In the midst of strategizing, we decide the outcome from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

Lin Chao has many fans who only engage in spot trading, believing that spot trading is the least risky in the crypto market. However, they are often brainwashed by many altcoin stories, thinking that although they are trading altcoins, the risks of spot trading are completely controllable. They believe that as long as the price drops, they will buy in, buying more as it falls, and that one day it will rise again. They think that as long as they keep buying, they can always recover their average cost. They even believe that the crypto market can be like other financial markets; as long as they do regular investments, they will definitely see returns in a few years, and if they accidentally invest in a hundredfold coin, they can achieve financial freedom.

If you are doing regular investment, whether in Bitcoin, the S&P 500, or altcoins, then today Lin Chao must sound the alarm for you. Because I have discovered one thing: the same strategy called DCA (Dollar-Cost Averaging), when applied to different assets, can yield very different results. Some people are accumulating assets, while others are slowly consuming time. Most people have never considered that the issue is not whether the DCA strategy is good or not, but rather whether this asset is worth sacrificing your time for.

Let’s briefly explain what DCA is. It involves choosing a target asset and investing a fixed amount at regular intervals to achieve the goal of steadily accumulating assets. DCA can be applied to any financial product: stocks, funds, ETFs, etc.—but I am not discussing cryptocurrencies here, as DCA for crypto assets is different from other types of assets.

Let’s start with DCA in stocks.

Why do so many people choose to use DCA to buy stocks, even for a lifetime? The reason is actually very simple: because you are not buying a price, you are buying a whole group of operating companies. You are buying companies where people are working every day, making products, selling services, competing, and being eliminated. When you buy the S&P 500, you are not buying five hundred stocks; you are buying the entire core collection of American enterprises. This collection has a very important characteristic: it self-corrects. Poor companies will be kicked out, and new companies will come in; inefficient ones will disappear, while efficient ones will remain. So when you use DCA to buy stocks, you are not essentially betting on price; you are betting on one thing: whether this economy will continue to operate. As long as society does not come to a standstill and companies are still creating value, time will definitely be on your side. This is also why, in the stock market, time is usually a friend— even if you buy at a high point, as long as you are buying the whole, as long as this system is still alive, the value will gradually catch up with the price.

Therefore, the real reason DCA works for stocks is never about “averaging down costs,” but rather value accumulates over time. To emphasize, Lin Chao is talking about value, not price. However, I must add: even in stocks, DCA is not a panacea. Many people are not actually investing in stocks or indices, but are picking individual stocks while pretending to be long-term investors—saying they are using DCA, but in their mindset, they are still betting on a single company. As long as growth stagnates or competitiveness disappears, time will not help you. So even in the stock market, the premise for DCA to work is: you are buying the whole, not a single story.

Now, can we directly apply the same logic to cryptocurrencies?

The answer is no. Because cryptocurrencies are fundamentally different from stocks. Bitcoin does not pay dividends, has no financial reports, no revenue, and does not generate cash flow just because you hold it. If you look at Bitcoin from a traditional stock perspective, you will definitely find it very strange.

So why do some people choose to DCA Bitcoin? The key lies here: the value of Bitcoin comes not from value creation, but from consensus. This consensus is not a belief spoken out loud, but a result that has survived the test of time. Bitcoin did not survive because it is perfect, but because it has endured the harshest tests: multiple bull and bear markets, regulatory crackdowns, exchange collapses, and media pessimism. And now, it has entered the mainstream capital system—there are ETFs, institutions, and countries beginning to take it seriously. This means that Bitcoin is no longer a question of “will it go to zero,” but rather “it is there.” So when you DCA Bitcoin, you are actually making a choice: to bet on a consensus that has already taken root over time. You are not betting that it will definitely rise; you are betting that it will not be kicked off the table. This is similar to stocks, but not entirely the same: stocks are about value creation, while Bitcoin is about consensus. However, although the things being bet on are different, Lin Chao believes that using DCA on both is not a big problem.

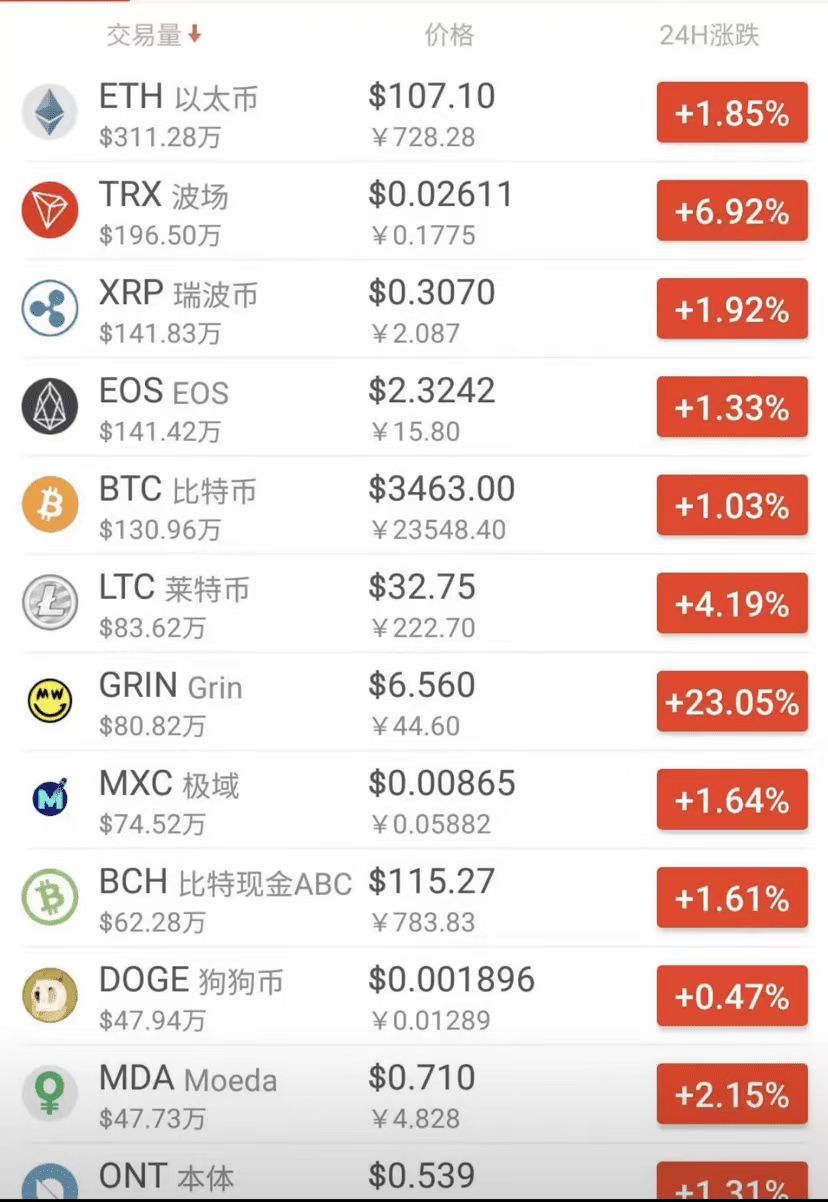

However, DCA for altcoins has significant issues. Why are most small coins not suitable for DCA? It can even be said that DCA is the riskiest approach. The key lies in four words: sacrificing time. Below is a screenshot from 2019, and to this day, indeed many coins, including BTC and ETH, have multiplied in market value, but upon careful comparison, many altcoins have also disappeared.

Many people do not realize that DCA itself is a very expensive decision because you are not just investing money; you are investing time—and time is not free. In the stock market, time helps you do one thing: eliminate poor companies.

But in the crypto space, time does the opposite: time is eliminating narratives. Most small coins do not gradually improve; they are slowly forgotten: narratives fade, funds rotate, development halts, and new things replace old ones. If you choose to use DCA on such assets, it means you are doing something very contradictory: using the most conservative, long-term strategy that requires time to be on your side to bet on an asset whose survival has not yet been proven. This is not prudent; it is a logical error. As Lin Chao has mentioned, Bitcoin survives not because its technology is the strongest, but because of people's consensus. You may have heard many claims like “this third-generation coin will replace Bitcoin in the future,” but honestly, such statements have been made since the first altcoin appeared, yet Bitcoin remains undefeated. Because it has experienced things that other altcoins have not, this has established its position—it has used time to flatten the risks.

But DCA for general altcoins is different. You think you are diversifying risk, but in reality, you are extending the time you bear the mistakes. Many people will say, “Then I will DCA a bunch of small coins, won’t that diversify risk?” But the reality is: there is no index in the crypto space, and weak players will not be automatically eliminated; the government will not bail you out if something goes wrong; it will not just leave the best few; time will only help you keep the one you have. So you will find that many people claim they are doing long-term investments, but in reality, they are just packaging short-term speculation as long-term behavior—especially in the case of DCA, you are not believing in time; you are hoping that the price will one day save you. This is less likely to happen in the stock market because the system helps you filter; but in the altcoin market, there is no mechanism to help you confirm whether this thing is worth existing; you can only focus on price, community, and narrative—none of which equate to value itself.

Lin Chao believes that DCA is not a universal solution; it is a strategy that has very high requirements for the essence of the asset. You must clarify: will time help you, or will it harm you?

Stocks: Because there is value creation, a system, and an elimination mechanism, time is usually a friend.

Bitcoin: Because the consensus has taken root (at least at this stage), time will not immediately become an enemy.

Most altcoins: Time itself is the biggest risk.

Lin Chao summarizes:

DCA is not a contest of discipline, nor is it guaranteed that whoever lasts longer will win. It only applies to assets where time is willing to be on your side. To clarify further: just because you think it is a quality asset or a good asset, does not mean you can use DCA on it. The reason Bitcoin's price has risen like this is not because its technology or underlying logic is strong, but because of the accumulation of consensus. If time itself is filtering out what you are betting on, then you are not investing; you are just postponing facing the mistake.

And what is the key point? Stocks at least have dividends, while altcoins do not. You might say, “I can buy and lend it out”—but that is fundamentally different. The dividends from stocks come from the profits of the company, and you are buying a machine that helps you make money; whereas in cryptocurrencies, we are seeking significant price differences. These are two different matters. So, is DCA itself a good strategy? If you choose good targets or large-cap targets, then it definitely can be—because the top companies are making more and more money, which allows them to remain in the top 500 or top 50. But for small coins, you can only bet that one day, there will be big whales and retail investors willing to drive the price up, allowing you to exchange your long-accumulated chips for more income.

Lin Chao did not say that everyone cannot touch altcoins; he just believes that they are not suitable for DCA. If you want to buy altcoins, you must use money you can afford to lose to make a probabilistic bet. The essence of DCA is to allow you not to make constant judgments, replacing emotions with rules; so when you use DCA on an asset that requires you to constantly judge whether it is still alive, whether it still has a narrative, whether it still has funding, whether it still has a community, you are essentially forcing something that should require your brain into a strategy that does not require thought—this is what Lin Chao hopes everyone understands to avoid logical errors.

As for whether the asset itself is worth DCA, here is a simple judgment method for everyone:

For whatever you are DCAing, whether it is stocks, Bitcoin, or altcoins, just ask yourself one question: “If starting today, this thing does not rise for five consecutive years, would I still continue to buy?” If you are willing, then using DCA makes sense; if you are not willing, then you are not actually DCAing; you are betting that it can rise quickly to save you. And this mindset usually leads you to the most dangerous places—because you will start to increase your investment, buying more as it falls, and the more you buy, the less you dare to stop. In the end, you are not accumulating; you are just being held hostage by that asset.

If you are feeling lost—unable to understand technology, unsure how to read charts, not knowing when to enter the market, unable to set stop losses, not understanding take profits, randomly increasing positions, getting stuck while trying to catch the bottom, unable to hold onto profits, missing market opportunities… these are common issues for retail investors. Lin Chao can help you establish the correct trading mindset. A single profitable trade speaks louder than a thousand words, and finding the right direction is better than repeatedly facing defeats. Instead of frequent operations, it is better to strike precisely, making each trade more valuable.

The success of investing depends not only on choosing good targets but also on when to buy and sell. Preserving capital and making good asset allocations are essential for steady progress in the ocean of investments. Life is like a long river flowing into the sea; what determines victory or defeat is never just the gains and losses of a single point or moment, but rather a well-thought-out strategy and knowing when to stop to gain.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier financial perspective.

This article represents personal opinions and does not constitute any trading advice. The crypto market is risky; invest with caution!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。