Author: Chen Mo cmDeFi

Recently, there has been a heated debate regarding Aave DAO vs Aave Labs, focusing on the governance power dispute between the protocol layer and the product layer, which reflects the governance dilemma faced by the entire industry. I have organized some thoughts on this issue. Who is the true owner of Aave?

1/6 · The Origin of the Issue

Aave Labs replaced the front-end integration of ParaSwap with CoW Swap, and the resulting fees flowed to Labs' private address. An anonymous DAO member, EzR3aL, exposed this matter on the governance forum, accusing Labs of "privatizing" the protocol's value. Labs' position is that this belongs to front-end and product layer revenue, owned by Labs and unrelated to the core of the protocol.

2/6 · First, let's break down who Aave DAO and Aave Labs are

- DAO represents the Protocol (protocol layer)

- Labs represents the Project (product layer)

The core controversy is whether Aave is a Protocol (managed by DAO) or a Project (built by Labs)? And how this affects revenue rights.

Aave DAO is easy to understand; it is a governance organization unique to the crypto world, composed of holders of the $AAVE token, who exercise power through voting within the DAO. Over 90% of crypto projects have this structure, and the definition of "governance token" comes from this. Its greatest power is to vote on project proposals, deciding whether to implement updates and developments, as well as the future direction of the project.

Aave Labs, on the other hand, is a development team responsible for building, updating, and maintaining the protocol (such as the front-end interface and mobile app). They also typically maintain the Aave brand and IP, so on social media and in the market, Aave Labs is often assumed to be Aave. Its founders also have significant influence on social media.

Generally, Aave Labs and Aave DAO need to collaborate. For example, Labs will propose many development plans, optimizations for certain features, and even version upgrades V3 and V4. These plans are led by Aave Labs but ultimately decided by DAO votes. Usually, when both parties have aligned interests, they support each other, forming Aave together.

3/6 · What core resources do they control?

Once conflicts of interest arise, it is possible to separate these two roles, as they are independent entities. Let's look at the core resources and powers each possesses:

Aave DAO controls the underlying core, such as smart contracts and treasury control, which is in the hands of the DAO. Although Labs can propose development plans, they must be approved by DAO votes to be implemented. Thus, it is a Protocol, and any product can operate on top of it; theoretically, multiple front-end products can be built on a Protocol, such as Aave? Bave? Cave, all are possible.

Aave Labs controls the front-end, brand, product marketing, and partnerships. Therefore, it directly communicates with users and represents a well-functioning product.

Supporters of Labs generally believe that the integration of CoW Swap is purely a front-end action, unrelated to Aave's underlying architecture. They argue that Labs could unilaterally decide not to integrate, and any resulting revenue would naturally belong to Labs. Conversely, DAO supporters argue that this is a form of plunder, as the existence of the AAVE governance token means that all benefits should first flow to AAVE holders or remain in the treasury to be decided by DAO votes. Additionally, the previous income from ParaSwap would continuously flow into the DAO, and the new CoW Swap integration changed this status, further leading the DAO to view this as a form of plunder.

Both sides hold their ground.

4/6 · Governance Dilemma

This reflects a rather awkward governance and power dilemma. From the perspective of $AAVE holders, they typically stand with the DAO, as income entering the treasury benefits token holders. While Labs has corresponding expenses each year, they can reimburse through the DAO. If they can independently open a profit channel, it seems that community power is gradually being consumed.

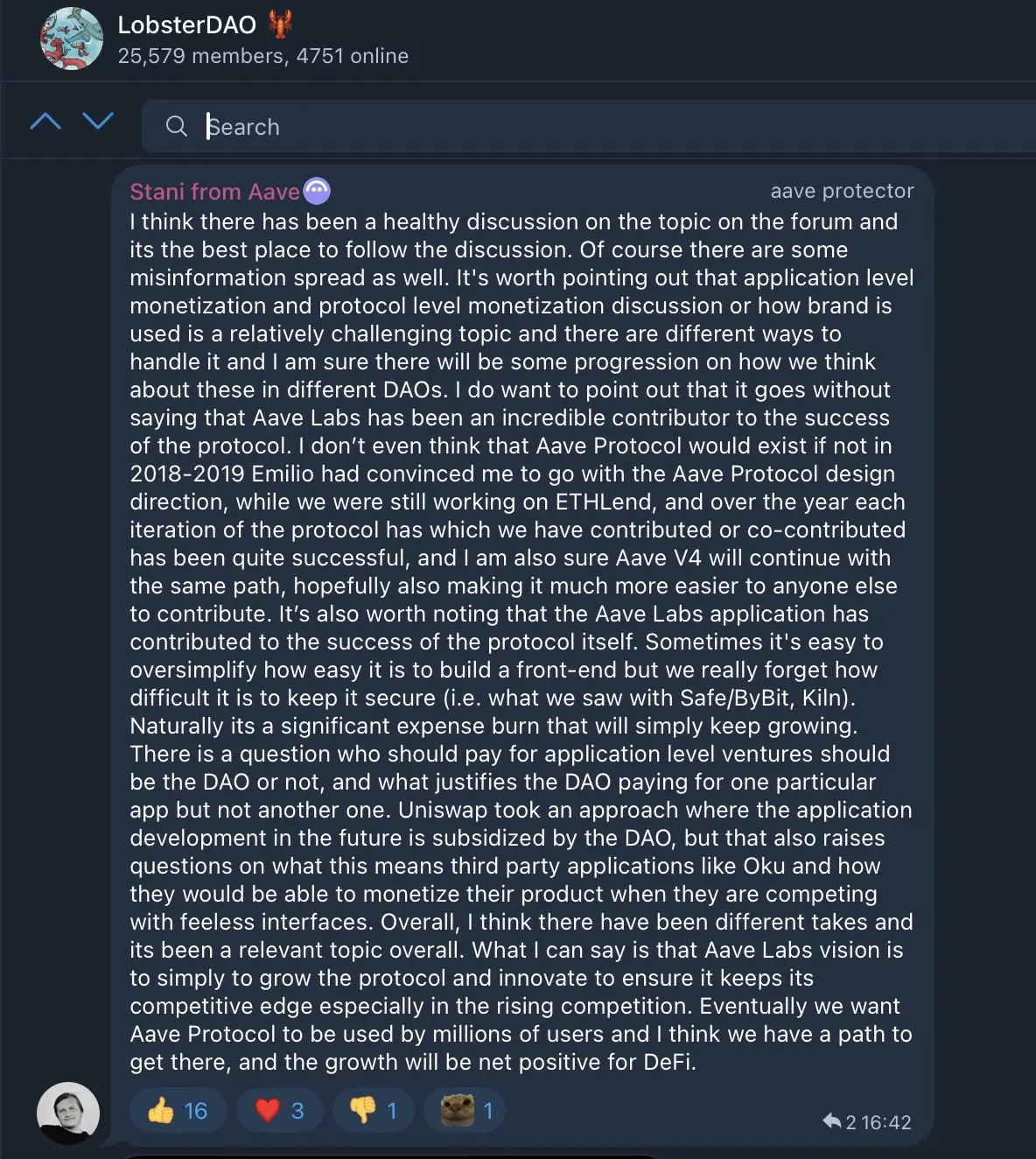

However, from Aave Labs' perspective, although the theoretical core control lies with the DAO, plans must ultimately be voted on to be implemented. From the first version of Aave to now, Labs has played a unifying role, making significant contributions to the project's growth. As Stani said, "If Emilio hadn't persuaded me to adopt the design direction of the Aave protocol in 2018-2019, when we were still working on ETHLend, I don't think the Aave protocol would even exist."

Who is the true owner of Aave?

5/6 · Power Struggle

This governance dilemma exists in most projects. Governance tokens are purchased with real money, and ideally, these holders collectively decide the project's future. When the team no longer holds voting rights, they can even be forced to replace Labs.

However, the gap between reality and the ideal state is significant. Even for projects with a certain market share, when internal issues or disputes arise, they can lose market presence after the drama, as seen with Sushi. The DAO can exercise power, and the project can change personnel. Thanks to the design of smart contracts, even if a project undergoes a major overhaul, the original stability of product functionality can be perfectly preserved. However, based on past cases, the results of splits usually lead to unfavorable outcomes.

The core issue here is that, currently, the DAO is characterized as a decentralized organization. Although it has voting rights, it struggles to operate efficiently. The community may include independent developers, VCs, and large holders. Once each role begins to fully exercise its power, a proposal may undergo multiple rounds of drafting, modification, and negotiation from the start. The success of a project requires a professional team and continuity. The DAO can hire a new team, but it may struggle to quickly connect and iterate, easily losing market position. Thus, Labs' existence appears to be an entity that can "control" the protocol (requiring collaboration with the DAO).

Personally, I lean towards a solution that balances the distribution of interests between the two. However, everything is still under discussion, and no governance vote has occurred. The potential hidden danger behind this is that even if a resolution is ultimately reached, this incident has already exposed the divergence in expectations between the founding team and token holders.

In the long run, I remain optimistic about Aave's development, as it is one of the few DeFi projects that has been validated by the market and possesses a strong moat. The contradiction in governance power is an issue the entire industry needs to face. How Aave handles this incident may become a model case for the future.

6/6 · Voices and Discussions

In the argument, Emilio believes that some are maliciously belittling Aave Labs' contributions and value. ACI team members pointed out that Aave Labs has attempted to exploit the DAO multiple times and has been exposed.

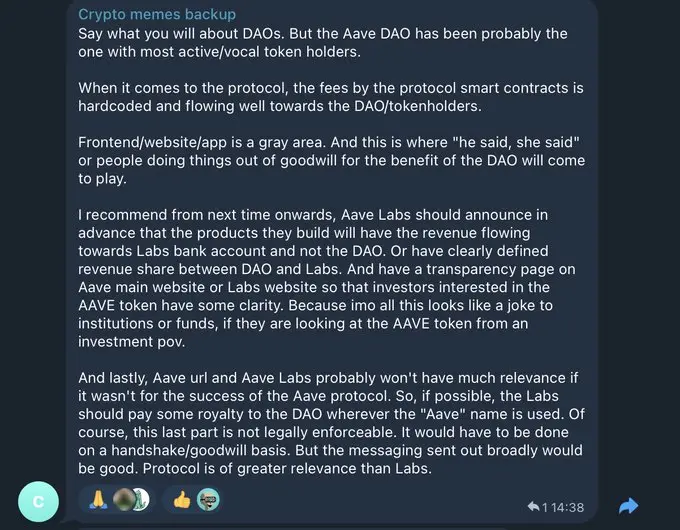

Community members' suggestions for Labs:

- In the future, Labs should announce in advance that the revenue from the products they build will flow to Labs, not the DAO.

- Alternatively, clearly define the revenue-sharing ratio between the DAO and Labs.

- Establish a transparent page on the Aave main website or Labs website to provide clear information, helping investors interested in the $AAVE token (especially institutions or funds) make judgments.

Although the DAO model is controversial, the token holders of Aave DAO are the most active and vocal group, demonstrating the community's vitality. The front-end, website, and applications are the focal points of the dispute, where "each side holds its ground," lacking clear definitions.

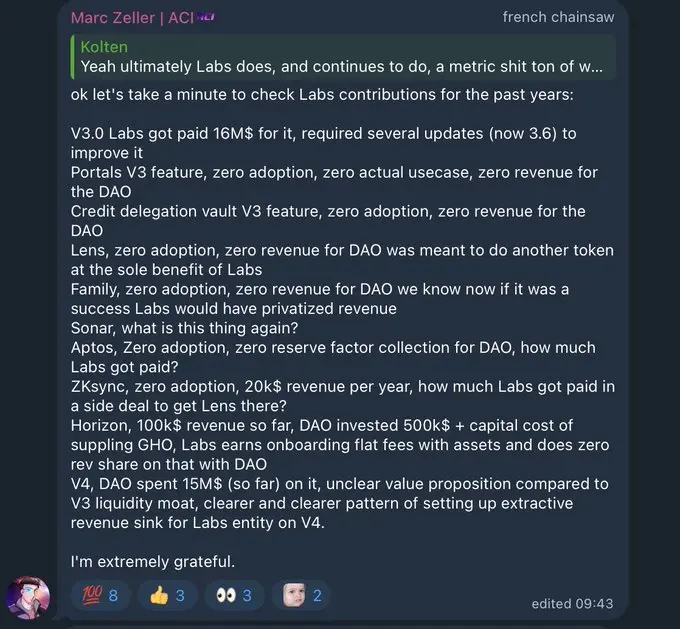

Zeller's accusations against Labs for extracting protocol value:

The projects he listed (Portals, Credit Delegation Vault, Lens, etc.) indeed indicate that many exploratory initiatives by Aave Labs have not directly translated into protocol revenue or significant adoption rates.

He also mentioned the V4 version, noting that the DAO has spent $15 million so far, and compared to the liquidity moat of V3, the value proposition is unclear. He expressed concerns about whether this is a new trap for extracting revenue.

In the process of innovation, failure is inevitable. Not every feature or product can succeed. The DAO is, in some sense, investing in Aave Labs' R&D capabilities. My understanding is that Zeller is not denying contributions but is calling for higher standards of accountability, transparency, and value alignment.

Recommended Reading:

Why is Asia's largest Bitcoin treasury company Metaplanet not bottom-fishing?

Multicoin Capital: The Era of Financial Technology 4.0 Has Arrived

a16z-backed Web3 unicorn company Farcaster forced to pivot, is Web3 social a false proposition?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。