additionally, Circle is laying out an AI agent economy, enabling AI to autonomously hold funds and pay for APIs, computing power, and other expenses through wallets and the Arc blockchain.

Notably, Circle completed its IPO in June this year, with its market capitalization peaking at $77 billion before falling back to $19.4 billion, and received conditional approval from the Office of the Comptroller of the Currency (OCC) to establish a national trust bank, which will greatly enhance the security and regulatory compliance of USDC reserves.

Arbitrum: Comprehensive Onboarding of Institutions, Historical Transactions Exceeding 2.1 Billion

This year, Arbitrum's narrative focus has shifted to institutional-level financial infrastructure. From powering the world's largest retail trading platform to settling tokenized funds from the largest asset management companies globally, Arbitrum claims to have become the preferred platform for major global institutions.

In terms of ecosystem, Arbitrum is evolving into a massive economy, with over 100 chains launched or in development, including Ethereal Perps DEX, Zama, and Blackbird. Additionally, over 1,000 projects are supported by Arbitrum, making it one of the top three public chains by protocol count. Currently, the Arbitrum network has generated over $600 million in ecosystem GDP, with a year-on-year growth of over 30%. Furthermore, Arbitrum One surpassed 2.1 billion historical transactions in 2025, with total value guaranteed exceeding $20 billion. Notably, it took less than a year to complete the second billion transactions, while the first billion took three years.

In terms of stablecoins, supply has increased by 82% year-on-year, with a market capitalization of approximately $8 billion. For instance, the DRIP program has driven stablecoin growth by over 229% within a few months; in terms of RWA tokenization, the scale surpassed $1.1 billion in October, 18 times that of the same period in 2024, with partner institutions including Robinhood, Franklin Templeton, Blackrock, and Spiko; active loans have grown by 109% to $1.5 billion, with new lending products from teams like Fluid growing over 460%.

Financially, Arbitrum has demonstrated extremely high profit margins and diversified revenue-generating capabilities. The gross profit for Q4 2025 is expected to be around $6.5 million (annualized at about $26 million), with a quarter-on-quarter growth of over 50% and a gross margin exceeding 90%. Additionally, revenue sources have expanded from 2 last year to 4 this year, with Timeboost generating over $5 million in revenue within the first 7 months of its launch. Moreover, Arbitrum has a substantial balance sheet, holding over $150 million in non-native assets, including cash equivalents and ETH, laying the foundation for its sustainable and strategic expansion.

Looking ahead to 2026, Arbitrum aims to integrate open programmable financial applications into the global economy. However, Arbitrum still faces intense competition in the L2 space, and the value capture capability has been questioned due to token incentive subsidies.

Aave: A Year of Absolute Dominance and Three Pillars

The Aave protocol has become the largest and most liquid lending protocol in history, capturing 59% of the DeFi lending market and accounting for 61% of all active loans in DeFi. Currently, Aave is facing an internal power struggle over governance rights. (Related reading: Price drop, whales exit, and the power struggle in Aave highlight governance dilemmas in DeFi)

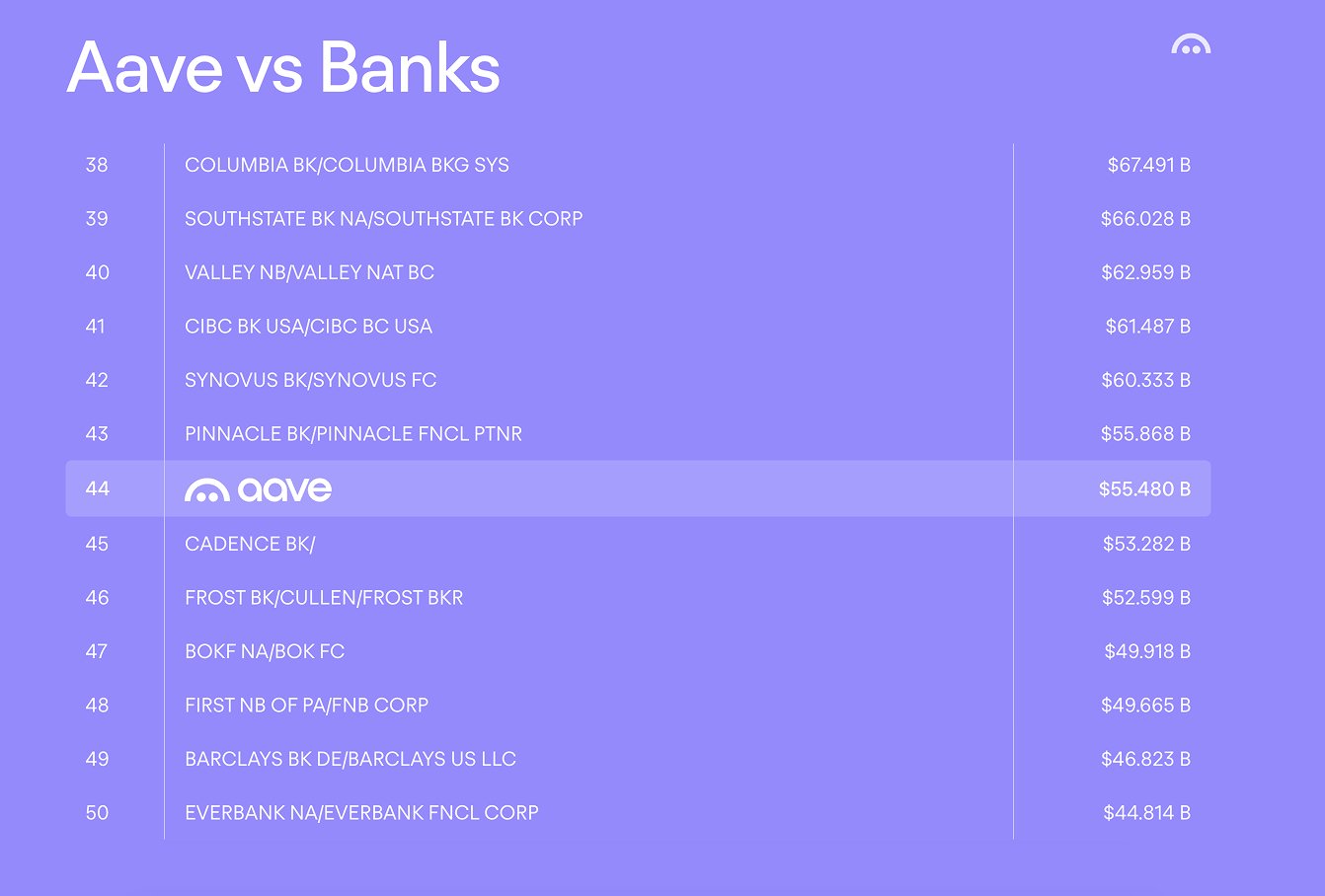

Over the past year, Aave has demonstrated remarkable resilience and expansion capabilities, with all core metrics reaching historical highs. In 2025, net deposits peaked at $75 billion, with a historical cumulative deposit processing of $3.33 trillion and nearly $1 trillion in loans issued, comparable to the top 50 banks in the U.S.; currently, Aave is the only protocol with a TVL exceeding $1 billion across four different networks.

As a result, Aave possesses strong revenue-generating capabilities. It generated $885 million in fees throughout the year, accounting for 52% of all fees generated by lending protocols, a figure that exceeds the total of its five closest competitors. This robust cash flow directly supports a large-scale AAVE token buyback program.

Looking ahead to 2026, Aave's strategic focus is on Aave V4, Horizon, and Aave App. Among these, Aave V4 will unify liquidity through a Hub & Spoke model, allowing Aave to handle trillions of dollars in assets, making it the preferred choice for any institution, fintech company, or enterprise seeking Aave's depth and reliable liquidity; Horizon targets the RWA lending market for institutions, aiming to expand net deposits from $550 million to over $1 billion; Aave App is a mobile entry point for the masses, covering 70% of global capital markets, aiming to onboard millions of new users onto the blockchain.

Starknet: A Year of Execution, Betting on BTCFi to Attract $160 Million

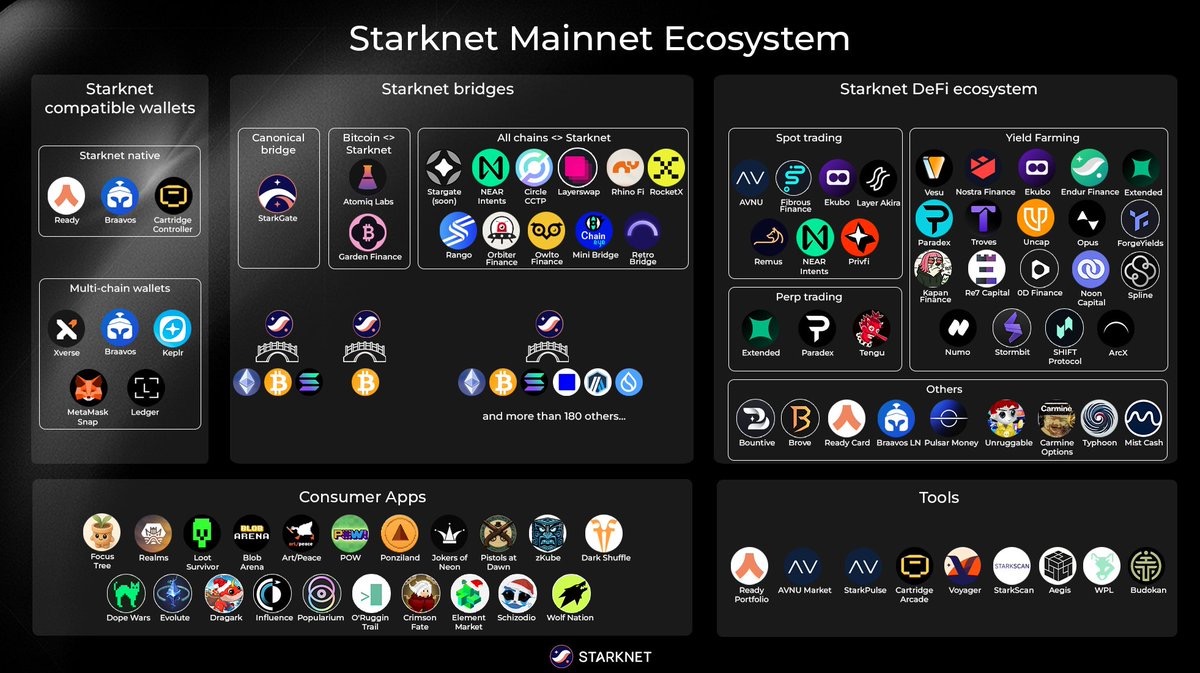

Starknet has supported $15 trillion in transaction volume and executed over 1 billion transactions. However, this year, Starknet faced multiple outages that raised questions, and its high language barrier has resulted in a significant gap in ecosystem development compared to EVM-compatible chains.

Starknet claims that 2025 is the "Year of Execution," achieving significant progress in performance, decentralization, interoperability, BTCFi, privacy, and ecosystem development.

In terms of performance, Starknet has completed several key technological implementations, particularly the integration of v0.14.0 (Grinta) and S-two. The v0.14.0 (Grinta) upgrade has made Starknet the first Rollup driven by a centralized ordering architecture, significantly enhancing user and developer experience; the next-generation prover S-two means lower costs and faster speeds, achieving a 100-fold leap in efficiency compared to the previous generation (Stone). Currently, TPS capacity has increased to over 1000, gas fees remain below $0.001, transaction latency has dropped from 2 seconds to 500 milliseconds, and throughput recently peaked at 2,630 UOPS (user operations per second), with processing capabilities approaching the demands of Web2 giants like Stripe or Nasdaq, and plans to increase capacity to over 10,000 TPS in the future.

In terms of economic models, Starknet has introduced a dual-token security model of STRK + BTC, allowing Bitcoin stakers to earn governance tokens STRK, thereby enhancing economic security. In just three months, Starknet's BTC staking volume has surpassed $160 million. Meanwhile, the staking volume of STRK has increased 11-fold since the beginning of the year (1.1 billion tokens), with a staking rate of 23%.

In terms of interoperability, Starknet has addressed the shortcomings of fund inflows and outflows, such as launching Circle CCTP, which connects institutional funding channels with native USDC; it is set to fully integrate LayerZero and Stargate, as well as integrate Near Intents, supporting seamless exchanges of over 120 assets with STRK.

In terms of application deployment, approximately 50 new teams joined the Starknet mainnet this year, covering sectors such as DeFi, payments, gaming, and consumer applications. For example, the Perp DEX Extended, developed by the former Revolut team, achieved a TVL of over $100 million within three months of its launch; Ready launched a closed loop for on-chain USDC and real-life payments (via Mastercard); full-chain games like Realms and Blob Arena have landed on mobile app stores, utilizing account abstraction for seamless interaction.

Regarding privacy, Starknet is advancing its "scale first, privacy later" strategy. Among these, the L2 Ztarknet based on Starknet is an important proposal that brings scalability and programmability, serving as a programmable layer for Zcash. At the same time, Starknet is building a complete privacy ecosystem, including core infrastructure, privacy payments, privacy transactions, privacy pools, new privacy banks, and data protection protocols.

In 2026, Starknet aims to further shift towards commercialization and scalability. For instance, it plans to directly link network revenue with the value of the STRK token; deepen its positioning as a "Bitcoin smart contract layer," setting hard targets of 10,000 BTC staked and a staking rate of over 35% for STRK; promote at least a threefold increase in the number of privacy products and launch exclusive products combining BTCFi + privacy; and integrate EVM wallets to significantly improve distribution and user experience.

NEAR: Sharding Expansion, Cross-Chain Execution, and Private AI

Having traversed multiple bull and bear cycles, NEAR has undergone several narrative adjustments. This year, NEAR has transformed into a universal execution layer for cross-chain DeFi and the agent economy through three key technologies: sharded blockchain infrastructure, intent-driven cross-chain execution, and hardware-supported private AI.

On the technical infrastructure front, NEAR has achieved a qualitative leap in underlying technology, laying a solid foundation for supporting large-scale AI agents and high-frequency financial operations. For example, NEAR achieved a public benchmark test of 1 million TPS on consumer-grade hardware, far exceeding traditional payment networks. Additionally, network performance has been further optimized, with NEAR achieving 1.2 seconds of finality confirmation and 600 milliseconds of block time, enabling it to compete with traditional financial systems in settlement speed; NEAR has also launched sharded smart contracts on the mainnet, enhancing decentralization and execution capabilities.

NEAR Intents has become the fastest-growing cross-chain infrastructure this year, achieving universal execution from DeFi to the AI market through chain abstraction technology. The core data of Intents is also impressive, with a historical total cross-chain transaction volume exceeding $7 billion and over 13 million cumulative swaps; it connects more than 25 major blockchains, supporting one-click swaps and unified liquidity for over 125 assets; and it supports over 1.6 million independent users, becoming a core hub connecting multi-chain ecosystems.

NEAR AI has introduced a new privacy-first intelligent category for enterprises and consumers, addressing the data leakage challenges faced by businesses adopting AI by supporting the deployment of models that provide end-to-end encryption of user data. Currently, it has established deep collaborations with Brave Nightly, OpenMind, TravAI, and others. Notably, the digital asset treasury and confidential AI cloud platform SovereignAI received $120 million in PIPE investment and launched the NEAR digital treasury.

In terms of economic models, NEAR has completed a critical halving upgrade, reducing the maximum annual inflation rate by 50%; the digital asset treasury and confidential AI cloud platform SovereignAI received $120 million in PIPE investment and launched the NEAR digital treasury; Bitwise has also launched a staking NEAR ETP, officially entering the asset allocation list of traditional financial institutions.

In terms of the developer ecosystem, NEAR's developer resources have significantly increased in 2025, covering seamless wallet onboarding innovations, multi-language support expansion, and toolchain improvements, providing a unified and convenient path for developers to build applications on NEAR.

Looking ahead to 2026, NEAR will focus on accelerating adoption and strengthening the value capture capability of its token economy. On one hand, NEAR will deepen the adoption of Intents, continue to expand integration scope and transaction volume, broaden distribution channels, and solidify its position as a universal execution layer across chains. On the other hand, NEAR will accelerate the application of NEAR AI in real-world scenarios, pushing the agent economy from concept to reality. Additionally, NEAR has established a new ecosystem sustainability framework, planning to introduce fees generated by NEAR Intents into the community governance treasury, thereby directly enhancing the value capture capability of the NEAR token and aligning protocol revenue with the interests of token holders.

Celo: Rejecting Empty Talk, Payments Shine

Celo has defined 2025 as a year of rejecting empty talk, completing multiple key technology upgrades and ecosystem expansions, and making positive progress in real-world payments. However, Celo still faces challenges such as a single distribution channel and intense competition.

This year, Celo underwent four hard forks, abandoning its independent L1 identity, completing the migration to Ethereum L2, and further upgrading to ZK Rollup. From a results-oriented perspective, this bold decision has achieved significant breakthroughs both technically and commercially. Data shows that its on-chain costs have decreased by 99.8%, and on-chain revenue has increased tenfold.

In terms of user and transaction data, Celo has surpassed 1 billion cumulative transactions, with peak daily active users reaching 790,000, ranking first among all L2s. More importantly, among the 5.2 million new users throughout the year, as much as 79% were first-time users of the chain. This data indirectly confirms that Celo's main growth is not from the migration of existing on-chain users.

The core driver of this achievement is the MiniPay wallet, deeply integrated with the Opera browser, which has brought over 11 million users to Celo this year by integrating Apple Pay and local payment systems in Nigeria, Brazil, and other regions, covering over 60 countries worldwide. This payment scenario based on real demand has directly driven the explosion of Celo's on-chain stablecoin business, with stablecoin transaction volume exceeding $65.9 billion year-to-date, a year-on-year increase of 142%. Among them, the weekly active users of USDT peaked at over 3.3 million, even surpassing Tron in activity.

In addition to payment services, Celo has also increased its infrastructure layout in 2025. For example, in the identity layer, the explosion of the Self Protocol and its support for Google Cloud and India's Aadhaar ID have solved the problem of on-chain identity verification, which is crucial for subsequently introducing regulated financial services (RWA, unsecured lending); in the privacy layer, Celo's collaboration with Ernst & Young (EY) on the L3 testnet Nightfall aims to address the privacy pain points enterprises face when conducting payment settlements on public chains.

Notably, to address the token price capture issue, Celo proposed a token economic model reconstruction plan in December, planning to introduce a burn and buyback mechanism in an attempt to build a healthier economic loop.

Looking ahead to 2026, Celo aims to make stablecoin payments as simple as native payments anywhere and fully expand the "mini-app" economy while strengthening trust and security (identity, user protection) based on scalable expansion.

Aptos: Optimizing Performance and Developer Experience

This year, Aptos's smart contract programming language Move continued to advance in expressiveness, high performance, and security, aiming to build a new generation of smart contract languages. However, in the high-performance public chain space, Aptos has yet to see a phenomenon-level application, and its token faces selling pressure from early institutions and teams.

In terms of language, Move 2 continued to expand the language's expressiveness this year, including the introduction of higher-order functions, on-chain storage, signed integer types, and detail improvements; in terms of performance, the Move technology stack has been optimized, including Rest API, indexers, Move compiler, and Move VM, with plans to redesign the Move VM next year to enhance parallelism, single-thread performance, and security; in terms of developer experience, Aptos has made several significant functional enhancements, including IDE support, transaction simulation sessions, a new decompiler, and mutation testing.

Next year, Aptos plans to redesign the Move VM and execution stack, elevating parallelism, single-thread performance, and security to a new level, and make the development experience more mainstream and convenient by introducing a TypeScript framework.

Sui: The Year of Technology Stack Implementation

In 2025, Sui shifted from the speed race to a full-stack platform, providing a complete technology stack called Sui Stack to address issues of computation, storage, privacy, identity, and liquidity, allowing developers to no longer rely on centralized services. Sui also faces challenges from high-performance chain competition, ecosystem and adoption rates, and token unlocking pressure.

This year, Sui completed several key pieces, achieving native interoperability:

Storage Layer: Walrus is a decentralized storage solution built for scale, integrity, and programmability, allowing large-scale data such as videos, audio, and AI models to be stored cheaply and decentralized. Walrus Sites provide a model for hosting decentralized front ends without relying on centralized hosting infrastructure.

Privacy and Security Layer: Seal brings programmable access control to the stack, allowing the construction of complex, Web2-like permission management systems, all of which are verifiable on-chain, facilitating the entry of enterprise-level applications.

Data Layer: The verifiable computation layer Nautilus utilizes TEE (Trusted Execution Environment) for on-chain verification and off-chain computation, allowing applications to handle heavy computations or private data without placing all the burden on the main chain while maintaining data verifiability.

Liquidity Layer: DeepBook V3 has become the shared liquidity infrastructure of the Sui ecosystem, supporting permissionless liquidity pools that serve all DeFi applications.

Identity and Governance: The identity and naming system SuiNS upgraded to infrastructure this year and launched the Move Registry (Sui's NPM package manager), achieving human-readable code packages.

Additionally, Sui has optimized its infrastructure and user experience. For example, Mysticeti v2 further enhances the performance of the underlying layer; Passkeys support FaceID/fingerprint for direct transaction signing without the need for mnemonic phrases; Slush Wallet & Enoki 2.0 allow users to use applications without being aware of the blockchain's existence.

Sui's full-stack capabilities are driving the construction of more innovative applications, including cross-chain hubs, full-chain gaming, full-chain finance, and AI payments. At the same time, Sui is accelerating its entry into the mainstream market, with Canary, 21Shares, and Grayscale all submitting spot ETF applications; inclusion in the Bitwise 10 index; and Nasdaq listing leveraged SUI ETFs.

Looking back at the end of 2025, Sui claims to have laid a solid foundation, and the future development will depend on how the community chooses to build upon it.

Hedera: Targeting AI and Tokenization, Reshaping Brand and Architecture

If the previous years were about proving that public distributed ledger technology (DLT) could handle real commercial workloads, then Hedera believes that 2025 has proven it to be a trusted layer relied upon by institutions. However, its development is still hindered by questions of centralized governance and a relatively weak ecosystem due to fierce competition in the public chain market.

In the field of tokenization, Hedera has demonstrated a shift from theory to practice. For example, the tokenized shares of a money market fund and UK government bonds issued on Hedera through Archax were used as collateral for foreign exchange transactions between Lloyds Banking Group and Aberdeen; the Canary HBAR ETF (HBR) was launched on the Nasdaq stock exchange in October 2025; a digital Australian dollar was launched on Hedera using Stablecoin Studio; and the Hedera Foundation invested in the tokenized products of Fidelity International's MMF issued on Hedera.

In the AI sector, Hedera has entered the niche of verifiability, including the launch of the open-source modular toolkit AI Studio and the creation of verifiable AI governance solutions in collaboration with Accenture and EQTY Labs.

On the architecture side, Hedera launched HashSphere in 2025, allowing organizations to deploy private permissioned networks while settling and inter-operating through the Hedera mainnet, meeting regulatory requirements for privacy and public demands for transparency. For instance, the Reserve Bank of Australia's (RBA) Project Acacia and the Qatar Financial Centre project both adopted this model.

In terms of internal governance and structure, Hedera has undergone a transformation. For example, the HBAR Foundation has transitioned to the Hedera Foundation, establishing a closer and more consistent brand system; partners like Arrow Electronics and Repsol have joined the council and launched the Hedera Enterprise Application Team (HEAT); in 2025, Hedera also introduced multiple builder tools to lower the barriers for developers and held several hackathons.

Additionally, Hedera gained attention from governments and regulatory bodies in 2025. For instance, Wyoming's Frontier Stablecoin (FRNT) chose Hedera as the candidate blockchain for the first state-issued stablecoin in the U.S.; the Bank of England and the Bank for International Settlements (BIS) Innovation Hub's DLT Challenge selected Hedera as one of only two L1 networks.

Hedera stated that 2026 will not be about starting new stories but rather expanding the story that began in 2025.

ZKsync: ZK Technology Moves Towards Production-Level Deployment

Looking back at 2025, ZKsync has pushed ZK technology towards production-level deployment. However, it still faces multiple challenges, including a community trust crisis triggered by airdrop controversies, varying quality of projects within the ecosystem, and increasing competitive pressure in technology.

This year, ZKsync achieved three major breakthroughs in technology and products: in privacy products, ZKsync launched Prividium, enabling institutions to operate private systems in compliance with regulations while natively connecting to Ethereum; in liquidity interoperability, L1 Interop established a new model of "private systems + public markets" by achieving bridge-less, native interoperability between ZK chains and Ethereum liquidity (such as Aave); in performance, the Atlas upgrade and Airbender technology significantly improved proof speeds and reduced costs, reshaping the performance standards of ZK.

In terms of ecosystem expansion, ZKsync completed several heavyweight collaborations across finance, consumption, and other fields, including UBS, Deutsche Bank, Abstract, and Sophon. At the same time, ZKsync launched ZKsync Managed Services, providing production-level infrastructure support for enterprises and lowering deployment barriers.

Additionally, ZKsync has strategically upgraded its token and brand. The ZK token has shifted from pure governance to practicality, clarifying interoperability and off-chain permissions as core pillars of value capture; the brand has also been repositioned as "immutable financial infrastructure."

As regulatory bodies like the SEC begin to recognize the compliance-promoting role of ZK technology, ZKsync claims it will leverage a unified architecture of privacy, performance, and public liquidity access to increase its construction efforts in 2026.

LayerZero: Over $50 Billion in Asset Adoption, Interoperability Enters Practical Application

In 2025, LayerZero is accelerating its evolution from a cross-chain tool to the underlying operating system of the crypto world. This means its main challenge lies in achieving high-efficiency cross-chain interoperability while ensuring security and developing effective economic models.

Currently, LayerZero has three major technical pillars:

OFT Standard: Allows tokens to be issued and transferred across more than 150 blockchains while maintaining a unified supply and contract address, enabling zero-slippage transfers (only requiring gas fees) and eliminating double-spending risks. Currently, over $50 billion in assets (such as USDT, PYUSD, and WBTC) adopt this standard. Issuers no longer need to develop separately for each chain but can use it as a distribution channel. For example, Ondo Finance has tokenized over 100 stocks using the OFT standard, and 61% of stablecoins move through LayerZero; PENGU has expanded to Solana, Abstract, and Hyperliquid using the OFT standard.

Decentralized Validator Network (DVN): Applications can autonomously choose who verifies cross-chain messages, such as selecting Google Cloud, Polyhedra, or running their own validation nodes. Security is no longer one-size-fits-all but configurable, programmable, and immutable. Applications have complete sovereignty over their security.

Full-Chain Messaging and Data OApp & lzRead: Supports sending any data (messages) across chains and pulling/reading data from multiple chains. This enables not only transfers but also cross-chain governance, complex DeFi logic (such as EtherFi cross-chain staking), and identity verification.

Currently, LayerZero's three practical areas of interoperability are: new chains, which solve early liquidity cold start issues by sharing users and liquidity through interconnectivity; institutional tokenization, where institutions like PayPal (PYUSD), BlackRock/Securitize (USDtb), and Ondo Finance utilize LayerZero to issue stablecoins and tokenized assets across multiple chains; and providing AI agents with tools to "read and write" full-chain data, enabling AI to autonomously conduct complex cross-chain arbitrage, payments, and asset rebalancing.

LayerZero envisions that its ultimate goal is to be as invisible as the TCP/IP protocol of the internet: essential but unseen. The foundation has been laid, and a truly global, open, and programmable financial system that transcends any single blockchain is accelerating, aiming to propel the crypto space to an explosive scale comparable to the internet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。