In the midst of strategizing, we decide the outcome from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

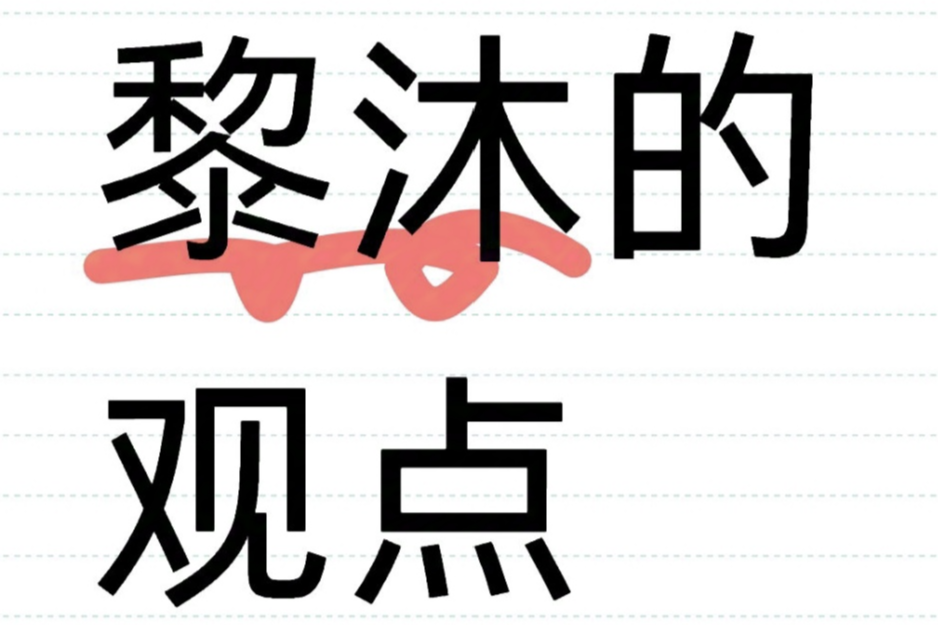

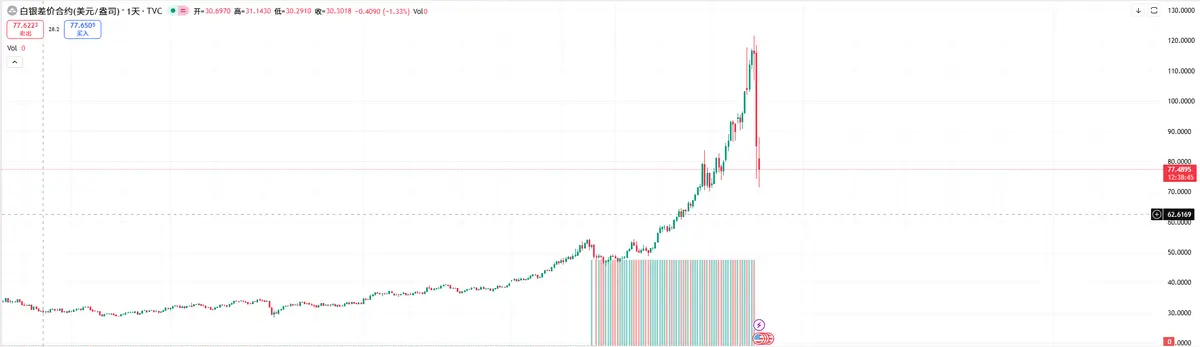

The global financial market is experiencing a major upheaval. This article may be a bit long, but please be patient and read to the end; it will surely help those of you who are confused about the future market. Recently, the market has been tumultuous. Just last week, I published an article warning that Bitcoin might drop to around $70,000, and over the weekend, Bitcoin fell by 7%. As of Lin Chao's writing, Bitcoin's price is still in a continuous decline, hovering around $75,000. However, even more shocking is the epic crash of gold and silver—gold recorded its largest single-day drop in decades, while silver plummeted nearly 40% in one day. If you have been following Lin Chao, you should feel fortunate to have avoided this epic crash. Such volatility should have occurred in high-risk "altcoins" in the cryptocurrency market, but now it is happening in widely recognized safe-haven assets like gold and silver, the world's first and second largest assets. What is happening in the global financial market?

The starting point of all this appeared last Friday: Trump nominated Kevin Warsh as the next Federal Reserve Chairman. To understand all this, we must first understand him.

Warsh's past can be described as a "hawkish model": he became the youngest Federal Reserve governor at 35, firmly opposed interest rate cuts after the 2008 financial crisis, and even resigned in protest of the second round of quantitative easing (QE2) in 2010. He openly stated that the Federal Reserve has long been in a "broken" state, calling the inflation out of control in 2021-22 the "biggest mistake in 45 years." However, this "tightening hawk" has recently undergone a subtle shift in attitude. He supports interest rate cuts, with the core logic being: inflation is a choice. He believes that the current high inflation is not an accident caused by the pandemic or supply chain issues, but rather the result of the Federal Reserve's past reckless money printing. Here, Lin Chao would like to explain the two main tools of the Federal Reserve: interest rates and the balance sheet. Lowering interest rates is a stimulus, while "expanding the balance sheet" (printing money to buy bonds) is the true "core engine" of inflation. Warsh's "unchanging" stance is that he has always opposed the latter, advocating for "quantitative tightening" (QT), which means withdrawing dollars from the market.

This financial logic sounds a bit contradictory; how can interest rate cuts and balance sheet reduction happen simultaneously?

The core answer lies in the "U.S. debt crisis." The interest payments on U.S. national debt have already exceeded military spending, putting immense pressure on the finances. Lowering interest rates is the most direct way to alleviate debt pressure, but the current chairman Powell is afraid to act due to high inflation. These details have been analyzed in previous writings by Lin Chao. But now, with Warsh's nomination, the solution he envisions has emerged: implementing both interest rate cuts and balance sheet reduction simultaneously. This has never happened in the history of the U.S. central bank because the two are fundamentally contradictory—one is stimulative, the other is tightening. But this precisely addresses the current deadlock: lowering interest rates is a political necessity to resolve the debt crisis, while balance sheet reduction is a technical means to hedge against inflation and soothe the market. Warsh's ultimate vision is to create a "supply-side recovery," which perfectly aligns with Trump's idea of bringing manufacturing back to the U.S. However, this approach is entirely different from the "demand-side recovery" logic of the past twenty years:

Old Logic (Demand Side): When the economy is bad, print money and distribute it to stimulate consumption and borrowing. This has created the myth that "big tech stocks always rise" because liquidity never dries up.

New Blueprint (Supply Side): Instead of flooding the market with money, improve productivity and supply efficiency through tax cuts, deregulation, promoting technological revolutions (like AI), and labor market reforms. This requires the economy to have inherent "resilience" and "vitality."

If the policy shifts, it means the safety net for the market is being pulled away. The Federal Reserve will no longer flood the market with money and will not provide unconditional support for all "stories." Instead, it will implement precise irrigation, meaning that companies without real profitability, even if they are in hot sectors like AI, may be ruthlessly abandoned by the market. This week, the stark contrast in stock prices between Microsoft and Meta is a preview: both are profitable, but Meta surged due to AI significantly boosting advertising profits, while Microsoft plummeted because its revenue overly relies on OpenAI, which may only be profitable in the future, directly using economic means to distinguish between "realized" and "promised." Therefore, in the next financial cycle, the strong will continue to get stronger.

Lin Chao's Summary

What does this mean for us "crypto people"?

First of all, Warsh himself has an unusually friendly attitude towards Bitcoin. He calls Bitcoin "an important asset," "the latest and coolest software," and even says, "If you are under 40, Bitcoin is your new gold." This endorsement from a candidate for the head of the world's most important central bank carries far more weight than the opinions of ordinary people. However, the short-term market is still tightening liquidity due to expectations of "balance sheet reduction," leading to volatility. More importantly, the underlying investment logic of the entire crypto space may face a significant change. In the past, under the expectation of abundant liquidity, the investment logic was "hotspots + liquidity = high returns." As long as it was an altcoin on a mainstream exchange, it was highly likely to rise in a bull market. But when "continuous money printing" is no longer a given, funds will become extremely selective, just as the stock market begins to differentiate between Microsoft and Meta. In the future, cryptocurrencies will be viewed more as "infrastructure" and "asset classes," rather than a vague whole. Exchange tokens (like BNB) may be more comparable to traditional brokerage stocks rather than ETH. Therefore, investing in any project (whether AI, DeFi, or other concepts) must seriously examine a question that has often been overlooked in the past: how does it actually make money? How much of its profits can truly benefit token holders? This is why Lin Chao has long mentioned that the era of widespread altcoin rises is gone forever.

The real opportunities in the financial market often do not lie in the bustling bull market, but in the quiet and desolate bear market. Chasing profits in a bull market yields limited returns; accumulating in a bear market is key to creating space for the future. For the vast majority of people, Lin Chao suggests adopting a "dollar-cost averaging" (DCA) approach to accumulate Bitcoin—and only Bitcoin. Because throughout history, only Bitcoin has consistently set new highs in every cycle, even Ethereum cannot guarantee that. If your income is fixed, you can set aside a fixed percentage each month; if your income is variable, you should reserve more "bullets" and increase your buying power as prices drop, managing your positions more flexibly. This is not mindlessly averaging down, but rather a long-term strategy based on Bitcoin's strongest consensus.

No one can accurately predict the bottom. Historical data shows that bear markets can drop by as much as 80%, which would put the bottom around $32,000. However, Lin Chao believes this situation is different: first, Bitcoin ETFs have brought unprecedented institutional fundamental support; second, compared to the previous two cycles driven by bubbles like NFTs and ICOs, this cycle's market bubble is smaller, led by ETFs. Therefore, key support levels are worth paying close attention to, such as $74,000 and further down around $53,200. For investors with limited funds, these levels can serve as references for increasing positions, but remember, this is still a probability game, and pursuing maximum profit may mean missing out on opportunities.

Here, Lin Chao also sincerely apologizes for the overly optimistic predictions made earlier. I once believed, based on historical statistics, that the market had a high probability of rising in January, but the facts have proven me wrong. I am not a fortune teller; the market's movements are ruthless, and Lin Chao accepts all criticism calmly. At this moment, the market is going through a difficult time. Bitcoin has fallen below previous lows, and the trend seems to be returning to the winter of 2022. Not only in the crypto space, but gold and silver are also experiencing a full-scale correction. Many friends who entered the market in the past one or two years, especially those who came in at Bitcoin's $100,000 high, are under immense pressure and self-doubt.

The most tormenting aspect of a bear market is not the shrinkage of assets, but the ensuing collapse of confidence—"Is this industry finished?" "Did I choose the wrong path?" Lin Chao has experienced this feeling countless times. But history has repeatedly proven that whenever you think "this time is really different," the market always cleans out those who lack patience, use excessive leverage, and ignore risk control. If you are still in the market at this moment, have cash, and have not been eliminated, then you are already at an advantage over most people.

Lin Chao believes that in the long term, for Bitcoin, in the narrative of "de-dollarization" and as a store of value, compared to gold's $34 trillion market value, Bitcoin's current market value of $1.6 trillion still shows enormous potential (even though Bitcoin is currently in a valuation-killing phase). However, regarding future potential, its current market size is still at a low point.

If you are feeling confused—unable to understand technology, unsure how to read the market, not knowing when to enter, unable to set stop losses, not understanding take profits, randomly increasing positions, getting stuck while trying to catch the bottom, unable to hold onto profits, missing out on opportunities… these are common problems for retail investors. Lin Chao can help you establish the correct trading mindset. A single profitable trade is worth more than a thousand words; finding the right direction is better than repeatedly facing defeat. Instead of frequent operations, it is better to strike precisely, making each trade more valuable.

The success of investing depends not only on choosing good targets but also on when to buy and sell. Preserving capital and making good asset allocations are essential for steady progress in the ocean of investments. Life is like a long river flowing into the sea; what determines victory or defeat is never the gains and losses of a single pass or the profits and losses of a moment, but rather planning before action and knowing when to stop to gain.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

This article is merely a personal opinion and does not constitute any trading advice. The crypto space carries risks; invest cautiously!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。