Hope 2026 is better for all of us.

Written by: Deep Tide TechFlow

There are less than 10 days left in 2025.

They say a day in the crypto world is like a year in the real world. But those truly immersed in it may feel it even more:

This year has gone by too quickly, so fast that events from the beginning of the year now feel like they happened three years ago.

How has your harvest been this year? Did you catch a few waves of opportunity, or were you educated by the market in a certain month? Is that coin you heavily invested in at the beginning of the year still around? Which narrative got you excited, and in which month did it happen?

Many answers may have already become vague.

The memory of the crypto market is too short; the hot topics from three months ago are no longer mentioned today, and judgments that were once confidently made are now hard to bring up.

We have compiled a complete market record for 2025, restoring it by month: what happened at the time, which coins rose, and what everyone was talking about.

No predictions, no judgments, just helping you recall what we experienced this year.

January: The Spotlight on AI Coins and TRUMP

Keywords: AI Agent, Political Meme, Optimism, and the First Cooling at the End of the Month

The main character in January was the AI Agent.

AI16Z reached an all-time high of $2.47 on January 2, with a market cap soaring to $2.5 billion, becoming the first AI token on the Solana chain to break this milestone. AIXBT, ARC, ZEREBRO, GRIFFAIN… these names were mentioned almost daily at that time.

Political memes were equally eye-catching. On January 17, the official token of $TRUMP launched, skyrocketing from under $1 to a historic high of $75 within two days, with a market cap exceeding $14 billion at one point.

I vaguely remember the shock of waking up to see TRUMP's crazy surge; everyone was questioning whether it was officially released, and later, as the information was confirmed, the president issuing a token became a first in this industry.

Additionally, XRP rose 50% that month due to news of Ripple executives meeting with Trump's team, with the market starting to bet it would be one of the first altcoins to get an approved ETF.

On a macro level, Trump signed an executive order on January 23: establishing a digital asset working group, exploring national crypto reserves, and banning the issuance of CBDCs in the U.S. Market sentiment was extremely optimistic for a time.

But by the end of the month, the wind changed. Around January 20, DeepSeek released a low-cost AI model, directly impacting the narrative of crypto AI Agents, making many Agents seem more like toys.

Many of the AI concept coins that had just surged fell back to their original points in the following weeks.

February: LIBRA Scam, Bybit Hacked

Keywords: Bybit Hacked, $LIBRA Scam, Major Liquidation

On February 21, Bybit experienced the largest cryptocurrency theft in history. North Korean hackers from Lazarus transferred about 400,000 ETH (worth approximately $1.5 billion) to addresses they controlled.

This loss was greater than that during the FTX collapse and far exceeded any previous exchange hacking incidents.

At the same time, trust in political memes completely collapsed this month. On Valentine's Day, February 14, Argentine President Milei launched a token on social media, which skyrocketed to $5 within 40 minutes, with a market cap reaching $4.5 billion. Hours later, the price plummeted by 85%, causing about 40,000 investors to lose over $250 million.

Subsequently, Milei deleted the post and denied involvement, and the token named after TRUMP and his wife gradually declined this month.

From February 24 to 27, Bitcoin experienced its worst three days since the FTX collapse in 2022, with a drop of 12.6%, and nearly $3 billion in leveraged positions were liquidated.

The meme coin sector was halved overall, and Solana's TVL plummeted by 30%, reaching its lowest level since November of the previous year.

However, there was an exception. Pi Network officially launched its mainnet on February 20, with the token peaking at $2.98, sparking discussions about "the ground promotion finally monetizing."

March: Strategic Reserves to the Left, Tariff Panic to the Right

Keywords: Strategic Reserves, Tariff Panic, Meme Collapse, MicroStrategy

March saw the beginning of favorable policies, with Trump hosting the first-ever crypto summit at the White House, where he signed an executive order to establish a "strategic Bitcoin reserve."

Days earlier, he announced on Truth Social that XRP, SOL, and ADA would also be included in the digital asset reserves, with ADA surging 70% in a single day, leading the market to believe that regulatory attitudes had completely shifted.

However, the favorable policies could not support the market. Trump's tariff threats triggered panic over a trade war, leading to widespread selling of risk assets. The meme sector experienced a collective collapse, with an overall drop of 40-60%.

The BSC chain unexpectedly became a safe haven. The Middle Eastern-themed meme coin Mubarak surged thousands of times after CZ repeatedly promoted it, with BSC's trading volume at one point exceeding that of Solana.

At the same time, the biggest trust crisis in March occurred at Hyperliquid, where attackers shorted using the JELLY token, manipulating prices and causing the HLP treasury to face a loss of about $12 million. Hyperliquid's response was to vote to delist the token and force a settlement, centralizing the crisis management of a "decentralized exchange," which led many to reevaluate the definition of DEX.

Off-chain, Strategy (formerly MicroStrategy) continued to accumulate, announcing on March 18 the issuance of $500 million in preferred stock specifically for buying BTC. The faith of Bitcoin hoarders remained solid.

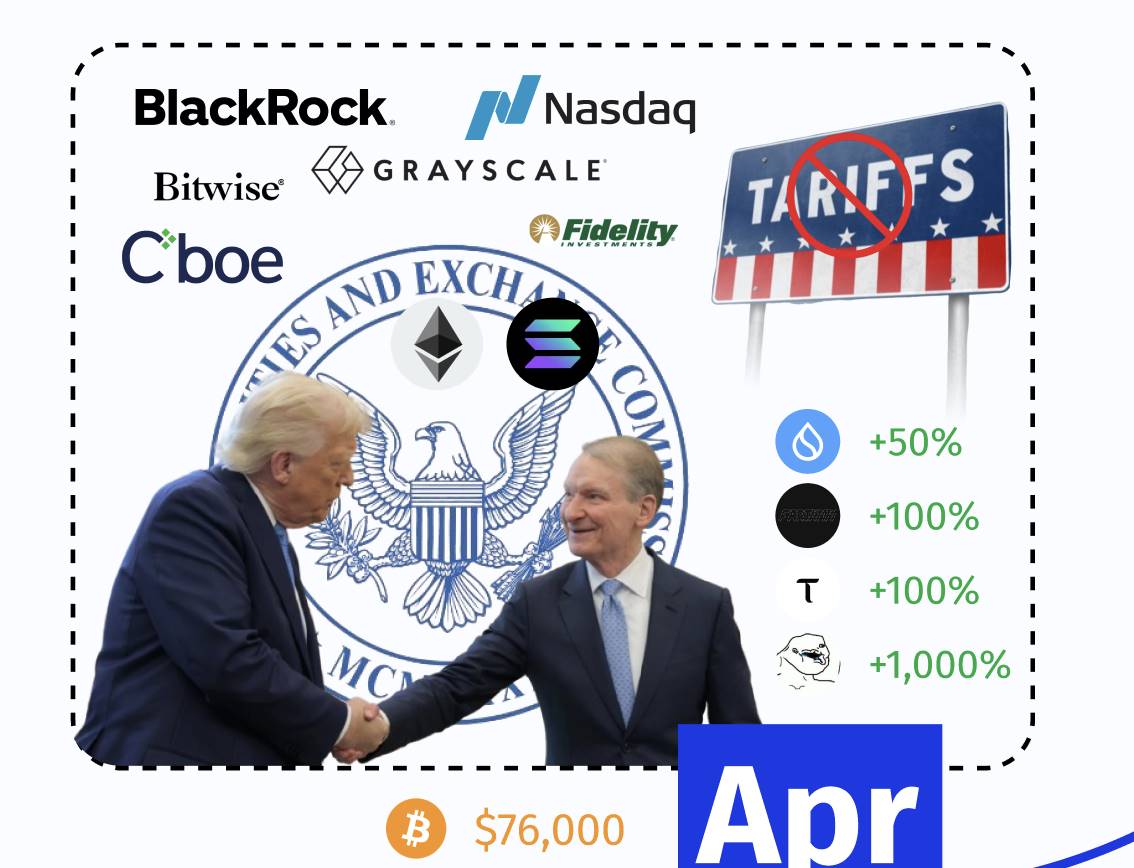

April: Policy Shift, Sentiment Recovery

Keywords: Tariff Suspension, Regulatory Shift, SOL ETF, Sentiment Reversal

April was a month of sentiment recovery.

On the 9th, Trump announced a 90-day tariff suspension, and upon the news, the S&P 500 surged 9.5% in a single day, marking the largest single-day increase since 2008; on the same day, the SEC approved ETH ETF options trading, further improving institutional allocation tools.

At the same time, the new SEC chairman Paul Atkins took office, and his pro-crypto stance gave the market hope.

The total market cap of the crypto market rebounded by 10.8% that month, with Bitcoin rising from a low of $76,000 to surpass $90,000 by the end of the month.

Canada launched the world's first Solana spot ETF that month, and SUI benefited from news of a partnership with Grayscale Trust and Mastercard, rising over 50%.

Meme coins also came back to life. Fartcoin rebounded over a hundred times from its bottom, becoming the leader of the rebound, while RFC (known as "Musk's mouthpiece") surged over a thousand times.

After the brutal cleansing of February and March, April was the moment many felt for the first time that "we're back."

May: We're So Back!

Keywords: All-Time Highs, US-China Thaw, DAT Narrative, ICP, Hyperliquid

May was the month with the highest sentiment so far in 2025.

On the 2nd, the US and China reached a 90-day tariff suspension agreement, temporarily clearing the clouds of the trade war, and risk assets rebounded across the board.

On the 7th, Ethereum completed the Pectra upgrade, the largest hard fork since the 2022 Merge. Although it did not immediately reflect in the price, ETH rose 44% that month, and market sentiment clearly warmed.

On the other hand, Bitcoin broke $110,000, reaching an all-time high; everything came back, and the crypto market began to bloom in multiple areas:

The narrative of "Digital Asset Treasury" (DAT) for listed companies continued to heat up. GameStop, SharpLink Gaming, and others began their journey of purchasing BTC and ETH, and Strategy's model was being replicated.

On-chain, new gameplay emerged. The Believe platform became popular, allowing users to simply @launchcoin with the token name on X to issue tokens with one click, giving rise to the so-called ICP narrative (Internet Capital Market); the platform token LAUNCHCOIN surged that month.

Virtuals Protocol launched the Genesis Launchpad, reigniting the AI token IPO craze, with VIRTUAL rising 60%. Kaito's Yap Points reward system took on a new height in on-chain social interactions, with the token rising 190%, and "mouth farming" gradually became a mainstream mode of earning.

Meanwhile, Hyperliquid's token HYPE rose 75% that month, and the Chinese crypto community began to enthusiastically discuss the new model of DEX and the so-called "human efficiency ratio," where Hyperliquid generates large-scale profits with very few employees.

May was good for everyone; everything finally came back to life.

June: DAT Heats Up, Stablecoin Frenzy

Keywords: Circle Listing, DAT Expansion, Tokenization of US Stocks

In June, the stablecoin narrative completely exploded.

On June 5, Circle rang the bell on the NYSE, with the ticker CRCL, IPO pricing at $31, oversubscribed by 25 times. On June 23, the stock price surged to a historic high of $298.99, nearly nine times the IPO price.

This marked a high point for crypto-native companies in the U.S. stock market and was a symbolic event for the recognition of stablecoins by traditional capital.

Four days later, another stablecoin project created an even bigger sensation. Plasma launched a public offering on Cobie's Sonar platform, raising $500 million in just five minutes.

The cap for that day was raised to $1 billion, filling up in 30 minutes. Tether CEO, Peter Thiel, and Bybit were among the early investors. The market's enthusiasm for "stablecoin infrastructure" exceeded everyone's expectations.

The DAT narrative continued to ferment. Strategy continued to buy, Metaplanet purchased 1,088 BTC in a month, and DeFi Development Corp announced a $5 billion equity financing limit specifically for increasing its SOL holdings, claiming to become the "SOL version of MicroStrategy." SharpLink Gaming also increased its ETH holdings to 188,000 coins.

On the 30th, another new narrative quietly launched: tokenization of U.S. stocks.

Kraken and Bybit simultaneously launched xStocks, allowing over 60 U.S. stocks (including Tesla, Nvidia, Apple, Microsoft, etc.) to be traded in token form on Solana.

At the same time, Hyperliquid solidified its position as the leader in on-chain derivatives trading, with Ethereum staking reaching an all-time high. The meme sector also had highlights, with BANANAS31 starting to surge; USELESS, due to its absurd and useless name, also rose over 2000%.

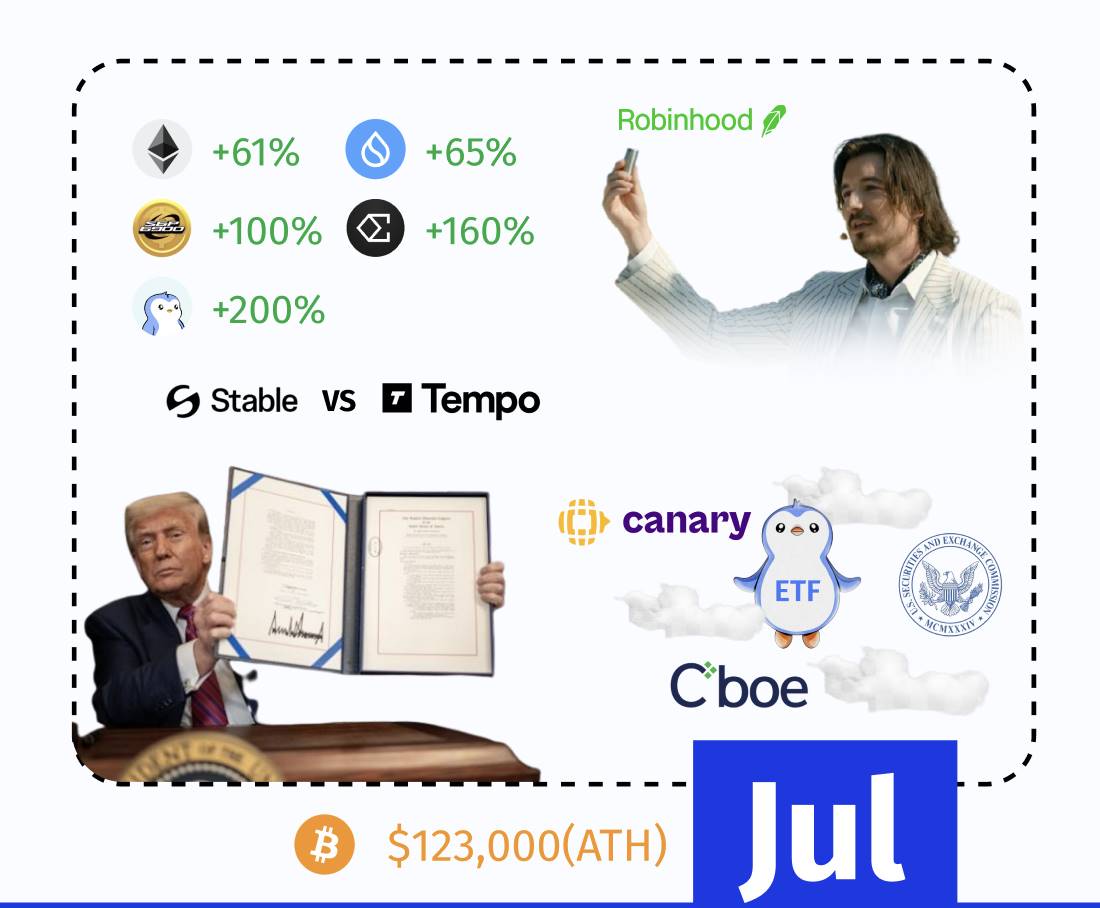

July: The GENIUS Act Takes Effect, BTC and ETH Reach New Highs

Keywords: GENIUS Act, BTC/ETH New Highs, Tokenization Expansion, Stablecoin Public Chain

On July 18, Trump signed the GENIUS Act, the first federal regulatory law for stablecoins in U.S. history.

Bitcoin was also on the move. Starting on July 10, it broke through, reaching a historic high of over $120,000 on July 14, with ETF inflows hitting a record $1.2 billion in a single day.

ETH also surged, hitting a new high of $3,848 on July 21.

At the same time, the tokenization narrative further heated up. Robinhood launched over 200 U.S. stock tokenized trades, running on Arbitrum, including private equity tokens for OpenAI and SpaceX.

PENGU also made a big move, submitting a PENGU ETF application; this could be the world's first ETF to include NFTs.

The stablecoin public chain war also began. Tether and Bitfinex-supported "Stable" released its roadmap on July 1, competing with Tempo and Circle's own Arc.

In the meme coin sector, SPX6900 rose over 100%, and the established stablecoin project ENA surged over 160%. Everything was looking good.

August: OKB Explodes, BTC Hits New High Again

Keywords: Exchange Token Explosion

The feeling in August was "not bad."

After reaching a new high of $124,000 in mid-August, BTC corrected, closing the month around $108,000. However, the altcoin market was booming, especially exchange tokens, which became the biggest winners.

On August 13, OKX announced a one-time burn of 65.25 million OKB, locking the total supply from 300 million to 21 million; at the same time, it upgraded the X Layer public chain. Upon the news, OKB surged 170% that day, reaching a new high of $148, and continued to climb to $255, rising nearly 400% from its bottom.

Meanwhile, MNT (Mantle) was integrated into the Bybit exchange, primarily focusing on RWA public chains. In the future, MNT will be used as a trading fee token on Bybit, similar to platform tokens.

On the 28th, the U.S. Department of Commerce announced a partnership with Chainlink and Pyth to put macroeconomic data like GDP and PCE on-chain; this news drove LINK up about 61% in August, while PYTH soared over 70% that day.

Hong Kong's stablecoin regulation also officially took effect. The "Stablecoin Ordinance" came into effect on August 1, with the Monetary Authority opening license applications, and many domestic companies like JD.com were eager to try (though they later withdrew for various reasons).

Of course, there was no shortage of drama with celebrity coins. On August 21, Kanye (Ye) launched the YZY token on Solana, which surged 1400% to $3 within an hour, with FDV briefly reaching $3 billion, then… plummeted 80%, gradually approaching zero.

Kanye claimed his Instagram was hacked and that he was promoting a fake coin. Regardless of the truth, another celebrity coin became a classic case of "fans footing the bill."

The SocialFi sector's ZORA also gained traction, riding the wave of integration with Coinbase's Base App and the Creator Coins trend, with an increase of over 100% in August, briefly reaching an ATH of $0.15.

Pump.fun also revived, reclaiming a large share of the Solana launchpad market, with August revenues of $46 million.

September: Fed Cuts Rates, ASTER Rises

Keywords: Rate Cut, Crypto IPO, Aster

On September 17, the FOMC announced a 25 basis point rate cut, the first rate cut of 2025.

In the same month, Tether was valued at $500 billion for private financing, once again highlighting its wealth, but it had little to do with most retail investors.

However, Tether co-founder Reeve Collins launched the STBL protocol, which surged 455% on its launch day on Binance Alpha on September 16, with FDV surpassing $1 billion, rising 44 times from its lowest to highest point in a month.

Crypto company IPOs saw a small surge. On September 11, Figure landed on Nasdaq as the "first RWA stock"; the next day, Gemini followed suit with its listing. Wall Street's attitude towards crypto was visibly changing.

In the crypto project space, the on-chain contract sector erupted into a "DEX war," with Aster emerging, and its token skyrocketed 2800% in the first week; its seven-day trading volume briefly exceeded Hyperliquid.

In terms of tokens, PUMP rose 160% for the month due to an aggressive buyback strategy (with over $95 million in buybacks), reaching an ATH on September 14. AVNT surged 660% after a rapid listing on both Upbit and Binance. BNB rose 19.7% after Franklin Templeton expanded the Benji platform. MNT increased 130% due to its integration into the Bybit ecosystem.

Meanwhile, Coinbase's x402 protocol was announced this month, laying the groundwork for the hot 402 sector in the following two months.

October: Living the Binance Life, Facing a Bloody Liquidation

Keywords: Epic Liquidation, Binance Life

October was supposed to be "Uptober."

The first Chinese meme coin "Binance Life" launched on October 4, with the slogan "Drive a Binance car, live in a Binance community, enjoy a Binance life." This meme resonated with the collective sentiment in the Chinese-speaking world, skyrocketing from zero to a market cap of $500 million in five days, with an increase of over 3000%.

For the past seven years, BTC had never fallen in October. But October 2025 completely broke this tradition.

At the beginning of October, BTC was still reaching new highs, hitting a historic high of $126K on October 3. Then, on October 11, an epic liquidation occurred, with $19 billion in leveraged positions being forcibly closed within 24 hours, resulting in the largest single-day liquidation disaster in crypto history.

From this point on, sentiment and liquidity in the crypto market began to plummet.

Although there was a partial increase in Zcash due to Naval's promotion this month, there were no significant hot topics afterward, and both institutions and retail investors suffered immeasurable losses in this wave.

November: Falling with Tears, Privacy Coins Rise Against the Trend

Keywords: BTC at $80K, DeFi Crashes, Privacy Surge, x402, Scammer BTC Seized

The liquidation wave in October was thought to be the worst, but November proved that the market could be even worse.

BTC fell from $110K at the beginning of the month to $80K, marking a seven-month low. The total market cap evaporated by nearly $1 trillion, dropping from $4.2 trillion to $3.2 trillion. BlackRock's IBIT saw a monthly outflow of $2.34 billion, setting a record for the largest monthly outflow since the ETF's inception.

However, some people were still making money in the bear market. Privacy coins unexpectedly became a safe haven, with ZEC skyrocketing from $40 in September to over $600 in November, an increase of over 1200%. DASH also rose from $20 to $136, more than a sixfold increase.

The AI payment narrative also briefly gained traction. Coinbase's x402 protocol allowed AI Agents to autonomously pay for services, with the ecosystem token PING rising from zero to a market cap of $70 million, while concept coins like PayAI and SANTA followed suit. However, the hype was short-lived, and by the end of the month, it began to wane.

Meanwhile, the "Digital Asset Treasury Company" (DAT) collectively fell into trouble.

Strategy plummeted 36% in November, and MSCI was evaluating whether to remove Strategy from the index; other ETH and SOL-based companies also continued to decline.

Additionally, a large amount of BTC from scammers Qian Zhimin and Chen Zhi, involving nearly 190,000 BTC, was seized by authorities, raising concerns about potential selling pressure and amplifying the label of "crypto = money laundering" once again.

December: Boredom, Drama, and Gossip

Riding a little electric scooter, finishing this delivery. No narrative, only emotions.

In the group, the discussions were not about positions but about gossip: who ran away, who scammed, who was unfairly distributing profits.

Some called this a "silent bear market." Slowly, silently, it wore down everyone's enthusiasm. The only consensus was to wait. Wait for liquidity to return.

The next year is just around the corner.

Those of us in crypto don't know where to go, but we are still on the road.

Hope 2026 is better for all of us.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。