Original Author: Stacy Muur

Original Translation: Deep Tide TechFlow

Abstract:

- Institutions become the marginal buyers of crypto assets.

- Real-world assets (RWAs) evolve from a narrative concept to an asset class.

- Stablecoins emerge as both a "killer application" and a systemic weak link.

- Layer 2 networks (L2) consolidate into a "winner-takes-all" landscape.

- Prediction markets evolve from toy-like applications to financial infrastructure.

- Artificial intelligence and crypto (AI × Crypto) shift from hype narratives to actual infrastructure.

- Launchpads industrialize, becoming the internet capital market.

- Tokens with high fully diluted valuations (FDV) and low circulation are proven structurally uninvestable.

- Information finance (InfoFi) experiences a boom, expansion, and then collapse.

- Consumer-grade crypto returns to the public eye, but through new digital banks (Neobanks) rather than Web3 applications.

- Global regulation gradually normalizes.

In my view, 2025 marks a turning point in the crypto space: it transitions from a speculative cycle to a foundational, institutional-scale structure.

We have witnessed a repositioning of capital flows, a restructuring of infrastructure, and the maturation or collapse of emerging sectors. Headlines around ETF inflows or token prices are merely superficial. My analysis reveals the deep structural trends underpinning the new paradigm of 2026.

Below, I will analyze the 11 pillars of this transformation, each supported by specific data and events from 2025.

1. Institutions Become the Dominant Force in Crypto Capital Flows

I believe that 2025 witnessed institutions gaining full control over crypto market liquidity. After years of observation, institutional capital finally surpassed retail, becoming the dominant force in the market.

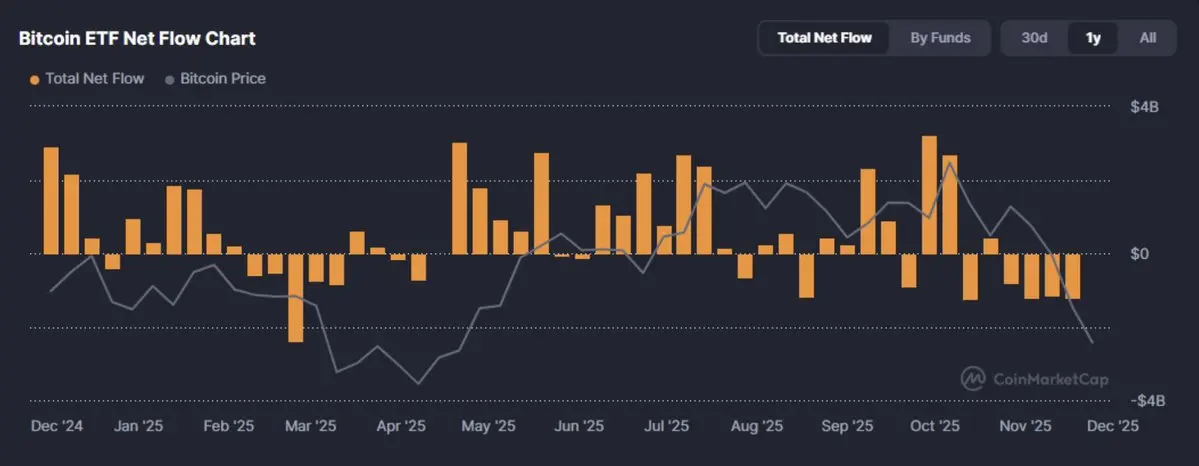

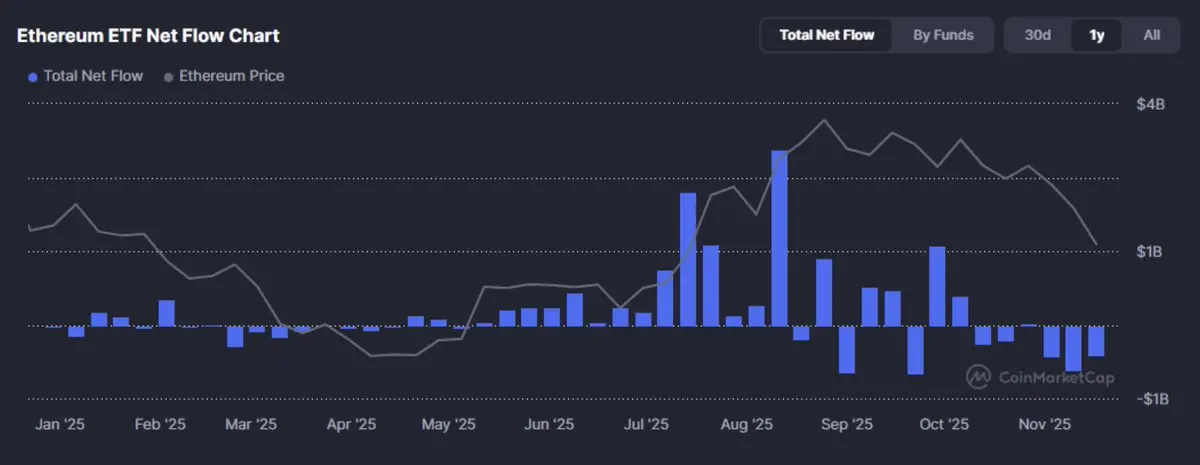

In 2025, institutional capital not only "entered" the crypto market but crossed a significant threshold. The marginal buyers of crypto assets shifted from retail investors to asset allocators for the first time. In just the fourth quarter, weekly inflows into U.S. spot Bitcoin ETFs exceeded $3.5 billion, led by products like BlackRock's IBIT.

These capital flows are not random; they represent a structural reallocation of risk capital. Bitcoin is no longer viewed as a curiosity-driven asset but as a macro tool with portfolio utility: digital gold, a convex inflation hedge, or simply an uncorrelated asset exposure.

However, this shift also brings dual effects.

Institutional capital flows are less reactive but more sensitive to interest rates. They compress market volatility while binding the crypto market to macroeconomic cycles. As one Chief Investment Officer stated, "Bitcoin is now a liquidity sponge with a compliance shell." As a globally recognized store of value, its narrative risk has significantly decreased; however, interest rate risk remains.

This shift in capital direction has far-reaching implications: from compressed exchange fees to a reshaping of the demand curve for yield-bearing stablecoins and the tokenization of real-world assets (RWAs).

The next question is no longer whether institutions will enter, but how protocols, tokens, and products will adapt to capital demands driven by Sharpe Ratios rather than market speculation.

2. Real-World Assets (RWAs) Transition from Concept to Real Asset Class

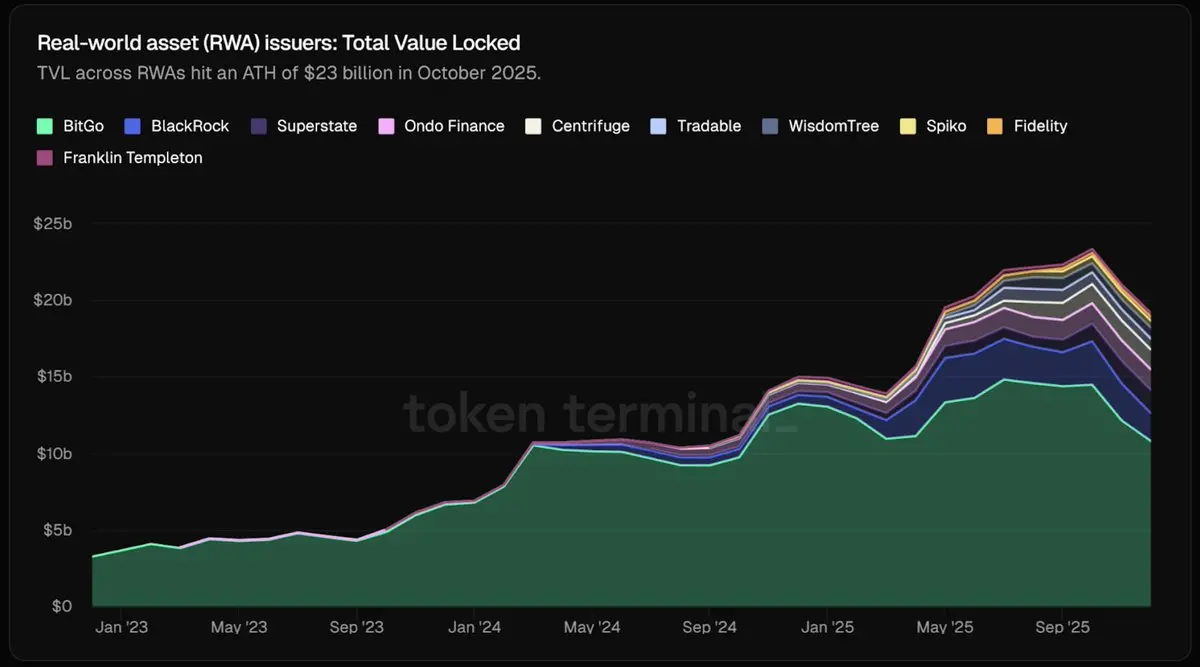

In 2025, tokenized real-world assets (RWAs) transitioned from concept to infrastructure in the capital markets.

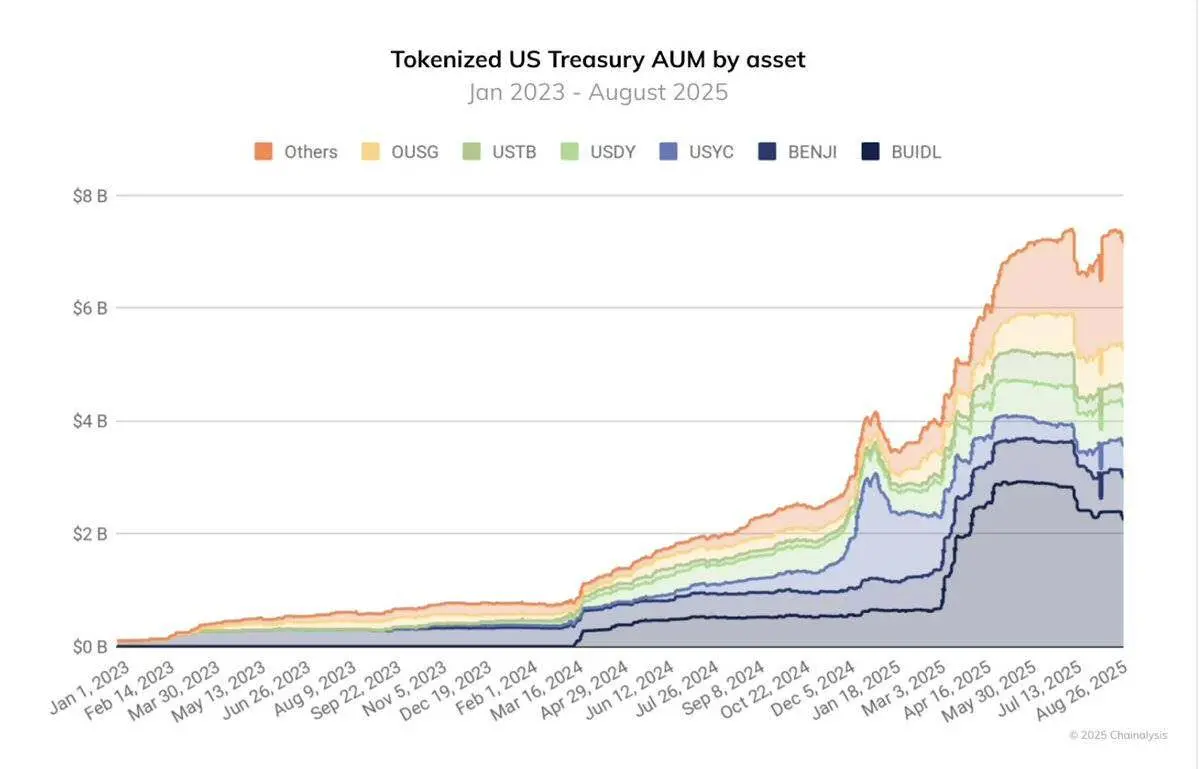

We have now witnessed substantial supply: as of October 2025, the total market capitalization of RWA tokens exceeded $23 billion, nearly quadrupling year-on-year. About half of this consists of tokenized U.S. Treasuries and money market strategies. With institutions like BlackRock issuing $500 million in Treasuries to BUIDL, this is no longer a marketing gimmick but a treasury backed by on-chain insured debt, rather than uncollateralized code.

Meanwhile, stablecoin issuers began supporting reserves with short-term notes, and protocols like Sky (formerly Maker DAO) integrated on-chain commercial paper into their collateral asset pools.

Stablecoins backed by Treasuries are no longer marginal; they are foundational to the crypto ecosystem. The assets under management (AUM) of tokenized funds nearly quadrupled within 12 months, growing from about $2 billion in August 2024 to over $7 billion in August 2025. At the same time, the infrastructure for the tokenization of real-world assets (RWA) from institutions like JPMorgan and Goldman Sachs transitioned from testnets to production environments.

In other words, the boundary between on-chain liquidity and off-chain asset classes is gradually collapsing. Traditional financial asset allocators no longer need to purchase tokens related to real-world assets; they now directly hold assets issued in on-chain native form. This shift from synthetic asset representation to actual asset tokenization is one of the most influential structural advancements of 2025.

3. Stablecoins: Both a "Killer Application" and a Systemic Weak Link

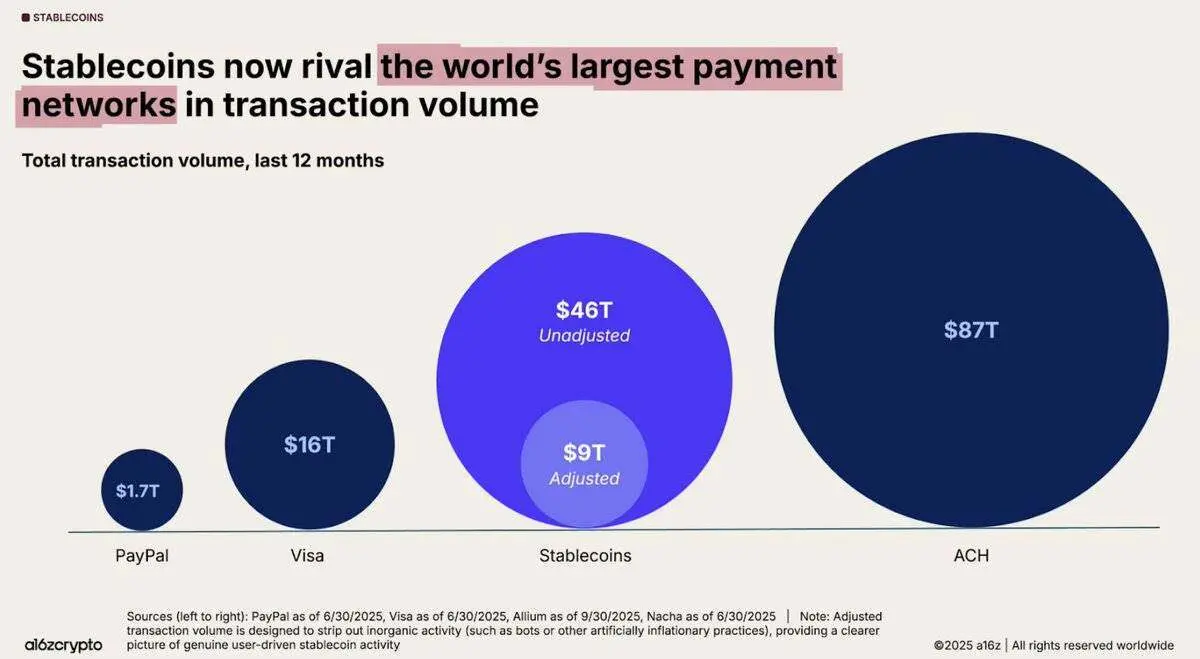

Stablecoins have fulfilled their core promise: a massively programmable dollar. Over the past 12 months, on-chain stablecoin transaction volume reached $46 trillion, a 106% year-on-year increase, averaging nearly $4 trillion per month.

From cross-border settlements to ETF infrastructure and DeFi liquidity, these tokens have become the financial hub of the crypto space, making blockchain a truly functional dollar network. However, the success of stablecoins has also revealed systemic vulnerabilities.

2025 exposed the risks of yield-bearing and algorithmic stablecoins, especially those relying on endogenous leverage support. Stream Finance's XUSD collapsed to $0.18, evaporating $93 million of user funds and leaving $285 million in protocol-level debt.

Elixir's deUSD collapsed due to a large loan default. USDx on AVAX fell due to alleged manipulation. These cases unequivocally revealed how opaque collateral, recursive rehypothecation, and concentrated risk can lead to stablecoin depegging.

The profit-seeking frenzy of 2025 further amplified this vulnerability. Capital flooded into yield-bearing stablecoins, some offering annual yields of 20% to 60% through complex treasury strategies. Platforms like @ethenalabs, @sparkdotfi, and @pendlefi absorbed billions, as traders chased synthetic dollar-based structural yields. However, with the collapse of deUSD, XUSD, and others, it became evident that DeFi had not truly matured but was trending towards centralization. Nearly half of the total value locked (TVL) on Ethereum is concentrated in @aave and @LidoFinance, while other funds are clustered in a few strategies related to yield-bearing stablecoins (YBS). This has led to a fragile ecosystem based on excessive leverage, recursive capital flows, and shallow diversification.

Thus, while stablecoins provide the system with momentum, they also exacerbate systemic pressure. We are not saying that stablecoins are "bankrupt"; they are crucial to the industry. However, 2025 proved that the design of stablecoins is as important as their functionality. As we move into 2026, the integrity of dollar-denominated assets has become a primary concern, not only for DeFi protocols but for all participants allocating capital or building on-chain financial infrastructure.

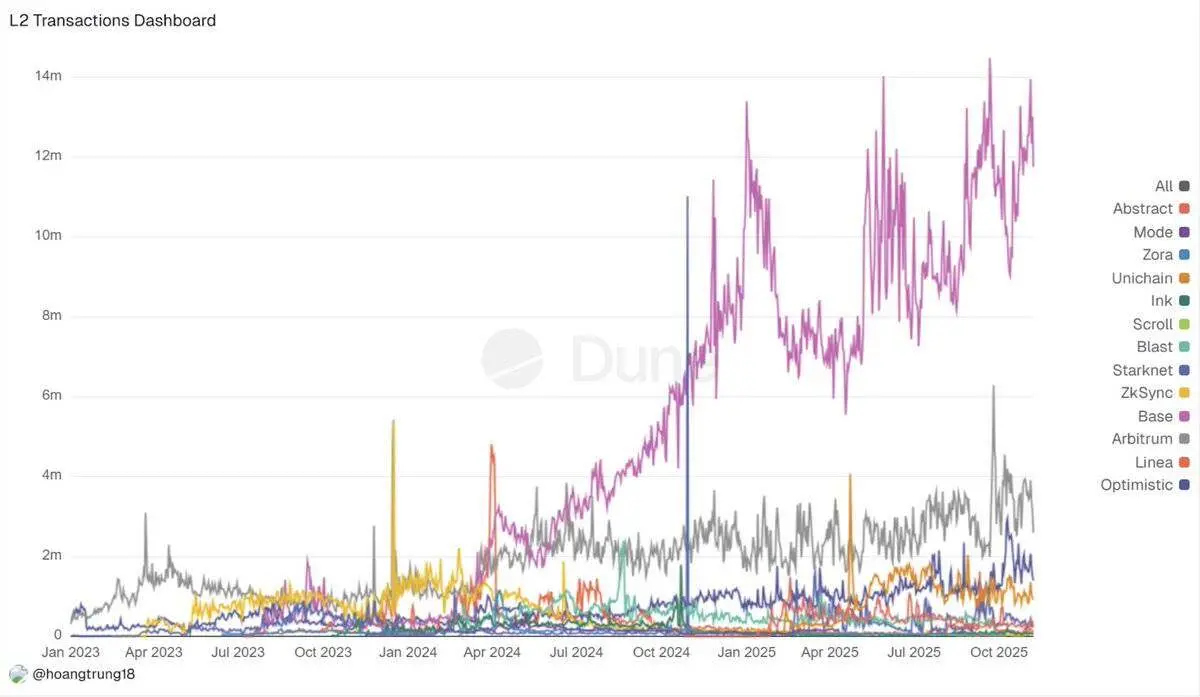

4. L2 Integration and the Illusion of Chain Stacks

In 2025, Ethereum's "Rollup-centric" roadmap collided with market realities. Once home to dozens of L2 projects on L2Beat, the landscape has evolved into a "winner-takes-all" scenario: @arbitrum, @base, and @Optimism attracted most of the new total value locked (TVL) and capital flows, while smaller Rollup projects saw their revenue and activity drop by 70% to 90% after incentives ended. Liquidity, MEV bots, and arbitrageurs follow depth and tight spreads, reinforcing this flywheel effect, depleting order flow on marginal chains.

Meanwhile, cross-chain bridge transaction volumes surged, reaching $56.1 billion in July 2025 alone, clearly indicating that "everything is Rollup" still means "everything is fragmented." Users still need to deal with isolated balances, L2 native assets, and duplicated liquidity.

It is important to clarify that this is not a failure but a process of consolidation. Fusaka achieved 5–8 times the Blob throughput, zk application chains like @Lighter_xyz reached 24,000 TPS, and some emerging dedicated solutions (like Aztec/Ten providing privacy features, MegaETH offering ultra-high performance) all indicate that a few execution environments are emerging.

Other projects have entered "sleep mode" until they can prove their moats are deep enough that leaders cannot simply fork to replicate their advantages.

5. The Rise of Prediction Markets: From Marginal Tools to Financial Infrastructure

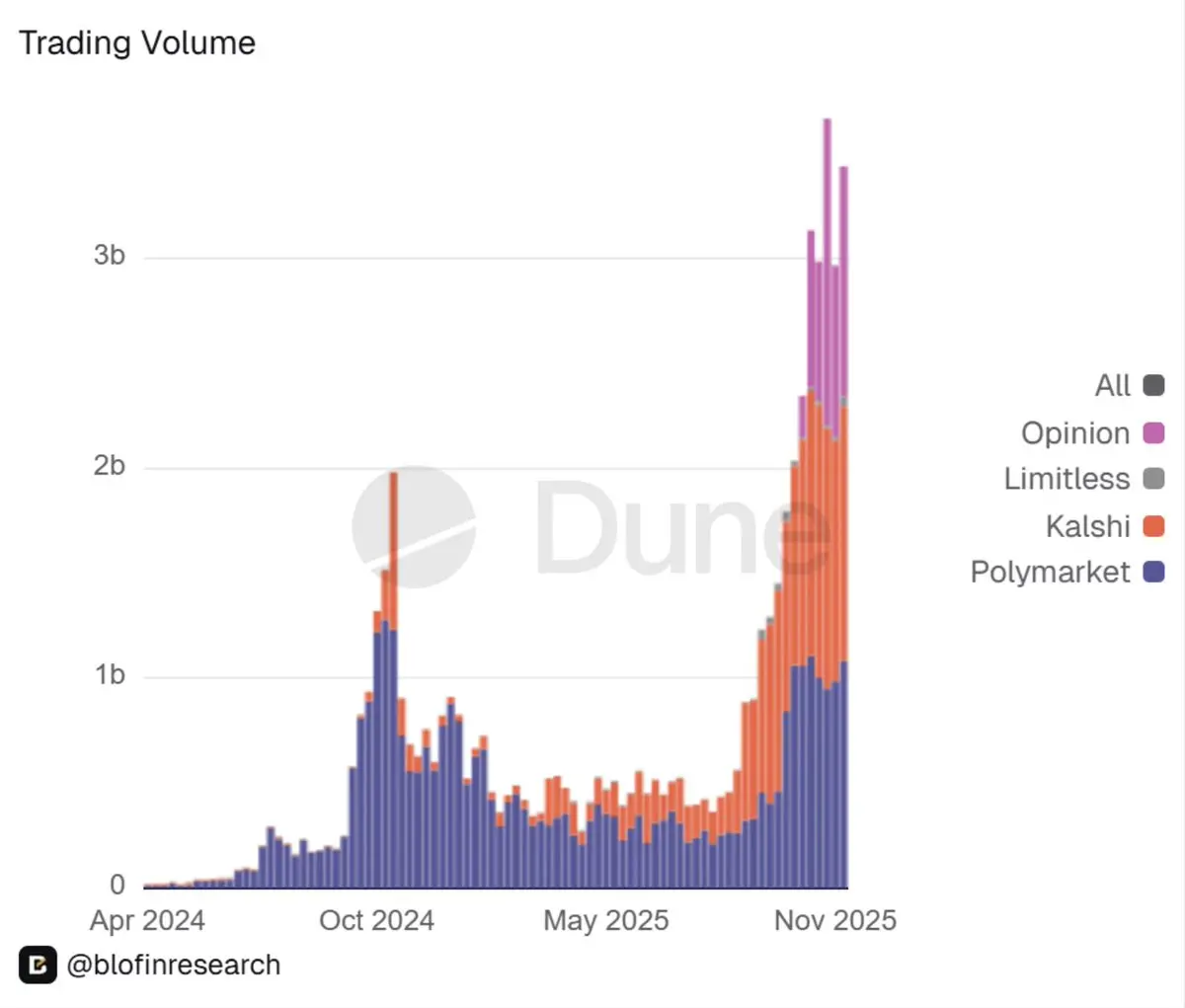

Another major surprise in 2025 was the formal legalization of prediction markets.

Once regarded as a marginal curiosity, prediction markets are gradually integrating into financial infrastructure. Long-time industry leader @Polymarket has made a regulated return to the U.S. market: its U.S. division received approval from the Commodity Futures Trading Commission (CFTC) to become a Designated Contract Market. Additionally, reports indicate that the Intercontinental Exchange (ICE) has invested billions of dollars, with a valuation nearing $10 billion. Capital flows followed suit.

Prediction markets have surged from being "interesting niche markets" to handling billions of dollars in weekly trading volume, with just the @Kalshi platform processing event contracts worth tens of billions in 2025.

I believe this marks the transition of blockchain markets from "toys" to genuine financial infrastructure.

Mainstream sports betting platforms, hedge funds, and DeFi-native managers now view Polymarket and Kalshi as predictive tools rather than entertainment products. Crypto projects and DAOs have also begun to see these order books as sources of real-time governance and risk signals.

However, this "weaponization" of DeFi has its dual aspects. Regulatory scrutiny will become stricter, liquidity remains highly concentrated on specific events, and the correlation between "prediction markets as signals" and real-world outcomes has yet to be validated under stress scenarios.

Looking ahead to 2026, it is clear that event markets have now entered the institutional spotlight alongside options and perpetual contracts. Portfolios will need to form clear views on whether—and how—to allocate to such exposures.

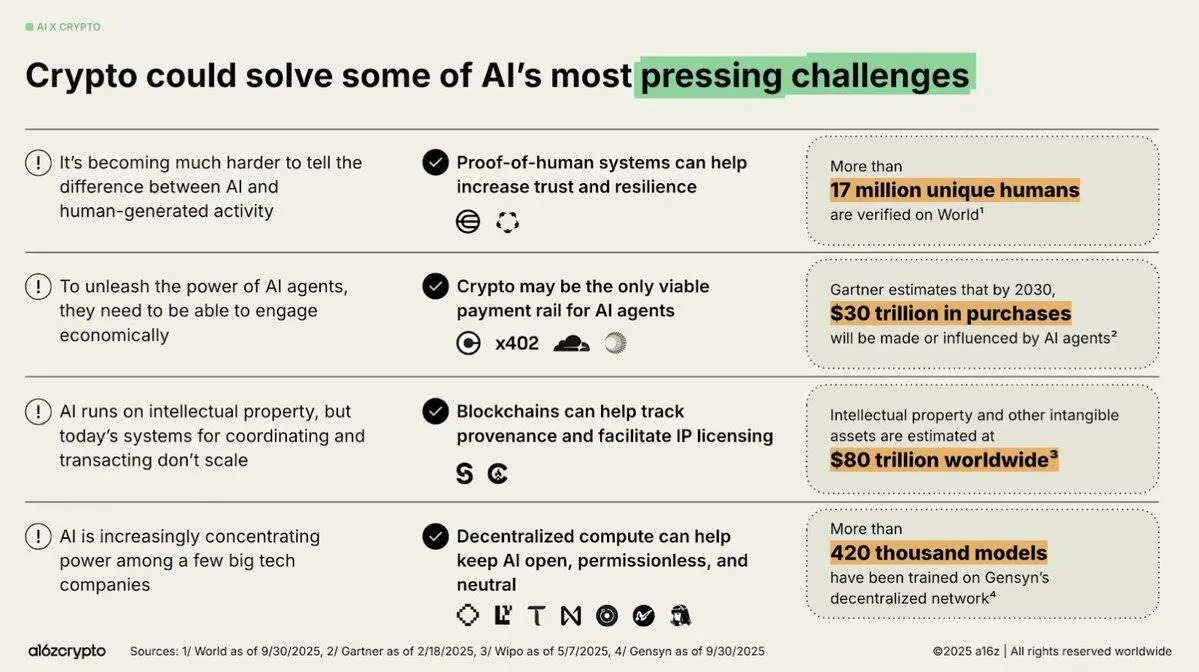

6. The Fusion of AI and Crypto: From Buzzword to Practical Infrastructure Transformation

In 2025, the combination of AI and crypto transitioned from a noisy narrative to structured practical applications.

I believe three themes defined the developments of this year:

First, the Agentic Economy shifted from a speculative concept to an actionable reality. Protocols like x402 enable AI agents to autonomously trade using stablecoins. The integration of Circle's USDC, along with the rise of orchestration frameworks, reputation layers, and verifiable systems (such as EigenAI and Virtuals), highlights that useful AI agents require collaboration, not just reasoning capabilities.

Second, decentralized AI infrastructure has become a core pillar of the field. Bittensor's dynamic TAO upgrade and the halving event in December redefined it as "Bitcoin for AI"; NEAR's chain abstraction brought about actual intent trading volume; while @rendernetwork, ICP, and @SentientAGI validated the feasibility of decentralized computing, model provenance, and hybrid AI networks. It is clear that infrastructure has gained a premium, while the value of "AI packaging" is gradually diminishing.

Third, the vertical integration of practicality is accelerating.

@almanak's AI community deployed quant-level DeFi strategies, @virtuals_io generated $2.6 million in fee revenue on Base, and robots, prediction markets, and geospatial networks became trusted agent environments.

The shift from "AI packaging" to verifiable agents and robot integration indicates that product-market fit is maturing. However, trust infrastructure remains a critical missing link, and the risk of hallucination still looms over autonomous trading.

Overall, market sentiment at the end of 2025 is optimistic about infrastructure, cautious about the practicality of agents, and generally believes that 2026 could be a year of breakthrough developments in verifiable and economically valuable on-chain AI.

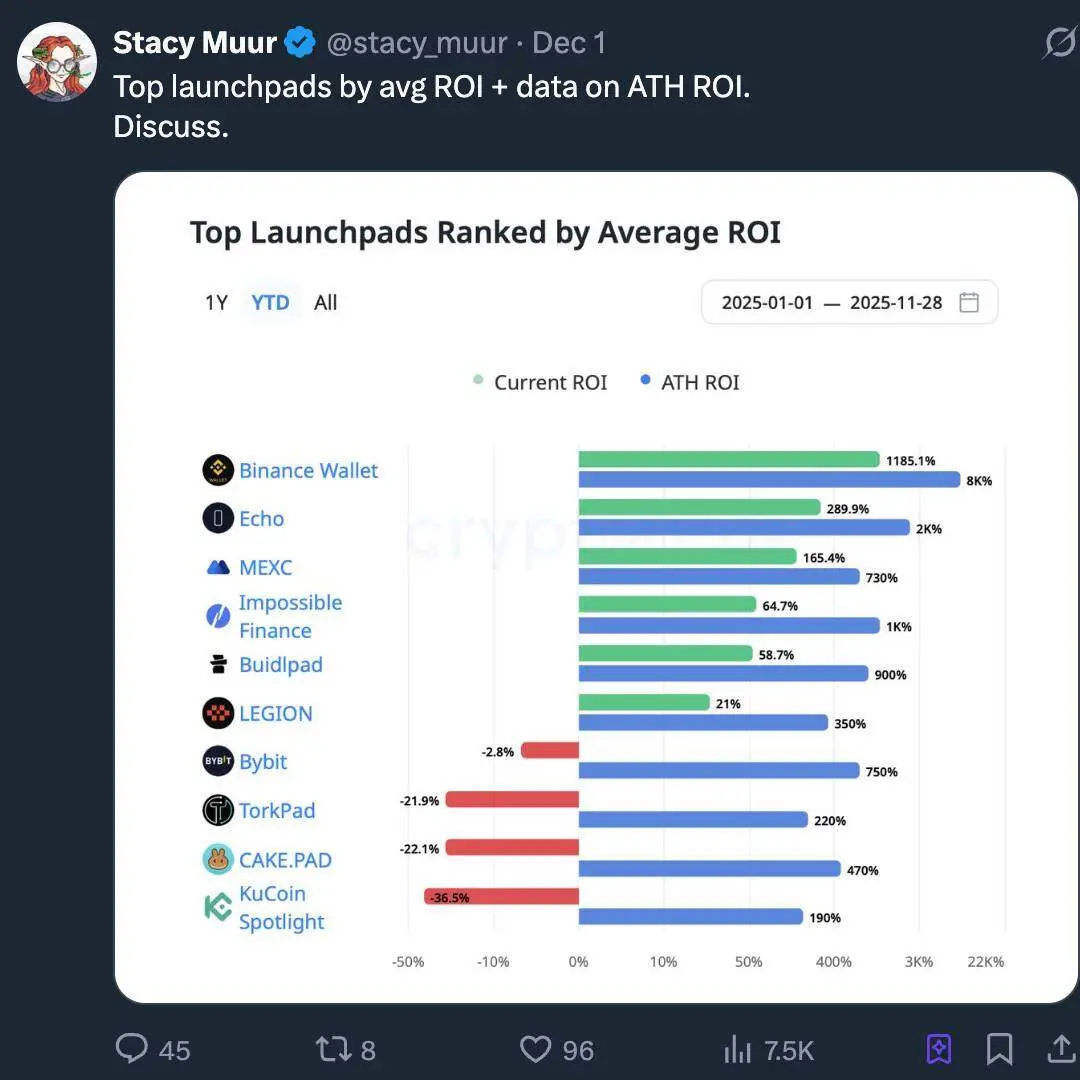

7. The Return of Launchpads: A New Era for Retail Capital

We believe that the launchpad craze of 2025 is not a "return of ICOs," but rather the industrialization of ICOs. The so-called "ICO 2.0" in the market is, in fact, the maturation of the crypto capital formation stack, gradually evolving into Internet Capital Markets (ICM): a programmable, regulated, around-the-clock underwriting track, rather than merely a "lottery-style" token sale.

The repeal of SAB 121 accelerated regulatory clarity, transforming tokens into financial instruments with vesting periods, disclosure requirements, and recourse rights, rather than simple issuances. Platforms like Alignerz embed fairness into their mechanisms: hash-based bidding, refund windows, and token vesting schedules based on lock-up periods rather than internal channel allocations. "No VC sell-offs, no insiders profiting" is no longer a slogan but a structural choice.

At the same time, we observe that launchpads are integrating into exchanges, signaling a structural shift: platforms related to Coinbase, Binance, OKX, and Kraken offer KYC/AML (Know Your Customer/Anti-Money Laundering) compliance, liquidity guarantees, and carefully curated issuance pipelines accessible to institutions. Independent launchpads are being forced to concentrate on verticals (such as gaming, memes, and early infrastructure).

From a narrative perspective, AI, RWAs (real-world assets), and DePIN (decentralized physical infrastructure networks) dominate the primary issuance channels, with launchpads acting more as narrative routers than hype machines. The real story is that the crypto space is quietly building an ICM layer that supports institutional-level issuance and long-term alignment of interests, rather than replaying the nostalgic trends of 2017.

8. The Structural Uninvestability of High FDV Projects

Throughout much of 2025, we witnessed the repeated validation of a simple rule: projects with high fully diluted valuations (FDV) and low circulation are structurally uninvestable.

Many projects—especially new L1 (layer one blockchain), sidechains, and "real yield" tokens—entered the market with FDVs exceeding a billion dollars and single-digit circulation supplies.

As one research firm stated, "High FDV, low circulation is a liquidity time bomb"; any large-scale sell-off by early buyers would directly destroy the order book.

The results were predictable. These tokens soared in price upon launch, but as unlock periods arrived and insiders exited, prices quickly plummeted. Cobie's famous saying—"Refuse to buy tokens with inflated FDVs"—transformed from a meme into a risk assessment framework. Market makers widened bid-ask spreads, and retail investors simply stopped participating, with many of these tokens showing almost no improvement over the following year.

In contrast, tokens with actual utility, deflationary mechanisms, or cash flow ties significantly outperformed those whose only selling point was "high FDV."

I believe that 2025 has permanently reshaped buyers' tolerance for "token economic dramatization." FDV and circulation are now viewed as hard constraints rather than irrelevant footnotes. Looking ahead to 2026, if a project's token supply cannot be absorbed by the exchange's order book without disrupting price trends, then that project is effectively uninvestable.

9. InfoFi: Rise, Frenzy, and Collapse

I believe that the prosperity and decline of InfoFi in 2025 became the clearest cyclical stress test of "tokenized attention."

InfoFi platforms like @KaitoAI, @cookiedotfun, and @stayloudio promised to reward analysts, creators, and community managers for their "knowledge work" through points and token payments. For a brief window, this concept became a hot venture capital theme, with firms like Sequoia, Pantera, and Spartan pouring in substantial investments.

The information overload in the crypto industry and the popular trend of combining AI with DeFi made on-chain content curation seem like an obvious missing foundational module.

However, this design choice of measuring attention is a double-edged sword: when attention becomes the core metric, content quality collapses. Platforms like Loud and their peers were inundated with AI-generated low-quality content, bot farms, and interactive alliances; a few accounts captured most of the rewards while long-tail users realized the game was rigged against them.

Multiple tokens experienced 80–90% retracements, with some even facing complete collapses (for example, WAGMI Hub raised nine-figure funding only to suffer a major exploit), further damaging the credibility of the field.

The final conclusion indicates that the first-generation attempts at InfoFi are structurally unstable. Although the core idea—monetizing valuable crypto signals—remains attractive, incentive mechanisms need redesigning, based on verified contributions rather than mere click counts.

I believe that by 2026, the next generation of projects will learn from these lessons and make improvements.

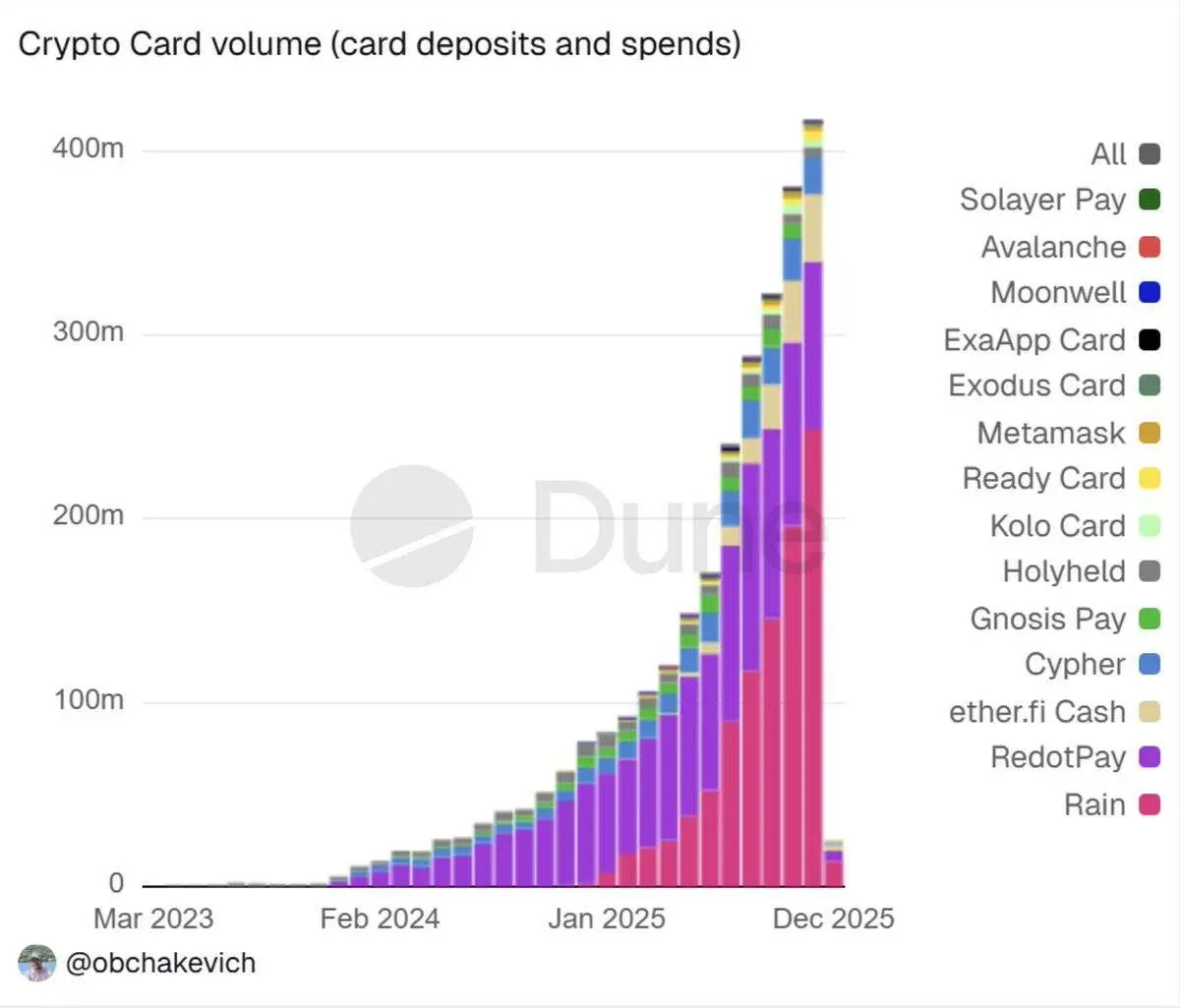

10. The Return of Consumer Crypto: A New Paradigm Led by New Banks

In 2025, the return of consumer crypto is increasingly seen as a structural shift driven by new banks (Neobanks), rather than a result of local Web2 applications.

I believe this shift reflects a deeper understanding: when users onboard through financial vernacular they are already familiar with (such as deposits and yields), adoption rates accelerate, while the underlying settlement, yield, and liquidity tracks quietly migrate on-chain.

What ultimately emerged is a Hybrid Banking Stack, where new banks shield users from the complexities of gas fees, custody, and cross-chain bridges while providing direct access to stablecoin yields, tokenized government bonds, and global payment rails. The result is a consumer funnel capable of attracting millions of users "deeper on-chain" without requiring them to think about complex technical details like seasoned users.

The mainstream view across the industry indicates that new banks (Neobanks) are gradually becoming the de facto standard interface for mainstream crypto demand.

Platforms like @etherfi, @Plasma, @URglobal, @SolidYield, @raincards, and Metamask Card are typical representatives of this shift: they offer instant deposit channels, 3-4% cashback cards, annual percentage yields (APY) of 5-16% through tokenized government bonds, and self-custody smart accounts, all packaged in a compliant environment that supports KYC.

These applications benefit from the regulatory reset of 2025, including the repeal of SAB 121, the establishment of a stablecoin framework, and clearer guidance for tokenized funds. These changes reduce operational friction and expand their potential market size in emerging economies, particularly in regions where practical pain points like yield, foreign exchange savings, and remittances are prominent.

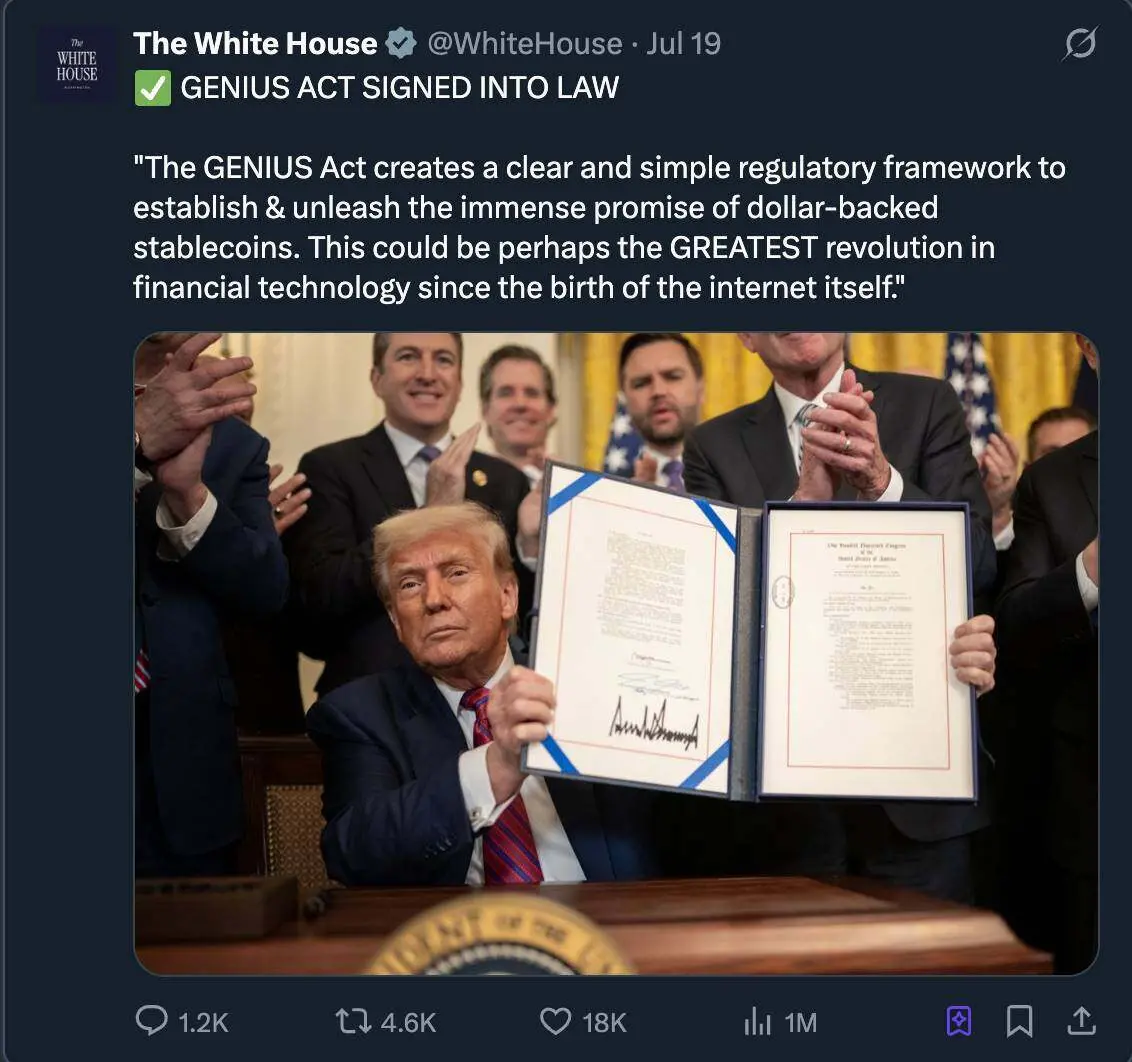

11. Normalization of Global Crypto Regulation

I believe that 2025 was the year when crypto regulation finally achieved normalization.

Conflicting regulatory directives gradually formed three identifiable regulatory models:

- European Framework: Including the Markets in Crypto-Assets Regulation (MiCA) and the Digital Operational Resilience Act (DORA), with over 50 MiCA licenses issued, and stablecoin issuers regarded as electronic money institutions.

- U.S. Framework: Including stablecoin legislation similar to the GENIUS Act, SEC/CFTC guidance, and the launch of spot Bitcoin ETFs.

- Asia-Pacific Patchwork Model: Such as Hong Kong's full-reserve stablecoin regulations, Singapore's license optimization, and broader adoption of the FATF (Financial Action Task Force) travel rules.

This is not just superficial; it fundamentally reshapes risk models.

Stablecoins have transitioned from "shadow banking" to regulated cash equivalents; banks like Citi and Bank of America can now operate tokenized cash pilots under clear rules; platforms like Polymarket can relaunch under the oversight of the Commodity Futures Trading Commission (CFTC); and U.S. spot Bitcoin ETFs can attract over $35 billion in stable capital flows without survival risk.

Compliance has transformed from a burden into a moat: institutions with robust regulatory technology (Regtech) frameworks, clear cap tables, and auditable reserves suddenly enjoy lower capital costs and faster institutional access.

In 2025, crypto assets transitioned from curious products in the gray area to regulated entities. Looking ahead to 2026, the debate has shifted from "whether this industry is allowed to exist" to "how to implement specific structures, disclosures, and risk controls."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。