Author: Michael Nadeau

Title: BTC Update: Our Views On Last Week's FOMC and The "Big Picture"

Compiled and Organized by: BitpushNews

Last week, the Federal Reserve lowered the target range for interest rates to 3.50%–3.75%—a move that was fully digested by the market and largely anticipated.

What truly surprised the market was the Fed's announcement to purchase $40 billion in short-term Treasury bills (T-bills) each month, which some quickly labeled as "QE-lite."

In today's report, we will delve into what this policy change has altered and what it has not. Additionally, we will explain why this distinction is crucial for risk assets.

Disclaimer: The views expressed in this article are solely those of the author and should not be considered investment advice.

Let's get started.

1. "Short-term" Layout

The Federal Reserve cut interest rates as expected. This is the third rate cut this year and the sixth since September 2024. The total rate has been reduced by 175 basis points, pushing the federal funds rate to its lowest level in about three years.

In addition to the rate cut, Powell announced that the Fed will begin "Reserve Management Purchases" of short-term Treasury bills at a pace of $40 billion per month starting in December. Given the ongoing tightness in the repo market and bank sector liquidity, this move was entirely within our expectations.

The current consensus view in the market (whether on X platform or CNBC) considers this a "dovish" policy shift.

Discussions on whether the Fed's announcement equates to "money printing," "QE," or "QE-lite" quickly took over social media timelines.

Our Observations:

As "market observers," we find that the market's psychological state still leans towards "risk-on." In this state, we expect investors to "overfit" the policy headlines, trying to piece together bullish logic while ignoring the specific mechanisms through which policy translates into actual financial conditions.

Our view is that the Fed's new policy is favorable for the "financial market pipeline," but not for risk assets.

Where do we differ from the general market perception?

Our points are as follows:

- Short-term Treasury purchases ≠ Absorbing market duration

The Fed is purchasing short-term T-bills, not long-term coupon bonds. This does not remove the market's interest rate sensitivity (duration).

- Long-term yields are not suppressed

While short-term purchases may slightly reduce future long-term bond issuance, this does not help compress the term premium. Currently, about 84% of Treasury issuance is in short-term notes, so this policy has not materially changed the duration structure faced by investors.

- Financial conditions are not broadly easing

These reserve management purchases aimed at stabilizing the repo market and bank liquidity will not systematically lower real interest rates, corporate borrowing costs, mortgage rates, or equity discount rates. Their impact is localized and functional, rather than a broad monetary easing.

Therefore, no, this is not QE. This is not financial repression. It is important to clarify that the acronym does not matter; you can call it money printing, but it has not deliberately suppressed long-term yields by removing duration—which is precisely what would force investors to move to the higher end of the risk curve.

This situation has not occurred yet. Since last Wednesday, the price movements of BTC and the Nasdaq index have confirmed this.

What would change our view?

We believe BTC (and broader risk assets) will have their shining moments. But that will happen after QE (or whatever the Fed calls the next phase of financial repression).

That moment will arrive when:

- The Fed artificially suppresses the long end of the yield curve (or signals to the market).

- Real interest rates decline (due to rising inflation expectations).

- Corporate borrowing costs decrease (providing momentum for tech stocks/Nasdaq).

- Term premiums compress (long-term rates decline).

- Equity discount rates decrease (forcing investors into longer-duration risk assets).

- Mortgage rates decline (driven by suppression of long-end rates).

At that point, investors will smell the scent of "financial repression" and adjust their portfolios. We are not currently in that environment, but we believe it is coming. While timing is always difficult, our baseline assumption is that volatility will significantly increase in the first quarter of next year.

This is what we see as the short-term landscape.

2. A Broader Perspective

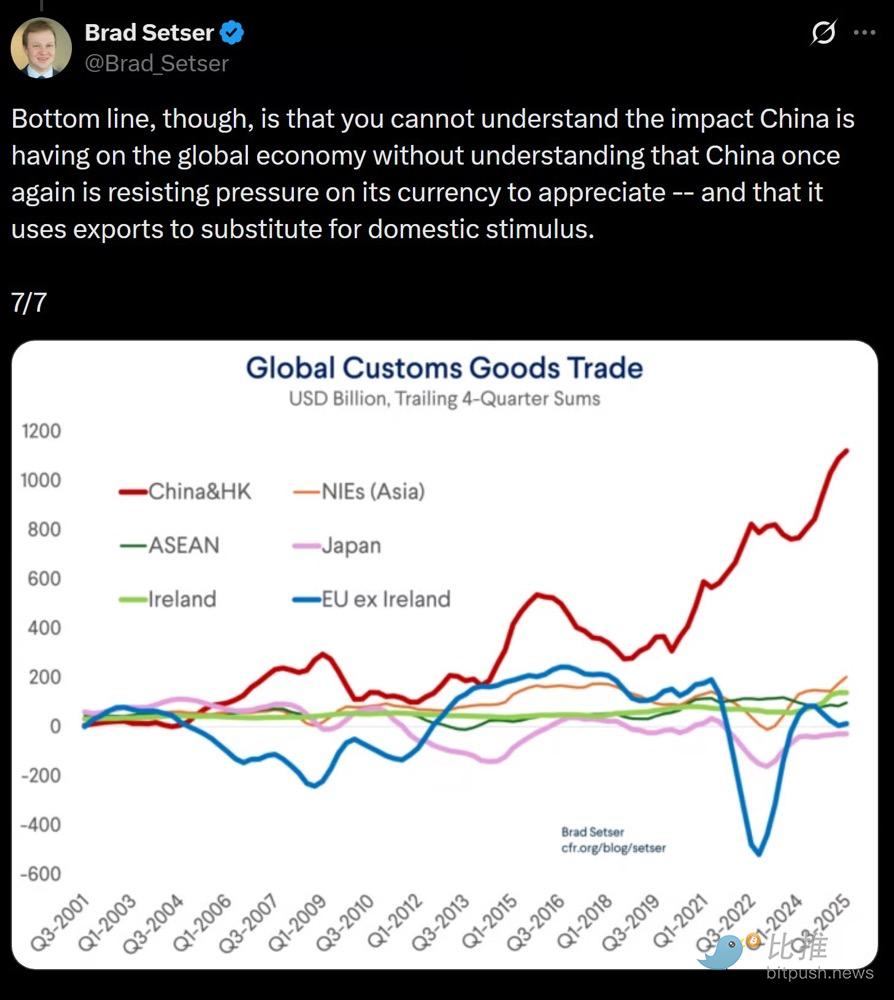

The deeper issue is not the Fed's short-term policy, but the global trade war (currency war) and the tensions it creates at the core of the dollar system.

Why?

The U.S. is moving towards the next strategic phase: reshoring manufacturing, reshaping global trade balances, and competing in strategically essential industries like AI. This goal directly conflicts with the dollar's role as the world's reserve currency.

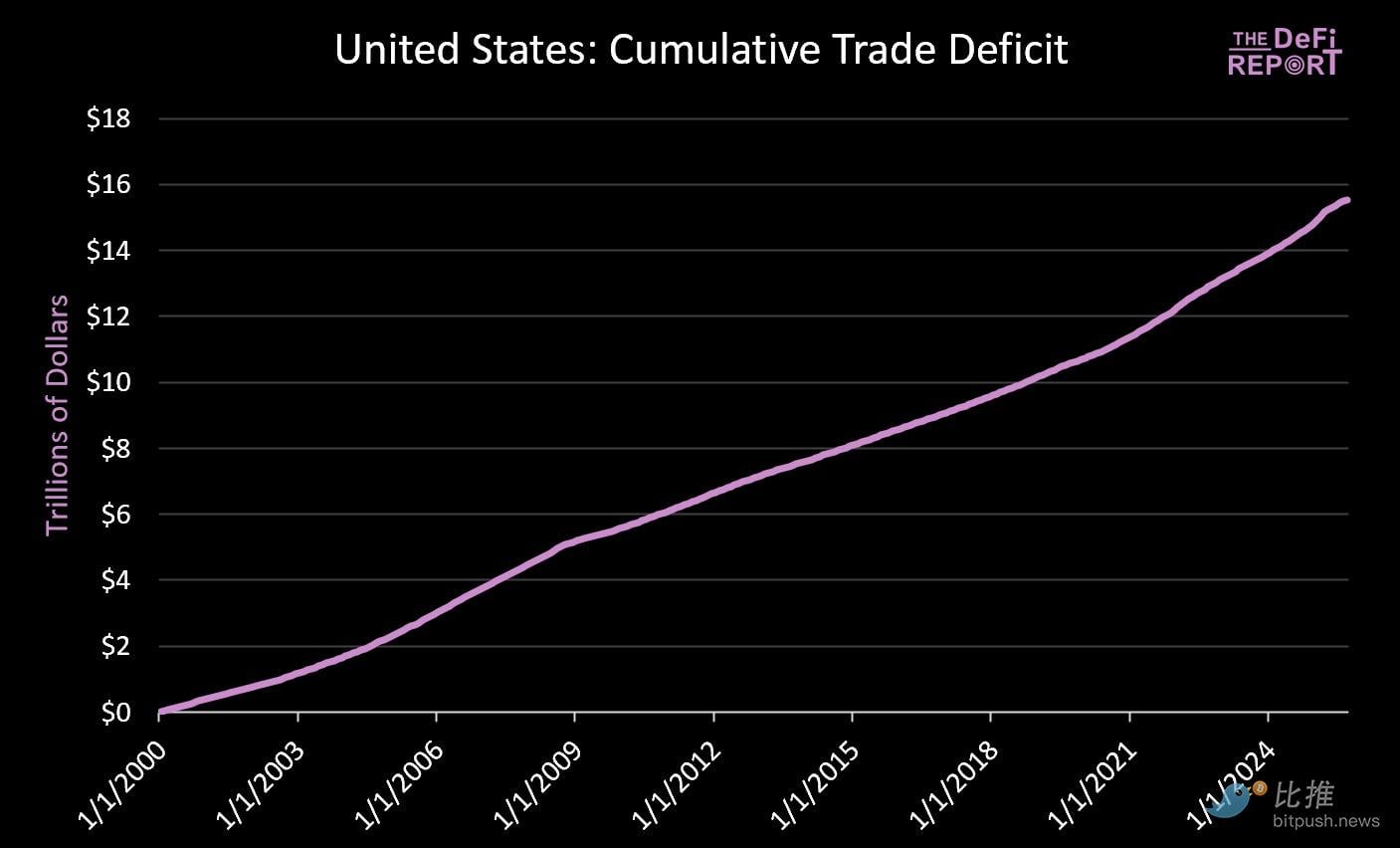

The status of a reserve currency can only be maintained as long as the U.S. continues to run trade deficits. In the current system, dollars are sent overseas to purchase goods and then cycle back to U.S. capital markets through Treasuries and risk assets. This is the essence of "Triffin’s Dilemma."

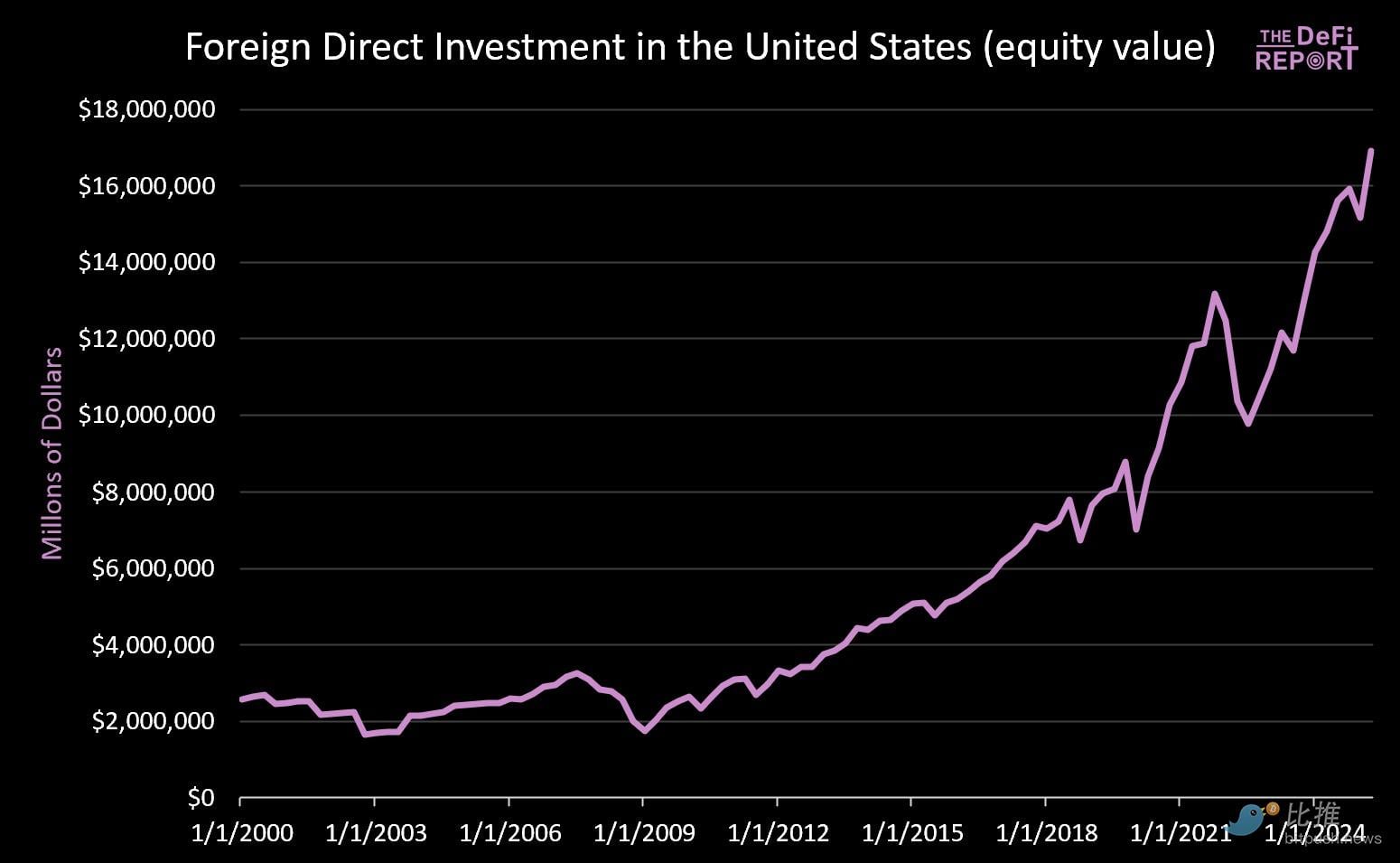

- Since January 1, 2000: U.S. capital markets have received over $14 trillion (not counting the current $9 trillion in bonds held by foreigners).

- Meanwhile, to pay for goods, about $16 trillion has flowed overseas.

Efforts to reduce the trade deficit will inevitably decrease the circulating capital flowing back to U.S. markets. While Trump touted Japan and other countries' commitments to "invest $550 billion in U.S. industry," he did not clarify that capital from Japan (and other countries) cannot simultaneously exist in both manufacturing and capital markets.

We believe this tension will not be resolved smoothly. Instead, we expect higher volatility, asset repricing, and ultimately monetary adjustments (i.e., dollar depreciation and the shrinkage of the real value of U.S. Treasuries).

The core point is that China is artificially suppressing the yuan's exchange rate (giving its export products an artificial price advantage), while the dollar is artificially overvalued due to foreign capital investment (leading to relatively cheap import prices).

We believe a forced depreciation of the dollar may be imminent to resolve this structural imbalance. In our view, this is the only viable path to address global trade imbalances.

In a new round of financial repression, the market will ultimately decide which assets or markets qualify as "stores of value."

The key question is whether U.S. Treasuries can continue to play the role of a global reserve asset when all is said and done.

We believe that Bitcoin and other global, non-sovereign stores of value (such as gold) will play a far more significant role than they do now. The reason is that they possess scarcity and do not rely on any policy credit.

This is what we see as the "macro landscape" setting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。