Private equity and venture capital: illiquidity + complexity premium

Definition

Investments in private companies or startups, often involving significant capital and a long investment horizon.

Historical Returns

- Private equity: nominal returns of approximately 10-15% per year;

- Venture capital: nominal returns can vary widely, but successful funds may achieve returns of 20% or more.

Investment Returns:

- Illiquidity risk: capital is locked up for several years, with no ability to sell or access funds;

- Business risk: the potential for total loss if the company fails;

- Complexity risk: understanding the business model and market dynamics is crucial for success.

Trade-offs:

Investors must be prepared for long holding periods and the possibility of significant volatility in returns. The potential for high returns comes with the risk of losing the entire investment, and the lack of liquidity can be a significant drawback, especially in times of market stress.

3. Conclusion: Rethinking the Vault

As we navigate the evolving landscape of DeFi and the broader financial ecosystem, it is essential to reassess our understanding of vaults. They are not merely yield-generating machines but complex financial instruments that carry inherent risks.

Investors must approach vaults with the same diligence and scrutiny they would apply to traditional financial products. By understanding the underlying risks and aligning expectations with historical benchmarks, we can better navigate the opportunities and challenges presented by this innovative space.

In the end, the future of DeFi vaults will depend on transparency, risk management, and the ability to adapt to the realities of the financial world. As we move forward, let us embrace a more informed perspective that recognizes the complexities and potential of these financial tools.

Investments in private companies and projects that are illiquid and have longer time horizons, such as buyouts and growth equity investments; early-stage venture capital or distressed and special situation investments.

Historical Returns

- Private equity: net internal rates of return (IRR) around 15% in many years (but highly cyclical)

- Venture capital: top quartile fund managers achieve returns of over 20-30%

However, the data shows significant volatility: once fees and survivor bias are considered, the median actual return is much closer to single digits.

Investment Returns:

- Long-term illiquidity: capital locked up for 7-12 years

- Complexity: customized deals, governance, and structures

- Manager skill: significant differences between different managers and investment years

- Information asymmetry: requires specialized channels and due diligence

- Higher principal risk: venture capital is highly dependent on execution and economic cycles; there is a high risk of principal loss.

Trade-offs: Long-term capital lock-up; typically no secondary market. Additionally, despite the higher risks, many funds underperform the public markets after fees are deducted.

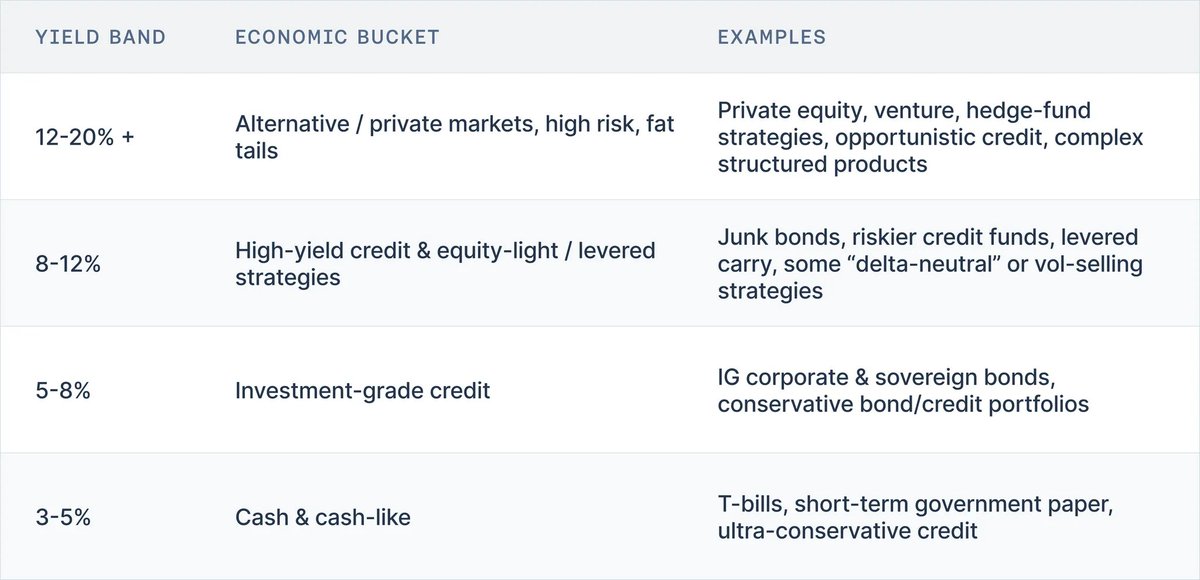

3. There’s No Such Thing as a Free Lunch: The Yield Ladder

When you compile all this historical data, a simple fact emerges:

No asset class in the real world can provide high returns without taking on high risks.

A practical way to interpret vault yields is to use the yield ladder model:

- 3-5% → Cash, government bonds, short-term government bonds, ultra-conservative credit

- 5-8% → Investment-grade bonds, conservative credit portfolios

- 8-12% → High-yield bonds, higher-risk credit, light equity strategies, some leveraged arbitrage

- 12-20%+ → Private equity, venture capital, hedge fund strategies, opportunistic credit, complex structured products

Over a century of market data shows that this yield ladder has demonstrated remarkable resilience through wars, hyperinflation, tech booms, and changes in interest rate systems.

Putting portfolios on-chain does not invalidate this. Therefore, whenever you see a DeFi vault, ask yourself two questions:

- Does the advertised risk align with the advertised return?

- Where does the yield come from?

4. Conclusion: The Correct Mental Model for Vault Yields

Setting aside marketing and UI, the facts are actually quite simple:

- Vaults are no longer automatic compounding "farms," but rather portfolios with APIs;

- Their yields are the price of the risks they underwrite;

- Market data over a century shows that reasonable yield ranges have remained remarkably stable under specific risks.

Cash-like instruments have nominal yields of only single digits, with real yields nearly zero.

Investment-grade credit yields are slightly higher due to term and default risks.

High-yield credit and stocks can yield high single digits or even teens.

Private equity, venture capital, and hedge fund strategies are historically the only investment options that can consistently provide median returns in the teens or higher, but they also come with the realities of illiquidity, opacity, and the risk of permanent loss.

Putting these portfolios on-chain does not change the relationship between risk and return. In today’s DeFi front end, five distinctly different risk levels may all be presented in the same friendly advertising format: "Deposit USDC, earn X% yield," yet it rarely shows whether you are taking on the risks of cash, investment-grade credit, junk credit, stocks, or hedge funds.

For individual users, this is already bad enough, as they may unknowingly invest in complex credit products or leveraged portfolios they do not understand.

But this also has systemic consequences: to maintain competitive yields, every product within a specific "category" tends to opt for the highest-risk configurations within that category. Safer configurations appear to "underperform" and are thus overlooked. Those custodians and protocols that quietly take on more risk in credit, leverage, or basis will be rewarded until events like Stream or Elixir remind everyone of the actual risks they are taking.

Thus, the yield ladder is not just a teaching tool. It is the beginning of the risk language that the industry currently lacks. If we can consistently answer these two questions for every vault:

- Which level of the ladder does this vault belong to?

- What risks (contract risk, credit risk, term risk, liquidity risk, directional risk) will this yield expose me to?

Then we can assess performance by risk level, rather than turning the entire ecosystem into a single, indiscriminate annual percentage yield (APY) competition.

In the subsequent parts of this series, we will apply this framework directly to crypto. First, we will map today’s major vaults and collapses onto the ladder to see what their yields truly tell us. Then we will zoom out to discuss what needs to change: labels, standards, curation practices, and system design.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。