The Ineffectiveness of the Old Script in 2025

As 2025 comes to a close, the crypto market presents an unprecedented "split" phenomenon: Bitcoin (BTC), driven by institutional funds, repeatedly hits new highs, reaching as much as $125,000; Ethereum (ETH) struggles around $2,800, still significantly below its historical peak; and the once "rising tide lifts all boats" altcoins have plunged into despair, with most projects down 80-95% from their 2021 highs, failing to recover even in the context of BTC's new highs.

This is a complete departure from the classic narrative of the crypto market over the past decade. The traditional "four-year cycle" script—"BTC rises first → ETH follows → altcoins surge"—seems to have completely failed in 2025. The "carving a boat to seek a sword" strategy familiar to old players has now become a joke of "carving a boat to seek fish."

Meanwhile, outlook reports for 2026 released by institutions like Grayscale and CoinShares further reinforce a harsh reality: the "class solidification" in the crypto market is accelerating—BTC has become the "digital gold" in institutional asset allocation, while altcoins have devolved into a "twilight of the gods" with depleted liquidity.

Is this a temporary failure of the cycle, or a permanent change in market structure? This article will deconstruct the ongoing "crypto paradigm shift" from four dimensions: phenomenon observation, deep mechanisms, institutional behavior, and liquidity structure.

1. Phenomenon Observation: The "Great Divergence" of BTC and Altcoins

1.1 Data Doesn't Lie: Unprecedented Performance Divergence

The crypto market in 2025 can aptly be described as "fire and ice."

Figure: ETH/BTC exchange rate chart

1. Bitcoin's "Never-Setting Sun":

- Steady price performance: Rising from about $70,000 at the beginning of the year to a peak of $125,000 (+78%), maintaining a range of $86,000-88,000 even after a pullback.

- Influx of institutional funds: Hundreds of billions of dollars in net inflows into spot ETFs, with products like BlackRock's IBIT dominating the market.

- Highly concentrated holdings: ETFs hold over a million BTC, and MicroStrategy holds about 670,000 BTC (accounting for 3.2% of the circulating supply).

- Enhanced market dominance: BTC's market cap dominance surged from 50% at the beginning of 2024 to the current 59-60%, reaching a recent high.

2. Ethereum's "Midlife Crisis":

- Significantly lagging growth: Limited price increase this year, currently around $2,800, far behind BTC's performance.

- Collapse of relative value: The ETH/BTC exchange rate has dropped to a near-historic low, more than 60% down from its historical peak.

- Sparse institutional interest: Total AUM of spot ETFs is far lower than that of BTC ETFs, with periodic outflows of funds.

- Lackluster on-chain activity: Gas fees have significantly decreased, reflecting weak user activity and network demand.

3. Altcoins' "Twilight of the Gods":

- Seasonal indicators collapse: The Altcoin Season Index has remained below 20 for the entire year (50 and above indicates an altcoin season), marking the longest period of low activity in history.

- Generally underperforming the market: Most of the top 100 market cap projects have underperformed BTC this year, with many projects down over 80% from their 2021 highs.

- New coins immediately underperform: Mainstream CEX new coins launched in 2025 often break below their initial listing price, with VC coins becoming "toxic."

- Liquidity depletion: Daily trading volume of altcoins has plummeted over 70% compared to 2021, with insufficient CEX depth causing any selling pressure to trigger a collapse.

1.2 Historical Comparison: This Time "Really Is Different"

Looking back at the past three bull markets, the rotation logic of "BTC → ETH → Altcoins" was almost a market law:

2017 Bull Market: Classic Three-Stage Rocket

- BTC rose from $1,000 to $20,000 (+1,900%).

- ETH skyrocketed from $8 to $1,400 (+17,400%).

- The ICO bubble ignited, with altcoins generally seeing 50-500x increases.

2020-2021 Bull Market: The Frenzy of DeFi and NFTs

- BTC rose from $10,000 to $69,000 (+590%).

- ETH rose from $200 to $4,800 (+2,300%).

- The DeFi Summer and NFT boom propelled altcoins to generally see 10-100x increases.

2024-2025 Bull Market: Breakdown of Transmission Mechanisms

- BTC surged from a low point to $125,000 (+over 78%).

- ETH's growth was limited, hovering around $2,800.

- Altcoins collectively stagnated, even continuing to decline when BTC hit new highs.

The core difference is clear: in 2025, BTC's gains no longer "spill over" to ETH and altcoins; funds seem to be blocked by an invisible wall within the BTC ecosystem. This wall is called "institutionalization."

2. Deep Mechanisms: How Institutional ETFs "Rewrite the Rules of the Game"

2.1 BTC Becomes the "Shadow of US Tech Stocks"

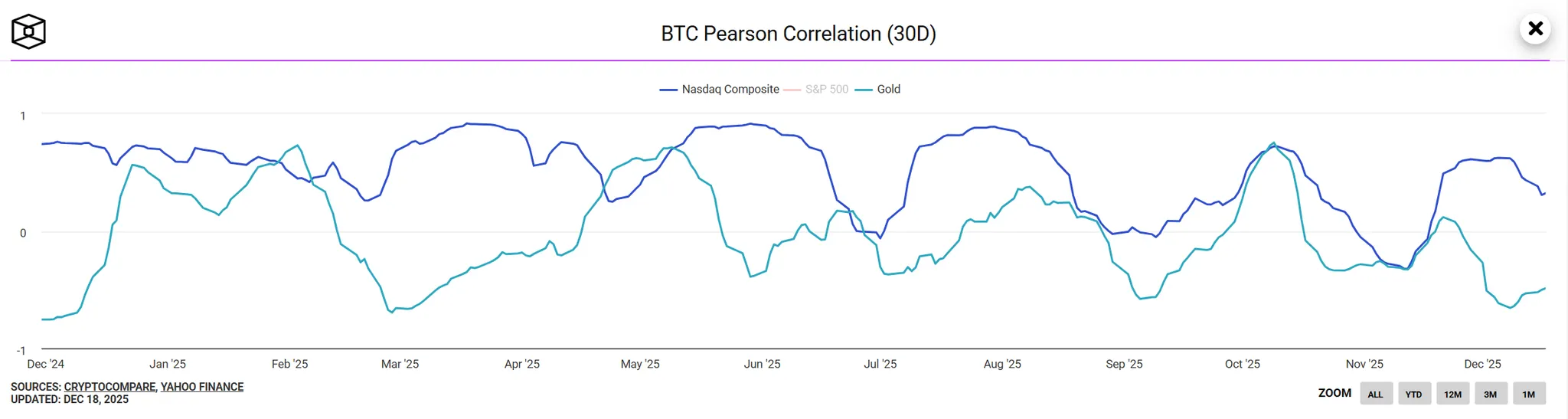

Figure: 30-day correlation coefficients of BTC with Nasdaq/Gold

In January 2024, the US SEC approved the spot BTC ETF, marking the entry of the crypto market into the "institutional era." However, the side effect of this milestone event is that BTC gradually detaches from the native crypto narrative, becoming a "satellite asset" of traditional finance.

High Correlation with Nasdaq

In 2025, the 30-day correlation coefficient between BTC and the Nasdaq 100 index remained stable in the range of 0.75-0.85, reaching a historical high; while its correlation with gold dropped below 0.2. When US tech stocks (like Nvidia and Tesla) surged, BTC ETF inflows accelerated; when US stocks corrected, BTC fell in tandem.

Essential transformation: BTC is no longer "digital gold" (a safe-haven asset), but rather "digital tech stocks" (a risk asset). Its pricing power has shifted from crypto natives to Wall Street fund managers.

The "One-Way Siphon" Effect of Institutional Buying

Clients of traditional asset management giants like BlackRock and Fidelity (pension funds, family offices, high-net-worth individuals) only recognize BTC and avoid altcoins. The reason is not a deep understanding of crypto technology, but rather a combination of "regulatory compliance + ample liquidity + brand recognition":

- BTC has an SEC-approved spot ETF.

- BTC has CME futures and a well-developed derivatives market.

- BTC has a 15-year brand accumulation.

In contrast, altcoins are still seen as "unknown assets" by institutions, with overlapping regulatory, liquidity, and project risks that cannot pass traditional financial due diligence.

Structural solidification of fund flows: In 2025, of the hundreds of billions flowing into BTC ETFs, over 95% is locked within the BTC ecosystem, with less than 5% flowing into ETH/altcoins through OTC trades or DeFi bridges. This sharply contrasts with the past "fund spillover effect."

MicroStrategy's "Unlimited Ammo" Model

Michael Saylor's MicroStrategy has become another dominant force in the BTC market. By issuing convertible bonds and increasing stock issuance, the company continues to buy BTC, currently holding about 670,000 BTC (costing around $30 billion).

More critically, the MSTR stock price has long had a 2-3x premium over the value of its BTC holdings, making it a proxy tool for retail investors to "leverage long BTC." A positive feedback loop is thus formed:

MSTR stock price rises → Market cap expands → Debt issuance capacity increases → More BTC purchases → BTC price rises → MSTR stock price rises again

This "corporate hoarding" model further siphoned off funds that could have flowed into altcoins, reinforcing BTC's dominance.

2.2 Why is ETH "Falling Behind"? Layer 2's "Vampire Attack"

Ethereum's weak performance is not only due to institutional disinterest but also because of internal contradictions within its own ecosystem.

The Liquidity Dispersal Dilemma of Layer 2

Layer 2 networks like Arbitrum, Optimism, Base, and zkSync have a total value locked (TVL) exceeding hundreds of billions of dollars, approaching 60% of the mainnet. However, the problem is that these L2 tokens (like ARB, OP) have not provided sufficient value capture for ETH, instead diverting users and funds.

Core contradiction: When users trade on L2, the gas fees are paid in L2 tokens or stablecoins, not ETH. The economic model of L2 is structurally decoupled from the ETH mainnet— the more successful L2 becomes, the lower the demand for ETH. This is a typical "vampire attack."

The "Prisoner's Dilemma" of Staking Returns

After ETH transitioned to PoS, staking yields are around 3-4% annually. Although liquid staking derivatives (like Lido's stETH) occupy a significant proportion of the total staking volume, this has not driven up ETH prices.

The paradox is: the staked ETH is locked, reducing circulating supply (which should be bullish for price), but simultaneously reduces speculative demand (actually suppressing price). ETH has downgraded from "programmable currency" to "yield-bearing bond," but its 3-4% yield cannot compete with US Treasuries' 4.5%, let alone attract crypto investors seeking high returns.

Narrative Vacuum Lacking Killer Applications

The DeFi Summer and NFT boom of 2021 once made ETH synonymous with the "world computer." But in 2025:

- DeFi's locked value has halved from its peak.

- NFT trading volume has plummeted by 90%.

- Emerging applications like AI Agents and on-chain games have yet to achieve scale effects.

The narrative comparison is stark: BTC has a clear positioning of "digital gold + institutional allocation," Solana has market consensus as "high-performance public chain + meme culture," while ETH's positioning is vague—neither sufficiently "hard currency" nor "sexy."

2.3 Altcoins' "Liquidity Black Hole"

If BTC is the "never-setting empire," and ETH is in a "midlife crisis," then altcoins are experiencing a true "twilight of the gods"—once-celebrated projects are falling, and new projects are stillborn.

The "High FDV Low Circulation" Death Trap of VC Coins

In 2024-2025, a large number of VC-backed projects launched at extremely high valuations (FDV often ranging from $1-5 billion), but with only 5-10% in circulation. This model is destined to fail:

- Retail investors buy at high prices.

- VC and team unlock selling pressure lasts 1-3 years.

- Prices decline over the long term, making it difficult for even valuable projects to escape misfortune.

Typical Case: A Well-Known Layer 1 Project Launched with a $3 Billion Circulating Market Cap and $30 Billion FDV

A well-known Layer 1 project launched with a fully diluted valuation (FDV) of $3 billion and a circulating market cap of only $300 million. Six months later, the price dropped by 80%, and the FDV still stood at $1 billion—valuation remained inflated, but retail investors had lost everything.

The "Ponzi Game" of Meme Coins and Market Fatigue

In 2025, meme coins in the Solana ecosystem (such as BONK, WIF, POPCAT) briefly attracted funds, but essentially represented a "zero-sum game"—early players harvested latecomers. Lacking real value support, 90% of meme coins went to zero within three months.

Even more serious is the market fatigue effect: after being continuously "harvested" (the 2022 Terra collapse, FTX bankruptcy, and the 2024-2025 VC coin disasters), retail investors gradually distanced themselves from the altcoin market, forming a psychological trauma of "once bitten, twice shy."

CEX's "Liquidity Depletion" and Death Spiral

The trading volume of altcoins on leading exchanges like Binance and Coinbase has plummeted by over 70% compared to 2021, with smaller exchanges facing waves of shutdowns. Reasons include:

- Regulatory pressure: Ongoing lawsuits against Binance and Coinbase by the SEC.

- User attrition: Shifting towards compliant products like BTC ETFs.

- Declining project quality: Bad coins driving out good coins.

Insufficient liquidity has led to increased price volatility (an order book with 10% depth may have less than $100,000), further scaring off investors and creating a death spiral of "liquidity depletion → price crash → investors exit → liquidity further depletes."

Exhaustion of Narratives and the Dilemma of Homogeneous Competition

In 2017, there were ICOs; in 2020, DeFi emerged; in 2021, NFTs and the metaverse took center stage; in 2024, AI and RWA appeared… but in 2025, no new narrative could truly ignite the market.

Existing tracks (Layer 1, Layer 2, DeFi, NFT) are highly saturated, with severe homogeneity among projects, making it difficult for users to distinguish between them. The ultimate result: funds are unsure where to invest and simply "lie flat" in BTC.

3. Institutional Perspective: Grayscale and CoinShares' 2026 Predictions

3.1 Grayscale Report: The Dawn of the Institutional Era and Layered Structure

Grayscale's "2026 Digital Asset Outlook: Dawn of the Institutional Era" clearly states that the crypto market is entering a new phase dominated by traditional finance.

BTC: An Irreversible Institutionalization Process

Grayscale expects a structural shift in digital asset investment to accelerate in 2026, driven by two major themes:

- Macroeconomic demand for alternative store-of-value assets: Ongoing fiscal imbalances, inflation risks, and global monetary supply growth are driving demand for BTC and ETH as scarce digital commodities.

- Increased regulatory clarity: More countries are expected to approve crypto ETP products, and the U.S. may pass bipartisan market structure legislation to further integrate blockchain finance.

Key catalysts include:

- The 20 millionth Bitcoin is about to be mined: The 20 millionth BTC will be mined in March 2026 (out of a total supply of 21 million), reinforcing the narrative of BTC's fixed supply transparency and scarcity.

- Increased institutional allocation: U.S. state pensions and sovereign wealth funds (like Harvard's endowment and UAE's Mubadala) will gradually increase their BTC allocation from the current less than 0.5% to higher levels.

- Hedging against dollar depreciation: Amid soaring U.S. Treasury yields and a global trend of de-dollarization, BTC's hedging properties as "digital gold" are becoming increasingly prominent.

Grayscale predicts that BTC is likely to set a historical high in the first half of 2026, breaking through $150,000 as the baseline scenario.

ETH: "Sideways Accumulation" in a Painful Transformation

Grayscale candidly states that ETH is undergoing a "painful transformation," requiring time to adapt to institutional adoption and regulatory standards. The three major directions of transformation include:

- Deep integration of Layer 2 with the mainnet: Improving the economic model (such as further evolution of EIP-4844) to ensure that the success of L2 truly feeds back into ETH's value.

- Institutional-grade DeFi/RWA applications: Scaling compliant use cases like tokenized bonds and on-chain asset management.

- Mass consumer adoption: Breaking through "small circles" with applications in on-chain social and gaming.

However, these transformations require 1-2 years for validation. Grayscale predicts that ETH is more likely to be in a "sideways accumulation" phase in 2026, with relatively limited price increases, far from replicating the explosive growth of 2017 or 2021.

Altcoins: Layered Fate and the Sifting of the Wheat from the Chaff

The report emphasizes that "not all tokens will successfully transition out of the old era," and altcoins will show clear layering:

First Tier: Near-Institutional Assets

- Representative projects: Solana, Avalanche, Polygon.

- Characteristics: Have real users, institutional backing, and regulatory pathways.

- Expectations: Likely to attract some institutional funds, but with growth far inferior to BTC.

Second Tier: Ecosystem and Utility Tokens

- Representative projects: DeFi protocols (Aave, Morpho, Uniswap), AI chains (Bittensor, Near).

- Characteristics: Benefit from real use case growth, supported by cash flow.

- Expectations: Limited upside, but can survive in the "utility era."

Third Tier: Speculative Tokens

- Representative projects: Meme coins, pure narrative projects, VC coins with high FDV and low circulation.

- Characteristics: Lack real utility, relying on retail FOMO.

- Expectations: High probability of marginalization or going to zero.

Grayscale clearly states that the "era of universal altcoin growth" has completely ended, and the traditional four-year halving cycle is collapsing, replaced by more stable institutional capital inflows. In the future, only projects with sustainable income, real users, and regulatory pathways will survive, while the rest will disappear in the "sifting of the wheat from the chaff."

3.2 CoinShares: From Speculation to Utility, "Hybrid Finance" Defines the Future

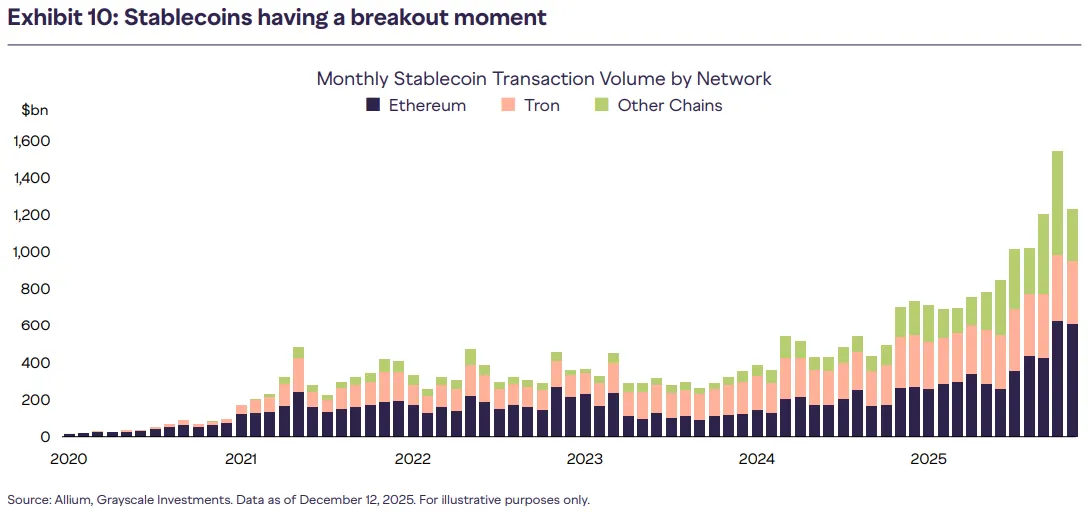

CoinShares' "Outlook 2026: Toward Convergence and Beyond" report presents a more radical view: 2025 is the last year driven by speculation, and 2026 will shift towards practicality, cash flow, and integration.

The Rise of "Hybrid Finance"

CoinShares introduces the concept of "Hybrid Finance": a deep integration of public chains with traditional financial systems, forming new infrastructures that neither can build alone. The core story of 2026 is "convergence":

1. Traditional Institutions Building on Public Chains:

- BlackRock issues on-chain money market funds (BUIDL).

- Franklin Templeton launches tokenized government bonds.

- Banks like Citibank and HSBC issue bonds on private chains.

2. Stablecoins Transitioning from Crypto Tools to Global Payment Tracks:

- Regulatory frameworks like the U.S. GENIUS Act and the EU MiCA provide green lights.

- After acquiring Bridge, Stripe allows businesses to integrate stablecoin payments directly via API.

- The stablecoin market cap moves from $200 billion towards $500 billion.

3. Tokenization Explosion:

- Private credit and tokenized government bonds dominate the market.

- On-chain products offer faster settlement, lower costs, and global distribution.

- The market cap of RWA (real-world assets) is expected to exceed $50 billion in 2026.

4. The Era of Value Capture:

- Applications like Hyperliquid buy back/burn tokens through revenue.

- Tokens upgrade from "governance tools" to "equity-like assets."

- Cash flow and fundamentals become core valuation metrics.

Institutional Dominance and the Disappearance of Retail FOMO

CoinShares points out that BTC ETF inflows exceeded $90 billion in 2025, indicating that institutional mainstreaming is irreversible. Meanwhile, retail FOMO sentiment has significantly weakened due to past traumas, narrative fatigue, and regulatory uncertainties, with retail funds choosing to wait or only investing in mainstream assets like BTC.

2026 Price Scenario Predictions

CoinShares provides three scenarios based on the macro environment:

- Soft landing (baseline scenario): BTC breaks through $150,000, ETH follows with limited growth, and near-institutional altcoins rise moderately.

- Stable growth: BTC maintains a range of $110,000-140,000, with reduced market volatility.

- Stagflation/recession: Short-term pressure but mid-term recovery, with BTC's "digital gold" attributes becoming more pronounced.

Core Predictions:

- BTC's market cap share further rises to over 65% (currently 59-60%).

- Institutional dominance in pricing power, with retail influence marginalized.

- Liquidity concentrates on practical projects, with only those possessing "real users + real income + regulatory pathways" able to succeed.

- 90% of existing altcoins will be eliminated, completing the "survival of the fittest" in the market.

Ultimate judgment: CoinShares believes that in 2026, digital assets will no longer "challenge" traditional finance but will become part of mainstream finance. Practicality will prevail, hybrid finance will define the future, and the crypto market will transform from "disruptor" to "integrator."

4. Core Question: Is the Four-Year Cycle Really Over?

4.1 The Essence of the Cycle: From "Supply-Driven" to "Demand-Driven"

The past four-year cycle was essentially a supply-driven model:

Classic Transmission of the Halving Effect: BTC halving → Reduced miner selling pressure → Supply contraction → Price increase → Triggering FOMO → Retail influx → Funds spill over to ETH → Then spill over to altcoins.

Periodic Influx of New Funds: Each bull market has new sources of funds (2017 was retail from ICOs, 2021 was DeFi/NFT players and pandemic-induced money printing), and these funds follow the natural flow path of "BTC → ETH → Altcoins."

Structural changes in 2025: Demand-side reconstruction.

However, in 2025, fundamental changes occurred on the demand side:

- Institutional funds' "targeted demand": Only buying BTC and not altcoins, leading to funds unable to "spill over."

- Permanent absence of retail FOMO: After experiencing the 2022 collapse, retail investors lost confidence in altcoins, and even when BTC hits new highs, they dare not chase.

- Solidification of liquidity layering: The liquidity pools of BTC, ETH, and altcoins have been completely severed, and funds cannot flow freely as they did in the past.

Conclusion: The logic of the four-year cycle of "halving → BTC rises → altcoin rotation" has not ended, but its transmission mechanism has been interrupted by institutionalization. The future cycle may be a "lame bull market" of "BTC rising alone → ETH barely following → altcoins continuing to decline."

4.2 Do Altcoins Have a Future?

The answer is: Most altcoins do not have a future, but a few tracks still have room for survival.

Types of Altcoins Without a Future

- High FDV and low circulation VC coins: The economic model is inherently distorted, and retail investors are always the bag holders.

- Meme coins with no real utility: Except for a few "cultural symbols" (like DOGE and SHIB), most will go to zero.

- Homogeneous Layer 1/Layer 2: The market only needs 3-5 mainstream public chains (like ETH, Solana, BNB Chain, etc.), while the rest are "zombie chains."

The crypto market in 2025 is undergoing a painful but necessary "coming of age"—transforming from a retail-led investment market to an institutional-led asset allocation market.

Bitcoin's "never-setting sun" is not a victory for crypto, but rather the "taming" of crypto by traditional finance. When BTC becomes the "shadow of U.S. tech stocks," it gains liquidity and compliance but also loses the original intention of being a "decentralized currency." This is progress, but also a compromise.

The "twilight of the altcoins" is not an end, but the eve of rebirth. When the bubble bursts and bad coins are cleared, truly valuable projects will rise from the ruins. History always rhymes—every bubble burst carries the seeds of the next era.

The four-year cycle has not ended; it has merely changed its face. The future bull market may no longer be a carnival of "all coins rising together," but a brutal competition of "the strong getting stronger and the weak exiting." In this competition, those who can understand the new rules, embrace institutionalization, and adhere to value investing will be the ones who laugh last.

This report's data is compiled and organized by WolfDAO. If you have any questions, please contact us for updates.

Written by: Nikka / WolfDAO (X: @10xWolfdao)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。